Fast as lightning is not enough, what is the EVM chain really pushing for?

Original Title: Battle of the EVM Chains: Who's Winning the Giga Gas War?

Original Author: yusufxzy, Delphi_Digital Researcher

Original Translation: Dynamic Duo Deep

Editor's Note: The current focus of EVM-compatible chains (such as Sonic, MegaETH, Monad, Sei, Fuel) has shifted from decentralization and security to raw performance and ecosystem strategy. Each chain is competing in the market through differentiated paths (such as developer incentives, extreme speed, ecosystem pre-building, technical optimization, or Layer 2 innovation), but the ultimate winner must establish an advantage across comprehensive dimensions such as speed, user experience, economic model, and ecosystem maturity, rather than relying solely on throughput.

The following is the original content (rearranged for easier reading comprehension):

The blockchain space has entered a new dimension of competition. The early battle between L1 and L2 focused on decentralization, composability, and security. Now the battlefield has shifted to the raw performance track. Multiple EVM-compatible chains including Sonic, MegaETH, Fuel, Monad, and Sei are competing to break through the once-considered impossible scalability peak. But is raw performance the deciding factor? This article analyzes the strategic differences of these chains.

Sonic: Linking Developer Rewards to Ecosystem Contribution

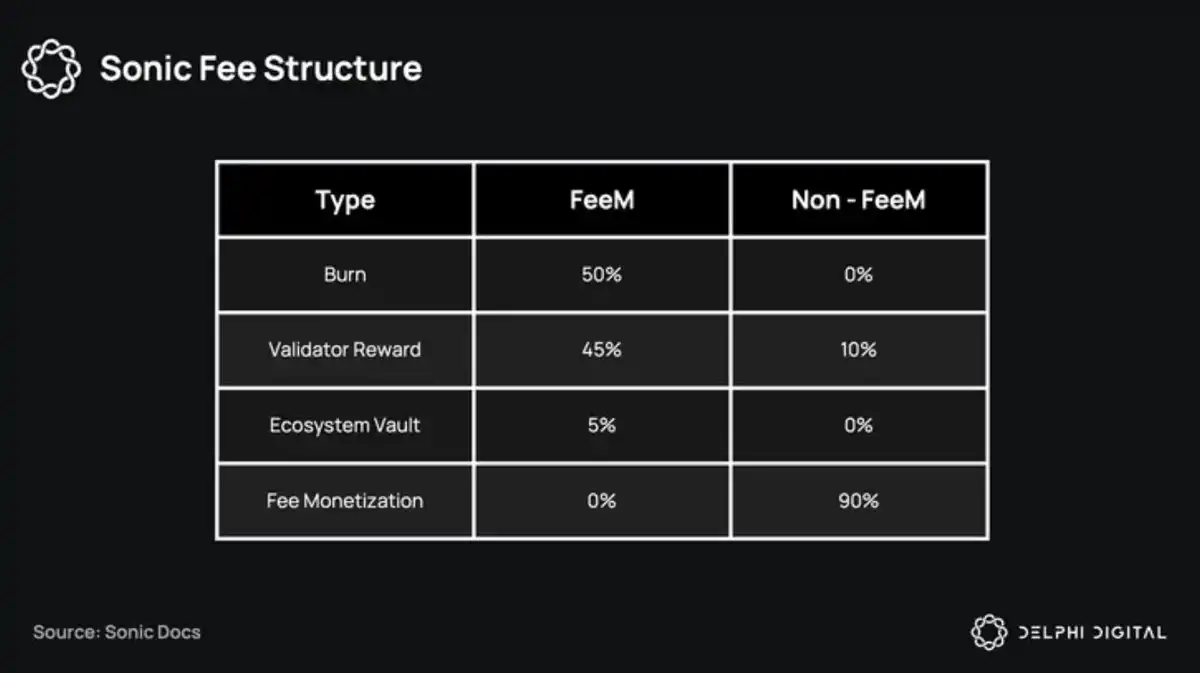

@SonicLabs (formerly Fantom) has completed a strategic transformation, and its core innovation, the "FeeM" mechanism, allocates 90% of transaction fees generated by applications to developers, with validators receiving only 10%.

