Bring the Ethos to Corporate Etherians

Original Article Title: "Ethereum Developers Bringing Their Talents to the Private Sector"

Original Article Author: Eric, Foresight News

On the evening of the 19th (Beijing time), Bankless co-founder David Hoffman posted on X to "commemorate" Ethereum Foundation's longest-serving researcher, Dankrad Feist, who chose to leave Ethereum and join the stablecoin L1 Tempo.

David Hoffman believes that the issue of for-profit companies absorbing talent nurtured by the Ethereum open-source community is significant and states that these companies will not necessarily bring greater benefits to Ethereum as they claim. David Hoffman bluntly expressed, "In my view, the significance of Tempo is to intercept the tens of trillions of dollars expected to flow into it over the next decade and put it on their private blockchain. Of course, this will grow the pie, but Tempo still intends to take as big a slice of that pie as possible." He believes that Tempo will be restricted by compliance issues regardless and that even issuing tokens cannot solve this. Although Tempo and Ethereum will both bring changes to the world, only Ethereum is best suited to be a trusted, neutral global settlement layer, with no shareholders and not bound by laws.

The "grass is greener on the other side" sentiment towards Ethereum has been evident since this cycle, as Ethereum's price performance lagged behind Bitcoin. Over time, it has become apparent that the departure of talented individuals from the Ethereum community seems to be an irreversible trend. When dreams clash with interests, many people ultimately choose the latter, which has long been a concern in the industry...

Dankrad Feist is Not the First, Nor Will He Be the Last

On the 17th of this month, Dankrad Feist announced on X that he would join Tempo and continue to serve as a research advisor for Ethereum Foundation's protocol cluster's three strategic initiatives (L1 scaling, Blob extension, and user experience improvement). Dankrad Feist stated, "Ethereum has a unique set of strong values and technical choices that underpin it. Tempo will be a great complement, built on similar technology and values while able to break boundaries in scale and speed. I believe this will greatly benefit Ethereum. Tempo's open-source tech can easily reintegrate back into Ethereum, benefiting the entire ecosystem."

According to LinkedIn, Dankrad Feist officially became an Ethereum researcher in 2019, focusing on researching Ethereum mainnet's sharding technology for scalability. The current core part of Ethereum's scalability roadmap, Danksharding, is named after him. Danksharding is seen as a key technological path for Ethereum to achieve high throughput and low-cost transactions, widely regarded by the community as a crucial upgrade direction post "Ethereum 2.0."

Dankrad Feist drove the precursor version of Danksharding, Proto-Danksharding (EIP-4844), which introduced the blob transaction type. This EIP provided Rollup with a cheaper and more efficient data availability layer, significantly reducing the data publishing costs of Rollup.

Furthermore, he engaged in a public dispute with Geth lead developer Péter Szilágyi on the MEV issue, eventually prompting Vitalik to intervene and push the community to prioritize MEV mitigation mechanisms like PBS (Proposer-Builder Separation).

Tempo researcher Mallesh Pai introduced new members joining Tempo in September, including Liam Horne, former CEO of OP Labs and co-founder of ETHGlobal.

Prior to Dankrad Feist, another figure that surprised the industry was Danny Ryan, co-founder of Etherealize, which secured a $40 million funding. As a former core member of the Ethereum Foundation known as the "Ethereum 2.0 Lead," he announced an indefinite departure in September 2024 and joined Etherealize just six months later. However, given Etherealize's similarity to ConsenSys founded by Ethereum co-founder Joseph Lubin, who left 11 years ago due to commercialization disputes, Danny Ryan received wide understanding.

What really concerns David Hoffman are companies like Tempo and Paradigm. Renowned Ethereum developer Federico Carrone expressed a similar view, retweeting David Hoffman's tweet about Dankrad Feist joining Tempo and stating that he has been warning for the past two years that Paradigm's influence within Ethereum could pose a tail risk to the entire ecosystem.

