The Trilemma of the New Crypto Economy: The Intersection of Energy, Cutting-Edge Technology, and Stablecoins

Original Article Title: Energy, Frontier, Stablecoin

Original Article Authors: @ManoppoMarco, @primitivecrypto Investors

Original Article Translation: zhouzhou, BlockBeats

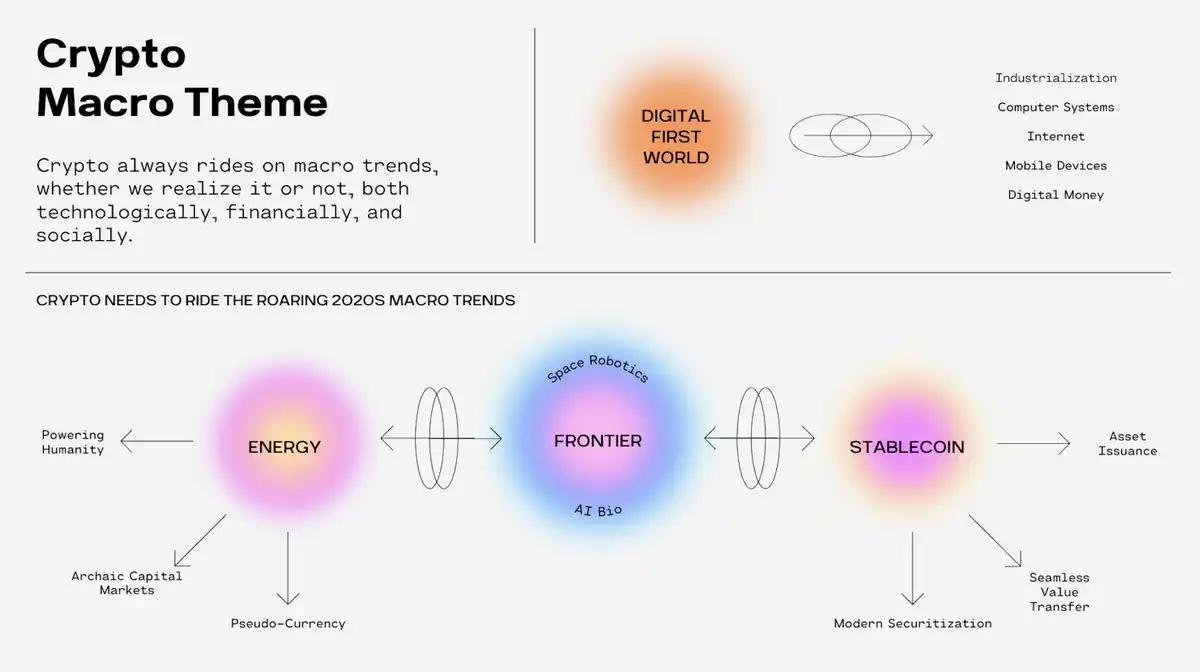

Editor's Note: This article explores the current status and future direction of the cryptocurrency industry, suggesting that innovation in the crypto space has become flat, with new technologies and projects failing to bring breakthroughs. The author believes that true innovation should combine the core features of crypto, such as incentive mechanisms, asset liquidity, and seamless transfer, to address macro issues. By integrating energy, frontier technology, and stablecoin, the crypto industry can be propelled to a higher level of development.

The following is the original content (slightly reorganized for clarity):

This is the first part of an exploratory paper series that I will be writing in the coming weeks.

Is the crypto industry getting boring... or growing? Over the past few months, Crypto Twitter's mood has been mixed, with both excitement and fatigue, mainly due to two reasons:

· The trench is dead.

· The institutions are here to take your lunch money.

The former means that the rebellious, cypherpunk-style innovation is no longer as prevalent in the crypto industry as it was in the past. Since DeFi unlocked our imagination in 2019, there has been no real 0 to 1 innovation in our field. Of course, blockchain has become faster, and we are all working hard to help traditional finance save 30 basis points through asset tokenization (which is a trillion-dollar opportunity!), but it can also be said that the original spirit of crypto is slowly fading away.

The latter means that the current crypto space is filled with MBA graduates and professional protocol hoppers (I swear I will make PPH a real term), who now dominate our field. These professionals, hey, I bet some senior managers of big protocols haven't even tried issuing their own coin on PumpFun.

Overall, observing all this has made me start thinking about which possible new verticals we can explore to get my CT friends excited again.

Frankly, I don't think what's happening in the crypto industry is bad or boring; it's just the natural progression of business and tech cycles within a maturing vertical.

But hey, maybe I'm too pragmatic. So, what's new?

New virtual machines, new blockchains, and new Ponzi economics will continue to attract funding, especially in the early stages. Because crypto is still the world's best capital market. Ask any Web2 VC friend of yours how things are on their end, and you might think we're no longer in a bear market.

