Web3 New Tale of Two Cities: Stablecoins and Money Market Funds

Original Article Title: Stablecoins and the parallels with Money Market Funds

Original Article Authors: @shawnwlim, @artichokecap Founders

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: The regulatory dispute over stablecoins bears resemblance to the experience of Money Market Funds (MMFs) half a century ago. MMFs were initially designed for corporate cash management but faced criticism due to lack of deposit insurance and vulnerability to runs, impacting bank stability and monetary policy. Nevertheless, MMF assets now exceed $7.2 trillion. The 2008 financial crisis led to the collapse of the Reserve Fund, and in 2023, the SEC is still pushing for MMF regulatory reform. The history of MMFs suggests that stablecoins may face similar regulatory challenges but could ultimately become a crucial part of the financial system.

The following is the original content (slightly edited for readability):

Stablecoins are exciting, and the upcoming stablecoin legislation in the US represents a rare opportunity to upgrade the existing financial system. Those studying financial history will notice parallels between it and the invention and development of Money Market Funds about half a century ago.

Money Market Funds were invented in the 1970s as a cash management solution, primarily for corporates. At that time, US banks were prohibited from paying interest on balances in checking accounts, and corporations were often unable to maintain savings accounts. If a business wanted to earn interest on idle cash, they had to buy US Treasuries, engage in repurchase agreements, invest in commercial paper, or certificates of deposit. Managing cash was a cumbersome and operationally intensive process.

The design of Money Market Funds was to maintain a stable share value, with each share pegged at $1. The Reserve Fund, Inc. was the first MMF. Launched in 1971, it was introduced as "a convenient alternative for investing temporary cash balances," which would typically be placed in money market instruments like Treasuries, commercial paper, bank acceptances, or CDs, with an initial asset size of $1 million.

Other investment giants quickly followed suit: Dreyfus (now part of BNYglobal), Fidelity, Vanguard_Group. In the 1980s, almost half of Vanguard's legendary mutual fund business growth was attributable to its Money Market Fund.

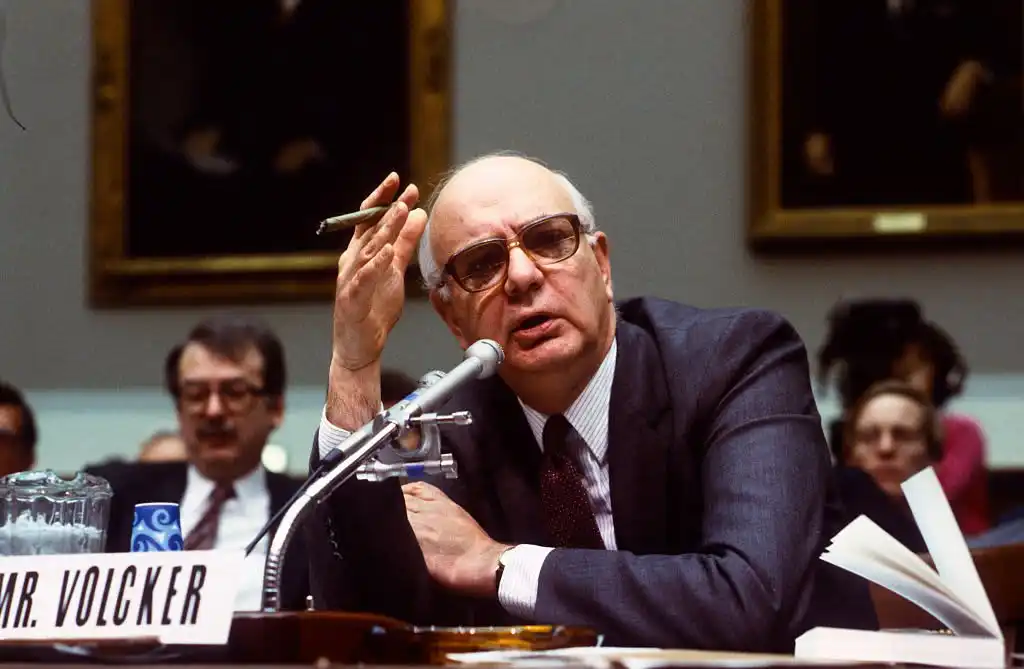

During his tenure as Chairman of the Federal Reserve from 1979 to 1987, Paul Volcker was highly critical of Money Market Funds (MMFs). He continued his criticism of MMFs as late as 2011.

