Mining Rig Prices Increase by 24% as Trump's Tariff Policy Hits US Bitcoin Mining Industry

Original Article Title: How Trump's Tariffs Will Affect Bitcoin Mining

Original Article Author: Jaran Mellerud

Original Article Translation: Deep Tide TechFlow

Trump's tariff policy will have a significant impact on the Bitcoin mining industry. Here is an analysis of the policy's impact on the industry.

On April 2nd, Trump announced comprehensive new tariffs on imported goods aimed at strengthening U.S. trade balance. The Southeast Asia region was hit the hardest, impacting the Bitcoin mining machine supply chain profoundly. This region is home to most of the major mining hardware manufacturers, including Bitmain, MicroBT, and Canaan.

Furthermore, as the U.S. holds 36% of the global hashrate, these tariffs could significantly affect miners' profitability, hardware prices in the U.S. and abroad, and the global hashrate distribution.

Before delving into the multifaceted impact of these tariffs on the Bitcoin mining industry, let's first briefly explain how tariffs work.

How Do Tariffs Work?

Tariffs are taxes imposed by the government on imported goods, usually aimed at protecting domestic industries by raising the prices of foreign products. When tariffs are in place, importers must pay a certain percentage of the declared value of the goods to customs upon entry.

For example, if a U.S. company imports $1,000 worth of electronics from China and the tariff rate is 54%, the importer must pay an additional $540 in tariffs, bringing the total import cost to $1,540. This increased cost is often passed on to consumers or reduces the importer's profit margins.

Tariff History: The U.S.-China Trade War and Its Ripple Effects

Bitcoin mining is a global industry, with the U.S. being a significant player, and the trade war and resulting tariffs have already impacted the industry. However, in the past, companies in the industry have found ways to circumvent these tariffs. In the following section, we will explore how tariffs have historically affected the Bitcoin mining supply chain and what strategies companies have employed to bypass these tariffs.

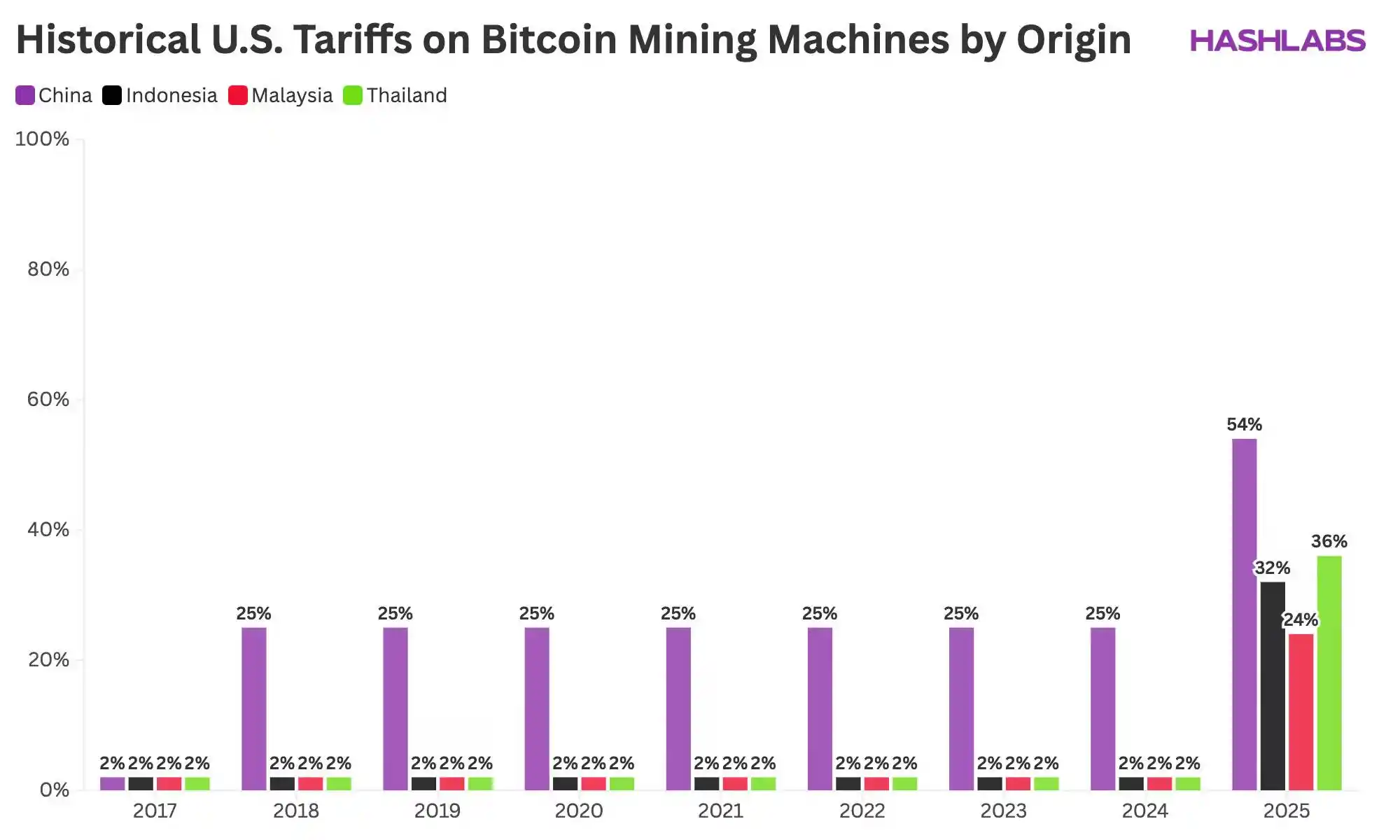

In 2018, the U.S. government imposed a 25% tariff on a range of Chinese goods, including electronics, as part of the U.S.-China trade war.

In response, companies such as Bitmain began seeking ways to circumvent these high tariffs. They shifted their production from mainland China to Southeast Asian countries such as Indonesia, Thailand, and Malaysia, where exported goods to the US are either tariff-free or subject to lower tariffs—typically ranging from 1% to 3% for electronic products.

This strategy was effective until earlier this month when Trump raised tariffs on imports from Indonesia, Malaysia, and Thailand to 32%, 24%, and 36%, respectively. As a result, companies like Bitmain and MicroBT can no longer entirely avoid these high tariffs, which were initially targeted at goods imported from China.

In the following sections, we will elaborate on how these newly imposed tariffs will impact the Bitcoin mining industry.

Significant Price Increase Expected for Mining Machines in the US

The most direct and noticeable impact of the tariffs is that mining machine prices in the US are expected to increase significantly.

As Ethan Vera pointed out in "The Mining Pod" show: "...any company operating in the United States looking to purchase mining machines will need to pay an additional 22% to 36% for these machines." This aligns with our data.