This model has proven effective—ecosystem DEX project @ShadowOnSonic

has quickly risen to the Top 4 in weekly revenue rankings. Meanwhile, Sonic's dual incentives through DeFi app interactions and token airdrops have driven TVL to a historical high of $9.62 billion.

Competitive Advantage:

• Direct economic incentives linking to developer loyalty

• High-yield-driven application ecosystem stickiness

• Early adoption to validate the effectiveness of the metric verification model

Potential Challenge:

• Decentralization is still at a nascent stage (currently around 35-40 validator nodes)

• Continued development momentum is needed to eliminate the impact of Fantom's brand history

MegaETH: The Balancing Act of Ultimate Speed and User Experience

The @megaeth_labs testnet set a performance record of one gigagas per second with a 0.1 millisecond block time, leveraging its L2 architecture to achieve this breakthrough by abandoning the consensus mechanism.

But the chain's ambition goes beyond data: it is the first to experimentally support EIP-7702, addressing a historical pain point since 2020 where users have lost over $300 million due to approval operations through innovations such as transaction batching and Gas abstraction.

In terms of community building, MegaETH, with a valuation of $2 million, completed a public sale in 10 minutes, raising $10 million, followed by an NFT fundraising round reaching a $6 million valuation, starkly in contrast to VC financing.

Competitive Advantages:

• Industry-leading testnet performance metrics

• First-mover advantage in UX innovation (EIP-7702)

• Community consensus achieved through fair token distribution

Potential Challenges:

• Dependency on the EigenDA data availability layer

• Aggressive performance targets awaiting real-world validation

Monad: Building an Ecosystem Before Going Live

Although the @monad_xyz mainnet has not yet launched, it has already built a complete infrastructure matrix: on the first day, it integrated with the Phantom wallet, attracted top DeFi protocols like Uniswap/Balancer, and integrated cross-chain solutions like LayerZero.

This "plug-and-play" strategy can be seen as a force multiplier in today's crowded blockchain space.

Competitive Advantages:

• Ready-to-use ecosystem infrastructure

• Launch-ready with high liquidity channels

Key Challenge:

• Need to transform early momentum into sustained growth

Sei: The Disruptive Challenge of Tech Prodigies

@SeiNetwork has achieved an internal scalability breakthrough through deep optimization of the consensus and storage layers, along with injecting funding into early developers. However, the current ecosystem still lacks flagship applications, struggles with user adoption and faces competition gaps, as its technical advantages have yet to translate into market influence.

Competitive Advantage:

• Proven scalability technology architecture

• Specialized grant programs for builders

Key Challenge:

• Low actual adoption rates

• Urgent need to create a phenomenon-level application

Fuel: Breaking Free from Ethereum's DA Shackles

@fuel_network's upcoming "Redacted" L2 adopts an alternative DA solution, aiming to achieve a throughput of 150,000 TPS, marking a strategic shift from Ethereum compatibility to performance prioritization. Its vision of 1-millisecond confirmations and 400,000 orders per second will redefine the performance benchmark for public chains.

Endgame Perspective: The Value War Beyond Throughput

While the market value of these tokens is still to be observed, the current L1 and L2 race has become saturated. With intense competition among chains in terms of liquidity, applications, developers, and users, valuations may show a downward trend.

As gas in the gigabyte range becomes the norm, the real winners will be those that can offer a higher value public chain, including speed advantages, incentive mechanisms, user experience, ecosystem completeness, and security guarantees among other comprehensive strengths. The gigabyte gas war is intensifying, but the ultimate key to victory is by no means limited to raw throughput.

