Berachain Launches PoL Mining: Can $HONEY "Sticky" Liquidity in the Ecosystem?

Original Article Title: Berachain's Proof of Liquidity: Is It Sticky Though?

Original Article Author: Castle Labs, Web3 Ecosystem Partner

Original Article Translation: DeepSeek

Editor's Note: PoL requires staking assets in a liquidity pool rather than static locking, utilizing liquidity incentives, validator dynamics, and ecosystem optimization to improve capital efficiency, enhance network security, and DeFi liquidity. Currently, Berachain has a stablecoin APR of over 20%, and with the PoL launch, Berachain is expected to address DeFi inefficiencies and drive ecosystem growth. However, its success still faces challenges such as operational complexity, incentive misalignment, and regulatory uncertainty.

Below is the original content (slightly rephrased for clarity):

With the launch of PoL, can Berachain prove that its liquidity mechanism will fundamentally transform the DeFi landscape?

Berachain is an emerging Layer1 blockchain with a core design principle of leveraging Proof of Liquidity (PoL), a consensus mechanism that integrates liquidity provision into network security to empower value for ecosystem applications.

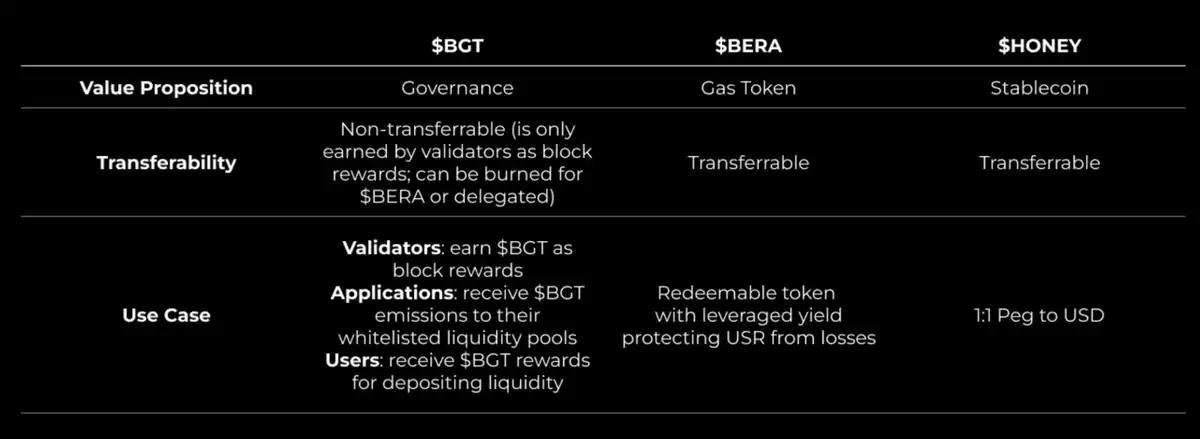

The system adopts a dual-token model ($BERA and $BGT) aimed at building a mutually beneficial ecosystem for validators, developers, and users (refer to the Honeypaper whitepaper).

With the PoL deployment, we will witness whether Berachain can address the inefficiencies in the DeFi space and meet market expectations.

Operation Mechanism of Proof of Liquidity

Unlike traditional Proof of Stake (PoS), PoL requires staked assets to be in a liquidity pool rather than static locking. This mechanism operates through the synergy of the following components:

1. Liquidity Incentives

Users who deposit assets into whitelisted DeFi protocols (such as DEX or lending markets) can receive $BGT from a reward treasury. These smart contract-controlled pools continuously release $BGT to incentivize users to enhance ecosystem liquidity.

Unlike transferable rewards, the non-transferable nature of $BGT ties its value to ongoing participation, promoting long-term commitment.

2. Validator Dynamics

Validators stake the network Gas token $BERA to maintain chain security and earn $BGT rewards. Their key obligation is to allocate a portion of the rewards to a designated treasury to guide liquidity toward specific applications. In return, validators may receive protocol fees or native tokens as incentives, forming a symbiotic relationship. This structure highlights PoL's emphasis on mutualistic benefits.