However, the 22% price hike only applies to imported mining machines. Currently, there is still a substantial amount of mining machine inventory in the US. Based on Bitmars' pricing data, there is a 13% to 25% price difference between mining machines in the US and those in Hong Kong. As the US inventory diminishes, this price difference could narrow to 22%, plus a small shipping cost.

The graph above shows the final cost of importing a $1000 Bitcoin mining device into the US and Finland before and after the introduction of equivalent tariffs. Finland, like most other countries, has no tariffs on electronics imported from Asia—we use it as an example because we mine there.

As shown in the graph, due to approximately 2% tariff, the initial cost of importing a mining machine to the US was slightly higher. However, after the introduction of the new tariffs, the lowest cost of a $1000 mining machine in the US increased to $1240. This is a significant increase. Meanwhile, in Finland and most other countries, the cost of a $1000 mining machine remains the same due to the absence of tariffs.

In an industry as cost-sensitive as Bitcoin mining, a 22% increase in mining machine prices may render operations financially unsustainable. In the subsequent sections of this article, we will explore how these changes affect mining profitability in the US compared to other regions.

Mining Machines Outside the US May Become Cheaper

As mining machine prices within the US rise, prices of mining machines in other parts of the world may see an opposite downward trend.

The demand for mining machines shipped to the US is expected to plummet, possibly approaching zero. Given the US has been a dominant player in the ASIC (Application-Specific Integrated Circuit) market, representing nearly 40% of the global hashrate, the sharp decline in US purchases will lead to a significant drop in global demand.

With reduced demand from US miners, manufacturers will face an oversupply of inventory originally intended for the US market. To clear this surplus stock, they may need to lower prices to attract buyers from other regions.

While it's difficult to precisely predict how much mining machine prices will drop—since mining profitability also impacts prices—we can draw a conclusion based on fundamental economic principles: a decrease in demand for an asset usually leads to a price drop.

This price drop will make it easier for miners outside the US to expand further, which may also result in the decline of the US's share in global hashrate that we will discuss next.

US Share in the Global Bitcoin Mining Industry Will Decline

Since China banned Bitcoin mining in 2021, the US has been a dominant force in Bitcoin mining. According to data from Hashrate Index, the US currently holds 36% of the global hashrate.

Like any business activity, the core of Bitcoin mining lies in balancing risk and reward. Over the past four years, the US has attracted significant mining investment as it is seen as one of the lowest-risk environments in the world, with political stability, abundant energy, and a liberalized electricity market. Additionally, miners have so far avoided major import tariffs, helping them control capital expenditures. These factors together have created an unparalleled risk-reward balance.

To understand how new tariffs are reshaping the US's share in global mining, we first analyze from the perspective of returns.

The following graph shows the estimated payback period for deploying an Antminer S21+ in the US and a country unaffected by tariffs. As the data shows, overpaying by 24% for the same mining machine in the US significantly extends the payback period—undermining the core economic rationale for mining in the US.

In addition to the higher mining machine cost, the risk aspect has also been impacted. Many US miners felt reassured during the Trump administration, expecting a stable regulatory environment. But they are now experiencing the flip side of his policy volatility. Even if these tariffs are rescinded within months, the damage has been done—the confidence in long-term planning has been shaken. In a scenario where key variables could change overnight, few are willing to make significant investments.

In any case, the once unparalleled risk-return balance of U.S. Bitcoin mining has significantly deteriorated. This change could lead to a gradual decline in the U.S.' share of the global mining industry relative to other countries.

Of course, existing mining machines already imported into the U.S. will not be affected—miners have no reason to shut them down. However, the path to expansion has now become steep and filled with uncertainty.

Meanwhile, miners in tax-free jurisdictions will continue to scale up, solidifying their competitive advantage. Therefore, it is expected that the U.S.' global hash rate share will decrease—not because miners are exiting, but because they are no longer growing.

From a broader perspective, this could lead to a more diverse geographical distribution of Bitcoin mining than ever before. While the U.S. will still be a major player, its dominance will weaken, and the global hash rate distribution will become more balanced. This aligns with predictions from Braiins' Kristian Csepcar and Bitmars' Summer Meng.

Network Hash Rate Growth Will Slow Down

In the previous section, we explained how the new tariffs could lead to a decrease in the U.S.' share of the global Bitcoin mining industry. Given the U.S.' significant role in global hash rate, its slowdown—or even halt—in growth will inevitably result in an overall deceleration of global hash rate growth.

According to Hashrate Index data, as of the second quarter of 2025, the U.S. accounts for approximately 36% of the global hash rate. In contrast, CBECI data shows that as of January 2022, the U.S.' hash rate share was around 38%. This suggests that over the past three years, the growth rate of the U.S. mining industry has been roughly in line with other regions worldwide.

If this growth trajectory were to continue, the U.S. would contribute around 36% to future global hash rate growth. Therefore, if the U.S. mining industry stagnates due to tariffs' impact, it could lead to a reduction in the global hash rate growth rate of up to 36%.

However, the likelihood of a complete halt in U.S. mining industry growth is very low. As we will explain in the next section, these tariffs may be temporary, and there may be ways to circumvent them in the future. Therefore, the more realistic expectation is that the U.S. mining industry will continue to expand, but at a much slower pace than before. The assumption of a 36% reduction in global hash rate growth should be seen as an absolute upper limit—the actual impact may be slightly lower.

In the long run, if U.S. growth slows down or stalls, miners from other countries may accelerate their expansion to gradually fill this gap.

Nevertheless, in the short to medium term—within the next year or two—we may see global hash rate growth slower than previously expected. In an industry where slower hash rate growth translates to higher earnings, this will be a welcome development for miners worldwide.

Is This Temporary or Permanent?

So far, this article has taken a rather pessimistic view of how these tariffs could impact the U.S. Bitcoin mining industry—an outlook that is understandable given the immediate and severe effects they could bring about. However, the situation is more nuanced, and there are some crucial questions worth exploring.

In the following sections, we will address these questions and assess how the long-term prospects of the U.S. mining industry could cope with the current challenges.

Will Trump repeal the tariffs after implementing them for a few months?

It is entirely possible—especially considering the unpredictable and reactive nature of Trump's policy-making style. If the tariffs are repealed, U.S. miners would once again be able to import mining equipment at competitive prices, alleviating many of the immediate pressures they face.

However, the damage to long-term investor confidence may already have been done. Even if the tariffs are lifted, the sudden introduction of them has made large-scale, long-term investments in the U.S. mining industry more challenging. In a capital-intensive industry like Bitcoin mining, policy stability is crucial—and right now, that is in short supply.

Can mining equipment manufacturers circumvent the tariffs by importing chips from China Taiwan and assembling the miners in the U.S.?

Mining equipment manufacturers may indeed circumvent the tariffs by importing chips from China Taiwan and assembling miners locally in the U.S. According to the White House's official statement, semiconductors are not subject to the reciprocal tariffs. This means that chips can be imported into the U.S. duty-free. However, local production of miners in the U.S. still requires other components, many of which have become more expensive due to tariffs, leading to overall economic inflation in the U.S.

