a16z: Predicting the Market, the Emerging Key to Unlocking New Traffic

Original Article Title: Prediction Path Screenshots: a New Kind of Meme

Original Article Author: Alex Danco, a16z

Original Article Translation: Deep Tide TechFlow

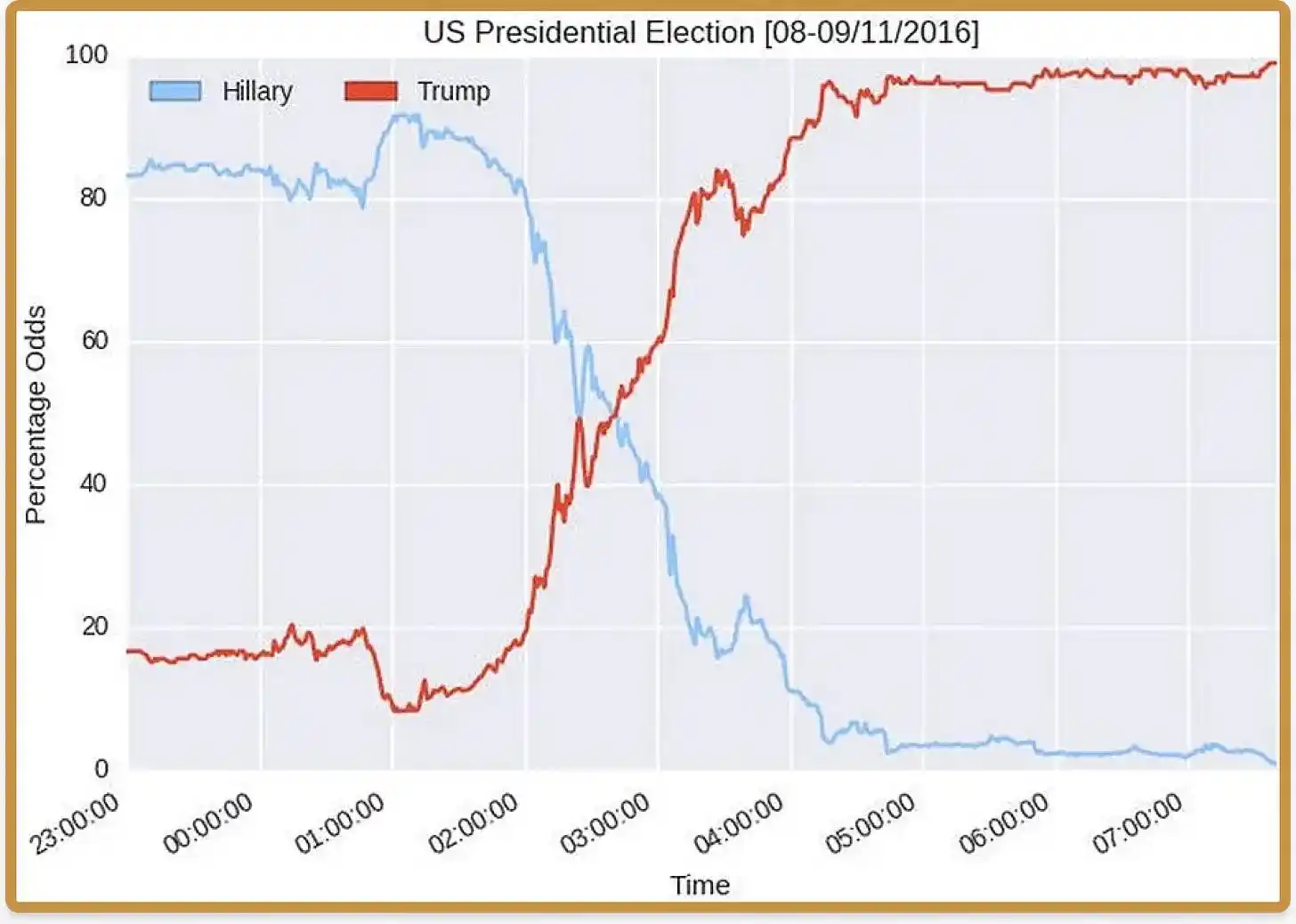

In the mid-2010s, a new form of visual content began to emerge in elections, sports matches, and playoff competitions: the "probability over time" chart. These charts were compelling because they told a captivating story: what was initially expected to happen, and what actually happened.

