Web3 New Tale of Two Cities: Stablecoins and Money Market Funds

Original Article Title: Stablecoins and the parallels with Money Market Funds

Original Article Authors: @shawnwlim, @artichokecap Founders

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: The regulatory dispute over stablecoins bears resemblance to the experience of Money Market Funds (MMFs) half a century ago. MMFs were initially designed for corporate cash management but faced criticism due to lack of deposit insurance and vulnerability to runs, impacting bank stability and monetary policy. Nevertheless, MMF assets now exceed $7.2 trillion. The 2008 financial crisis led to the collapse of the Reserve Fund, and in 2023, the SEC is still pushing for MMF regulatory reform. The history of MMFs suggests that stablecoins may face similar regulatory challenges but could ultimately become a crucial part of the financial system.

The following is the original content (slightly edited for readability):

Stablecoins are exciting, and the upcoming stablecoin legislation in the US represents a rare opportunity to upgrade the existing financial system. Those studying financial history will notice parallels between it and the invention and development of Money Market Funds about half a century ago.

Money Market Funds were invented in the 1970s as a cash management solution, primarily for corporates. At that time, US banks were prohibited from paying interest on balances in checking accounts, and corporations were often unable to maintain savings accounts. If a business wanted to earn interest on idle cash, they had to buy US Treasuries, engage in repurchase agreements, invest in commercial paper, or certificates of deposit. Managing cash was a cumbersome and operationally intensive process.

The design of Money Market Funds was to maintain a stable share value, with each share pegged at $1. The Reserve Fund, Inc. was the first MMF. Launched in 1971, it was introduced as "a convenient alternative for investing temporary cash balances," which would typically be placed in money market instruments like Treasuries, commercial paper, bank acceptances, or CDs, with an initial asset size of $1 million.

Other investment giants quickly followed suit: Dreyfus (now part of BNYglobal), Fidelity, Vanguard_Group. In the 1980s, almost half of Vanguard's legendary mutual fund business growth was attributable to its Money Market Fund.

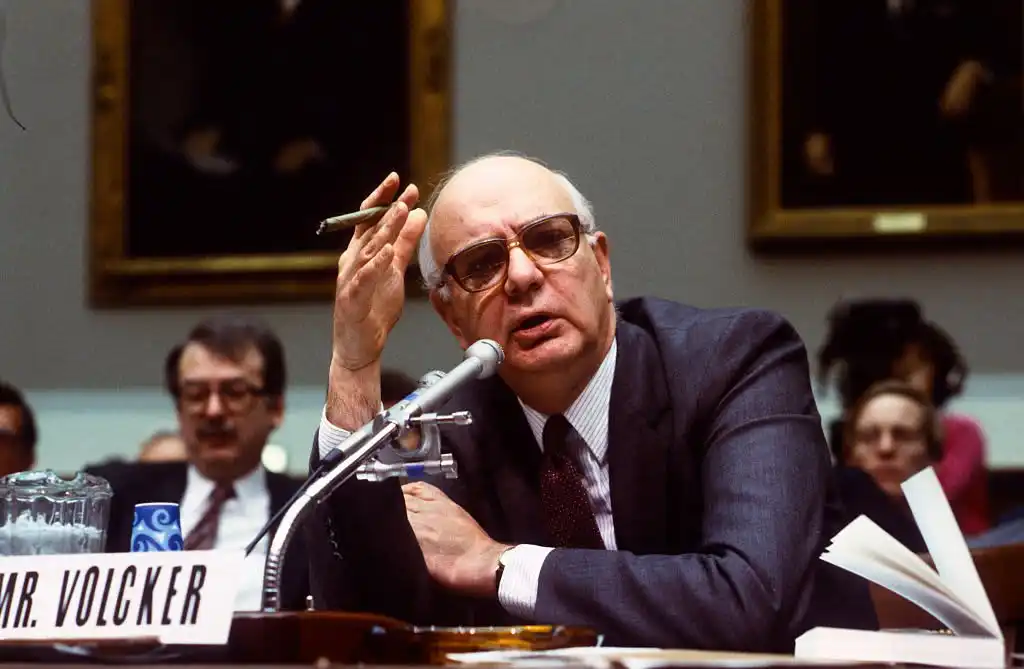

During his tenure as Chairman of the Federal Reserve from 1979 to 1987, Paul Volcker was highly critical of Money Market Funds (MMFs). He continued his criticism of MMFs as late as 2011.