Currently, manufacturers like MicroBT have established assembly lines in the U.S., but Bitmain has yet to follow suit. Even with MicroBT's assembly capabilities, their production capacity is far from sufficient to meet U.S. demand for miners in the next 1-2 years.

Therefore, while this option is technically viable, it does not address the immediate concerns of U.S. miners. However, in the long run, we anticipate more miner assembly gradually shifting to the U.S. as manufacturers adapt to the new tariff environment and expand local production capacity. This transition may help reduce reliance on international imports and lessen the impact of tariffs over time.

Is it realistic to establish a complete Bitcoin mining hardware supply chain in the United States from chip manufacturing to final assembly?

Establishing a full Bitcoin mining hardware supply chain in the United States from chip manufacturing to final assembly is a complex challenge, despite strong advocacy from the Bitcoin mining industry and political leaders for localized chip production. Currently, the most advanced chips used in Bitcoin mining are manufactured in Taiwan and South Korea, regions with decades of expertise and finely tuned supply chains. The United States' reliance on key components from Asian countries poses a significant geopolitical risk not only to the Bitcoin mining industry but to the entire high-tech sector.

While localizing mining rig assembly in the U.S. is feasible, continued dependency on imported chips remains a major hurdle. Companies like Bitmain, MicroBT, and Canaan could establish assembly lines in the U.S., with new players such as Auradine also eyeing this market. However, without domestically produced cutting-edge chips, these manufacturers will still rely on imports in the foreseeable future.

Kristian Csepcsar from Braiins further emphasized this challenge, saying: "Chip foundries have started setting up manufacturing facilities in the U.S., but they are starting from a high nanometer level. It takes years to nurture talent and expertise to transition to lower nanometer levels. This is a progressive process—companies start with high nanometer chips to ensure a return on investment, then strive to expand to more advanced technology. Even as the U.S. progresses, establishing a fully localized Bitcoin mining hardware supply chain is nearly impossible due to the high costs. The real question is, if demand is high, whether it is still cheaper to manufacture in China and pay tariffs. After all, starting end-to-end manufacturing in the U.S. requires time and substantial investment, just as Bitmain recently attempted to set up assembly lines in China—although there has been little news since."

In summary, while the U.S. has great potential in assembly and chip manufacturing, a fully localized Bitcoin mining hardware supply chain remains a long-term goal rather than a short-term reality. The cost, time, and complexity of this transition make it unlikely to be achieved on a large scale in the coming years.

Conclusion

In conclusion, the newly implemented import tariffs will significantly impact the U.S. Bitcoin mining industry—leading to price increases for hardware, a decrease in U.S. market share, and a slowdown in global hash rate growth—but the long-term implications are more intricate.

As events unfold, miners and industry stakeholders need to closely monitor the political and economic landscape to address potential tariff and policy changes. The U.S. mining industry may face challenges in the short term, but there are still opportunities for growth and adaptation within the global mining ecosystem.

関連記事

Trust Walletハッキングでユーザーは350万ドルの資産を失う

Key Takeaways Trust Walletのハッキング事件で、最大の損失を出したのは350万ドル相当の資産を持つアドレス。 第二の損失者は140万ドル相当の資産を失い、これらのウォレットは長期間休眠していた。 今回の事件で、Trust Walletから合計600万ドル以上の暗号資産が盗まれた。 この事件は、非托管型ウォレットのセキュリティーに関する大きな懸念を生む。 WEEX Crypto News, 26 December 2025 Trust Walletの概要とハッキング事件の発生 Trust Walletは、2017年にウクライナの開発者ヴィクトル・ラドチェンコによって設立され、現在は100以上のブロックチェーンをサポートする多機能暗号通貨ウォレットです。Binanceによる初めての買収として2018年に買収されたことで、その成長は加速しました。モバイルデバイスだけでなく、デスクトップブラウザでも使用でき、デジタル資産の保存、送信、受信をより確実に行うために設計されています。…

ビットコインとイーサリアムの歴史的オプション満期が迫る:市場はどう反応するか

Key Takeaways 本日、ビットコインとイーサリアムのオプション満期が合計270億ドルに達し、史上最大の規模となる。 ビットコインは約236億ドルのオプションを抱えており、88000ドル付近での価格動向が注目される。 イーサリアムでは、オプションの約37億ドル分が満期を迎え、短期的には3000ドルが重要な価格ポイント。 オプション満期後の資金フローと機関投資家の動向により、市場の次の動きが左右される。 WEEX Crypto News, 26 December 2025 オプション満期の影響について 本日、ビットコイン(BTC)とイーサリアム(ETH)のオプションが合わせて約270億ドルに達し、暗号通貨市場に大きな影響を及ぼすとみられています。特に、ビットコインのオプション満期は歴史的に最大規模で、これは市場に新たな波紋を投げかけています。オプション市場は、通常の現物市場とは異なり、価格変動やトレーダーの心理に大きな影響を与えることが知られていますが、今回の規模の大きさは特筆すべき事態です。 ビットコイン市場の展望 ビットコインのオプション満期額は236億ドルに達し、その多くがDeribitで取引されています。BTCの価格は現在87,000ドル近辺で推移しており、この満期は短期的な価格動向に大きな影響をもたらす可能性があります。特に、ビットコインオプションのプット・コール比率が0.33とされており、これが市場のボラティリティをさらに高める要因となっています。 イーサリアム市場の行方 イーサリアムは、本日満期を迎えるオプションが37億ドル分あり、これはトレーダーの動向にさらなる波乱をもたらす可能性があります。ETHの価格は3000ドルを軸に揺れ動いており、今回の満期が価格の上昇や下降を引き起こすか注目されています。特に、プット・コール比率が0.43であるため、ここでの動きが市場センチメントをどう変えるかが鍵となります。…

BDXNプロジェクトが40万ドル相当のBDXNトークンを複数の取引所に送金

Key Takeaways BDXN関連の3つのウォレットアドレスが、合計40万ドル相当のBDXNトークンを複数の取引所に送金。 トークンはプロジェクトのウォレットから2ヶ月前に移動された。 関与したアドレスは以下の通り:0xD5682dcA35D78c13b5103eB85c46cDCe28508dfB、0xD0Fc2894Dd2fe427a05980c2E3De8B7A89CB2672、0xAc245a570A914C84300f24a07eb59425bbdC1B48。 お金の動きはonchainschool.proによって監視されていた。 この出来事は、仮想通貨マーケットの透明性と監視能力の重要性を強調している。 WEEX Crypto News, 26 December 2025 BDXNトークンの大量送金の背景 BDXNプロジェクト関連の3つのウォレットアドレスが、いくつかの主要な仮想通貨取引所に40万ドル相当のBDXNトークンを送金したことが明らかになりました。この情報はonchainschool.proの監視によって報告されており、ウォレットの動きが詳細に追跡されています。 プロジェクトの目的と送金の理由 BDXNは、新興のプロジェクトであり、そのトークンは様々な用途に利用されます。この度の送金は、プロジェクトの資金管理や市場での取引に関連する可能性があります。特に、多くのプロジェクトが取引所での流動性を高めるためにトークンを移動することが一般的です。 ウォレットのアドレスとトークンの送金履歴…

