Decoding SynFutures, the Base Layer Aggregator

SynFutures is currently the leading derivative project in the Base protocol ecosystem. It recently announced its post-TGE roadmap, revealing that in addition to entering the derivatives space, it will also expand into the spot aggregator track in the future. In the author's opinion, this is a very bold yet highly imaginative business expansion by the team, reminiscent of the Solana ecosystem leader Jupiter.

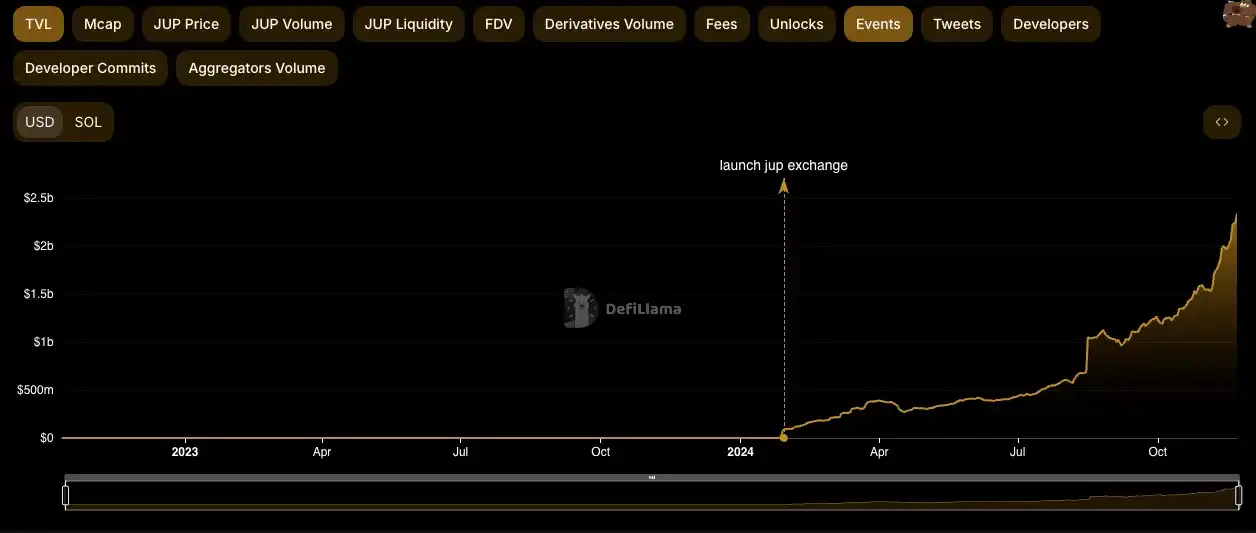

The Rise of Jupiter

If you have used Solana, you most likely have used Jupiter. Jupiter is the first stop for most users entering the Solana ecosystem, and it can be said to be the **gateway to the Solana ecosystem**. Users can trade spot, trade contracts, purchase JLP, participate in cross-chain activities, and join Launchpad here. Those familiar with Jupiter will know that Jupiter initially only had the spot aggregator business. After the success of this business, it launched contract trading before TGE. Leveraging the impact of airdrops and JLP rewards after TGE, it helped achieve tremendous success in contract trading, becoming a giant spanning multiple tracks in today's Solana ecosystem.

So how did Jupiter achieve such great success today? A significant reason lies in its "diversification strategy," which is not limited to success in one track but rather uses its advantages, resources, brand, and traffic in the original track to horizontally expand into other businesses. Due to its significant first-mover advantage in the Solana ecosystem, it has rapidly become a leader in new fields.

SynFutures at the Core of the Base Ecosystem

From the roadmap currently announced by SynFutures, its current market position and post-TGE development strategy bear many similarities to Jupiter. Firstly, SynFutures is currently the leading derivative track project in the Base ecosystem, and Base can be said to be the hottest project in the L2 ecosystem with the most funds, traffic, and popularity. As the derivative leader SynFutures and the spot leader Aerodrome, there is no doubt that these two projects are best positioned to receive the overflow of public chain momentum, making them the reservoirs of resources in the Base ecosystem. The rapid growth of SynFutures in the Base ecosystem and its importance to the Base ecosystem can also be seen from the data after SynFutures launched on Base:

· Base was launched on July 1st, and its trading volume exceeded $1 billion just 10 days after launch

· The cumulative trading volume is close to $35 billion, with a daily average volume of $230 million

· Q3 trading volume accounts for nearly 50% of the Base network

· The trading volume in the past 24 hours accounts for 72% of the Base network, six times that of the second-place

Becoming the Super App of the Base Ecosystem

Benefiting from its first-mover advantage in various aspects such as users, community, and the market, SynFutures also has the potential to excel in the field of spot aggregation in the Base ecosystem. In the author's view, what SynFutures values is not the trading volume of spot aggregation business but rather the customer acquisition capability in the spot aggregator track. After all, most users do not directly interact with spot DEXs but rather execute trades through aggregators. Spot aggregators are essential tools for on-chain players and serve as hubs for traffic and users. Success in this business can further drive the growth of its futures trading business in terms of users, trading volume, and TVL, as derivative businesses are the most profitable.