With these images, you can tell many fascinating stories. Solely through probability changes, you can tell stories of collapse, redemption, or the underdog's comeback. (Kurt Vonnegut gave many of these stories a famous name, such as "man in a hole," "boy meets girl," and "downward spiral," each with its own shape.) These images are a "meme": they compress a large amount of information into a small space and fully convey the story when shared.

Despite being highly engaging, these charts had a major limitation: they existed almost exclusively in the realms of politics, sports, or financial markets. The reason is clear: the operation of these charts required widely accepted predictive odds, and these odds had to be legally usable. The financial markets have always had these odds; elections have polling data to leverage, allowing the construction of these probability paths like Nate Silver. And sports seasons (or even individual games) have a clear structure and enough historical data to confidently predict a team's playoff advancement probability. Furthermore, the form of the "story shape" could not extend more deeply into popular culture.

The Slow Arrival of Prediction Markets

Prediction markets address this issue in an obvious way. As long as you can define a contract and its resolution terms, we now have a way to make these "prediction shapes" appear in any ongoing story in the world. Popular predictions—the starting components needed for these stories—have transitioned from scarce to abundant.

In fact, these markets did not emerge overnight, or even initially in this manner. In early 2024, the journal Works in Progress published an article titled "Why Prediction Markets Are Unpopular." The chapter argued that there was "little natural demand for prediction market contracts" because the three types of groups traditionally constituting market participants—savers (seeking wealth accumulation), thrill-seeking bettors (betting for excitement), and savvy traders (trying to profit from market distortions caused by the former two groups)—had no particular reason to engage in prediction markets. Savers might purchase a market index to accumulate wealth in the long term, but they had no reason to bet on the outcome of a presidential election. Thrill-seeking bettors might be more inclined to participate, but they had more engaging speculative ways, such as day trading, meme coins, or sports betting, rather than predicting the outcome of state senate elections. And due to the lower participation of the other two groups, savvy traders also did not see how much money they could make by entering the market.

Due to limited participation from these three groups, the prediction market is destined to suffer from inadequate liquidity and relative uselessness in predicting the future. The poor performance of the prediction market in predicting the mid-term election results in 2022 further validates this viewpoint.

However, in the year and a half since that article was published, an interesting shift has occurred: the prediction market has rapidly entered mainstream pop culture. As predicted by the huge volume of weekly sports game bets, the largest market is in the sports arena. But they have successfully entered mainstream culture—even becoming the theme of an episode of South Park—while also covering markets ranging from the New York City mayoral election results to the Federal Reserve's policy rate path, and even to the timeline of Taylor Swift's wedding.

Breaking the Fourth Wall

What has changed over the past two years? There may not be a one-size-fits-all solution. The 2024 election undoubtedly played a role: Americans have a long history of betting on elections, and the trading volume on the prediction market increased 42 times from early June to the election cycle. However, this momentum did not dissipate after the election.

A key player in this positive feedback loop is a new type of market participant, one that did not exist a few years ago but is now ubiquitous. This participant is akin to promoters in traditional betting activities, like promoters of Las Vegas boxing matches. They are ordinary social media users and a new form of meme—posting prediction path screenshots.

Today, the prediction market is not just about classic market dynamics but also about social media-driven viral dissemination. The key mechanism is to post screenshots when a prediction contract becomes topical, attracting attention and liquidity to the contract.

A good example is a pop culture question contract on the Kalshi platform: "Will Taylor Swift and Travis Kelce get married in 2025?" If you look at the chart, you will notice two important things happening on August 26th, when Swift and Kelce announced their engagement on Instagram. First is the significant increase in odds; second is the substantial increase in liquidity as people start paying attention to the contract. While there will always be some degree of liquidity spike regardless, undoubtedly, these screenshots shared at crucial moments constitute the viral dissemination of the contract itself and serve as the entry point to attract people to place bets. This phenomenon of "breaking the fourth wall" suddenly made a broader audience aware of this meme (or more accurately, aware of the reason for following this contract), adding an interesting new meta-element to the future story.

The New "Protagonist" on the Timeline

**Betting on the Pope** is said to be the "original prediction market" and has recently witnessed the glorious return of this tradition. For Catholics worldwide, this is a great moment as Archbishop Robert Prevost has become the first American pope — Pope Leo XIV. For the betting market, this is also a significant moment as few considered him a competitive candidate: most attention was focused on popular figures like Pietro Parolin and Luis Antonio Tagle.

The day after the smoke cleared, X's @Domahhhh shared the true essence of the timeline: the days leading up to the conclave and the key moments between the decision-making and the revelation, detailing his thought process and bet sizing.

In his own words: "As a directional bet, I decided to place a large sum of money that the next pope would not be [Parolin and Tagle, the two frontrunners]."

