Analyzing WEEX Exchange: Markets, Liquidity, and Transparency

Introduction

This report provides a comprehensive analysis of WEEX's trading environment, focusing on the following key areas:

Liquidity Depth: Assessment of market depth for major trading pairs on futures markets.

Asset Diversity: Evaluation of the variety and number of assets listed on the platform.

Comparative Analysis: Benchmarking WEEX against other leading cryptocurrency exchanges in terms of liquidity, asset offerings.

For the analysis of markets, we selected the 10 most actively traded coins and tokens. The assets are grouped into:

For the futures market, the analysis focuses on top-of-book liquidity (±0.1%), assessing the available volume at the best bid and ask prices. This approach provides a more accurate representation of immediate execution liquidity in the futures market. The data snapshot took place in May 2025.

Markets Analysis

Liquidity Depth and Slippage Analysis on Futures Markets

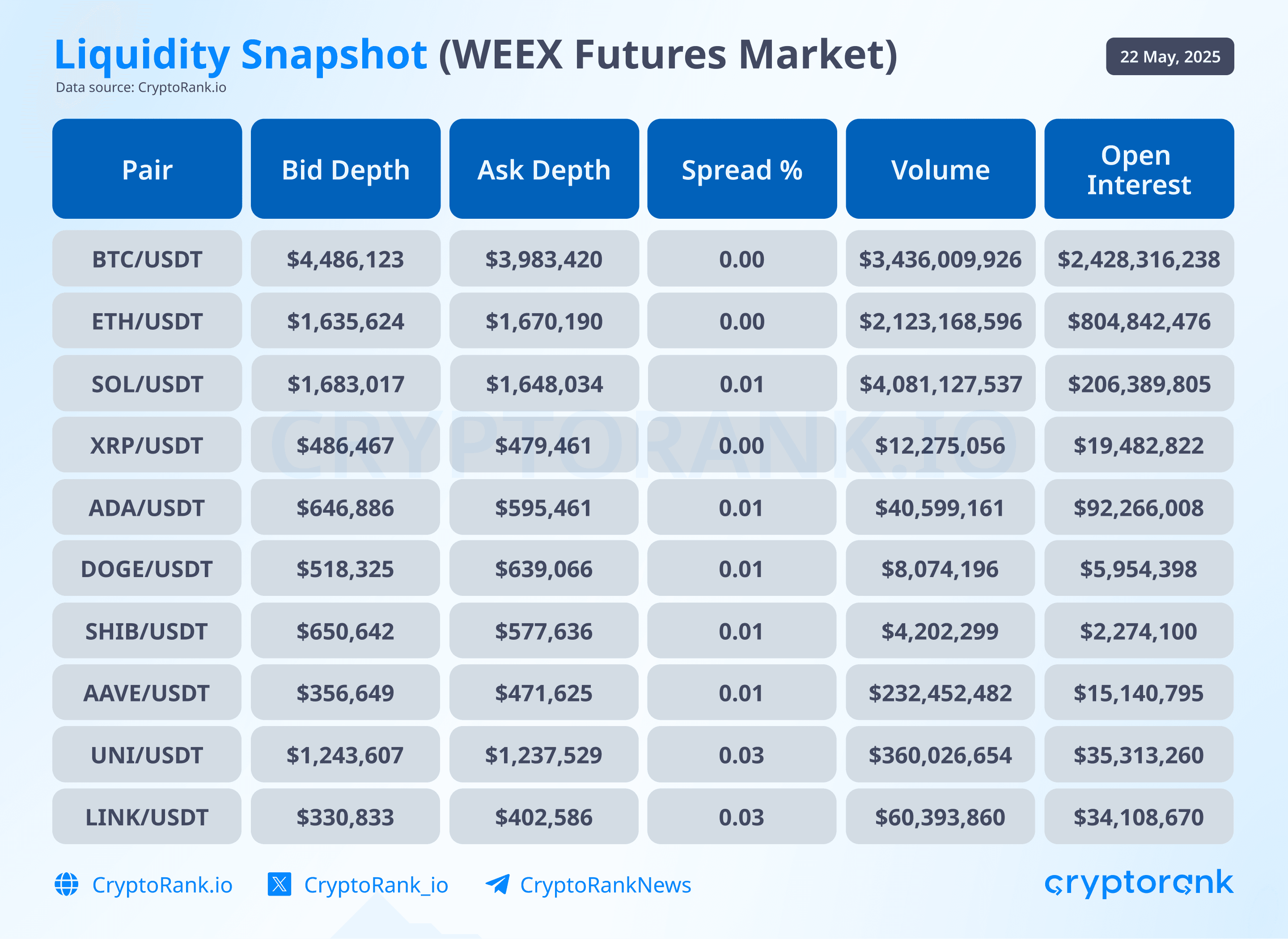

WEEX’s futures markets demonstrate varied liquidity conditions across major and mid-cap assets. Using ±2% depth and spread as proxies for execution quality, the analysis reveals that only a handful of contracts exhibit deep enough order books to reliably handle large trades with minimal slippage.

