Berachain Launches PoL Mining: Can $HONEY "Sticky" Liquidity in the Ecosystem?

Original Article Title: Berachain's Proof of Liquidity: Is It Sticky Though?

Original Article Author: Castle Labs, Web3 Ecosystem Partner

Original Article Translation: DeepSeek

Editor's Note: PoL requires staking assets in a liquidity pool rather than static locking, utilizing liquidity incentives, validator dynamics, and ecosystem optimization to improve capital efficiency, enhance network security, and DeFi liquidity. Currently, Berachain has a stablecoin APR of over 20%, and with the PoL launch, Berachain is expected to address DeFi inefficiencies and drive ecosystem growth. However, its success still faces challenges such as operational complexity, incentive misalignment, and regulatory uncertainty.

Below is the original content (slightly rephrased for clarity):

With the launch of PoL, can Berachain prove that its liquidity mechanism will fundamentally transform the DeFi landscape?

Berachain is an emerging Layer1 blockchain with a core design principle of leveraging Proof of Liquidity (PoL), a consensus mechanism that integrates liquidity provision into network security to empower value for ecosystem applications.

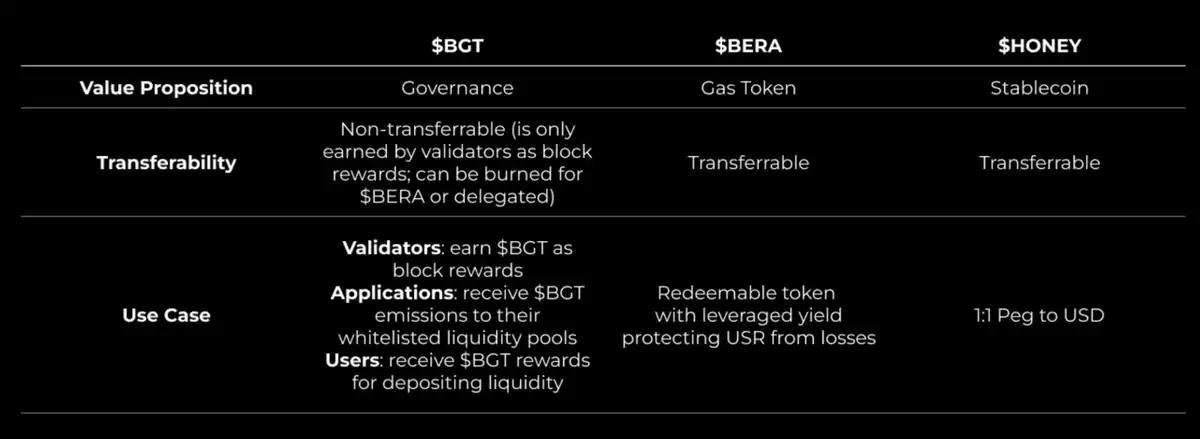

The system adopts a dual-token model ($BERA and $BGT) aimed at building a mutually beneficial ecosystem for validators, developers, and users (refer to the Honeypaper whitepaper).

With the PoL deployment, we will witness whether Berachain can address the inefficiencies in the DeFi space and meet market expectations.

Operation Mechanism of Proof of Liquidity

Unlike traditional Proof of Stake (PoS), PoL requires staked assets to be in a liquidity pool rather than static locking. This mechanism operates through the synergy of the following components:

1. Liquidity Incentives

Users who deposit assets into whitelisted DeFi protocols (such as DEX or lending markets) can receive $BGT from a reward treasury. These smart contract-controlled pools continuously release $BGT to incentivize users to enhance ecosystem liquidity.

Unlike transferable rewards, the non-transferable nature of $BGT ties its value to ongoing participation, promoting long-term commitment.

2. Validator Dynamics

Validators stake the network Gas token $BERA to maintain chain security and earn $BGT rewards. Their key obligation is to allocate a portion of the rewards to a designated treasury to guide liquidity toward specific applications. In return, validators may receive protocol fees or native tokens as incentives, forming a symbiotic relationship. This structure highlights PoL's emphasis on mutualistic benefits.

3. Ecosystem Synergy

PoL builds a triple-incentive system for validators, applications, and liquidity providers. The protocol boosts competition rewards for validators distributing $BGT, while users delegate their $BGT to preferred validators. This design of a quasi-resource allocation market achieves network-level optimization of capital efficiency.

4. Capital Efficiency and Security

Traditional PoS locks capital in staking contracts, whereas PoL enables staked assets to secure the network and provide DeFi liquidity simultaneously. If this dual-purpose design scales successfully, it could make Berachain a benchmark for a sustainable blockchain economy.