Today, many of the criticisms raised by policymakers against stablecoins echo those from half a century ago against Money Market Funds:

· Systemic Risk and Banking Safety Concerns: MMFs lack deposit insurance and a lender of last resort mechanism, unlike insured banks. Because of this, MMFs are susceptible to rapid runs, which could exacerbate financial instability and lead to contagion. There are also concerns that deposits shifting from insured banks to MMFs could weaken the banking sector as banks lose their low-cost and stable deposit base.

· Unfair Regulatory Arbitrage: MMFs provide bank-like services, maintaining a stable $1 share price, but without rigorous regulatory oversight or capital requirements.

· Weakening of Monetary Policy Transmission Mechanism: MMFs could weaken the Fed's monetary policy tools, as traditional monetary policy instruments like bank reserves are less effective when funds flow from banks to MMFs.

Today, MMFs have financial assets exceeding $7.2 trillion. For reference, M2 (excluding MMF assets) is $21.7 trillion.

In the late 1990s, the rapid growth in MMF assets was a result of financial deregulation (the Gramm-Leach-Bliley Act repealed the Glass-Steagall Act, fueling a wave of financial innovation), while the prosperity of the internet facilitated better electronic and online trading systems, speeding up fund inflows into MMFs.

Do you see a pattern here? (I would like to point out that even half a century later, the regulatory struggle around MMFs is far from over. The SEC adopted MMF reforms in 2023, including raising minimum liquidity requirements and removing fund manager restrictions on investor redemptions.)

Unfortunately, the Reserve Fund met its end after the 2008 financial crisis. It held some Lehman Brothers debt securities, which were written down to zero, leading to the fund's breaking of the buck event and significant redemptions.

También te puede interesar

WEEXPERIENCE Whales Night: AI Trading, Crypto Community & Crypto Market Insights

El 12 de diciembre de 2025, WEEX organizó WEEXPERIENCE Whales Night, un encuentro comunitario offline diseñado para reunir a los miembros de la comunidad criptomoneda local. El evento combinó el intercambio de contenido, juegos interactivos y presentaciones de proyectos para crear una experiencia offline relajada pero atractiva.

AI Trading Risk in Cryptocurrency: Why Better Crypto Trading Strategies Can Create Bigger Losses?

El riesgo en long no reside principalmente en una mala toma de decisiones o errores emocionales. Cada vez más en tiempo real en la estructura del mercado, las vías de ejecución y el comportamiento colectivo. Comprender este cambio es más importante que encontrar la próxima estrategia “mejor”.

AI Agents Are Replacing Crypto Research? How Autonomous AI Is Reshaping Crypto Trading

La IA está pasando de asistir trades a automatizar todo el proceso de investigación a ejecución en mercados de criptomonedas. La ventaja cambió de la perspectiva humana a los sistemas de flujos de datos, velocidad y listos para la ejecución, lo que hace que los retrasos en la integración de la IA sean una desventaja competitiva.

AI Trading Bots and Copy Trading: How Synchronized Strategies Reshape Crypto Market Volatility

Los trades minoristas de criptomonedas han enfrentado en long los mismos desafíos: mala gestión de riesgos, entradas tardías, decisiones emocionales y ejecución inconsistente. Las herramientas de tradear de IA prometían una solución. Hoy en día, los sistemas de copy trading potenciados por IA y bots de ruptura ayudan a los trades a dimensionar posiciones, establecer stops y actuar más rápido que nunca. Más allá de velocidad y precisión, estas herramientas están remodelando los mercados silenciosamente: los trades no solo tradean más inteligentemente, sino que se mueven en sincronización, creando una nueva dinámica que amplifica bot riesgo como oportunidad.

AI Trading in Crypto Explained: How Autonomous Trading Is Reshaping Crypto Markets and Crypto Exchanges

AI tradeando está transformando rápidamente el panorama cripto. Las estrategias tradicionales luchan por mantenerse al día con la volatilidad continua de las criptomonedas y su compleja estructura de mercado, mientras que la IA puede procesar datos masivos, generar estrategias adaptativas, gestionar el riesgo y ejecutar trades de forma autónoma. Este artículo guía a los usuarios de WEEX a través de qué es el AI tradear, por qué las criptomonedas acelerar su adopción, cómo evoluciona el sector hacia los agentes autónomos y por qué WEEX está construyendo el ecosistema de tradear de IA de la próxima generación.