3. Ecosystem Synergy

PoL builds a triple-incentive system for validators, applications, and liquidity providers. The protocol boosts competition rewards for validators distributing $BGT, while users delegate their $BGT to preferred validators. This design of a quasi-resource allocation market achieves network-level optimization of capital efficiency.

4. Capital Efficiency and Security

Traditional PoS locks capital in staking contracts, whereas PoL enables staked assets to secure the network and provide DeFi liquidity simultaneously. If this dual-purpose design scales successfully, it could make Berachain a benchmark for a sustainable blockchain economy.

Tokenomics: Dual-Token System

According to the Honeypaper, the Berachain ecosystem is driven by two distinct utility tokens:

· $BERA: The native Gas token used to pay transaction fees and validator staking, serving as the cornerstone of network security and operational costs.

· $BGT (Governance Token): Liquidity providers acquire it through market-making, holders can burn $BGT at a 1:1 rate to receive $BERA, or influence reward distribution through delegation. Its non-transferability ensures governance remains in the hands of active participants.

This model establishes validators relying on $BERA for security and users guiding liquidity through $BGT, creating a positive feedback loop to drive ecosystem growth.

$BGT Liquidity Forecast and Ecosystem Impact

The success of PoL hinges on the distribution and use of $BGT. This section outlines its potential impact:

1. Liquidity Aggregation

$BGT is expected to flow into DEXs, lending protocols, and other high-yield platforms—areas that have long dominated DeFi transaction volume. Validators may prioritize treasury rewards, leading liquidity toward established use cases. However, with a well-designed incentive mechanism, emerging areas such as derivatives or RWAs also have opportunities.

2. Network Activity

Validators maintain blockchain security and earn $BGT rewards by staking the Gas token $BERA in the staking network. Their key responsibility is to allocate a portion of the $BGT issuance to a reward pool, effectively directing liquidity into specific applications. In return, validators receive income shares, native token rewards, and other diverse incentives—forming a symbiotic relationship. This architecture distinctly embodies the core pursuit of PoL (Proof of Liquidity) for mutual benefit and incentive alignment.

3. Ecosystem Expansion

The deep liquidity spawned by PoL attracts developers and capital influx. Blocmates analysis suggests that new projects, from yield aggregators to cross-chain bridges, may onboard, echoing the scenario of Polygon's ecosystem TVL growing by 300% in 18 months post-2021.

4. Validator Competition

Validators strategically allocate $BGT rewards to attract delegations. According to Berachain forum disclosures on the reward pool whitelist mechanism, protocols offering the optimal risk-adjusted return may dominate early liquidity trends, shaping the overall ecosystem development focus.

Opportunities and Risks

Opportunities

• Capital Efficiency Enhancement: The dual-purpose staking assets enable PoL's locked capital throughput to potentially exceed traditional PoS by 15-25%, significantly reducing opportunity costs compared to the Ethereum staking model

• Decentralization Resilience: The distributed distribution of rewards among validators, users, and applications helps mitigate centralization risks

• Long-Term Growth: A liquidity-driven security model can attract institutional-grade DeFi projects, supporting 3-5 years of ecosystem expansion

Risks

• Operational Complexity: The multi-layered mechanisms involving validator rewards, reward pool whitelist, and $BGT delegation may deter regular users, with the first-year adoption rate potentially reaching only 10-20% of the target audience

• Incentive Misalignment: Validator collusion with protocols can distort the flow of $BGT (as evidenced by early governance disputes in SushiSwap)

• Validator Reliance: Network stability hinges on validators surpassing short-term self-interest to pursue collective well-being—something hard to predict pre-mainnet launch

• Regulatory Changes: The integration design of liquidity tokens and governance tokens may face regulatory uncertainty in jurisdictions such as the United States regarding DeFi regulations

Summary

In the current sluggish market environment, Berachain's PoL launch can be considered one of the few highlights, injecting new excitement into the industry.

