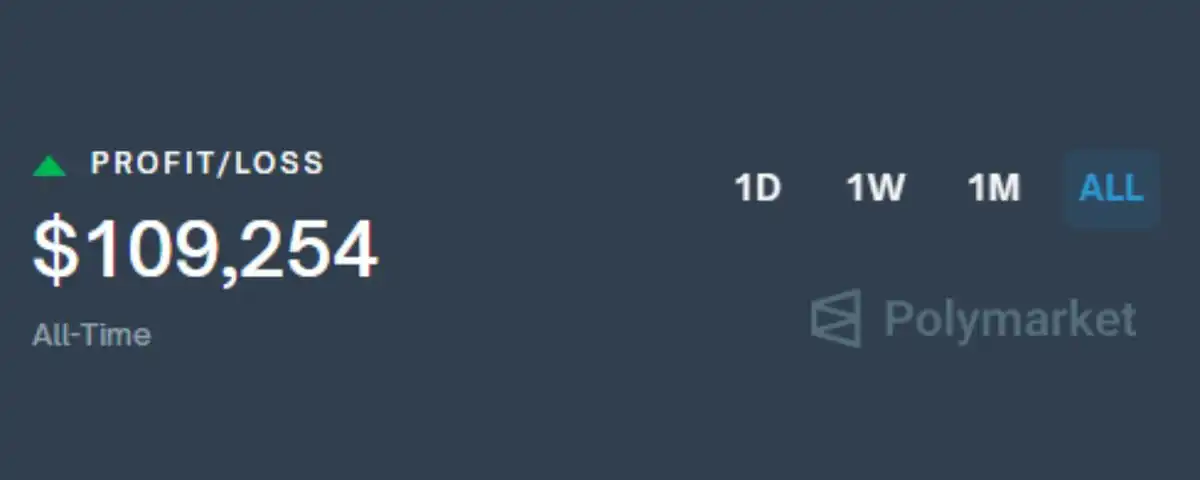

How Did I Make $100,000 in 3 Months on Polymarket?

Original Title: How I Made $100k Arbitraging Between Prediction Markets (Full Guide)

Original Author: @PixOnChain, Crypto Researcher

Original Translation: Deep in Motion

Abstract: Leveraging price differences between prediction markets for arbitrage, combining swift action and early exit strategies to earn risk-free profits

Editor's Note: This article details the author's strategy of earning $100k through arbitrage between prediction markets. The author utilizes price differences across platforms for the same event, locking in risk-free profits, with a focus on pricing errors in multi-outcome markets. Key steps include identifying spreads, swift action, automated monitoring, and early exits for APY optimization. The author emphasizes the importance of niche markets, volatility, and thorough rule scrutiny, providing an efficient Web3 arbitrage guide.

The following is the original content (lightly edited for readability):

Most people gamble on prediction markets.

I make money through arbitrage.

Here is my specific strategy to earn $100k from decentralized, inefficient prediction markets—completely devoid of gambling.

Step One: Understand the Rules

Prediction markets allow you to bet on real-world outcomes.

· "Will Ethereum reach $5000 by December?"

· "Will MrBeast run for president?"

· "Will Kanye West launch his own token?"

Each market has its own participant base.

Each group has its own biases.

This means that pricing for the same event on different platforms... will vary.

Herein lies the arbitrage opportunity.

If platform A's "Yes" price is 40 cents, and platform B's "No" price is 55 cents...

You can lock in a 5-cent profit regardless of the outcome.

This is arbitrage.

But there are even better opportunities...

Step 2: Find Your Edge

For me, what works well is the multi-outcome markets.

These markets are where issues are most likely to arise.

For example:

· Who will win this weekend's F1 race?

· Which party will win the UK General Election?

· Who will be the next one eliminated on the reality show?

More outcomes = higher complexity = more pricing errors.

In theory, the sum of the probabilities of all outcomes should be 100%.

In reality? I often see the market sum up to 110%.

Why? Because most platforms embed a hidden fee—the 'overround'.

Plus, many platforms let the crowd determine the odds.

This leads to lucrative yet inefficient arbitrage opportunities.

Step 3: How to Identify an Arbitrage Opportunity

The rules are as follows:

You find pricing for the same event on different platforms. Select the lowest price for each outcome. If the sum is less than 1 dollar, you've found an arbitrage opportunity.

Let me show you a real example.

Market: Who will be the next Pope?