BTC/USDT remains the most liquid futures pair, with a +2% depth of $4.49M and -2% depth of $3.98M, and a zero spread, which is ideal for large and frequent execution. ETH/USDT also shows solid liquidity, with approximately $1.6M on each side of the book, offering high availability for both retail and institutional traders. SOL/USDT performs similarly, maintaining tight spreads and order book depth exceeding $1.6M, indicating an active derivatives market.

UNI/USDT stands out with depth over $1.2M on each side and a moderate spread of 0.03%, suggesting stable market-making activity. Other pairs like DOGE/USDT, ADA/USDT, and SHIB/USDT maintain depth between $500k and $650k, with spreads holding around 0.01%, making them viable for moderate trading volume but vulnerable to slippage on larger orders.

Contracts such as AAVE/USDT, LINK/USDT, and XRP/USDT display more limited depth, ranging from $330k to $486k, with higher spreads (0.03% for LINK and UNI). These markets are better suited for smaller trades, as larger orders may lead to visible price movement.

Analyzing the Open Interest (OI) relative to trading volume, pairs like BTC/USDT and ETH/USDT indicate a healthy balance, suggesting sustainable liquidity and moderate speculative activity. XRP/USDT's high OI compared to its lower volume points to increased speculative positioning, possibly raising volatility risks.

Overall, WEEX provides high execution quality for top-traded assets like BTC, ETH, and SOL, while offering access to a wide range of altcoin derivatives with moderate to low liquidity. Traders should account for depth limitations and spread sensitivity when planning trade size and strategy across less liquid pairs.

Number of Listed Assets and Presence of Long-tail or Early-listed Tokens.