This is the first major test of its concept validation, which will determine whether PoL can truly open up a new paradigm. Although projects like Initia have had similar attempts with "built-in liquidity," Berachain is the first case to undergo a real test.

Will it be a success? Can the "honey" truly create highly sticky liquidity? The answer will soon be revealed!

Original article link: Link

Vous pourriez aussi aimer

WEEXPERIENCE Nuit des baleines : Trading IA, communauté crypto et marché crypto

Le 12 décembre 2025, WEEX a organisé WEEXPERIENCE Whales Night, un rassemblement communautaire hors ligne conçu pour rassembler les membres de la communauté crypto locale. L'événement a combiné le partage de contenu, des jeux interactifs et des présentations de projets pour créer une expérience hors ligne détendue et attrayante.

Risque de trading d'IA en cryptomonnaie : Pourquoi de meilleures stratégies de trading crypto peuvent-elles générer des pertes plus importantes ?

Le risque ne réside plus principalement dans une mauvaise prise de décision ou des erreurs émotionnelles. Il vit de plus en plus dans la structure du marché, les parcours d'exécution et le comportement collectif. Comprendre ce changement est plus important que de trouver la prochaine stratégie « meilleure ».

Les agents de l'IA remplacent-ils la recherche crypto ? Comment l'IA autonome remodele le trading crypto

L'IA passe de l'assistance aux traders à l'automatisation de l'ensemble du processus de recherche à l'exécution sur les marchés crypto. L'avantage est passé de l'information humaine aux pipelines de données, à la vitesse et aux systèmes d'IA prêts à être exécutés, ce qui fait des retards dans l'intégration de l'IA un désavantage concurrentiel.

Boots de trading et copy trading IA : Comment les stratégies synchronisées remodèlent la volatilité du marché crypto

Les traders crypto de détail sont confrontés depuis longtemps aux mêmes défis : mauvaise gestion des risques, entrées tardives, décisions émotionnelles et exécution incohérente. Les outils de trading IA promettaient une solution. Aujourd'hui, les systèmes de copy trading et les bots de cassage alimentés par l'IA aident les traders à dimensionner leurs positions, à définir des stops et à agir plus rapidement que jamais. Au-delà de la vitesse et de la précision, ces outils remodèlent tranquillement les marchés : les traders ne tradent pas seulement plus malin, ils évoluent de façon synchronisée, créant une nouvelle dynamique qui amplifie à la fois les risques et les opportunités.

Le trading d'IA en crypto expliqué : Comment le trading autonome remodele les marchés crypto et les plateformes d’échange crypto

L’IA Trading transforme rapidement le paysage crypto. Les stratégies traditionnelles peinent à suivre la volatilité constante de la crypto et la structure complexe du marché, tandis que l'IA peut traiter des données massives, générer des stratégies adaptatives, gérer les risques et exécuter des trades de manière autonome. Cet article guide les utilisateurs de WEEX sur ce qu'est le trading d'IA, pourquoi la crypto accélère son adoption, comment le secteur évolue vers des agents autonomes et pourquoi WEEX construit l'écosystème de trading d'IA de nouvelle génération.

Appelez à rejoindre AI Wars : WEEX Alpha Awakens – Tournoi mondial de trading d’IA avec une cagnotte de 880 000 $

Maintenant, nous lançons un appel aux traders d'IA du monde entier pour qu'ils rejoignent AI Wars : WEEX Alpha Awakens, un tournoi mondial de trading d'IA doté d'une cagnotte de 880 000 $.

Trading d'IA sur les marchés crypto : Des bots de trading automatisés aux stratégies algorithmiques

Le trading basé sur l'IA fait passer la crypto de la spéculation au détail à une concurrence de niveau institutionnel, où l'exécution et la gestion des risques comptent plus que dans le sens. À mesure que le trading de l'IA prend de l'ampleur, les risques systémiques et la pression réglementaire augmentent, faisant des performances à long terme, des systèmes robustes et de la conformité les principaux facteurs de différenciation.