Two platforms are running this market simultaneously.

Prices are as follows:

Polymarket/Myriad

We select the lowest price for each outcome:

· Pietro Parolin: 35.2 cents (Myriad)

· Luis Antonio Tagle: 30 cents (Polymarket)

· Others: 32.7 cents (Myriad)

· Total: 97.9 cents

You buy into all three outcomes.

One of them must prevail.

You guarantee to get back 1 dollar.

Profit: 2.1 cents per transaction = 2.1% risk-free return.

This is arbitrage.

You are not betting on who will become the Pope. You are betting on two platforms not being able to agree on the pricing of a potential candidate. When they disagree — you profit.

P.S. This is not the best opportunity, just one I found today.

Myriad has low liquidity, but two platforms still show a similar spread.

If you monitor more markets, you will find bigger opportunities.

I usually only enter when the Annual Percentage Yield (APY) is above 60% (APY = (spread / settlement days) × 365).

The market spread is 2.1%, with a settlement time of 29 days:

(0.021 / 29) × 365 ≈ 26.4% APY

Not good enough for me.

Locking funds for a month for only 26% APY? Pass.

But if the same spread settles in 7 days?

That's over 100% APY — I'm in.

How to find these high APY opportunities?

Step Four: Race Against Time

Predicting market arbitrage is a game of timing. Once a price discrepancy occurs, you usually have only minutes, not hours.

· Someone posts a rumor.

· One market updates its price.

· Another market lags behind.

This delay is your entire advantage. If possible — automate this part.

At the beginning, I had 7 platform tabs open simultaneously. I refreshed like a maniac. Used price alerts on Discord, Telegram, Twitter.

Sometimes, I could spot the spread just by muscle memory. The faster you act, the more you earn. Hesitate for 5 minutes, and the spread is gone.

The best spread I caught was 18%, and the trade volume was substantial.

Make sure you have enough liquidity available to deploy in each market and understand all fees.

Step Five: Early Exit

Most people wait for the outcome to be revealed. I don't. I've already made most of my profit when the outcome is unknown.

Assume I bought all outcomes at 94 cents. This locks in a 6-cent spread. One of the outcomes will pay out at $1.

But I don't have to wait.

If the market tightens — those same shares can now be sold for 98 cents or 99 cents collectively — I exit.

This is only effective when all outcome prices remain stable.

If one outcome skyrockets and the others plummet, there is no opportunity to exit.

So I need to monitor the entire portfolio. I exit when the total value goes up.

This can significantly increase your APY and allow you to rotate between different markets more quickly.

Additional Tips

· Look for overlapping events (e.g., "Trump wins the 2024 election" and "Republican victory") — hidden arbitrage opportunities are right there.

· Target small markets — more pricing errors, less competition.

· Use less popular platforms — more spreads, bigger advantages, plus potential airdrop rewards.

· Carefully read settlement rules — one word can change the outcome.

· Always triple-check the order book and your buy-in price. Include all fees in your calculations.

It took me 2.5 months to earn $100,000.

Some weeks had no opportunities. Some weeks were non-stop busy.

The larger the market fluctuation, the bigger the spread.

So if the market is quiet, don't rush, keep looking. There will always be another mispriced market.

Original tweet link: Tweet Link

Te puede gustar

Trust Wallet Sufre un Hackeo que Lleva a la Pérdida de 3,5 Millones de Dólares

Key Takeaways Un hackeo a Trust Wallet resultó en una pérdida de 3,5 millones de dólares para el…

Trust Wallet Resuelve Brecha de Seguridad en Extensión del Navegador

Key Takeaways Trust Wallet solucionó una brecha de seguridad en la versión 2.68 de su extensión de navegador…

Los Gigantes de Ethereum Acumulan Monedas: Reflexiones y Predicciones para el Futuro

Key Takeaways En la última semana, grandes inversores han incrementado su posesión de Ethereum (ETH) de forma significativa.…

Bitcoin Experimenta Menor Riesgo de Caída: ¿Un Cambio en el Horizonte?