Federico Carrone wrote that the sole objective of a venture capital fund is to maximize returns for LPs, and Ethereum should not form a deep technical dependency on a venture capitalist playing with very high strategic skill. After the FTX scandal, Paradigm almost entirely removed all cryptocurrency-related brand exposure, making a high-profile shift to AI. Carrone believes this is enough to prove his point.

Following Trump's return to the White House, Paradigm re-entered the Web3 space, heavily recruiting top community researchers and funding key Ethereum open-source libraries, as well as supporting Stripe's launch of Tempo. Carrone believes that while Paradigm claims everything they do is beneficial for Ethereum - more funding, more tools, more testnets, new ideas that can all feed back into Ethereum - these are indeed potential benefits. However, when a company has too much visibility and influence over an open-source project, priorities shift from the community's long-term vision to corporate interests.

The Accumulation of Ethereum's Technical Debt

The mere loss of talent in the Ethereum open-source community may not be a cause for widespread concern, but if talent loss is accompanied by the accumulation of technical debt, then there is cause for high alert.

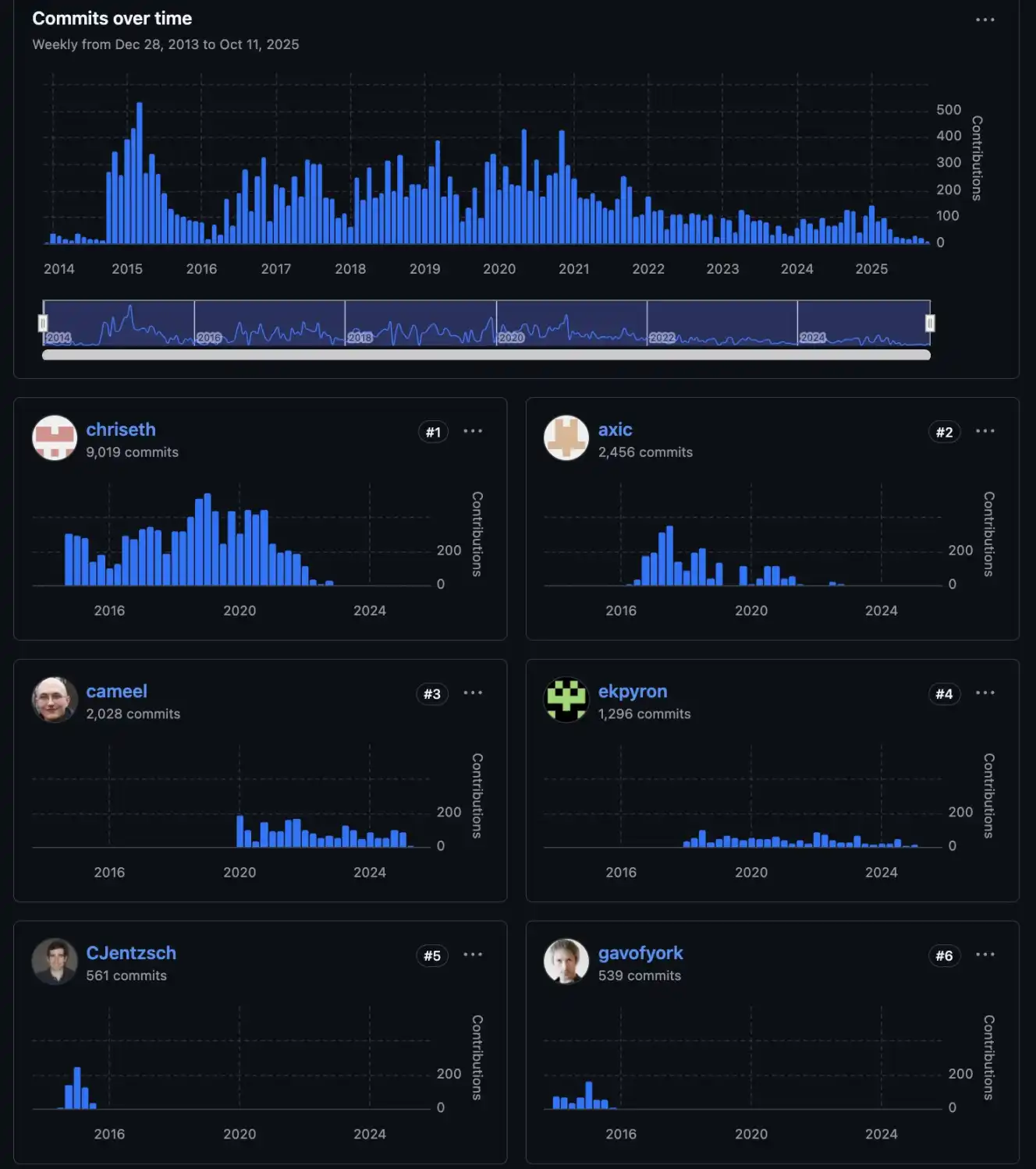

A week ago, a community user posted a screenshot on X and stated that the top contributors to the Solidity language have almost ceased their development efforts. Only Cameel continues to raise new issues and drive technical progress, but it appears to be in a maintenance mode. They believe the community needs to allocate more resources to support this programming language.

Some users in the comments questioned why effort should be spent on continuing to improve upgrade Solidity rather than just maintaining it to ensure stability and security. The user who posted explained that even changing the Solidity compiler would not affect any already deployed contracts but could enhance security, improve development experience, or support the use of new contracts. As shown in the image above, the level of development activity has sharply declined since the beginning of the last hype-driven bull market.