Analyse du sentiment de l'IA et volatilité des cryptomonnaies : Ce qui fait bouger les prix crypto

Le sentiment lié à l'IA influence de plus en plus les marchés crypto, les changements d'attente liés à l'IA se traduisant par une certaine volatilité pour les principaux actifs numériques. Les marchés crypto ont tendance à amplifier les discours sur l'IA, permettant aux flux basés sur les sentiments de l'emporter sur les fondamentaux à court terme. Comprendre comment le sentiment IA se forme et se propage aide les investisseurs à mieux anticiper les cycles de risque et les opportunités de positionnement sur les actifs numériques.

Guerres de l'IA : Guide du participant

Dans cette confrontation ultime, les meilleurs développeurs, quants et traders du monde entier déploieront leurs algorithmes dans des batailles sur le marché réel, en compétition pour l'un des prix les plus importants de l'histoire du trading crypto basé sur l'IA : 880 000 dollars américains, dont une Bentley Bentayga S pour le champion. Ce guide vous accompagnera à travers toutes les étapes nécessaires, de l'inscription au début officiel de la compétition.

Semaine des banques centrales et volatilité des marchés crypto : Comment les décisions relatives aux taux d'intérêt influencent les conditions de trading sur WEEX

Les décisions relatives aux taux d'intérêt prises par les grandes banques centrales, comme la Réserve fédérale, sont des événements macroéconomiques importants qui ont un impact sur les marchés financiers mondiaux et influencent directement les attentes de liquidité des marchés et l'appétence au risque. À mesure que le marché des cryptomonnaies continue de se développer et que sa structure de trading et ses participants mûrissent, le marché des cryptomonnaies est progressivement intégré dans le système d'établissement des prix macroéconomiques.

Test de l'API WEEX : Guide officiel des API de trading de Hackathon et de Crypto pour le trading d’IA

WEEX API Testing est conçu pour garantir que chaque participant peut transformer la logique de trading en exécution réelle. Toutes les interactions API ont lieu sur le système de trading en direct de WEEX, ce qui permet aux participants de travailler dans des conditions de marché authentiques plutôt que dans des simulations. Avec une faible exigence d'entrée, la tâche est accessible à la fois aux développeurs expérimentés et aux débutants motivés, tout en validant les compétences techniques essentielles.

Pourquoi WEEX Alpha se réveille-t-il le meilleur tournoi de trading d'IA de 2025 ? Tout ce que vous devez savoir

Pour accélérer les percées à l'intersection de l'IA et de la crypto, WEEX lance le premier Hackathon mondial de trading d'IA – AI Wars: Alpha se réveille. L'événement propose une cagnotte révolutionnaire dépassant 880 000 $, dont une Bentley Bentayga S pour le champion ultime.

AI Wars: WEEX Alpha Awakens | Guide des processus de test de l'API WEEX Global Hackathon

AI Wars : L'inscription au Réveil Alpha WEEX est maintenant ouverte. Ce guide explique comment accéder au test API et terminer le processus avec succès.

Qu'est-ce que le réveil de WEEX Alpha et comment participer ? Un guide complet

Pour accélérer les percées à l'intersection de l'IA et de la crypto, WEEX lance le premier Hackathon mondial de trading d'IA – AI Wars: Alpha se réveille.

Join AI Wars: WEEK Alpha se réveille !Appel mondial pour les Alphas de Trading IA

AI Wars: WEEX Alpha Awakens est un hackathon mondial de trading sur l'IA à Dubaï, appelant les équipes quantiques, les traders algorithmiques et les développeurs d'IA à lancer leurs stratégies de trading crypto sur les marchés en direct pour une part d'une cagnotte de 880 000 $ US.

WEEX dévoile le trade to Earn: Jusqu'à 30 % de remise instantanée + 2 M$ WXT Rachat

WEEX est heureuse d’annoncer le lancement de son programme Trade to Earn, qui vous accorde automatiquement jusqu’à 30% de rabais sur les frais de trading. Toutes les récompenses sont créditées directement sur votre compte au comptant en WXT $, soutenu par notre plan de rachat de WXT $2,000,000 qui alimente la valeur à long terme des jetons.