Key Takeaways Matrixport destaca una disminución marginal en el riesgo bajista de Bitcoin, situando el mercado en un…

Fed Q1 2026 Outlook: Potential Bitcoin and Crypto Market Impacts

Key Takeaways Fed pauses on rate cuts could put pressure on the crypto market, but “stealth QE” measures…

Ethereum en 2026: Forks Glamsterdam y Hegota, y escalado de L1

Key Takeaways En 2026, se espera que Ethereum implemente el fork Glamsterdam, mejorando el procesamiento paralelo perfecto y…

Kraken IPO y las Fusiones y Adquisiciones para Reavivar el Ciclo ‘Intermedio’ de Criptomonedas

Key Takeaways El próximo IPO de Kraken y las fusiones y adquisiciones estratégicas podrían atraer capital nuevo desde…

Volumen de derivados de criptomonedas se dispara a $86 billones en 2025, promediando $265 mil millones por día

Aspectos Clave El comercio de derivados de criptomonedas alcanzó los $86 billones en 2025, con un promedio diario…

Amenazas de ingeniería social que costaron miles de millones en 2025: Cómo protegerte

Principales conclusiones: La mayoría de los ataques criptográficos en 2025 no surgieron de errores de código, sino de…

Trust Wallet Cubre Pérdidas de 7 Millones de Dólares por Hackeo el Día de Navidad: Insiders en la Mira

Key Takeaways Trust Wallet sufrió un ataque que resultó en la pérdida de $7 millones en criptomonedas durante…

Aave governance vote ends in rejection after community feedback

Key Takeaways Aave’s governance proposal to place control of brand assets under DAO ownership was rejected by the…

Una Feliz Navidad, Caroline Ellison: Aquí un adelanto de su liberación de custodia

Key Takeaways Caroline Ellison, la ex directora ejecutiva de Alameda Research, será liberada de prisión antes de lo…

Consejos para Cripto Principiantes, Veteranos y Escépticos de un Bitcoiner que Sepultó $700M

Key Takeaways Educación fundamental: Antes de invertir en criptomonedas, entender cómo funcionan las blockchain y el propósito de…

Quantum computing en 2026: No hay un día del fin para las criptomonedas, pero es momento de prepararse

La computación cuántica aún no representa una amenaza inminente para Bitcoin y otras criptomonedas, sin embargo, los preparativos…

Los sueños de Bitcoin de El Salvador acercados a la realidad en 2025

Key Takeaways En 2025, los planes de adopción de Bitcoin de El Salvador enfrentaron desafíos debido a las…

Ethereum poco probable que alcance nuevos máximos en 2026: análisis de Ben Cowen

Key Takeaways Ben Cowen, analista de criptomonedas, cree que Ethereum probablemente no alcanzará nuevos máximos en 2026 debido…

El token financiero World Liberty de Trump termina 2025 con una caída de más del 40%

Key Takeaways: El proyecto criptográfico del Trump presenta una disminución importante en el valor del token financiero World…

Blockchains se preparan en silencio para la amenaza cuántica mientras Bitcoin debate el cronograma

Los blockchains altcoin están tomando medidas para protegerse contra los riesgos cuánticos a largo plazo, mientras Bitcoin enfrenta…

Trust Wallet Sufre un Hackeo que Lleva a la Pérdida de 3,5 Millones de Dólares

Key Takeaways Un hackeo a Trust Wallet resultó en una pérdida de 3,5 millones de dólares para el…

Trust Wallet Resuelve Brecha de Seguridad en Extensión del Navegador

Key Takeaways Trust Wallet solucionó una brecha de seguridad en la versión 2.68 de su extensión de navegador…

Los Gigantes de Ethereum Acumulan Monedas: Reflexiones y Predicciones para el Futuro

Key Takeaways En la última semana, grandes inversores han incrementado su posesión de Ethereum (ETH) de forma significativa.…

Bitcoin Experimenta Menor Riesgo de Caída: ¿Un Cambio en el Horizonte?

Key Takeaways Matrixport destaca una disminución marginal en el riesgo bajista de Bitcoin, situando el mercado en un…

Fed Q1 2026 Outlook: Potential Bitcoin and Crypto Market Impacts

Key Takeaways Fed pauses on rate cuts could put pressure on the crypto market, but “stealth QE” measures…

Ethereum en 2026: Forks Glamsterdam y Hegota, y escalado de L1

Key Takeaways En 2026, se espera que Ethereum implemente el fork Glamsterdam, mejorando el procesamiento paralelo perfecto y…

Monedas populares

Últimas noticias cripto

Atención al cliente:@weikecs

Cooperación empresarial:@weikecs

Trading cuantitativo y CM:[email protected]

Servicios VIP:[email protected]