Vous pourriez aussi aimer

WEEXPERIENCE Nuit des baleines : Trading IA, communauté crypto et marché crypto

Le 12 décembre 2025, WEEX a organisé WEEXPERIENCE Whales Night, un rassemblement communautaire hors ligne conçu pour rassembler les membres de la communauté crypto locale. L'événement a combiné le partage de contenu, des jeux interactifs et des présentations de projets pour créer une expérience hors ligne détendue et attrayante.

Risque de trading d'IA en cryptomonnaie : Pourquoi de meilleures stratégies de trading crypto peuvent-elles générer des pertes plus importantes ?

Le risque ne réside plus principalement dans une mauvaise prise de décision ou des erreurs émotionnelles. Il vit de plus en plus dans la structure du marché, les parcours d'exécution et le comportement collectif. Comprendre ce changement est plus important que de trouver la prochaine stratégie « meilleure ».

Les agents de l'IA remplacent-ils la recherche crypto ? Comment l'IA autonome remodele le trading crypto

L'IA passe de l'assistance aux traders à l'automatisation de l'ensemble du processus de recherche à l'exécution sur les marchés crypto. L'avantage est passé de l'information humaine aux pipelines de données, à la vitesse et aux systèmes d'IA prêts à être exécutés, ce qui fait des retards dans l'intégration de l'IA un désavantage concurrentiel.

Boots de trading et copy trading IA : Comment les stratégies synchronisées remodèlent la volatilité du marché crypto

Les traders crypto de détail sont confrontés depuis longtemps aux mêmes défis : mauvaise gestion des risques, entrées tardives, décisions émotionnelles et exécution incohérente. Les outils de trading IA promettaient une solution. Aujourd'hui, les systèmes de copy trading et les bots de cassage alimentés par l'IA aident les traders à dimensionner leurs positions, à définir des stops et à agir plus rapidement que jamais. Au-delà de la vitesse et de la précision, ces outils remodèlent tranquillement les marchés : les traders ne tradent pas seulement plus malin, ils évoluent de façon synchronisée, créant une nouvelle dynamique qui amplifie à la fois les risques et les opportunités.

Le trading d'IA en crypto expliqué : Comment le trading autonome remodele les marchés crypto et les plateformes d’échange crypto

L’IA Trading transforme rapidement le paysage crypto. Les stratégies traditionnelles peinent à suivre la volatilité constante de la crypto et la structure complexe du marché, tandis que l'IA peut traiter des données massives, générer des stratégies adaptatives, gérer les risques et exécuter des trades de manière autonome. Cet article guide les utilisateurs de WEEX sur ce qu'est le trading d'IA, pourquoi la crypto accélère son adoption, comment le secteur évolue vers des agents autonomes et pourquoi WEEX construit l'écosystème de trading d'IA de nouvelle génération.

Appelez à rejoindre AI Wars : WEEX Alpha Awakens – Tournoi mondial de trading d’IA avec une cagnotte de 880 000 $

Maintenant, nous lançons un appel aux traders d'IA du monde entier pour qu'ils rejoignent AI Wars : WEEX Alpha Awakens, un tournoi mondial de trading d'IA doté d'une cagnotte de 880 000 $.

Trading d'IA sur les marchés crypto : Des bots de trading automatisés aux stratégies algorithmiques

Le trading basé sur l'IA fait passer la crypto de la spéculation au détail à une concurrence de niveau institutionnel, où l'exécution et la gestion des risques comptent plus que dans le sens. À mesure que le trading de l'IA prend de l'ampleur, les risques systémiques et la pression réglementaire augmentent, faisant des performances à long terme, des systèmes robustes et de la conformité les principaux facteurs de différenciation.

Analyse du sentiment de l'IA et volatilité des cryptomonnaies : Ce qui fait bouger les prix crypto

Le sentiment lié à l'IA influence de plus en plus les marchés crypto, les changements d'attente liés à l'IA se traduisant par une certaine volatilité pour les principaux actifs numériques. Les marchés crypto ont tendance à amplifier les discours sur l'IA, permettant aux flux basés sur les sentiments de l'emporter sur les fondamentaux à court terme. Comprendre comment le sentiment IA se forme et se propage aide les investisseurs à mieux anticiper les cycles de risque et les opportunités de positionnement sur les actifs numériques.