Nouveau: Prix de liquidation estimé sur les graphiques App Candlestick

WEEX a introduit un nouveau prix estimatif de liquidation (Est. Liq. Price) figure sur le graphique en chandelier pour aider les traders à mieux gérer le risque et à identifier des fourchettes sûres pour leurs positions.

WEEX AI Hackathon Guide: Trouvez votre UID WEEK et inscrivez-vous

D'ici février 2026, WEEX lance AI Wars: WEEK Alpha Awakens, le premier hackathon mondial de trading de crypto-IA. Venez votre UID et inscrivez-vous au WEEX Global AI Trading Hackathon.

WEEXPERIENCE Nuit des baleines : Trading IA, communauté crypto et marché crypto

Le 12 décembre 2025, WEEX a organisé WEEXPERIENCE Whales Night, un rassemblement communautaire hors ligne conçu pour rassembler les membres de la communauté crypto locale. L'événement a combiné le partage de contenu, des jeux interactifs et des présentations de projets pour créer une expérience hors ligne détendue et attrayante.

Risque de trading d'IA en cryptomonnaie : Pourquoi de meilleures stratégies de trading crypto peuvent-elles générer des pertes plus importantes ?

Le risque ne réside plus principalement dans une mauvaise prise de décision ou des erreurs émotionnelles. Il vit de plus en plus dans la structure du marché, les parcours d'exécution et le comportement collectif. Comprendre ce changement est plus important que de trouver la prochaine stratégie « meilleure ».

Les agents de l'IA remplacent-ils la recherche crypto ? Comment l'IA autonome remodele le trading crypto

L'IA passe de l'assistance aux traders à l'automatisation de l'ensemble du processus de recherche à l'exécution sur les marchés crypto. L'avantage est passé de l'information humaine aux pipelines de données, à la vitesse et aux systèmes d'IA prêts à être exécutés, ce qui fait des retards dans l'intégration de l'IA un désavantage concurrentiel.

Boots de trading et copy trading IA : Comment les stratégies synchronisées remodèlent la volatilité du marché crypto

Les traders crypto de détail sont confrontés depuis longtemps aux mêmes défis : mauvaise gestion des risques, entrées tardives, décisions émotionnelles et exécution incohérente. Les outils de trading IA promettaient une solution. Aujourd'hui, les systèmes de copy trading et les bots de cassage alimentés par l'IA aident les traders à dimensionner leurs positions, à définir des stops et à agir plus rapidement que jamais. Au-delà de la vitesse et de la précision, ces outils remodèlent tranquillement les marchés : les traders ne tradent pas seulement plus malin, ils évoluent de façon synchronisée, créant une nouvelle dynamique qui amplifie à la fois les risques et les opportunités.

Le trading d'IA en crypto expliqué : Comment le trading autonome remodele les marchés crypto et les plateformes d’échange crypto

L’IA Trading transforme rapidement le paysage crypto. Les stratégies traditionnelles peinent à suivre la volatilité constante de la crypto et la structure complexe du marché, tandis que l'IA peut traiter des données massives, générer des stratégies adaptatives, gérer les risques et exécuter des trades de manière autonome. Cet article guide les utilisateurs de WEEX sur ce qu'est le trading d'IA, pourquoi la crypto accélère son adoption, comment le secteur évolue vers des agents autonomes et pourquoi WEEX construit l'écosystème de trading d'IA de nouvelle génération.

Appelez à rejoindre AI Wars : WEEX Alpha Awakens – Tournoi mondial de trading d’IA avec une cagnotte de 880 000 $

Maintenant, nous lançons un appel aux traders d'IA du monde entier pour qu'ils rejoignent AI Wars : WEEX Alpha Awakens, un tournoi mondial de trading d'IA doté d'une cagnotte de 880 000 $.

Pièces populaires

Dernières actus crypto

Assistance client:@weikecs

Collaborations commerciales:@weikecs

Trading quantitatif/Market makers:[email protected]

Programme VIP:[email protected]