Tokenomics: Dual-Token System

According to the Honeypaper, the Berachain ecosystem is driven by two distinct utility tokens:

· $BERA: The native Gas token used to pay transaction fees and validator staking, serving as the cornerstone of network security and operational costs.

· $BGT (Governance Token): Liquidity providers acquire it through market-making, holders can burn $BGT at a 1:1 rate to receive $BERA, or influence reward distribution through delegation. Its non-transferability ensures governance remains in the hands of active participants.

This model establishes validators relying on $BERA for security and users guiding liquidity through $BGT, creating a positive feedback loop to drive ecosystem growth.

$BGT Liquidity Forecast and Ecosystem Impact

The success of PoL hinges on the distribution and use of $BGT. This section outlines its potential impact:

1. Liquidity Aggregation

$BGT is expected to flow into DEXs, lending protocols, and other high-yield platforms—areas that have long dominated DeFi transaction volume. Validators may prioritize treasury rewards, leading liquidity toward established use cases. However, with a well-designed incentive mechanism, emerging areas such as derivatives or RWAs also have opportunities.

2. Network Activity

Validators maintain blockchain security and earn $BGT rewards by staking the Gas token $BERA in the staking network. Their key responsibility is to allocate a portion of the $BGT issuance to a reward pool, effectively directing liquidity into specific applications. In return, validators receive income shares, native token rewards, and other diverse incentives—forming a symbiotic relationship. This architecture distinctly embodies the core pursuit of PoL (Proof of Liquidity) for mutual benefit and incentive alignment.

3. Ecosystem Expansion

The deep liquidity spawned by PoL attracts developers and capital influx. Blocmates analysis suggests that new projects, from yield aggregators to cross-chain bridges, may onboard, echoing the scenario of Polygon's ecosystem TVL growing by 300% in 18 months post-2021.

4. Validator Competition

Validators strategically allocate $BGT rewards to attract delegations. According to Berachain forum disclosures on the reward pool whitelist mechanism, protocols offering the optimal risk-adjusted return may dominate early liquidity trends, shaping the overall ecosystem development focus.

Opportunities and Risks

Opportunities

• Capital Efficiency Enhancement: The dual-purpose staking assets enable PoL's locked capital throughput to potentially exceed traditional PoS by 15-25%, significantly reducing opportunity costs compared to the Ethereum staking model

• Decentralization Resilience: The distributed distribution of rewards among validators, users, and applications helps mitigate centralization risks

• Long-Term Growth: A liquidity-driven security model can attract institutional-grade DeFi projects, supporting 3-5 years of ecosystem expansion

Risks

• Operational Complexity: The multi-layered mechanisms involving validator rewards, reward pool whitelist, and $BGT delegation may deter regular users, with the first-year adoption rate potentially reaching only 10-20% of the target audience

• Incentive Misalignment: Validator collusion with protocols can distort the flow of $BGT (as evidenced by early governance disputes in SushiSwap)

• Validator Reliance: Network stability hinges on validators surpassing short-term self-interest to pursue collective well-being—something hard to predict pre-mainnet launch

• Regulatory Changes: The integration design of liquidity tokens and governance tokens may face regulatory uncertainty in jurisdictions such as the United States regarding DeFi regulations

Summary

In the current sluggish market environment, Berachain's PoL launch can be considered one of the few highlights, injecting new excitement into the industry.

This is the first major test of its concept validation, which will determine whether PoL can truly open up a new paradigm. Although projects like Initia have had similar attempts with "built-in liquidity," Berachain is the first case to undergo a real test.

Will it be a success? Can the "honey" truly create highly sticky liquidity? The answer will soon be revealed!

Original article link: Link

También te puede gustar

Opciones de Criptomonedas: Bitcoin y Ethereum Enfrentan Expiración Histórica

Key Takeaways Un imponente vencimiento de opciones de Bitcoin y Ethereum, valorado en más de $27 mil millones,…

Los movimientos de las ballenas en Hyperliquid alteran el panorama de criptomonedas

Key Takeaways La cantidad de ballenas BTC al alza en Hyperliquid ha disminuido notablemente. Los inversores bajistas en…

Trust Wallet Resuelve Problema de Seguridad en Extensión del Navegador

Key Takeaways Trust Wallet confirmó que un incidente de seguridad afectó específicamente a la versión 2.68 de su…

El Impacto de la Expiración Masiva de Opciones en el Precio de Bitcoin

Key Takeaways La expiración de opciones de Bitcoin este trimestre es la más grande registrada, con un impacto…