Similar to its Jupiter Launchpad business, SynFutures also has the Perp Launched business. In the future, as the demand for listing from projects increases, SynFutures may receive a certain token reward from projects and airdrop them to SynFutures' token stakers. This will incentivize more users to stake, attract more projects to participate in the perp launchpad, and create a positive feedback loop.

Previously, SynFutures has successfully engaged in pilot collaborations for Perp Launchpad with well-known LST, LRT projects such as Lido, Solv Protocol, PumpBTC, top-tier MEME projects such as Cat in a Dogs World (MEW), Degen, and the recently popular AI+MEME project Virtual Protocol on Base. These collaborations have helped projects expand their user base and visibility on the Base chain, receiving rewards from projects and distributing them to SynFutures users. Meanwhile, SynFutures has also established a $1 million Perp Launchpad Grant Program to support emerging projects with listings, event support, etc., helping projects increase their on-chain user base, exposure, and activity.

Base Ecosystem Value Capture Black Hole

And as SynFutures becomes the most crucial reservoir of traffic, users, and funds in the Base ecosystem, its value capture will also reach astonishing levels. In the current scenario of contract-based trading only, its fee revenue in the past 30 days has already surpassed 3.3 million USD, ranking third in the protocol (the third rank being Base Network's Sequencer). As revenue grows with the maturity of its Perp Launchpad and other businesses, SynFutures has a significant opportunity to stand shoulder to shoulder with top protocols like AAVE, MakerDAO, and have more incentive to buy back tokens compared to other protocols.

And we all know that Base is most likely not going to mint tokens due to compliance reasons. But this is actually a good thing for projects in the Base ecosystem because ecosystem valuation and premium will be transferred to other projects within the Base ecosystem. As the flagship of the Base ecosystem, SynFutures, if given the opportunity to be listed on Coinbase like AERO, could potentially be the biggest beneficiary. After all, for the Base ecosystem to grow, it cannot do without Coinbase's support, and the most crucial factor in this process is to find a foothold in this ecosystem. Given that derivatives are a flagship on Base alongside spot trading, its importance to Base is self-evident, and Coinbase is more likely to provide resources to support its further growth, becoming the Killer App of the Base chain.

SynFutures, the Synthesis of the Base Ecosystem

In this scenario, as Jupiter of the Base ecosystem, what is the value proposition of SynFutures? Considering that its official website hints at an upcoming TGE, this is a very interesting question. Taking a spot dex as an example, the valuation of a Solana ecosystem project is approximately twice that of the Base ecosystem.

Therefore, a reasonable valuation of SynFutures on Base would be half of Jupiter's current valuation, roughly reaching around a 5.5 billion USD valuation.

If we take Jupiter's potential into account, some of its businesses are still in the early stage of development, carrying a certain level of unknown risk. Therefore, a calculation based on Jupiter's opening price may be more reasonable. Considering that we are now at the beginning of a bull market and the market sentiment is quite enthusiastic, a valuation of 3 billion US dollars may be a more reasonable price.

From their Discord, it is evident that their Korean community is exceptionally active. SynFutures, backed by well-known investors from both the East and the West such as Pantera, Polychain, Dragonfly, and SIG, has raised over $37.4 million. If there is an opportunity in the future to list on Korean exchanges like Upbit, then this valuation could potentially go even higher, especially considering that we are only at the beginning of a raging bull market.

Epilogue: As We Witness the $100,000 Bitcoin

Bitcoin has finally reached this historic moment, gradually turning the future into reality. With Bitcoin's liquidity overflowing and new funds entering the market, the structural issues in the current altcoin market will change, ushering in a new season of altcoins. In this season, the most anticipated projects are those that can earn real profits, especially those that have found their positioning, have a clear strategy, and are rapidly rising projects, such as Jupiter on Base and the derivatives leader, SynFutures, discussed today.

This article is a contributed submission and does not represent the views of BlockBeats.