Guerres de l'IA : Guide du participant

Dans cette confrontation ultime, les meilleurs développeurs, quants et traders du monde entier déploieront leurs algorithmes dans des batailles sur le marché réel, en compétition pour l'un des prix les plus importants de l'histoire du trading crypto basé sur l'IA : 880 000 dollars américains, dont une Bentley Bentayga S pour le champion. Ce guide vous accompagnera à travers toutes les étapes nécessaires, de l'inscription au début officiel de la compétition.

Semaine des banques centrales et volatilité des marchés crypto : Comment les décisions relatives aux taux d'intérêt influencent les conditions de trading sur WEEX

Les décisions relatives aux taux d'intérêt prises par les grandes banques centrales, comme la Réserve fédérale, sont des événements macroéconomiques importants qui ont un impact sur les marchés financiers mondiaux et influencent directement les attentes de liquidité des marchés et l'appétence au risque. À mesure que le marché des cryptomonnaies continue de se développer et que sa structure de trading et ses participants mûrissent, le marché des cryptomonnaies est progressivement intégré dans le système d'établissement des prix macroéconomiques.

Test de l'API WEEX : Guide officiel des API de trading de Hackathon et de Crypto pour le trading d’IA

WEEX API Testing est conçu pour garantir que chaque participant peut transformer la logique de trading en exécution réelle. Toutes les interactions API ont lieu sur le système de trading en direct de WEEX, ce qui permet aux participants de travailler dans des conditions de marché authentiques plutôt que dans des simulations. Avec une faible exigence d'entrée, la tâche est accessible à la fois aux développeurs expérimentés et aux débutants motivés, tout en validant les compétences techniques essentielles.

Pourquoi WEEX Alpha se réveille-t-il le meilleur tournoi de trading d'IA de 2025 ? Tout ce que vous devez savoir

Pour accélérer les percées à l'intersection de l'IA et de la crypto, WEEX lance le premier Hackathon mondial de trading d'IA – AI Wars: Alpha se réveille. L'événement propose une cagnotte révolutionnaire dépassant 880 000 $, dont une Bentley Bentayga S pour le champion ultime.

AI Wars: WEEX Alpha Awakens | Guide des processus de test de l'API WEEX Global Hackathon

AI Wars : L'inscription au Réveil Alpha WEEX est maintenant ouverte. Ce guide explique comment accéder au test API et terminer le processus avec succès.

Qu'est-ce que le réveil de WEEX Alpha et comment participer ? Un guide complet

Pour accélérer les percées à l'intersection de l'IA et de la crypto, WEEX lance le premier Hackathon mondial de trading d'IA – AI Wars: Alpha se réveille.

Join AI Wars: WEEK Alpha se réveille !Appel mondial pour les Alphas de Trading IA

AI Wars: WEEX Alpha Awakens est un hackathon mondial de trading sur l'IA à Dubaï, appelant les équipes quantiques, les traders algorithmiques et les développeurs d'IA à lancer leurs stratégies de trading crypto sur les marchés en direct pour une part d'une cagnotte de 880 000 $ US.

WEEX dévoile le trade to Earn: Jusqu'à 30 % de remise instantanée + 2 M$ WXT Rachat

WEEX est heureuse d’annoncer le lancement de son programme Trade to Earn, qui vous accorde automatiquement jusqu’à 30% de rabais sur les frais de trading. Toutes les récompenses sont créditées directement sur votre compte au comptant en WXT $, soutenu par notre plan de rachat de WXT $2,000,000 qui alimente la valeur à long terme des jetons.