After the fourth round of voting, white smoke rose (indicating the successful election of a new pope). Relatively speaking, this was fast. The logical conclusion (which I immediately thought of) was that the front-runners from the first round had consolidated votes and become pope. Parolin's odds rose to around 65%. Tagle held steady at around 20%. These two had an 85% chance of becoming pope, and honestly, even though in hindsight this price was way off, it was hard to feel at the time that it was that off. I was certain I had lost a significant amount of money! I decided not to chase bad money, not to bet more on Tagle/Parolin. I would accept my losses like a good boy."

**But** I did browse the list of other options. When two people are trading at over 85%, everyone else is in the bargain bin. I went scavenging in the bargain bin and found Teksen's odds at 100 to 1, Prevost's odds at 200 to 1. In hindsight, I **should've also bought into Grygik at that time's price**.

I knew one piece of information: a total of four votes. That was too fast for an underdog stock. Toss all underdog tickets in the trash. You need a strong person who can cast two-thirds of the votes in a relatively short time. Those two were the ones I picked. While other traders were focusing on Tagle/Parolin, I bought thousands of shares in each.

A few minutes later, I was surprised to see Prevost — whom I had just bought shares of at 200 to 1 twenty minutes ago — step onto the balcony as the pope."

There used to be a joke that said, "Every day on the timeline has a protagonist, and the goal is to never be the protagonist." This kind of "victory prediction publisher" is a new protagonist, able to become a temporary validated hero.

Placing a Bet

The 2024 presidential election brought a well-deserved redemption story to the prediction markets. It all started with the long process of Biden dropping out of the race, during which the prediction markets provided a useful quantification tool to measure the impact of various events on the probability of a candidate dropping out. From journalists to Wall Street traders, everyone began to rely on prediction markets alongside traditional polling and commentary tools. In the end, despite criticism throughout the election cycle due to the influence of "whale" traders, the prediction markets still outperformed the polls. A year later, Kalshi's daily trading volume now exceeds the levels seen during the 2024 election (at least during football games).

Prediction markets now represent something significant, not just in terms of their utility as financial tools or sources of information. They represent a sense of responsibility and a new role on the timeline: the "hero who makes brave decisions" and the "fool who makes bad decisions." These individuals are now thrust into the spotlight, becoming caricatures reminiscent of Vonnegut's short stories.

In various fields such as politics, business, and culture, we expect our leaders and public figures to truly steer our institutions toward a successful future. This means making bold decisions and proving them right. Over the past few decades, there has been a widespread sense that we have slipped into a culture of leaders lacking accountability, and when individuals step up to resist this trend, we appreciate it even more.

This is perhaps the key mechanism through which prediction markets are set to alter the trajectory of pop culture: not only because betting itself is an information flow that can direct attention where needed, but also because the path of a prediction from start to finish brings new memes to the timeline and thrusts new characters into the forefront.

También te puede interesar

AI Trading Bots and Copy Trading: How Synchronized Strategies Reshape Crypto Market Volatility

Los trades minoristas de criptomonedas han enfrentado en long los mismos desafíos: mala gestión de riesgos, entradas tardías, decisiones emocionales y ejecución inconsistente. Las herramientas de tradear de IA prometían una solución. Hoy en día, los sistemas de copy trading potenciados por IA y bots de ruptura ayudan a los trades a dimensionar posiciones, establecer stops y actuar más rápido que nunca. Más allá de velocidad y precisión, estas herramientas están remodelando los mercados silenciosamente: los trades no solo tradean más inteligentemente, sino que se mueven en sincronización, creando una nueva dinámica que amplifica bot riesgo como oportunidad.

Central Bank Week and Crypto Market Volatility: How Interest Rate Decisions Shape Trading Conditions on WEEX

Las decisiones sobre tasas de interés de los principales bancos centrales, como la Reserva Federal, son eventos macroeconómicos importantes que afectan a los mercados financieros mundiales, influyendo directamente en las expectativas de liquidez y el apetito de riesgo del mercado. A medida que el mercado criptomonedas continúa desarrollándose y su estructura tradeando y participantes maduran, el mercado cripto se está incorporando gradualmente al sistema de precios macroeconómicos.

Join AI Wars: WEEX Alpha Awakens!Global Call for AI Trading Alphas

Guerras de IA: WEEX Alpha Awakens es un hackathon global de IA tradeando en Dubái, que llama a equipos cuánticos, trades algorítmicos y desarrolladores de IA para que den rienda suelta a sus estrategias de IA tradeando cripto en mercados en tiempo real por una parte de un pool de premios de US$880.000.