ハイパーリクイッドでのビットコインとイーサリアムポジションの変化が浮き彫りに

Key Takeaways 最近、ハイパーリクイッドにおけるBTCの多頭巨鯨数が約2ヶ月で半減した。 ETHでは空頭巨鯨が多頭の2倍に増加している。 大手BTC空頭巨鯨の平均ポジション価格は8.82万ドル、清算価格は9.41万ドル。 ETH最大空頭巨鯨はポジション平均価格が3129ドル、清算価格が3796ドル。 WEEX Crypto News, 26 December 2025 ハイパーリクイッドにおけるポジションの動向 仮想通貨市場での最近の出来事は、投資家やトレーダーにとても重要な情報を提供しています。特にハイパーリクイッドプラットフォームでのビットコイン(BTC)およびイーサリアム(ETH)の動向に変化が見られます。市場分析ツールHyperInsightによると、このプラットフォーム上での多頭(買い)と空頭(売り)ポジションに大きな変化がありました。 BTC多頭ポジションの急減 過去2ヶ月間で、ハイパーリクイッドにおけるBTCの多頭巨鯨数が劇的に減少しました。今年の10月14日には234名の多頭巨鯨が存在しましたが、最新のデータではこれが122名にまで減少しています。これは約50%の減少を意味し、多頭の勢いが弱まっていることを示しています。一方で、現在の空頭巨鯨数は116名で、過去に比べて変化は少なく、若干の増加に留まっています。この動きは、ビットコインに対する市場全体のリスクアペタイトの変化を示唆しています。 ETH空頭の増加 イーサリアム市場では、空頭が多頭をかなり上回っています。現在、ETHの空頭巨鯨は113名で、多頭の58名に対して倍に達しています。このことは、特にイーサリアム市場での売り圧力が増している可能性を示唆しています。市場のセンチメントが冷却し、ETHに対して伝統的な強気ポジションを取り控える動きが広まっていると言えるでしょう。…

ビットコイン、9万ドルへの勢いを再び満たす

Key Takeaways マーケットでは短期的にビットコインが8.2万ドルから9.5万ドルまでの変動が予測される。 BTC価格が9万ドルを超え、24時間で1.53%上昇した。 Deribitで270億ドル相当のビットコインとイーサリアムのオプションが到期し、市場に影響を与える。 現物金と銀の価格が歴史的高値を更新、多くの投資家が注目している。 WEEX Crypto News, 26 December 2025 ビットコインの価格動向と市場の反応 12月26日、ビットコインの価格は再び9万ドルを試す動きを見せ、価格は急騰しています。最新のデータによれば、特に12月22日以降の上昇が顕著で、90,027ドルを記録し、24時間での上昇率は1.53%でした。この背景には、近日中に満期を迎えるビットコイン・オプションが市場に与える影響があると見られています。12月26日に予定されている270億ドル相当のオプション到期は、市場に新たな変革をもたらす可能性があります。 マーケットの変動と価格の背景 現時点でのビットコインの動きは、年内に9.5万ドルを超える可能性があると予測されています。この見通しの中では、特にオプション取引の影響が注目されています。取引所情報によると、ビットコイン価格の上昇は、このオプション取引の満期に伴う市場動向との関連が指摘されています。 また、市場は過去のビットコイン価格の大幅な変動に基づき、価格への影響を予測しています。今年初の価格からの回復は比較的遅れたものの、オプションの影響で通常の市場ダイナミクスが回復しつつあります。 現物資産の相場動向…

比特コイン史上最大の期権到期、BTC価格に波紋

Key Takeaways 236億ドル規模のビットコイン期権が到期し、短期的な価格変動が予想される。 BTCの取引価格は現在約8.7万ドルで推移している。 取引所Deribitで大量の未平倉契約が期権到期により清算される見込み。 市場は最大痛点価格9.5万ドルに向かって動く可能性がある。 短期的には約8.2万ドルまで下落した後に反発する予測がある。 WEEX Crypto News, 26 December 2025 史上最大の期権到期が及ぼすBTCの今後の動向 2025年12月26日、ビットコイン(BTC)は8.7万ドルの水準で圧力が続いている中、史上最大とされる期権到期を迎え、短期価格の動向を大きく揺るがしそうです。約236億ドル規模のBTC期権契約が12月24日にDeribitで到期する予定で、これは同取引所での未清算契約の半分以上を占めます。この結果、ビットコイン価格の短期的な方向性に注目が集まっています。 Deribit上の巨大な期権到期による市場への影響 Deribitでは、約30万枚のビットコイン期権と44.6万枚のiSharesビットコイン信託期権が到期します。この期権決済だけで市場の風向きを変えることはないかもしれませんが、過去数回のクリスマス期にみられた5%から7%の価格変動が再び発生する可能性が指摘されています。 Deribitのデータは、「最大痛点価格」が約9.5万ドルであることを示しており、多くの期権はこの価格で無価値となります。市場では0.38のプット・コール比率が報告されており、投資家は全体としてビットコインの中期的な見込みを楽観視しています。…

マトリックスポートのビットコイン市場に関する見解が示唆する新たな動向

Key Takeaways マトリックスポートの最新報告では、ビットコイン市場が「下行受限」フェーズへ向かっていると指摘。 2025年末に向けて市場の感情が保守的になり、2026年には圧力が続く可能性。 ビットコインの価格変動は金融派生商品の影響を受けやすく、リスク管理が重要。 歴史的に年末は慎重な動きが多いが、新年には急速な感情転換の可能性も。 史上最大規模のビットコインオプションの到期が市場のプレッシャーやチャンスを示唆。 WEEX Crypto News, 26 December 2025 マトリックスポートによるビットコイン市場の分析 マトリックスポートはビットコインの最新動向を分析し、その市場が「下行受限」の段階に移行しつつあると報告しています。この段階では、ビットコインの下向きのリスクが相対的に抑えられ、多くの市場参加者はリスクに対してより慎重になる傾向があります。この分析は、2025年12月現在、マトリックスポートが提供する広範な金融サービスを活用した調査に基づいています。 市場環境とビットコインの圧力 2025年末に向けて、ビットコイン市場は保守的な動きを見せています。市場の参加者は慎重になり、特に金融市場の年末の特徴であるリスク回避の動きが鮮明です。この動きは、2026年にかけてビットコインがさらなる圧力下に置かれる可能性を示しています。過去のデータによれば、新しい年が始まると、資金の再編成とリスク予算の回復により市場感情が予期せぬ速さで変わることがあり、これが市場の活性化の鍵となる可能性があります。 ビットコインの価格変動と金融派生商品…