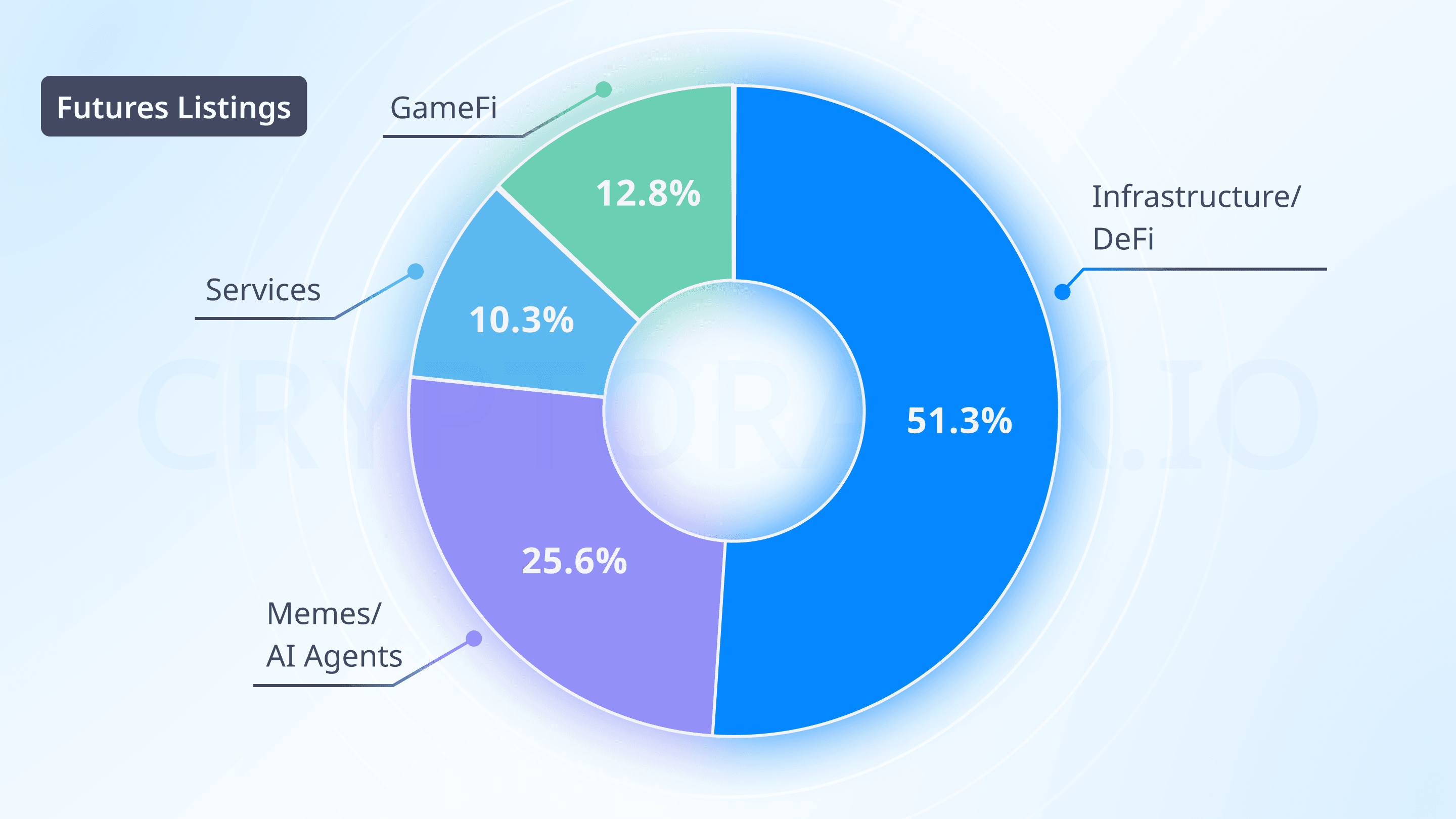

The number of futures trading pairs on WEEX exceeds 700. This highlights the dynamic nature of WEEX's futures offerings, which may appeal to traders seeking diverse derivative instruments. In the last month, WEEX introduced 39 new futures trading pairs.

The futures market prioritizes infrastructure and DeFi tokens (51.3% of new pairs), suggesting a focus on assets with stronger fundamentals or market stability, suitable for leveraged trading. The lower proportion of meme and AI agent tokens (25.6%) in futures indicates a more selective approach, likely to ensure liquidity and reduce risk in derivatives. The presence of GameFi (12.8%) and service-oriented tokens (10.3%) in futures further diversifies offerings, tapping into emerging trends like blockchain gaming.

The high volume of new listings (39 futures pairs in one month) underscores WEEX’s agility in responding to market trends. The emphasis on long-tail tokens in the spot market and early-listed projects across both markets, supported by the WE-Launch program, positions WEEX as a platform for discovering undervalued or emerging assets, appealing to a broad spectrum of traders.

WEEX demonstrates a notable presence of long-tail and early-listed tokens, enhancing its appeal for niche and emerging market traders. Long-tail tokens, defined as less popular or niche cryptocurrencies, are evident from recent listings on WEEX's new token announcements page, such as PUSSFi (PUSS), FARTGIRL, and 42069COIN, listed in April 2025. These tokens, often meme coins or projects with smaller market caps, are typically not widely traded on major exchanges, fitting the long-tail category.

Early-listed tokens, those listed shortly after launch, are supported through WEEX's WE-Launch program, which focuses on airdrops for early-stage crypto projects. The WE-Launch page details historical projects. The program's structure, requiring WXT staking for airdrops, further underscores WEEX's strategy to engage with emerging projects, likely attracting traders interested in growth opportunities.

In summary, WEEX lists around 700 for futures trading, with potential updates suggesting higher futures figures. The exchange actively supports long-tail and early-listed tokens, as evidenced by recent listings and the WE-Launch program, catering to a broad spectrum of trading preferences.