But these optimizations have become somewhat boring; even though they still bring returns to early investors, they haven't unlocked new mechanisms or driven new business models that propel our industry forward.

Therefore, this article is an attempt to imagine things that could drive the industry forward.

My assumption is that the answer lies in the combination of the following three intersections:

· Energy

· Cutting-edge Technology

· Stablecoins

Let's dissect these three concepts.

Triumvirate

The original meaning of "Triumvirate" was the rule of three men—referring to the informal alliance of Caesar, Pompey, and Crassus in 60 BC. If you think I'm a bit old-fashioned, go with your gut.

I believe that crypto is fundamentally a macro asset. The technological and capital market value that crypto provides is most effective when combined with macro trends. Digitalization was the earliest trend that brought crypto into our world. In an increasingly digital world, there has to be a native way to exchange value -> hence crypto.

Now, the world is undergoing several macro trends:

· Energy: Demand for more energy

· Cutting-edge Technology: Demand for technological advancement

· Stablecoins: Demand for seamless value transfer

These three constitute the crypto Triumvirate. By properly combining these three verticals, crypto can be propelled to the next level.

I'll be the first to admit that, taken individually, this concept is not groundbreaking. Some funds have already started focusing on the convergence of crypto and energy, such as @uraniumdigital_ and @daylightenergy_'s recent funding rounds; while some have explored the combination of crypto and cutting-edge technology, like @openmind_agi and @Spacecoin_xyz.

The key is, when you combine these three elements, what kind of product and incentive mechanism flywheel can you ignite.

· A DeFi project without asset issuance? Boring.

· A stablecoin without real-world use case? Oversaturated.

· Cutting-edge technology without a crypto flywheel? Pointless.

In Summary

How to leverage the best attributes of crypto: incentive mechanisms, populism, and seamless asset creation/transfer, and combine them with the most interesting problems of our generation — not just for the sake of a forced narrative, but because the nature of crypto can truly create a better product and incentive flywheel for the problem you are solving.

I once read a saying, stripped of everything, there are only two ways to make money:

· You create value and convert it into money

· You facilitate the flow of funds and charge a fee

I believe that crypto, if done right, will embody both methods (1) and (2) simultaneously.

In the second part, I will explore the first-generation existing mechanisms/business models of these tripartite political projects and consider what might happen when they are combined.

Vous pourriez aussi aimer

WEEXPERIENCE Nuit des baleines : Trading IA, communauté crypto et marché crypto

Le 12 décembre 2025, WEEX a organisé WEEXPERIENCE Whales Night, un rassemblement communautaire hors ligne conçu pour rassembler les membres de la communauté crypto locale. L'événement a combiné le partage de contenu, des jeux interactifs et des présentations de projets pour créer une expérience hors ligne détendue et attrayante.

Risque de trading d'IA en cryptomonnaie : Pourquoi de meilleures stratégies de trading crypto peuvent-elles générer des pertes plus importantes ?

Le risque ne réside plus principalement dans une mauvaise prise de décision ou des erreurs émotionnelles. Il vit de plus en plus dans la structure du marché, les parcours d'exécution et le comportement collectif. Comprendre ce changement est plus important que de trouver la prochaine stratégie « meilleure ».

Les agents de l'IA remplacent-ils la recherche crypto ? Comment l'IA autonome remodele le trading crypto

L'IA passe de l'assistance aux traders à l'automatisation de l'ensemble du processus de recherche à l'exécution sur les marchés crypto. L'avantage est passé de l'information humaine aux pipelines de données, à la vitesse et aux systèmes d'IA prêts à être exécutés, ce qui fait des retards dans l'intégration de l'IA un désavantage concurrentiel.

Boots de trading et copy trading IA : Comment les stratégies synchronisées remodèlent la volatilité du marché crypto

Les traders crypto de détail sont confrontés depuis longtemps aux mêmes défis : mauvaise gestion des risques, entrées tardives, décisions émotionnelles et exécution incohérente. Les outils de trading IA promettaient une solution. Aujourd'hui, les systèmes de copy trading et les bots de cassage alimentés par l'IA aident les traders à dimensionner leurs positions, à définir des stops et à agir plus rapidement que jamais. Au-delà de la vitesse et de la précision, ces outils remodèlent tranquillement les marchés : les traders ne tradent pas seulement plus malin, ils évoluent de façon synchronisée, créant une nouvelle dynamique qui amplifie à la fois les risques et les opportunités.