Matrixport Predice Cambio en el Juego de Bitcoin

Key Takeaways Matrixport observa un cambio en la dinámica del mercado de Bitcoin, pasando de un riesgo de…

Las Ballenas de Ethereum Impulsan el Mercado: Predicciones y Tendencias 2025-2030

Key Takeaways Las ballenas de Ethereum están acumulando grandes cantidades de ETH, lo que sugiere confianza en el…

Fed Q1 2026: Potencial impacto en Bitcoin y mercados cripto

Key Takeaways Las pausas de la Fed podrían presionar a los criptomercados, pero la “QE encubierta” podría amortiguar…

El volumen de los derivados de criptomonedas explota a $86T en 2025, con Binance liderando

Puntos Clave En 2025, el comercio de derivados de criptomonedas alcanzó un volumen de 86 billones de dólares,…

Ethereum en 2026: Forks Glamsterdam y Hegota, Escalado L1 y Más

Puntos Clave: Los forks Glamsterdam y Hegota prometen mejorar significativamente el rendimiento y la escalabilidad de Ethereum en…

OPI de Kraken y fusiones para avivar el ciclo ‘intermedio’ de las criptomonedas

Key Takeaways La OPI potencial de Kraken y las fusiones y adquisiciones podrían atraer capital de las finanzas…

Amenazas a la seguridad humana en criptomonedas para 2026: Consejos de expertos

Key Takeaways La ingeniería social se ha convertido en la principal amenaza para la seguridad de las criptomonedas.…

Consejos para Nuevos en Cripto, Veteranos y Escépticos de un Bitcoiner que Perdió $700 Millones

Key Takeaways: Comprender antes de invertir: Los principiantes deben entender las criptomonedas antes de comprarlas. Evitar el apalancamiento:…

Trust Wallet cubrirá pérdida de $7 millones en hackeo navideño, dice Zhao

Puntos clave Trust Wallet sufrió un hackeo el día de Navidad, resultando en pérdidas cerca de $7 millones,…

Feliz Navidad, Caroline Ellison: Aquí llega su liberación anticipada

Resumen de Claves Caroline Ellison, ex CEO de Alameda Research, será liberada en enero tras cumplir una sentencia…

La computación cuántica en 2026: No habrá un apocalipsis criptográfico, pero es momento de prepararse

Puntos Clave La computación cuántica no representará una amenaza inmediata para la criptografía en 2026, pero el concepto…

Ethereum No Es Probable Que Alcance Nuevos Máximos en 2026: Análisis de Ben Cowen

La perspectiva de Ether de alcanzar nuevos máximos en 2026 según Ben Cowen es pesimista; podría ser solo…

Blockchains se preparan silenciosamente para la amenaza cuántica mientras Bitcoin debate su cronograma

Key Takeaways Las computadoras cuánticas aún no pueden romper Bitcoin, pero blockchains importantes están preparándose para un futuro…

El token financiero World Liberty de Trump termina 2025 con una caída de más del 40%

Key Takeaways El proyecto de criptomoneda de la familia Trump, World Liberty Financial, ha experimentado una caída significativa…

Opciones de Criptomonedas: Bitcoin y Ethereum Enfrentan Expiración Histórica

Key Takeaways Un imponente vencimiento de opciones de Bitcoin y Ethereum, valorado en más de $27 mil millones,…

Los movimientos de las ballenas en Hyperliquid alteran el panorama de criptomonedas

Key Takeaways La cantidad de ballenas BTC al alza en Hyperliquid ha disminuido notablemente. Los inversores bajistas en…

Trust Wallet Resuelve Problema de Seguridad en Extensión del Navegador

Key Takeaways Trust Wallet confirmó que un incidente de seguridad afectó específicamente a la versión 2.68 de su…

El Impacto de la Expiración Masiva de Opciones en el Precio de Bitcoin

Key Takeaways La expiración de opciones de Bitcoin este trimestre es la más grande registrada, con un impacto…

Matrixport Predice Cambio en el Juego de Bitcoin

Key Takeaways Matrixport observa un cambio en la dinámica del mercado de Bitcoin, pasando de un riesgo de…

Las Ballenas de Ethereum Impulsan el Mercado: Predicciones y Tendencias 2025-2030

Key Takeaways Las ballenas de Ethereum están acumulando grandes cantidades de ETH, lo que sugiere confianza en el…

Monedas populares

Últimas noticias cripto

Atención al cliente:@weikecs

Cooperación comercial:@weikecs

Trading cuantitativo y MM:[email protected]

Servicios VIP:[email protected]