New: Estimated Liquidation Price on App Candlestick Charts

WEEX presentó un nuevo precio de liquidación estimado (Est. Liq. Price) función en el gráfico de velas para ayudar a los trades gestionar mejor el riesgo e identificar rangos seguros para sus posiciones.

WEEX VIP Perks

Cada nivel VIP ofrece beneficios exclusivos cuidadosamente adaptados para respaldar tu éxito de trade, como límites más altos para retirar, comisiones reducidas y soporte premium.

WEEX en Taipei Blockchain Week 2025

Del 4 al 6 de septiembre de 2025, el corazón de la innovación en el sector de la Web3 latió fuerte y claro en el Parque Cultural y Creativo Songshan en Taipéi, Taiwán, donde WEEX participó con orgullo como Patrocinador Plata del evento Taipei Blockchain Week 2025.

WEEX en la Gala de bienvenida de CONF3RENCE Dortmund 2025

Para WEEX, participar en CONF3RENCE Dortmund representa otro paso importante en su estrategia de expansión global.

WEEX en el evento CCCC Dubai 2024

La participación en el evento CCCC Dubái marcó un hito estratégico para WEEX en Oriente Medio y el norte de África.

Por qué tus chats de ChatGPT podrían no ser privados: Advertencia urgente de Sam Altman el 5 de agosto de 2025

Imagina que le cuentas todo lo que te pasa a alguien de confianza, solo para descubrir que esos detalles íntimos podrían acabar...

WEEX patrocina el evento Taipei Blockchain Week 2025

Para WEEX, participar en la Taipei Blockchain Week (Semana de la blockchain en Taipéi) representa un hito importante en su continua expansión global.

AI Trading Bots and Copy Trading: How Synchronized Strategies Reshape Crypto Market Volatility

Los trades minoristas de criptomonedas han enfrentado en long los mismos desafíos: mala gestión de riesgos, entradas tardías, decisiones emocionales y ejecución inconsistente. Las herramientas de tradear de IA prometían una solución. Hoy en día, los sistemas de copy trading potenciados por IA y bots de ruptura ayudan a los trades a dimensionar posiciones, establecer stops y actuar más rápido que nunca. Más allá de velocidad y precisión, estas herramientas están remodelando los mercados silenciosamente: los trades no solo tradean más inteligentemente, sino que se mueven en sincronización, creando una nueva dinámica que amplifica bot riesgo como oportunidad.

Central Bank Week and Crypto Market Volatility: How Interest Rate Decisions Shape Trading Conditions on WEEX

Las decisiones sobre tasas de interés de los principales bancos centrales, como la Reserva Federal, son eventos macroeconómicos importantes que afectan a los mercados financieros mundiales, influyendo directamente en las expectativas de liquidez y el apetito de riesgo del mercado. A medida que el mercado criptomonedas continúa desarrollándose y su estructura tradeando y participantes maduran, el mercado cripto se está incorporando gradualmente al sistema de precios macroeconómicos.

Join AI Wars: WEEX Alpha Awakens!Global Call for AI Trading Alphas

Guerras de IA: WEEX Alpha Awakens es un hackathon global de IA tradeando en Dubái, que llama a equipos cuánticos, trades algorítmicos y desarrolladores de IA para que den rienda suelta a sus estrategias de IA tradeando cripto en mercados en tiempo real por una parte de un pool de premios de US$880.000.

New: Estimated Liquidation Price on App Candlestick Charts

WEEX presentó un nuevo precio de liquidación estimado (Est. Liq. Price) función en el gráfico de velas para ayudar a los trades gestionar mejor el riesgo e identificar rangos seguros para sus posiciones.

WEEX VIP Perks

Cada nivel VIP ofrece beneficios exclusivos cuidadosamente adaptados para respaldar tu éxito de trade, como límites más altos para retirar, comisiones reducidas y soporte premium.

WEEX en Taipei Blockchain Week 2025

Del 4 al 6 de septiembre de 2025, el corazón de la innovación en el sector de la Web3 latió fuerte y claro en el Parque Cultural y Creativo Songshan en Taipéi, Taiwán, donde WEEX participó con orgullo como Patrocinador Plata del evento Taipei Blockchain Week 2025.

Monedas populares

Últimas noticias sobre criptomonedas

Atención al cliente:@weikecs

Cooperación empresarial:@weikecs

Trading cuantitativo y MM:[email protected]

Programa VIP:[email protected]