Le trading d'IA en crypto expliqué : Comment le trading autonome remodele les marchés crypto et les plateformes d’échange crypto

L’IA Trading transforme rapidement le paysage crypto. Les stratégies traditionnelles peinent à suivre la volatilité constante de la crypto et la structure complexe du marché, tandis que l'IA peut traiter des données massives, générer des stratégies adaptatives, gérer les risques et exécuter des trades de manière autonome. Cet article guide les utilisateurs de WEEX sur ce qu'est le trading d'IA, pourquoi la crypto accélère son adoption, comment le secteur évolue vers des agents autonomes et pourquoi WEEX construit l'écosystème de trading d'IA de nouvelle génération.

Appelez à rejoindre AI Wars : WEEX Alpha Awakens – Tournoi mondial de trading d’IA avec une cagnotte de 880 000 $

Maintenant, nous lançons un appel aux traders d'IA du monde entier pour qu'ils rejoignent AI Wars : WEEX Alpha Awakens, un tournoi mondial de trading d'IA doté d'une cagnotte de 880 000 $.

Trading d'IA sur les marchés crypto : Des bots de trading automatisés aux stratégies algorithmiques

Le trading basé sur l'IA fait passer la crypto de la spéculation au détail à une concurrence de niveau institutionnel, où l'exécution et la gestion des risques comptent plus que dans le sens. À mesure que le trading de l'IA prend de l'ampleur, les risques systémiques et la pression réglementaire augmentent, faisant des performances à long terme, des systèmes robustes et de la conformité les principaux facteurs de différenciation.

Analyse du sentiment de l'IA et volatilité des cryptomonnaies : Ce qui fait bouger les prix crypto

Le sentiment lié à l'IA influence de plus en plus les marchés crypto, les changements d'attente liés à l'IA se traduisant par une certaine volatilité pour les principaux actifs numériques. Les marchés crypto ont tendance à amplifier les discours sur l'IA, permettant aux flux basés sur les sentiments de l'emporter sur les fondamentaux à court terme. Comprendre comment le sentiment IA se forme et se propage aide les investisseurs à mieux anticiper les cycles de risque et les opportunités de positionnement sur les actifs numériques.

Guerres de l'IA : Guide du participant

Dans cette confrontation ultime, les meilleurs développeurs, quants et traders du monde entier déploieront leurs algorithmes dans des batailles sur le marché réel, en compétition pour l'un des prix les plus importants de l'histoire du trading crypto basé sur l'IA : 880 000 dollars américains, dont une Bentley Bentayga S pour le champion. Ce guide vous accompagnera à travers toutes les étapes nécessaires, de l'inscription au début officiel de la compétition.

Semaine des banques centrales et volatilité des marchés crypto : Comment les décisions relatives aux taux d'intérêt influencent les conditions de trading sur WEEX

Les décisions relatives aux taux d'intérêt prises par les grandes banques centrales, comme la Réserve fédérale, sont des événements macroéconomiques importants qui ont un impact sur les marchés financiers mondiaux et influencent directement les attentes de liquidité des marchés et l'appétence au risque. À mesure que le marché des cryptomonnaies continue de se développer et que sa structure de trading et ses participants mûrissent, le marché des cryptomonnaies est progressivement intégré dans le système d'établissement des prix macroéconomiques.

Test de l'API WEEX : Guide officiel des API de trading de Hackathon et de Crypto pour le trading d’IA

WEEX API Testing est conçu pour garantir que chaque participant peut transformer la logique de trading en exécution réelle. Toutes les interactions API ont lieu sur le système de trading en direct de WEEX, ce qui permet aux participants de travailler dans des conditions de marché authentiques plutôt que dans des simulations. Avec une faible exigence d'entrée, la tâche est accessible à la fois aux développeurs expérimentés et aux débutants motivés, tout en validant les compétences techniques essentielles.

Pourquoi WEEX Alpha se réveille-t-il le meilleur tournoi de trading d'IA de 2025 ? Tout ce que vous devez savoir

Pour accélérer les percées à l'intersection de l'IA et de la crypto, WEEX lance le premier Hackathon mondial de trading d'IA – AI Wars: Alpha se réveille. L'événement propose une cagnotte révolutionnaire dépassant 880 000 $, dont une Bentley Bentayga S pour le champion ultime.

AI Wars: WEEX Alpha Awakens | Guide des processus de test de l'API WEEX Global Hackathon

AI Wars : L'inscription au Réveil Alpha WEEX est maintenant ouverte. Ce guide explique comment accéder au test API et terminer le processus avec succès.

Qu'est-ce que le réveil de WEEX Alpha et comment participer ? Un guide complet

Pour accélérer les percées à l'intersection de l'IA et de la crypto, WEEX lance le premier Hackathon mondial de trading d'IA – AI Wars: Alpha se réveille.