Comparison with Other Exchanges

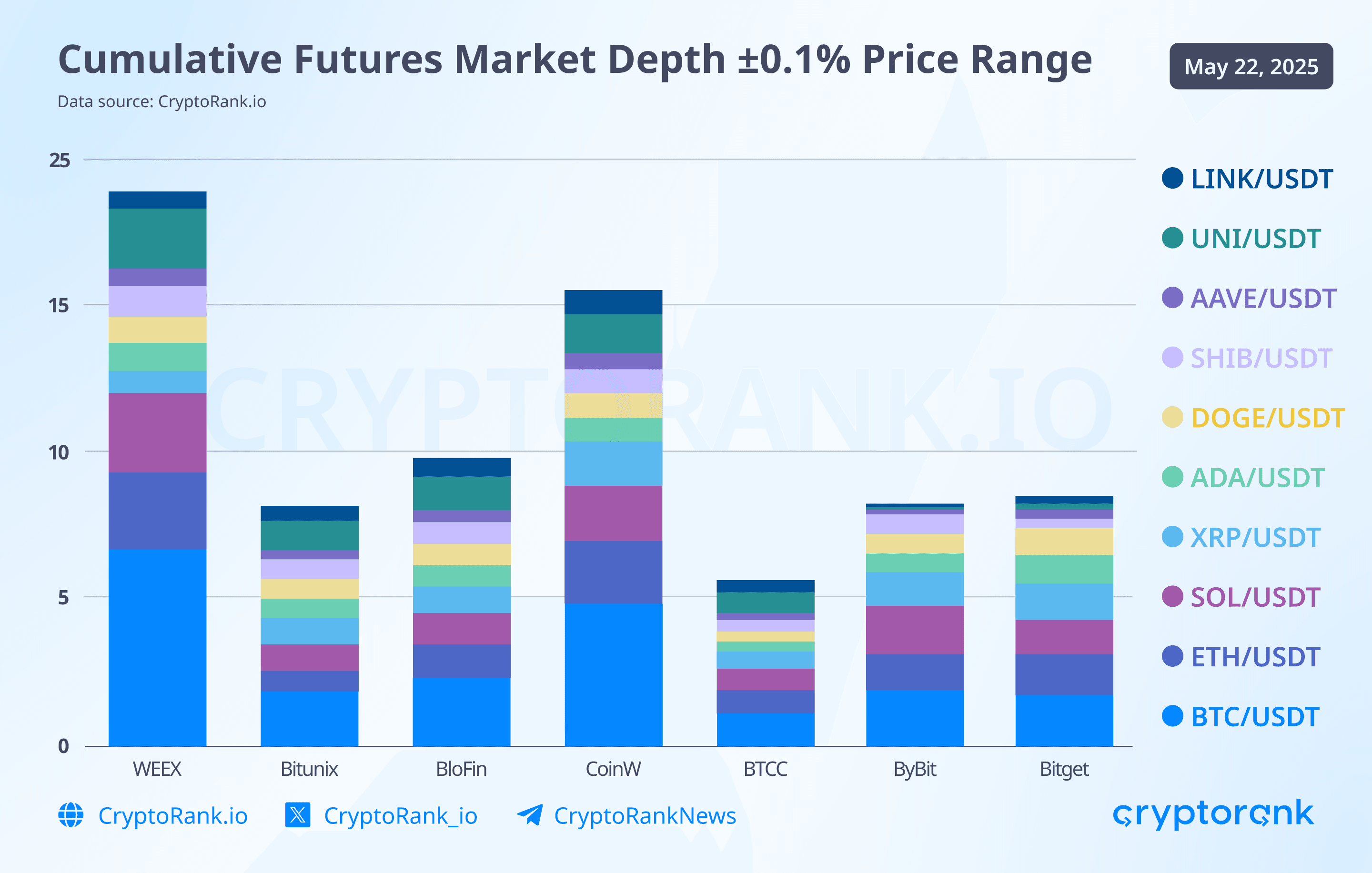

When WEEX is evaluated against other cryptocurrency exchanges, such as Bitunix, CoinW, BloFin, BTCC, Bybit, Bitget, in futures markets, several distinct patterns emerge regarding liquidity depth, execution quality, and asset coverage.

In the futures segment, WEEX offers more than 700 contracts, the largest among the compared platforms. This includes not only high-cap assets but also speculative tokens, AI-themed coins, and meme derivatives. Most competitors support 300–550 pairs, placing WEEX ahead in market exposure and product variety.