Today, many of the criticisms raised by policymakers against stablecoins echo those from half a century ago against Money Market Funds:

· Systemic Risk and Banking Safety Concerns: MMFs lack deposit insurance and a lender of last resort mechanism, unlike insured banks. Because of this, MMFs are susceptible to rapid runs, which could exacerbate financial instability and lead to contagion. There are also concerns that deposits shifting from insured banks to MMFs could weaken the banking sector as banks lose their low-cost and stable deposit base.

· Unfair Regulatory Arbitrage: MMFs provide bank-like services, maintaining a stable $1 share price, but without rigorous regulatory oversight or capital requirements.

· Weakening of Monetary Policy Transmission Mechanism: MMFs could weaken the Fed's monetary policy tools, as traditional monetary policy instruments like bank reserves are less effective when funds flow from banks to MMFs.

Today, MMFs have financial assets exceeding $7.2 trillion. For reference, M2 (excluding MMF assets) is $21.7 trillion.

In the late 1990s, the rapid growth in MMF assets was a result of financial deregulation (the Gramm-Leach-Bliley Act repealed the Glass-Steagall Act, fueling a wave of financial innovation), while the prosperity of the internet facilitated better electronic and online trading systems, speeding up fund inflows into MMFs.

Do you see a pattern here? (I would like to point out that even half a century later, the regulatory struggle around MMFs is far from over. The SEC adopted MMF reforms in 2023, including raising minimum liquidity requirements and removing fund manager restrictions on investor redemptions.)

Unfortunately, the Reserve Fund met its end after the 2008 financial crisis. It held some Lehman Brothers debt securities, which were written down to zero, leading to the fund's breaking of the buck event and significant redemptions.

Te puede gustar

Trust Wallet Sufre un Hackeo que Lleva a la Pérdida de 3,5 Millones de Dólares

Key Takeaways Un hackeo a Trust Wallet resultó en una pérdida de 3,5 millones de dólares para el…

Trust Wallet Resuelve Brecha de Seguridad en Extensión del Navegador

Key Takeaways Trust Wallet solucionó una brecha de seguridad en la versión 2.68 de su extensión de navegador…

Los Gigantes de Ethereum Acumulan Monedas: Reflexiones y Predicciones para el Futuro

Key Takeaways En la última semana, grandes inversores han incrementado su posesión de Ethereum (ETH) de forma significativa.…

Bitcoin Experimenta Menor Riesgo de Caída: ¿Un Cambio en el Horizonte?

Key Takeaways Matrixport destaca una disminución marginal en el riesgo bajista de Bitcoin, situando el mercado en un…

Fed Q1 2026 Outlook: Potential Bitcoin and Crypto Market Impacts

Key Takeaways Fed pauses on rate cuts could put pressure on the crypto market, but “stealth QE” measures…

Ethereum en 2026: Forks Glamsterdam y Hegota, y escalado de L1

Key Takeaways En 2026, se espera que Ethereum implemente el fork Glamsterdam, mejorando el procesamiento paralelo perfecto y…

Kraken IPO y las Fusiones y Adquisiciones para Reavivar el Ciclo ‘Intermedio’ de Criptomonedas

Key Takeaways El próximo IPO de Kraken y las fusiones y adquisiciones estratégicas podrían atraer capital nuevo desde…