Crypto Derivatives Volume Explodes to $86T in 2025

Key Takeaways 仮想通貨デリバティブ取引量は2025年に86兆ドルに達し、1日あたり平均2650億ドルとなった。 Binanceは世界市場の約30%を占め、主要な取引所としての地位を確保。 OKX、Bybit、Bitgetも含み、トップ4の取引所で総市場シェアの62.3%を占めた。 デリバティブの複雑性が増し、機関投資家主導の市場へと進化。 極端な市場イベントがリスク管理を試すことになり、既存のマージンメカニズムや清算ルールが検証された。 WEEX Crypto News, 2025-12-26 10:06:42 仮想通貨デリバティブ市場の急成長 2025年、仮想通貨デリバティブ市場は過去に類を見ない成長を遂げ、その取引量は86兆ドルに到達しました。この成長は、1日あたり平均2650億ドルの取引を意味しています。Binanceはこの急増の中で市場をリードし、全体の約30%の取引量を占めることになりました。その結果、世界中で取引される100ドルのうち約30ドルが同取引所を経由していることになります。 Binanceの成功は、主にその効率的な取引メカニズムと包括的なサービス提供によるものであり、利用者は多様な金融商品を利用できます。その影響により、OKX、Bybit、Bitgetなどの他の主要取引所も市場の重要な位置を占めることになり、これらの取引所での年間取引量はそれぞれ8.2兆ドルから10.8兆ドルに及びました。これにより、これら4つの取引所が市場の約62.3%を占めています。 仮想通貨デリバティブの進化とその影響 2025年を通じて、仮想通貨デリバティブ市場は、これまでの小売主導のハイレバレッジを用いたバブルと崩壊のモデルから、証券取引所取引型ファンド(ETF)やオプション、コンプライアントな先物取引を通じて機関投資家主導の流れに移行しました。この変化は市場の安定性をもたらしましたが、それに伴いリスクも増大しました。 市場はより複雑になり、さまざまなリスク管理の枠組みが試されることになりました。特に、極端な市場イベントが発生した際には、既存のマージンメカニズムや清算ルールがその耐久性を試されました。このようなストレステストを経て、市場の強さと弱さがより明確になりました。…

Kraken IPOが暗号『中期段階』サイクルを再燃させる可能性

重要なポイント KrakenのIPO(新規株式公開)は、暗号通貨の成長を加速し、伝統的な金融(TradFi)から新たな資本を引き寄せる可能性があります。 Bitcoinは過去最高値を記録しましたが、その後の市場変動によって価格が下落しました。 一部の専門家は、2026年にBitcoinが下落の年になると予測していますが、他の専門家は長期的な上昇トレンドを主張しています。 市場の動向は、流動性や国家の採用といったマクロ経済的な要因によって左右されるようになっています。 WEEX Crypto News, 2025-12-26 10:06:43 Krakenと伝統的金融資本の相互作用 Krakenの新規株式公開(IPO)は、暗号通貨界における新たな潮流を生み出す可能性があります。これは特に、伝統的な金融制度(TradFi)からの新たな資本を呼び込む一助となるでしょう。この動きは、様々な暗号通貨企業が上場を目指す一大トレンドの一環でもあります。 Bitcoinは10月6日に過去最高値である126,000ドル以上を記録しましたが、その後の19億ドルに及ぶ清算イベントの影響を受けて現在は87,015ドル(記事執筆時点)の取引価格となっています。これにより、最近二週間で6%の減少を示していますが、50T Fundsの創設者兼CEOであるDan Tapieroは、「Bitcoinブル市場はまだ中期段階にある」と主張しています。彼は、KrakenのIPO及び増加するM&A(合併・買収)活動が、新たな資本を引き寄せる「追い風」を提供すると見ています。 Krakenは11月18日に20億ドルの評価額に達するために8億ドルの資金を調達し、同年11月初めに米国でのIPOを申請しました。これにより新たな市場の局面がどのように進展するか、注目されています。 Bitcoin市場の予測と見解の相違 しかし、すべてのアナリストが現行のブルサイクルの継続を信じているわけではありません。Fidelityのグローバルマクロ経済研究ディレクターであるJurrien…

Fed Q1 2026 Outlook: Bitcoinと仮想通貨市場への影響

Key takeaways Fedの金利引き下げの休止は仮想通貨に圧力をかける可能性があるが、「隠れ量的緩和」が下振れリスクを軽減するかもしれない。 流動性は金利引き下げ以上に重要であり、2026年第1四半期のBitcoinとETHの動向を形作る。 2025年には米連邦準備制度理事会(Fed)が三度の金利引き下げを実施したが、インフレ率によっては2026年初にはさらに下がる可能性がある。 軽微な供給施策が市場の方向性に影響を与え、特にETFの流入が投資家のリスク志向を支えると予想される。 WEEX Crypto News, 2025-12-26 10:06:42(today’s date,foramt: day, month, year) Fedの政策に対する仮想通貨市場の反応 2025年の米連邦準備制度理事会(Fed)は、経済の減速とインフレ圧力の緩和に対処するために金利引き下げを三回実施しました。特に、雇用の減少と消費者物価指数(CPI)の改善が見られる中、第4四半期に集中的に利下げが行われました。しかし、仮想通貨市場はこの養成政策に対して常識外の反応を見せました。Bitcoin(BTC)、Ethereum(ETH)などの主要な仮想通貨は、これまでの高値から1.45兆ドルを超える時価総額の減少を経験しました。 BitcoinとEthereumに対する金利引き下げ休止の影響…

Ethereum in 2026: Glamsterdam and Hegota Forks, L1 Scaling, and Beyond

新しいEthereumフォーク「Glamsterdam」は2026年にEthereumスケーリングの新たな一章を開く。 ガスリミットの200万への増加は、より大量の取引を同時に処理する能力をもたらす。 Zero-Knowledge( ZK )証明が進化し、Ethereum L1のスケーリングを加速させる。 新たなデータブロブを活用することで、Layer 2のネットワークが飛躍的に性能を向上させる。 「Heze-Bogota」フォークは、検閲への抵抗力を強化し、セキュリティ面での向上を目指す。 WEEX Crypto News, 2025-12-26 10:06:42 2026年には、Ethereumにとって重要な年となることが予想されています。この年、GlamsterdamフォークがEthereumブロックチェーンの処理能力を一段と向上させることが期待されています。特にガスリミットの大幅な引き上げやZero-Knowledge (ZK) 証明の普及が、Ethereumのスケーリングを新たなレベルへ引き上げる要因として注目されています。 Glamsterdamフォークの詳細とその影響…