Join AI Wars: WEEK Alpha se réveille !Appel mondial pour les Alphas de Trading IA

AI Wars: WEEX Alpha Awakens est un hackathon mondial de trading sur l'IA à Dubaï, appelant les équipes quantiques, les traders algorithmiques et les développeurs d'IA à lancer leurs stratégies de trading crypto sur les marchés en direct pour une part d'une cagnotte de 880 000 $ US.

WEEX dévoile le trade to Earn: Jusqu'à 30 % de remise instantanée + 2 M$ WXT Rachat

WEEX est heureuse d’annoncer le lancement de son programme Trade to Earn, qui vous accorde automatiquement jusqu’à 30% de rabais sur les frais de trading. Toutes les récompenses sont créditées directement sur votre compte au comptant en WXT $, soutenu par notre plan de rachat de WXT $2,000,000 qui alimente la valeur à long terme des jetons.

Nouveau: Prix de liquidation estimé sur les graphiques App Candlestick

WEEX a introduit un nouveau prix estimatif de liquidation (Est. Liq. Price) figure sur le graphique en chandelier pour aider les traders à mieux gérer le risque et à identifier des fourchettes sûres pour leurs positions.

WEEX AI Hackathon Guide: Trouvez votre UID WEEK et inscrivez-vous

D'ici février 2026, WEEX lance AI Wars: WEEK Alpha Awakens, le premier hackathon mondial de trading de crypto-IA. Venez votre UID et inscrivez-vous au WEEX Global AI Trading Hackathon.

WEEXPERIENCE Nuit des baleines : Trading IA, communauté crypto et marché crypto

Le 12 décembre 2025, WEEX a organisé WEEXPERIENCE Whales Night, un rassemblement communautaire hors ligne conçu pour rassembler les membres de la communauté crypto locale. L'événement a combiné le partage de contenu, des jeux interactifs et des présentations de projets pour créer une expérience hors ligne détendue et attrayante.

Risque de trading d'IA en cryptomonnaie : Pourquoi de meilleures stratégies de trading crypto peuvent-elles générer des pertes plus importantes ?

Le risque ne réside plus principalement dans une mauvaise prise de décision ou des erreurs émotionnelles. Il vit de plus en plus dans la structure du marché, les parcours d'exécution et le comportement collectif. Comprendre ce changement est plus important que de trouver la prochaine stratégie « meilleure ».

Les agents de l'IA remplacent-ils la recherche crypto ? Comment l'IA autonome remodele le trading crypto

L'IA passe de l'assistance aux traders à l'automatisation de l'ensemble du processus de recherche à l'exécution sur les marchés crypto. L'avantage est passé de l'information humaine aux pipelines de données, à la vitesse et aux systèmes d'IA prêts à être exécutés, ce qui fait des retards dans l'intégration de l'IA un désavantage concurrentiel.

Boots de trading et copy trading IA : Comment les stratégies synchronisées remodèlent la volatilité du marché crypto

Les traders crypto de détail sont confrontés depuis longtemps aux mêmes défis : mauvaise gestion des risques, entrées tardives, décisions émotionnelles et exécution incohérente. Les outils de trading IA promettaient une solution. Aujourd'hui, les systèmes de copy trading et les bots de cassage alimentés par l'IA aident les traders à dimensionner leurs positions, à définir des stops et à agir plus rapidement que jamais. Au-delà de la vitesse et de la précision, ces outils remodèlent tranquillement les marchés : les traders ne tradent pas seulement plus malin, ils évoluent de façon synchronisée, créant une nouvelle dynamique qui amplifie à la fois les risques et les opportunités.

Le trading d'IA en crypto expliqué : Comment le trading autonome remodele les marchés crypto et les plateformes d’échange crypto

L’IA Trading transforme rapidement le paysage crypto. Les stratégies traditionnelles peinent à suivre la volatilité constante de la crypto et la structure complexe du marché, tandis que l'IA peut traiter des données massives, générer des stratégies adaptatives, gérer les risques et exécuter des trades de manière autonome. Cet article guide les utilisateurs de WEEX sur ce qu'est le trading d'IA, pourquoi la crypto accélère son adoption, comment le secteur évolue vers des agents autonomes et pourquoi WEEX construit l'écosystème de trading d'IA de nouvelle génération.

Appelez à rejoindre AI Wars : WEEX Alpha Awakens – Tournoi mondial de trading d’IA avec une cagnotte de 880 000 $

Maintenant, nous lançons un appel aux traders d'IA du monde entier pour qu'ils rejoignent AI Wars : WEEX Alpha Awakens, un tournoi mondial de trading d'IA doté d'une cagnotte de 880 000 $.

Pièces populaires

Dernières actus crypto

Assistance client:@weikecs

Collaborations commerciales:@weikecs

Trading quantitatif/Market makers:[email protected]

Programme VIP:[email protected]