Call to Join AI Wars: WEEX Alpha Awakens — Global AI Trading Competition with $880,000 Prize Pool

Ahora, pedimos que trades de IA de todo el mundo se unan a las Guerras de IA: Alpha Awakens de WEEX, una Competencia de trading global de IA con un pool de premios de $880.000.

AI Trading in Crypto Markets: From Automated Trading Bots to Algorithmic Strategies

Tradear impulsado por IA está cambiando las criptomonedas de la especulación minorista a la competencia de nivel institución, donde la ejecución y la gestión de riesgos son más importantes que la dirección. A medida que la IA tradea, aumentan el riesgo sistémico y la presión regulatoria, lo que hace que el rendimiento en long plazo, los sistemas robustos y el cumplimiento sean los diferenciadores clave.

AI Sentiment Analysis and Cryptocurrency Volatility: What Moves Crypto Prices

El sentimiento de IA está influyendo cada vez más en los mercados de criptomonedas, con cambios en las expectativas relacionadas con la IA que se traducen en volatilidad para los principales activos digitales. Los mercados de criptomonedas tienden a amplificar las narrativas de IA, permitiendo que los flujos impulsados por el sentimiento superen a los fundamentales en short plazo. Comprender cómo se forma y spread el sentimiento de IA ayuda a los inversores a anticipar mejor los ciclos de riesgo y las oportunidades de posición en distintos activos digitales.

AI Wars: Guía del participante

En este enfrentamiento definitivo, los mejores desarrolladores, analistas cuantitativos y traders de todo el mundo darán rienda suelta a sus algoritmos desde batallas en el mercado real, compitiendo por uno de los pools de premios más exuberantes en la historia del trading de cripto con IA: 880.000 USD, lo que incluye un Bentley Bentayga S para el campeón. Esta guía te orientará por cada paso que debes dar desde el registro hasta el inicio oficial de la competencia.

Central Bank Week and Crypto Market Volatility: How Interest Rate Decisions Shape Trading Conditions on WEEX

Las decisiones sobre tasas de interés de los principales bancos centrales, como la Reserva Federal, son eventos macroeconómicos importantes que afectan a los mercados financieros mundiales, influyendo directamente en las expectativas de liquidez y el apetito de riesgo del mercado. A medida que el mercado criptomonedas continúa desarrollándose y su estructura tradeando y participantes maduran, el mercado cripto se está incorporando gradualmente al sistema de precios macroeconómicos.

WEEX API Testing: Official Guide for AI Trading Hackathon and Crypto Trading APIs

WEEX API Testing está diseñado para garantizar que cada participante pueda convertir la lógica tradeando en una ejecución real. Todas las interacciones de la API tienen lugar en el sistema tradeando en tiempo real de WEEX, lo que permite que los participantes trabajen en condiciones auténticas del mercado en lugar de simulaciones. Con un requisito de entrada bajo, bot desarrolladores experimentados como principiantes motivados pueden acceder a la tarea, sin dejar de validar las habilidades técnicas esenciales.

Why is WEEX Alpha Awakens the Best AI Trading Competition of 2025? Everything You Need to Know

Para acelerar los avances en la intersección de la IA y las criptomonedas, WEEX lanzar el primer Hackathon de tradear de IA global del mundo: AI Wars: Alpha Despierta. El evento presenta un innovador pool de premios que supera los $880.000, incluyendo un Bentley Bentayga S para el campeón final.

AI Wars: WEEX Alpha Awakens | WEEX Global Hackathon API Test Process Guide

Guerras de IA: El registro de WEEX Alpha Awakens ya está abierto. y esta guía describe cómo acceder a la prueba de API y completar el proceso con éxito.

What is WEEX Alpha Awakens and How to Participate? A Complete Guide

Para acelerar los avances en la intersección de la IA y las criptomonedas, WEEX lanzar el primer Hackathon de tradear de IA global del mundo: AI Wars: Alpha Despierta.

Join AI Wars: WEEX Alpha Awakens!Global Call for AI Trading Alphas

Guerras de IA: WEEX Alpha Awakens es un hackathon global de IA tradeando en Dubái, que llama a equipos cuánticos, trades algorítmicos y desarrolladores de IA para que den rienda suelta a sus estrategias de IA tradeando cripto en mercados en tiempo real por una parte de un pool de premios de US$880.000.