WEEX shows strong immediate liquidity on major trading pairs. For the BTC/USDT pair, WEEX offers the highest among all analyzed exchanges at the top of the book, surpassing both institutional platforms like Bitget and Bybit. Similar trends are observed for ETH/USDT and SOL/USDT well above top-of-book levels at competitors such as Bitunix, BloFin, and BTCC.

Bitget and Bybit show relatively low top-of-book volume, These platforms maintain a dense layer of small, rapidly replenished limit orders close to the mid-price. While this enables high-frequency trading and nearly instant execution for small orders, it means actual top-of-book depth appears limited in snapshots, even though liquidity increases significantly at slightly deeper levels such as within 0.1% of the mid-price. At these depths, WEEX and other mid-tier exchanges currently cannot compete with the scale and algorithmic liquidity density of Bybit and Bitget.

Liquidity on futures for pairs like SOL/USDT, ETH/USDT, and DOGE/USDT is sufficient for moderate volume trading. Notably, spreads on WEEX remain exceptionally low (0.00–0.01%), even on mid- and low-cap contracts, offering reliable execution conditions.

While it does not yet match the institutional-level liquidity of Bybit or Bitget on core futures pairs, WEEX remains highly competitive in spread efficiency and continues to build market depth. For traders focused on variety, early access, and efficient execution in liquid majors, WEEX represents a uniquely positioned alternative in the current exchange landscape.

Security and Transparency

WEEX maintains a strict 1:1 reserve ratio, ensuring that all user assets are fully backed. The platform provides a Proof of Reserves system, allowing users to verify that their holdings are matched by equivalent reserves. This system enhances trust and transparency by demonstrating the platform's solvency.

To safeguard user assets, WEEX has established a 1,000 BTC Protection Fund, serving as an emergency reserve to cover potential losses. The platform employs advanced security measures, including two-factor authentication (2FA), cold storage solutions, and regular security audits. WEEX has also undergone independent security assessments, affirming its commitment to maintaining high-security standards.

Conclusion

WEEX presents itself as a fast-evolving exchange with a strong balance between innovation, asset diversity, and user-focused infrastructure. WEEX demonstrates strengths that position it as a compelling alternative for retail and mid-size traders.

WEEX doesn’t yet match the institutional-grade depth and volume of the largest exchanges, but it competes effectively in fee efficiency, asset breadth, and execution quality on major pairs. Its aggressive listing approach and focus on emerging sectors give it an edge for users seeking fast access to new market opportunities.

For retail traders, WEEX offers an appealing mix of low fees, wide asset selection, and solid execution on leading pairs. Its support for long-tail tokens and early-stage projects makes it especially attractive to users following trends and new narratives in crypto.

In summary, WEEX is a well-rounded exchange for users who prioritize early access, cost efficiency, and diverse exposure, while accepting the trade-offs of moderate depth in less mainstream markets.

Join Us on the Next WEEX Adventure

This year, WEEX measured the world with our footsteps and earned trust through action. Whether you’re a trader, developer, or industry observer, we look forward to meeting you at our next stop.

Be Part of What’s Next! Register Now

Follow WEEX on social media:

· Instagram: @WEEX_Exchange

· X: @WEEX_Official

· Tiktok: @weex_global

· Youtube: @WEEX_Global

· Telegram: WeexGlobal Group

Te puede gustar

El 2026 Podría Iniciar un “Cripto Invierno,” pero la Institucionalización y la Transformación en la Cadena Están Acelerándose

Key Takeaways Cantor Fitzgerald advierte sobre una posible tendencia bajista sostenida en el mercado de Bitcoin hacia 2026.…

Respuesta más Reciente del Fundador de Lighter sobre el Progreso del Lanzamiento de Tokens

Puntos Clave Lighter planea completar su Evento de Generación de Tokens (TGE) en los últimos tres días del…

Oportunidad de Arbitraje para la Quema de Tokens UNI y Debate de Liquidez de Acciones Tokenizadas de Ondo: ¿De qué Habla la Comunidad Cripto Internacional Hoy?

Key Takeaways El mercado cripto está en medio de amplias discusiones que abarcan desde pronósticos para 2026 hasta…

¿Verá Ethereum una fuerte ruptura después del final de la salida neta de staking?