Federico Carrone also expressed his concerns, stating that what worries him the most is that many core tools and libraries built around Solidity may not receive long-term maintenance at all. Even the latest Solidity compiler is currently supported by very few developers. Additionally, companies related to L2 and ZK technologies are downsizing, making it possible that the iteration of cutting-edge technology may rely on just a few companies. As the Gas Limit increases, many execution clients have not made substantial performance improvements, and judging from the libraries, the development teams of these clients seem to have fallen behind.

Federico Carrone stated, "Ethereum's technical debt continues to accumulate, not only because the protocol itself must keep evolving, but also because many dependent libraries and peripheral repositories are now stagnant. The entire ecosystem continues to expand, guarding assets worth billions of dollars, while part of its foundation is quietly eroding."

The Open Source Community Cannot Solely Rely on "Love-Powered" Contributions

For an open-source community like Ethereum that carries a significant amount of tangible value in the form of programmable money, balancing "love-powered" contributions with economic incentives is a problem with no prior cases to reference. This should have been a highly concerning issue for the Ethereum Foundation, but it seems to have been overlooked.

Péter Szilágyi, who joined the Ethereum Foundation in 2015 and was responsible for Geth development and maintenance, explicitly outlined three of the most disappointing issues in a letter to the Ethereum Foundation leadership a year and a half ago: being portrayed externally as a leader but marginalized internally, severe income misalignment with Ethereum's market cap growth, and an excessive influence of Vitalik and a small group around him on the Ethereum ecosystem.

By the end of 2024, Péter Szilágyi discovered the Ethereum Foundation secretly incubating an independent Geth fork team, was subsequently fired due to disputes with the Ethereum Foundation, and was repeatedly denied rehiring. Subsequently, the Ethereum Foundation even proposed to pay Péter Szilágyi $5 million for Geth to become independent of the foundation, a proposal that was rejected. Currently, Péter Szilágyi still maintains the Geth codebase as an independent contributor.

Rumors of internal corruption within the Ethereum Foundation have been widespread, but this is actually a problem that should have been anticipated from the moment the Ethereum Foundation was established. The saying goes, "Where there are people, there is a rivers-and-lakes community," indicating that we cannot eliminate human greed. However, we cannot allow Ethereum to gradually lose its most core value due to commercialization.