2025年の暗号通貨セキュリティ:ソーシャルエンジニアリングに対抗する方法

2025年において暗号通貨業界でのハッキングの多くは技術的な欠陥よりもソーシャルエンジニアリングによるもの。 ソーシャルエンジニアリングは、AIの進化により検出が難しくなってきている。 暗号通貨セキュリティの未来は、アイデンティティ検証とAI駆動の脅威検出によって形作られる。 個人情報の隠ぺいやインフラストラクチャの分離がセキュリティの向上につながる。 セキュリティ対策には、公式ソフトウェアの使用や、ハードウェアウォレットによる管理が推奨される。 WEEX Crypto News, 2025-12-26 10:06:42 2025年は暗号通貨業界におけるセキュリティ上の問題が増加し、その焦点はテクノロジー的な弱点よりも人間の行動に移っています。すでに3.4億ドル以上がハッカーの手に渡ったと報告されています。これらの攻撃の多くは、ソーシャルエンジニアリング手法によるもので、暗号通貨のセキュリティの未来がAI駆動の脅威検出とより賢明なアイデンティティ認証によって形作られていくでしょう。 ソーシャルエンジニアリングとは何か? ソーシャルエンジニアリングとは、人を操作して秘密情報を開示させたり、セキュリティを脅かす行動を取らせるサイバー攻撃の手法です。2025年には、この手段が更に高度になり、攻撃者は技術的手段よりも人間の心理に攻撃ポイントを移しています。暗号通貨の重要なコミュニケーションに関しては、サイバー空間ではなく人々の心理が戦場となっています。 例えば、2025年2月に起こったBybitの大規模なセキュリティ侵害事件では、悪意のあるJavaScriptが使用され、データが盗まれました。ニック・パーココ(Nick Percoco)氏は、セキュリティは高い壁を築くことではなく、心を訓練して操作を認識することであると述べています。「城の鍵を持っているからといって誰でも中に入れてはいけないんです。彼らが中の者や恐怖を煽る者だからといって、信じるべきではありません。」 自動化を活用して脅威に備える 暗号通貨のセキュリティにおける将来の道筋は、よりスマートなアイデンティティ確認とAIを使った脅威検出によって辿られることでしょう。パーココ氏によれば、将来は予防的防御がより重視され、人間の信頼ポイントを最小限にすることが重要です。 今後については、供給チェーンの妥協も重要な課題であり、些細なセキュリティ侵害が後々重大な問題を引き起こす可能性があるとされています。このため、自動化された防御を取り入れ、デジタルインタラクションを認証で確認することが推奨されています。…

Merry Christmas, Caroline Ellison: 早期釈放へのクリスマスプレゼント

元Alameda ResearchのCEOであるキャロライン・エリソンは、仮想通貨取引所FTXでの顧客資金の乱用に関与し2年間の懲役刑を受けましたが、アメリカ連邦当局の更新により、1月に釈放される予定です。 エリソンは、2022年11月のFTXの崩壊後、詐欺およびマネーロンダリングの罪で起訴され、有罪答弁をしました。 サム・バンクマン-フリードと共に裁判で証言したことにより、刑務所内の生活から数週間で解放されます。 釈放後もエリソンは、10年間の役員および取締役としての役職に就くことが禁止されています。 WEEX Crypto News, 2025-12-26 10:08:41 元Alameda ResearchのCEOであるキャロライン・エリソンが、連邦拘置所から早期の釈放を予定しています。この知らせは、多くの注意を集めた彼女の役割と関連のあるFTXの崩壊に関するもので、特にSam Bankman-Friedとの関係が注目されています。以下では、彼女の早期釈放に至る経緯や法的な影響を詳しく見ていきます。 キャロライン・エリソンの拘束と釈放 キャロライン・エリソンは、FTXの顧客資金の不正使用により2年間の収監を言い渡されていました。しかし、2025年12月の時点で彼女の釈放が2026年1月21日に決定しています。彼女は10月に刑務所からニューヨーク市の住宅出所管理フィールドオフィスに移送され、最初は2026年2月20日までそこに留まる予定でしたが、早めの釈放が決まりました。 釈放の背景と拘束の理由 アメリカ連邦当局は、彼女の釈放が連邦囚人に与えられる良好な行動のためのクレジットと再入所プログラムに関連している可能性があると示唆しています。具体的な理由は公開されていませんが、彼女がAlameda Researchの共同CEOとして参加し、その後単独CEOとなった経緯と、FTXの崩壊後に詐欺とマネーロンダリングで起訴されたことが大きく影響しています。…

Aaveのガバナンス投票でDAOによるブランド資産管理が拒否される

Key Takeaways Aaveのガバナンスプロポーザルが拒否されたことで、DeFiにおけるトークン価値の取り込みやガバナンスの問題が浮き彫りになった。 投票では55.29%が反対票を投じ、3.5%のみが支持する結果となった。 提案の拒否を通じて、トークン保有者の間での根深いトークン-エクイティの緊張が明らかになった。 ガバナンスの過程での早急な決定が批判され、特定の人物による影響力についての議論が起きた。 WEEX Crypto News, 2025-12-26 10:08:41(today’s date,foramt: day, month, year) Aaveコミュニティにおける最近のガバナンス投票では、Aaveトークン(AAVE)保有者が同プロトコルのブランド資産を分散型自律組織(DAO)の管轄下に置くという提案に対して「反対」の姿勢を示しました。この投票は、DeFi分野におけるガバナンスのダイナミクスがどのように変動し得るかを示す重要な事例です。 Aaveのガバナンス投票の結果とその影響 Aaveのガバナンスにおいて、DAOを通じてブランド管理を行う提案が55.29%の反対を受け、僅か3.5%の支持しか得られない結果に終わりました。これは、AaveのようなDeFiプラットフォームでどのようにしてブランドのアイデンティティを効果的に管理するかという問題に対する懸念を強調しています。…

Crypto Tips for Newcomers, Vets, and Skeptics in 2026

Key Takeaways 理解されていないまま暗号通貨に参入している人が増えている。 暗号通貨の仕組みや可能性を知ることが重要。 ベテランは新参者を教育し、暗号通貨を日常生活で使うべき。 批判する前に実際に暗号通貨を試すことが重要。 WEEX Crypto News, 2025-12-26 10:08:40 長年の経験を持つビットコイナーのジェームズ・ハウエルズは、過去に誤って8,000 BTCが入ったハードドライブを捨ててしまったことで知られています。彼がこの事実を乗り越え、2026年に向けて新参者やベテラン、そして懐疑的な人たちに向けたアドバイスを共有することにしました。この貴重な経験談を基に、私たちは暗号通貨について深く掘り下げ、なぜ理解が重要であるかを探ります。 新参者は暗号通貨を理解することから始めるべき 暗号通貨に初めて参入する人々は、まず購入する前に基礎をしっかり理解することが大切です。ジェームズ・ハウエルズは、新しい投資家が最初に学ぶべきことは、ブロックチェーンの仕組みや分散型金融の背景とその解決すべき現実世界の課題です。「ブロックチェーンやDeFi(分散型金融)がどのように運営されているか、そしてそれが何を解決するのかを理解することが大切だ」と、彼は述べています。 ブロックチェーンの意義を理解する 法定通貨のシステムは、政府や仲介者に力を集中させがちですが、一方でブロックチェーンは第三者の許可なしに選択できる代替手段を提供します。これは個人がより自由に金融活動を行うための道でもあります。 安全に実験を行う…