WEEX Unveils Trade to Earn: Up to 30% Instant Rebate + $2M WXT Buyback

WEEX se complace en anunciar el lanza de nuestro programa Tradea para Ganar, que te otorga automáticamente hasta un 30% tradeando cashbacks. Todas las recompensas se crédito directamente en tu cuenta spot en $WXT, con el respaldo de nuestro plan de comprar de $2.000.000 en WXT, que alimenta el valor de los token a en long plazo.

New: Estimated Liquidation Price on App Candlestick Charts

WEEX presentó un nuevo precio de liquidación estimado (Est. Liq. Price) función en el gráfico de velas para ayudar a los trades gestionar mejor el riesgo e identificar rangos seguros para sus posiciones.

WEEX AI Hackathon Guide: Find Your WEEX UID and Register

Desde ahora hasta febrero 2026, WEEX lanza AI Wars: Alpha Awakens de WEEX, el primer hackathon global de IA cripto tradeando. Accede a tu UID y registro para el Hackathon de tradear de IA global de WEEX.

WEEXPERIENCE Whales Night: AI Trading, Crypto Community & Crypto Market Insights

El 12 de diciembre de 2025, WEEX organizó WEEXPERIENCE Whales Night, un encuentro comunitario offline diseñado para reunir a los miembros de la comunidad criptomoneda local. El evento combinó el intercambio de contenido, juegos interactivos y presentaciones de proyectos para crear una experiencia offline relajada pero atractiva.

AI Trading Risk in Cryptocurrency: Why Better Crypto Trading Strategies Can Create Bigger Losses?

El riesgo en long no reside principalmente en una mala toma de decisiones o errores emocionales. Cada vez más en tiempo real en la estructura del mercado, las vías de ejecución y el comportamiento colectivo. Comprender este cambio es más importante que encontrar la próxima estrategia “mejor”.

AI Agents Are Replacing Crypto Research? How Autonomous AI Is Reshaping Crypto Trading

La IA está pasando de asistir trades a automatizar todo el proceso de investigación a ejecución en mercados de criptomonedas. La ventaja cambió de la perspectiva humana a los sistemas de flujos de datos, velocidad y listos para la ejecución, lo que hace que los retrasos en la integración de la IA sean una desventaja competitiva.

AI Trading Bots and Copy Trading: How Synchronized Strategies Reshape Crypto Market Volatility

Los trades minoristas de criptomonedas han enfrentado en long los mismos desafíos: mala gestión de riesgos, entradas tardías, decisiones emocionales y ejecución inconsistente. Las herramientas de tradear de IA prometían una solución. Hoy en día, los sistemas de copy trading potenciados por IA y bots de ruptura ayudan a los trades a dimensionar posiciones, establecer stops y actuar más rápido que nunca. Más allá de velocidad y precisión, estas herramientas están remodelando los mercados silenciosamente: los trades no solo tradean más inteligentemente, sino que se mueven en sincronización, creando una nueva dinámica que amplifica bot riesgo como oportunidad.

AI Trading in Crypto Explained: How Autonomous Trading Is Reshaping Crypto Markets and Crypto Exchanges

AI tradeando está transformando rápidamente el panorama cripto. Las estrategias tradicionales luchan por mantenerse al día con la volatilidad continua de las criptomonedas y su compleja estructura de mercado, mientras que la IA puede procesar datos masivos, generar estrategias adaptativas, gestionar el riesgo y ejecutar trades de forma autónoma. Este artículo guía a los usuarios de WEEX a través de qué es el AI tradear, por qué las criptomonedas acelerar su adopción, cómo evoluciona el sector hacia los agentes autónomos y por qué WEEX está construyendo el ecosistema de tradear de IA de la próxima generación.

Call to Join AI Wars: WEEX Alpha Awakens — Global AI Trading Competition with $880,000 Prize Pool

Ahora, pedimos que trades de IA de todo el mundo se unan a las Guerras de IA: Alpha Awakens de WEEX, una Competencia de trading global de IA con un pool de premios de $880.000.

Monedas populares

Últimas noticias sobre criptomonedas

Atención al cliente:@weikecs

Cooperación empresarial:@weikecs

Trading cuantitativo y MM:[email protected]

Programa VIP:[email protected]