Ethereum has a market cap of tens of billions of dollars, has facilitated the transfer of trillions of dollars' worth of value on-chain over the years, and is built on the foundation of a professional technical team, with a core ethos of permissionless open source, and through the commercialization brought by a large number of enterprises. However, such a vast system requires a significant amount of personnel to maintain, and as we have seen, these individuals are leaving due to disappointment or choosing to join other projects for economic gain.

The Ethereum Foundation underwent substantial reforms this year, but it does not seem to have produced remarkable results yet. Ethereum still can be described as the world's computer, with the potential in commercial applications still being continuously explored by brilliant teams. However, as the foundation of all this, Ethereum cannot continue to disappoint those who still persist for their ideals.

Vous pourriez aussi aimer

Trading d'IA sur les marchés crypto : Des bots de trading automatisés aux stratégies algorithmiques

Le trading basé sur l'IA fait passer la crypto de la spéculation au détail à une concurrence de niveau institutionnel, où l'exécution et la gestion des risques comptent plus que dans le sens. À mesure que le trading de l'IA prend de l'ampleur, les risques systémiques et la pression réglementaire augmentent, faisant des performances à long terme, des systèmes robustes et de la conformité les principaux facteurs de différenciation.

Analyse du sentiment de l'IA et volatilité des cryptomonnaies : Ce qui fait bouger les prix crypto

Le sentiment lié à l'IA influence de plus en plus les marchés crypto, les changements d'attente liés à l'IA se traduisant par une certaine volatilité pour les principaux actifs numériques. Les marchés crypto ont tendance à amplifier les discours sur l'IA, permettant aux flux basés sur les sentiments de l'emporter sur les fondamentaux à court terme. Comprendre comment le sentiment IA se forme et se propage aide les investisseurs à mieux anticiper les cycles de risque et les opportunités de positionnement sur les actifs numériques.

novembre 2025 Revue du marché cryptographique: Correction des prix, rachats d’ETF et évolution du paysage de la blockchain

Novembre 2025 a été marqué par une forte volatilité et une correction structurelle au sein de l’écosystème global de la blockchain, principalement sous l’effet des prévisions macroéconomiques fluctuantes et de la dynamique spécifique des flux de capitaux.

WEEX illumine la scène mondiale avec une série d'événements en personne en 2025

Au cœur de l'empreinte mondiale de WEEX : un élan que rien n'arrête

MetaMask Lance mUSD : Un Game-Changer pour les Stablecoins

Table des Matières CoinCryptoNewz Dans le monde en constante évolution des cryptomonnaies, imaginez un outil qui simplifie les…

Prédiction de Prix ZKC : Boundless Vise 1,50 $ Malgré une Chute de 50 %

Prédiction de Prix Boundless (ZKC) : Que Se Passe-t-Il Après une Baisse de 50 % ? Le graphique…

Top 4 raisons pourquoi le prix de l’Avantis coin est en hausse

Introduction au phénomène de l’Avantis coin Imaginez une crypto-monnaie qui grimpe comme une fusée, captivant les investisseurs du…

Pourquoi le prix de Linea s’effondre-t-il alors que les métriques clés atteignent des sommets records ?

Imaginez une crypto-monnaie qui voit son prix plonger comme une pierre dans l’eau, alors que son réseau explose…

Linea bondit alors que les investisseurs achètent le dip, les métriques de l’écosystème Linea atteignent des sommets records

Imaginez un réseau blockchain qui rebondit comme un athlète après une chute, attirant les investisseurs malins qui voient…

Le YU stablecoin de Yala, backed by Bitcoin, peine à retrouver son peg après un exploit

Mise à jour sur l’incident affectant le YU stablecoin Le YU stablecoin de Yala, collateralized par Bitcoin, a…

La Corée du Sud enregistre une flambée du trading volume pour ces 15 altcoins – Voici la liste mise à jour au 15 septembre 2025