量子コンピューティングと2026年における暗号の安全性

Key Takeaways 2026年に量子コンピュータがBitcoinなどの暗号通貨を破壊するリスクは低いが、現時点で準備が進んでいる。 量子コンピュータが暗号通貨に与える影響は「収集して後に解読」という待機戦略が懸念されている。 暗号通貨のセキュリティ脆弱性の多くは公開鍵暗号技術に依存しており、量子攻撃に備える必要がある。 専門家の間で議論が続いており、増え続けるデータセキュリティの意識が2026年に重要なテーマとなるだろう。 WEEX Crypto News, 2025-12-26 10:08:41 2026年に量子コンピューティングが暗号通貨に与える影響について、多くの思惑が交錯しています。「収穫して後で解読する」という手法が暗号通貨業界全体に動揺を与えており、近未来の量子技術の進展に備える必要性を強く感じる場面も増えています。しかし、そのリスクは実際にどれほど深刻なのでしょうか?そして2026年に本当に暗号通貨が危機にさらされるのか、専門家たちの見解を考えてみましょう。 暗号通貨に対する量子技術の脅威 量子コンピュータの登場は、長らく暗号通貨の世界において潜在的な脅威とされてきました。特にBitcoin(BTC)などのブロックチェーン技術を基本とした通貨は、公開鍵暗号技術に依存しています。公開鍵から秘密鍵を導出できるほどの量子コンピュータが実現されると、広範囲にわたって資金が盗まれるリスクが生じると指摘されています。 公開鍵暗号技術の脆弱性 Neil Puckrin氏など多くの専門家は、量子コンピュータによる暗号技術破壊のリスクを「現在のところほぼマーケティングであり、10%未満が実際の危険」としています。しかし、仮想通貨のセキュリティは公開鍵暗号技術に依存しており、この部分が量子攻撃の「最も弱い部分」とみなされています。特にアメリカ合衆国の規制当局である米国証券取引委員会(SEC)でも、量子コンピューティングが将来的に暗号通貨の保護を破る可能性があるとの警鐘が鳴らされています。 2026年に予測される状況…

Trust Walletの$7Mハック補償、CZが発表

クリスマスの日に約$7百万の損失を出したハックにつき、Trust Walletが補償を発表しました。 信頼の置けなかった拡張機能が、ユーザー情報を流出させた可能性があり、インサイダー関与の疑惑があります。 Binanceの共同創業者であるChangpeng Zhaoは、被害者への資金補償を保証しました。 仮想通貨ウォレットのセキュリティリスクが増大しており、Trust Walletのハックもその一例です。 ハックプランは12月初頭から準備されていたと報じられています。 WEEX Crypto News, 2025-12-26 10:08:40 Trust Walletのクリスマス・ハックの概要 仮想通貨の世界ではセキュリティの脅威が絶えません。信頼されていた仮想通貨ウォレット「Trust Wallet」が、2025年のクリスマスにユーザーから約$7百万を奪われるという衝撃的な事件が発生しました。このハック事件は、12月初頭から準備が進められていたことが判明し、業界に波紋を呼んでいます。ここではこの事件の詳細と、その背景について詳しく見ていきましょう。 ハック被害の詳細…

トランプのWorld Liberty Financialトークン、2025年末に40%以上減少

Key Takeaways World Liberty Financialトークン(WLFI)は、2025年末に40%以上の減少を記録。 プロジェクトは、トークンセールや主要暗号資産の取得などで始まったが、その後の公募取引で値下がり。 トランプ家が両手に抱えるビジネスは、潜在的な利益相反の懸念を呼んでいる。 World Liberty Financialは、2026年1月にリアルワールドアセットを立ち上げる予定。 WEEX Crypto News, 2025-12-26 10:10:42 プロジェクトの背景と発展 2025年末にトランプ家の暗号資産プロジェクトであるWorld Liberty…

Trust Walletハッキングでユーザーは350万ドルの資産を失う

Key Takeaways Trust Walletのハッキング事件で、最大の損失を出したのは350万ドル相当の資産を持つアドレス。 第二の損失者は140万ドル相当の資産を失い、これらのウォレットは長期間休眠していた。 今回の事件で、Trust Walletから合計600万ドル以上の暗号資産が盗まれた。 この事件は、非托管型ウォレットのセキュリティーに関する大きな懸念を生む。 WEEX Crypto News, 26 December 2025 Trust Walletの概要とハッキング事件の発生 Trust Walletは、2017年にウクライナの開発者ヴィクトル・ラドチェンコによって設立され、現在は100以上のブロックチェーンをサポートする多機能暗号通貨ウォレットです。Binanceによる初めての買収として2018年に買収されたことで、その成長は加速しました。モバイルデバイスだけでなく、デスクトップブラウザでも使用でき、デジタル資産の保存、送信、受信をより確実に行うために設計されています。…

ビットコインとイーサリアムの歴史的オプション満期が迫る:市場はどう反応するか

Key Takeaways 本日、ビットコインとイーサリアムのオプション満期が合計270億ドルに達し、史上最大の規模となる。 ビットコインは約236億ドルのオプションを抱えており、88000ドル付近での価格動向が注目される。 イーサリアムでは、オプションの約37億ドル分が満期を迎え、短期的には3000ドルが重要な価格ポイント。 オプション満期後の資金フローと機関投資家の動向により、市場の次の動きが左右される。 WEEX Crypto News, 26 December 2025 オプション満期の影響について 本日、ビットコイン(BTC)とイーサリアム(ETH)のオプションが合わせて約270億ドルに達し、暗号通貨市場に大きな影響を及ぼすとみられています。特に、ビットコインのオプション満期は歴史的に最大規模で、これは市場に新たな波紋を投げかけています。オプション市場は、通常の現物市場とは異なり、価格変動やトレーダーの心理に大きな影響を与えることが知られていますが、今回の規模の大きさは特筆すべき事態です。 ビットコイン市場の展望 ビットコインのオプション満期額は236億ドルに達し、その多くがDeribitで取引されています。BTCの価格は現在87,000ドル近辺で推移しており、この満期は短期的な価格動向に大きな影響をもたらす可能性があります。特に、ビットコインオプションのプット・コール比率が0.33とされており、これが市場のボラティリティをさらに高める要因となっています。 イーサリアム市場の行方 イーサリアムは、本日満期を迎えるオプションが37億ドル分あり、これはトレーダーの動向にさらなる波乱をもたらす可能性があります。ETHの価格は3000ドルを軸に揺れ動いており、今回の満期が価格の上昇や下降を引き起こすか注目されています。特に、プット・コール比率が0.43であるため、ここでの動きが市場センチメントをどう変えるかが鍵となります。…