Key Takeaways El final del año 2025 trae un cambio importante para Ethereum: la cola de entrada de…

# Título: Lanzamiento de ETF de XRP Impulsa Entradas de Capital y Expansión Multicadena

Key Takeaways Los ETFs de XRP, lanzados en noviembre, han registrado entradas constantes de capital, sumando más de…

# Análisis del Aumento de Precio de Uniswap (UNI): Consecuencias de la Propuesta ‘UNIfication’

Key Takeaways Uniswap (UNI) experimentó un aumento del 4.35% en 24 horas, alcanzando un valor de $6.27. La…

La Perspectiva de los Mercados de Activos Digitales para 2026 Según Altan Tutar

Puntos Clave Altan Tutar, cofundador de MoreMarkets, anticipa un futuro sombrío para la mayoría de las compañías de…

Coinbase destaca tres áreas que dominarán el mercado cripto en 2026

Puntos clave Coinbase Institutional resalta que el comportamiento del mercado cripto está siendo moldeado por fuerzas estructurales más…

Ingresos de ETF de XRP superan los $1.25 mil millones, pero la acción del precio se mantiene contenida

Puntos clave Los activos netos de ETF de XRP han cruzado el umbral de los $1.25 mil millones,…

Flow Validators Instantly Suspend Operations Amid Blockchain Rollback Conflict

Key Takeaways Flow Foundation faced criticism for proposing to roll back its blockchain to counter a $3.9 million…

Uniswap ejecuta quema de 100M de UNI tras aprobación de tarifas

Key Takeaways Uniswap ha eliminado 100 millones de tokens UNI de su circulación después de la aprobación de…

Aave governance vote ends in rejection after community feedback

Key Takeaways Aave’s governance proposal to place control of brand assets under DAO ownership was rejected by the…

Aave governance vote ends in rejection after community dissent

Una votación de gobernanza en Aave fue rechazada, reflejando tensiones sobre la captura de valor y la estructura…

Amplify ETFs para stablecoins y tokenización disponibles para el comercio

Key Takeaways Amplify ha lanzado dos nuevos ETFs en la NYSE Arca, enfocándose en stablecoins y tokenización, reflejando…

Hong Kong Advances Licensing Framework for Virtual Asset Dealers and Custodians

Key Takeaways Hong Kong is launching new licensing requirements for virtual asset dealers and custodians. The initiative is…

Aave founder faces controversy over $10M token acquisition amid governance drama

Key Takeaways Stani Kulechov, founder of Aave, encounters criticism after a $10 million AAVE token purchase ahead of…

Web3 y DApps en 2026: Un año impulsado por la utilidad para las criptomonedas

Key Takeaways El 2026 se presenta como un punto decisivo para las aplicaciones descentralizadas (DApps), las cuales deberán…

Qué sucedió hoy en el mundo de las criptomonedas

Key Takeaways Anthony Pompliano afirmó que la actual quietud en el precio de Bitcoin podría evitar una gran…

El 2026 Podría Iniciar un “Cripto Invierno,” pero la Institucionalización y la Transformación en la Cadena Están Acelerándose

Key Takeaways Cantor Fitzgerald advierte sobre una posible tendencia bajista sostenida en el mercado de Bitcoin hacia 2026.…

Respuesta más Reciente del Fundador de Lighter sobre el Progreso del Lanzamiento de Tokens

Puntos Clave Lighter planea completar su Evento de Generación de Tokens (TGE) en los últimos tres días del…

Oportunidad de Arbitraje para la Quema de Tokens UNI y Debate de Liquidez de Acciones Tokenizadas de Ondo: ¿De qué Habla la Comunidad Cripto Internacional Hoy?

Key Takeaways El mercado cripto está en medio de amplias discusiones que abarcan desde pronósticos para 2026 hasta…

¿Verá Ethereum una fuerte ruptura después del final de la salida neta de staking?

Key Takeaways El final del año 2025 trae un cambio importante para Ethereum: la cola de entrada de…

# Título: Lanzamiento de ETF de XRP Impulsa Entradas de Capital y Expansión Multicadena

Key Takeaways Los ETFs de XRP, lanzados en noviembre, han registrado entradas constantes de capital, sumando más de…

# Análisis del Aumento de Precio de Uniswap (UNI): Consecuencias de la Propuesta ‘UNIfication’

Key Takeaways Uniswap (UNI) experimentó un aumento del 4.35% en 24 horas, alcanzando un valor de $6.27. La…