Te puede gustar

El token financiero de World Liberty de Trump cierra 2025 con una caída del 40%

Key Takeaways World Liberty Financial, el proyecto criptográfico de la familia Trump, experimenta un final de 2025 con…

Tres señales de que Bitcoin está encontrando su fondo de mercado

Key Takeaways La presión de venta de Bitcoin puede estar disminuyendo debido a una estabilización en el impulso,…

Kraken’s IPO to Reignite Crypto’s Mid-Stage Cycle: Perspectives and Implications

Key Takeaways: Kraken’s upcoming IPO could draw substantial interest from traditional finance, fostering capital influx into the crypto…

Former SEC Counsel Explains How to Make Real-World Assets Compliant

Key Takeaways The SEC’s evolving stance on cryptocurrencies is increasingly supporting the growth of tokenized real-world assets (RWAs),…

Blockchains Discreetly Prepare for Quantum Challenge Amid Bitcoin’s Debate

Quantum computing’s potential impact on blockchain security is a growing concern, with altcoins leading preparations. Ethereum emphasizes early…

HashKey asegura $250 millones para nuevo fondo cripto mientras crece el interés institucional

Key Takeaways HashKey Capital ha recaudado $250 millones en compromisos para su cuarto fondo de criptomonedas, superando las…

Evaluación de desinversión institucional en cripto: Desenmascarando la verdad detrás de los flujos de salida de los ETF Bitcoin y Ether

Puntos clave Los ETF de Bitcoin y Ether han mostrado salidas sostenidas desde principios de noviembre, indicando un…

La caída del mercado cripto revela discrepancias entre las valoraciones de los VC y las capitalizaciones de mercado

Key Takeaways: La brecha entre las valoraciones de capital de riesgo (VC) y las capitalizaciones de mercado se…

Cómo Ondo Finance planea llevar acciones estadounidenses tokenizadas a Solana

Key Takeaways Ondo tiene planificado lanzar acciones y ETFs estadounidenses tokenizados en Solana a principios de 2026. Los…

Filipinas bloquea Coinbase y Gemini en medio de una ofensiva contra los VASP no licenciados

Key Takeaways Las autoridades filipinas han bloqueado el acceso a las plataformas de intercambio de criptomonedas Coinbase y…

Amplify ETFs para stablecoins y tokenización disponibles para el comercio

Key Takeaways Amplify ha lanzado dos nuevos ETFs en la NYSE Arca, enfocándose en stablecoins y tokenización, reflejando…

JPMorgan Explora el Comercio de Criptomonedas para Clientes Institucionales: Informe

Puntos Clave JPMorgan Chase está considerando expandir sus servicios de activos digitales al ofrecer comercio de criptomonedas a…

Trend Research silenciosamente se convierte en uno de los mayores poseedores de Ethereum con una compra de 46K ETH

Key Takeaways Trend Research ha aumentado significativamente sus tenencias de Ethereum con la compra de 46,379 ETH, ubicándose…

Las aspiraciones de Bitcoin de El Salvador se acercan a la tierra en 2025

Key Takeaways El Salvador fue pionero en adoptar el Bitcoin como moneda de curso legal, enfrentándose a retos…

Palmer Luckey’s Erebor alcanza una valoración de $4.35B mientras se avanza en la carta bancaria

Key Takeaways Erebor, respaldado por el empresario tecnológico Palmer Luckey, obtiene una valoración de $4.35 mil millones tras…

Predicciones de precios 22/12: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

Key Takeaways: Bitcoin y ciertas altcoins intentan una recuperación, aunque niveles más altos podrían atraer vendedores. Las previsiones…

Hong Kong Advances Licensing Framework for Virtual Asset Dealers and Custodians

Key Takeaways Hong Kong is launching new licensing requirements for virtual asset dealers and custodians. The initiative is…

Aave founder faces controversy over $10M token acquisition amid governance drama

Key Takeaways Stani Kulechov, founder of Aave, encounters criticism after a $10 million AAVE token purchase ahead of…

El token financiero de World Liberty de Trump cierra 2025 con una caída del 40%

Key Takeaways World Liberty Financial, el proyecto criptográfico de la familia Trump, experimenta un final de 2025 con…

Tres señales de que Bitcoin está encontrando su fondo de mercado

Key Takeaways La presión de venta de Bitcoin puede estar disminuyendo debido a una estabilización en el impulso,…

Kraken’s IPO to Reignite Crypto’s Mid-Stage Cycle: Perspectives and Implications

Key Takeaways: Kraken’s upcoming IPO could draw substantial interest from traditional finance, fostering capital influx into the crypto…

Former SEC Counsel Explains How to Make Real-World Assets Compliant

Key Takeaways The SEC’s evolving stance on cryptocurrencies is increasingly supporting the growth of tokenized real-world assets (RWAs),…

Blockchains Discreetly Prepare for Quantum Challenge Amid Bitcoin’s Debate

Quantum computing’s potential impact on blockchain security is a growing concern, with altcoins leading preparations. Ethereum emphasizes early…

HashKey asegura $250 millones para nuevo fondo cripto mientras crece el interés institucional

Key Takeaways HashKey Capital ha recaudado $250 millones en compromisos para su cuarto fondo de criptomonedas, superando las…

Monedas populares

Últimas noticias cripto

Atención al cliente:@weikecs

Cooperación empresarial:@weikecs

Trading cuantitativo y CM:[email protected]

Servicios VIP:[email protected]