BDXNプロジェクトが40万ドル相当のBDXNトークンを複数の取引所に送金

Key Takeaways BDXN関連の3つのウォレットアドレスが、合計40万ドル相当のBDXNトークンを複数の取引所に送金。 トークンはプロジェクトのウォレットから2ヶ月前に移動された。 関与したアドレスは以下の通り:0xD5682dcA35D78c13b5103eB85c46cDCe28508dfB、0xD0Fc2894Dd2fe427a05980c2E3De8B7A89CB2672、0xAc245a570A914C84300f24a07eb59425bbdC1B48。 お金の動きはonchainschool.proによって監視されていた。 この出来事は、仮想通貨マーケットの透明性と監視能力の重要性を強調している。 WEEX Crypto News, 26 December 2025 BDXNトークンの大量送金の背景 BDXNプロジェクト関連の3つのウォレットアドレスが、いくつかの主要な仮想通貨取引所に40万ドル相当のBDXNトークンを送金したことが明らかになりました。この情報はonchainschool.proの監視によって報告されており、ウォレットの動きが詳細に追跡されています。 プロジェクトの目的と送金の理由 BDXNは、新興のプロジェクトであり、そのトークンは様々な用途に利用されます。この度の送金は、プロジェクトの資金管理や市場での取引に関連する可能性があります。特に、多くのプロジェクトが取引所での流動性を高めるためにトークンを移動することが一般的です。 ウォレットのアドレスとトークンの送金履歴…

ハイパーリクイッドでのビットコインとイーサリアムポジションの変化が浮き彫りに

Key Takeaways 最近、ハイパーリクイッドにおけるBTCの多頭巨鯨数が約2ヶ月で半減した。 ETHでは空頭巨鯨が多頭の2倍に増加している。 大手BTC空頭巨鯨の平均ポジション価格は8.82万ドル、清算価格は9.41万ドル。 ETH最大空頭巨鯨はポジション平均価格が3129ドル、清算価格が3796ドル。 WEEX Crypto News, 26 December 2025 ハイパーリクイッドにおけるポジションの動向 仮想通貨市場での最近の出来事は、投資家やトレーダーにとても重要な情報を提供しています。特にハイパーリクイッドプラットフォームでのビットコイン(BTC)およびイーサリアム(ETH)の動向に変化が見られます。市場分析ツールHyperInsightによると、このプラットフォーム上での多頭(買い)と空頭(売り)ポジションに大きな変化がありました。 BTC多頭ポジションの急減 過去2ヶ月間で、ハイパーリクイッドにおけるBTCの多頭巨鯨数が劇的に減少しました。今年の10月14日には234名の多頭巨鯨が存在しましたが、最新のデータではこれが122名にまで減少しています。これは約50%の減少を意味し、多頭の勢いが弱まっていることを示しています。一方で、現在の空頭巨鯨数は116名で、過去に比べて変化は少なく、若干の増加に留まっています。この動きは、ビットコインに対する市場全体のリスクアペタイトの変化を示唆しています。 ETH空頭の増加 イーサリアム市場では、空頭が多頭をかなり上回っています。現在、ETHの空頭巨鯨は113名で、多頭の58名に対して倍に達しています。このことは、特にイーサリアム市場での売り圧力が増している可能性を示唆しています。市場のセンチメントが冷却し、ETHに対して伝統的な強気ポジションを取り控える動きが広まっていると言えるでしょう。…

ビットコイン、9万ドルへの勢いを再び満たす

Key Takeaways マーケットでは短期的にビットコインが8.2万ドルから9.5万ドルまでの変動が予測される。 BTC価格が9万ドルを超え、24時間で1.53%上昇した。 Deribitで270億ドル相当のビットコインとイーサリアムのオプションが到期し、市場に影響を与える。 現物金と銀の価格が歴史的高値を更新、多くの投資家が注目している。 WEEX Crypto News, 26 December 2025 ビットコインの価格動向と市場の反応 12月26日、ビットコインの価格は再び9万ドルを試す動きを見せ、価格は急騰しています。最新のデータによれば、特に12月22日以降の上昇が顕著で、90,027ドルを記録し、24時間での上昇率は1.53%でした。この背景には、近日中に満期を迎えるビットコイン・オプションが市場に与える影響があると見られています。12月26日に予定されている270億ドル相当のオプション到期は、市場に新たな変革をもたらす可能性があります。 マーケットの変動と価格の背景 現時点でのビットコインの動きは、年内に9.5万ドルを超える可能性があると予測されています。この見通しの中では、特にオプション取引の影響が注目されています。取引所情報によると、ビットコイン価格の上昇は、このオプション取引の満期に伴う市場動向との関連が指摘されています。 また、市場は過去のビットコイン価格の大幅な変動に基づき、価格への影響を予測しています。今年初の価格からの回復は比較的遅れたものの、オプションの影響で通常の市場ダイナミクスが回復しつつあります。 現物資産の相場動向…

比特コイン史上最大の期権到期、BTC価格に波紋

Key Takeaways 236億ドル規模のビットコイン期権が到期し、短期的な価格変動が予想される。 BTCの取引価格は現在約8.7万ドルで推移している。 取引所Deribitで大量の未平倉契約が期権到期により清算される見込み。 市場は最大痛点価格9.5万ドルに向かって動く可能性がある。 短期的には約8.2万ドルまで下落した後に反発する予測がある。 WEEX Crypto News, 26 December 2025 史上最大の期権到期が及ぼすBTCの今後の動向 2025年12月26日、ビットコイン(BTC)は8.7万ドルの水準で圧力が続いている中、史上最大とされる期権到期を迎え、短期価格の動向を大きく揺るがしそうです。約236億ドル規模のBTC期権契約が12月24日にDeribitで到期する予定で、これは同取引所での未清算契約の半分以上を占めます。この結果、ビットコイン価格の短期的な方向性に注目が集まっています。 Deribit上の巨大な期権到期による市場への影響 Deribitでは、約30万枚のビットコイン期権と44.6万枚のiSharesビットコイン信託期権が到期します。この期権決済だけで市場の風向きを変えることはないかもしれませんが、過去数回のクリスマス期にみられた5%から7%の価格変動が再び発生する可能性が指摘されています。 Deribitのデータは、「最大痛点価格」が約9.5万ドルであることを示しており、多くの期権はこの価格で無価値となります。市場では0.38のプット・コール比率が報告されており、投資家は全体としてビットコインの中期的な見込みを楽観視しています。…