Volumen de derivados de criptomonedas se dispara a $86 billones en 2025, promediando $265 mil millones por día

Aspectos Clave El comercio de derivados de criptomonedas alcanzó los $86 billones en 2025, con un promedio diario…

Amenazas de ingeniería social que costaron miles de millones en 2025: Cómo protegerte

Principales conclusiones: La mayoría de los ataques criptográficos en 2025 no surgieron de errores de código, sino de…

Trust Wallet Cubre Pérdidas de 7 Millones de Dólares por Hackeo el Día de Navidad: Insiders en la Mira

Key Takeaways Trust Wallet sufrió un ataque que resultó en la pérdida de $7 millones en criptomonedas durante…

Aave governance vote ends in rejection after community feedback

Key Takeaways Aave’s governance proposal to place control of brand assets under DAO ownership was rejected by the…

Una Feliz Navidad, Caroline Ellison: Aquí un adelanto de su liberación de custodia

Key Takeaways Caroline Ellison, la ex directora ejecutiva de Alameda Research, será liberada de prisión antes de lo…

Consejos para Cripto Principiantes, Veteranos y Escépticos de un Bitcoiner que Sepultó $700M

Key Takeaways Educación fundamental: Antes de invertir en criptomonedas, entender cómo funcionan las blockchain y el propósito de…

Quantum computing en 2026: No hay un día del fin para las criptomonedas, pero es momento de prepararse

La computación cuántica aún no representa una amenaza inminente para Bitcoin y otras criptomonedas, sin embargo, los preparativos…

Los sueños de Bitcoin de El Salvador acercados a la realidad en 2025

Key Takeaways En 2025, los planes de adopción de Bitcoin de El Salvador enfrentaron desafíos debido a las…

Ethereum poco probable que alcance nuevos máximos en 2026: análisis de Ben Cowen

Key Takeaways Ben Cowen, analista de criptomonedas, cree que Ethereum probablemente no alcanzará nuevos máximos en 2026 debido…

El token financiero World Liberty de Trump termina 2025 con una caída de más del 40%

Key Takeaways: El proyecto criptográfico del Trump presenta una disminución importante en el valor del token financiero World…

Blockchains se preparan en silencio para la amenaza cuántica mientras Bitcoin debate el cronograma

Los blockchains altcoin están tomando medidas para protegerse contra los riesgos cuánticos a largo plazo, mientras Bitcoin enfrenta…

Trust Wallet Sufre un Hackeo que Lleva a la Pérdida de 3,5 Millones de Dólares

Key Takeaways Un hackeo a Trust Wallet resultó en una pérdida de 3,5 millones de dólares para el…

Trust Wallet Resuelve Brecha de Seguridad en Extensión del Navegador

Key Takeaways Trust Wallet solucionó una brecha de seguridad en la versión 2.68 de su extensión de navegador…

Los Gigantes de Ethereum Acumulan Monedas: Reflexiones y Predicciones para el Futuro

Key Takeaways En la última semana, grandes inversores han incrementado su posesión de Ethereum (ETH) de forma significativa.…

Bitcoin Experimenta Menor Riesgo de Caída: ¿Un Cambio en el Horizonte?

Key Takeaways Matrixport destaca una disminución marginal en el riesgo bajista de Bitcoin, situando el mercado en un…

Fed Q1 2026 Outlook: Potential Bitcoin and Crypto Market Impacts

Key Takeaways Fed pauses on rate cuts could put pressure on the crypto market, but “stealth QE” measures…

Ethereum en 2026: Forks Glamsterdam y Hegota, y escalado de L1

Key Takeaways En 2026, se espera que Ethereum implemente el fork Glamsterdam, mejorando el procesamiento paralelo perfecto y…

Monedas populares

Últimas noticias cripto

Atención al cliente:@weikecs

Cooperación empresarial:@weikecs

Trading cuantitativo y CM:[email protected]

Servicios VIP:[email protected]