En Corée du Sud, où la population passionnée par les cryptomonnaies est particulièrement dense, on observe des volumes…

Native Markets revendique officiellement le ticker USDH stablecoin de Hyperliquid

Dans le monde dynamique des cryptomonnaies, où les prix fluctuent rapidement, Bitcoin (BTC) se négocie actuellement à environ…

Les memecoins sous pression : SHIB et Dogecoin chutent après le hack de 2,4 millions de dollars sur Shibarium le 15 septembre 2025

Les marchés des cryptomonnaies font face à une nouvelle vague de turbulence, avec les principaux memecoins qui subissent…

Charlie Kirk était-il détenteur de XRP ? Des commentaires antérieurs déclenchent la spéculation

Table des matières Times Tabloid Autres articles publiés le 14 septembre 2025 Elon Musk’s xAI licencie 500 annotateurs…

AVNT bondit de 67,3 % après la listing sur Binance

Tokentopnews.com met en lumière les actualités crypto du 15 septembre 2025 Imaginez un marché crypto qui pulse comme…

Projet Linea : L’avenir « Silver » de Ethereum Layer 2

Imaginez Ethereum comme un géant de l’industrie, puissant mais parfois lent sous le poids de sa propre envergure.…

Échec d’Extraction de Contenu en Blockchain : Causes et Solutions en 2025

Imaginez que vous essayez de puiser de l’or numérique dans le vaste univers de la Blockchain, mais au…

Tom Lee prédit avec confiance que Bitcoin atteindra 200 000 $ d’ici la fin de l’année

Imaginez Bitcoin comme un athlète en pleine course, boosté par des vents favorables comme les baisses de taux…

Trading d'IA sur les marchés crypto : Des bots de trading automatisés aux stratégies algorithmiques

Le trading basé sur l'IA fait passer la crypto de la spéculation au détail à une concurrence de niveau institutionnel, où l'exécution et la gestion des risques comptent plus que dans le sens. À mesure que le trading de l'IA prend de l'ampleur, les risques systémiques et la pression réglementaire augmentent, faisant des performances à long terme, des systèmes robustes et de la conformité les principaux facteurs de différenciation.

Analyse du sentiment de l'IA et volatilité des cryptomonnaies : Ce qui fait bouger les prix crypto

Le sentiment lié à l'IA influence de plus en plus les marchés crypto, les changements d'attente liés à l'IA se traduisant par une certaine volatilité pour les principaux actifs numériques. Les marchés crypto ont tendance à amplifier les discours sur l'IA, permettant aux flux basés sur les sentiments de l'emporter sur les fondamentaux à court terme. Comprendre comment le sentiment IA se forme et se propage aide les investisseurs à mieux anticiper les cycles de risque et les opportunités de positionnement sur les actifs numériques.

novembre 2025 Revue du marché cryptographique: Correction des prix, rachats d’ETF et évolution du paysage de la blockchain

Novembre 2025 a été marqué par une forte volatilité et une correction structurelle au sein de l’écosystème global de la blockchain, principalement sous l’effet des prévisions macroéconomiques fluctuantes et de la dynamique spécifique des flux de capitaux.

WEEX illumine la scène mondiale avec une série d'événements en personne en 2025

Au cœur de l'empreinte mondiale de WEEX : un élan que rien n'arrête

MetaMask Lance mUSD : Un Game-Changer pour les Stablecoins

Table des Matières CoinCryptoNewz Dans le monde en constante évolution des cryptomonnaies, imaginez un outil qui simplifie les…

Prédiction de Prix ZKC : Boundless Vise 1,50 $ Malgré une Chute de 50 %

Prédiction de Prix Boundless (ZKC) : Que Se Passe-t-Il Après une Baisse de 50 % ? Le graphique…

Pièces populaires

Dernières actus crypto

Assistance client:@weikecs

Collaborations commerciales:@weikecs

Trading quantitatif/Market makers:[email protected]

Programme VIP:[email protected]