Nouveau: Prix de liquidation estimé sur les graphiques App Candlestick

WEEX a introduit un nouveau prix estimatif de liquidation (Est. Liq. Price) figure sur le graphique en chandelier pour aider les traders à mieux gérer le risque et à identifier des fourchettes sûres pour leurs positions.

WEEX AI Hackathon Guide: Trouvez votre UID WEEK et inscrivez-vous

D'ici février 2026, WEEX lance AI Wars: WEEK Alpha Awakens, le premier hackathon mondial de trading de crypto-IA. Venez votre UID et inscrivez-vous au WEEX Global AI Trading Hackathon.

WEEXPERIENCE Nuit des baleines : Trading IA, communauté crypto et marché crypto

Le 12 décembre 2025, WEEX a organisé WEEXPERIENCE Whales Night, un rassemblement communautaire hors ligne conçu pour rassembler les membres de la communauté crypto locale. L'événement a combiné le partage de contenu, des jeux interactifs et des présentations de projets pour créer une expérience hors ligne détendue et attrayante.

Risque de trading d'IA en cryptomonnaie : Pourquoi de meilleures stratégies de trading crypto peuvent-elles générer des pertes plus importantes ?

Le risque ne réside plus principalement dans une mauvaise prise de décision ou des erreurs émotionnelles. Il vit de plus en plus dans la structure du marché, les parcours d'exécution et le comportement collectif. Comprendre ce changement est plus important que de trouver la prochaine stratégie « meilleure ».

Les agents de l'IA remplacent-ils la recherche crypto ? Comment l'IA autonome remodele le trading crypto

L'IA passe de l'assistance aux traders à l'automatisation de l'ensemble du processus de recherche à l'exécution sur les marchés crypto. L'avantage est passé de l'information humaine aux pipelines de données, à la vitesse et aux systèmes d'IA prêts à être exécutés, ce qui fait des retards dans l'intégration de l'IA un désavantage concurrentiel.

Boots de trading et copy trading IA : Comment les stratégies synchronisées remodèlent la volatilité du marché crypto

Les traders crypto de détail sont confrontés depuis longtemps aux mêmes défis : mauvaise gestion des risques, entrées tardives, décisions émotionnelles et exécution incohérente. Les outils de trading IA promettaient une solution. Aujourd'hui, les systèmes de copy trading et les bots de cassage alimentés par l'IA aident les traders à dimensionner leurs positions, à définir des stops et à agir plus rapidement que jamais. Au-delà de la vitesse et de la précision, ces outils remodèlent tranquillement les marchés : les traders ne tradent pas seulement plus malin, ils évoluent de façon synchronisée, créant une nouvelle dynamique qui amplifie à la fois les risques et les opportunités.

Le trading d'IA en crypto expliqué : Comment le trading autonome remodele les marchés crypto et les plateformes d’échange crypto

L’IA Trading transforme rapidement le paysage crypto. Les stratégies traditionnelles peinent à suivre la volatilité constante de la crypto et la structure complexe du marché, tandis que l'IA peut traiter des données massives, générer des stratégies adaptatives, gérer les risques et exécuter des trades de manière autonome. Cet article guide les utilisateurs de WEEX sur ce qu'est le trading d'IA, pourquoi la crypto accélère son adoption, comment le secteur évolue vers des agents autonomes et pourquoi WEEX construit l'écosystème de trading d'IA de nouvelle génération.

Appelez à rejoindre AI Wars : WEEX Alpha Awakens – Tournoi mondial de trading d’IA avec une cagnotte de 880 000 $

Maintenant, nous lançons un appel aux traders d'IA du monde entier pour qu'ils rejoignent AI Wars : WEEX Alpha Awakens, un tournoi mondial de trading d'IA doté d'une cagnotte de 880 000 $.

Pièces populaires

Dernières actus crypto

Assistance client:@weikecs

Collaborations commerciales:@weikecs

Trading quantitatif/Market makers:[email protected]

Programme VIP:[email protected]