What is Canton Network: Pioneering Institutional Crypto with Canton Coin (CC) and Privacy-Preserving Blockchain Innovation

Picture a world where the ironclad vaults of traditional finance open to blockchain’s relentless 24/7 pulse—without the usual chaos of exposed data or regulatory nightmares. That’s the reality Canton Network is building. Launched in May 2023 by a powerhouse consortium including Goldman Sachs, Microsoft, and Deutsche Bank, this public-yet-permissioned Layer 1 isn’t another speculative side project. It’s the settlement layer where real-world assets (RWAs) and stablecoins finally live and breathe on-chain. As of late 2025, with Canton Coin (CC) trading near $0.13 and daily transactions topping 600,000, Canton Network is quietly closing the gap between Wall Street caution and crypto speed.

What Makes Canton Network the Institutional Crypto Standard?

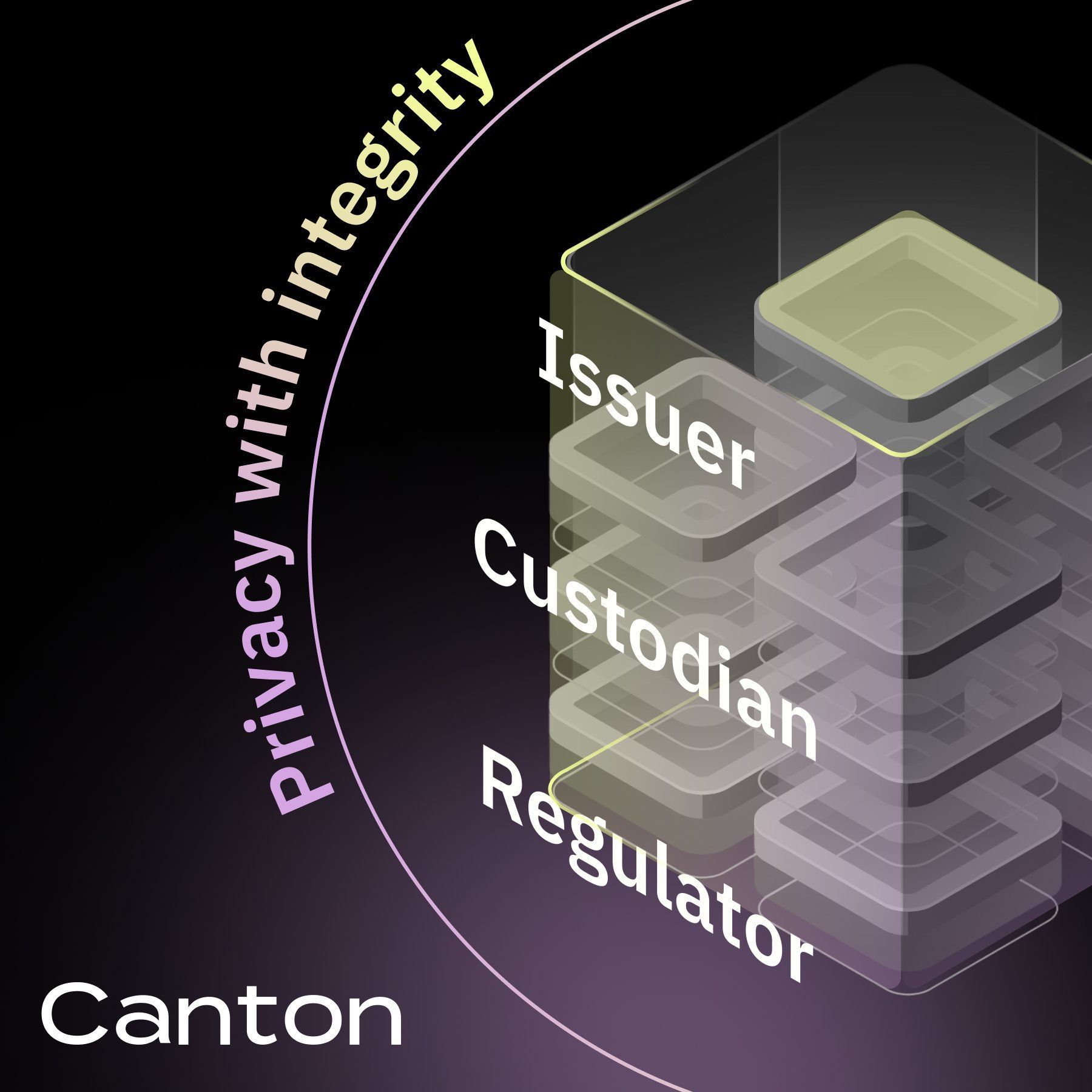

Canton Network runs on a “network of networks” architecture: each institution keeps its own private sub-ledger, syncing seamlessly via a shared global synchronizer. Unlike typical public chains that broadcast every transaction to every node—inviting compliance disasters—data here flows encrypted and only to parties specified in the smart contract. Sensitive operations, like the $280 billion daily U.S. Treasury repo market, remain confidential yet fully auditable.

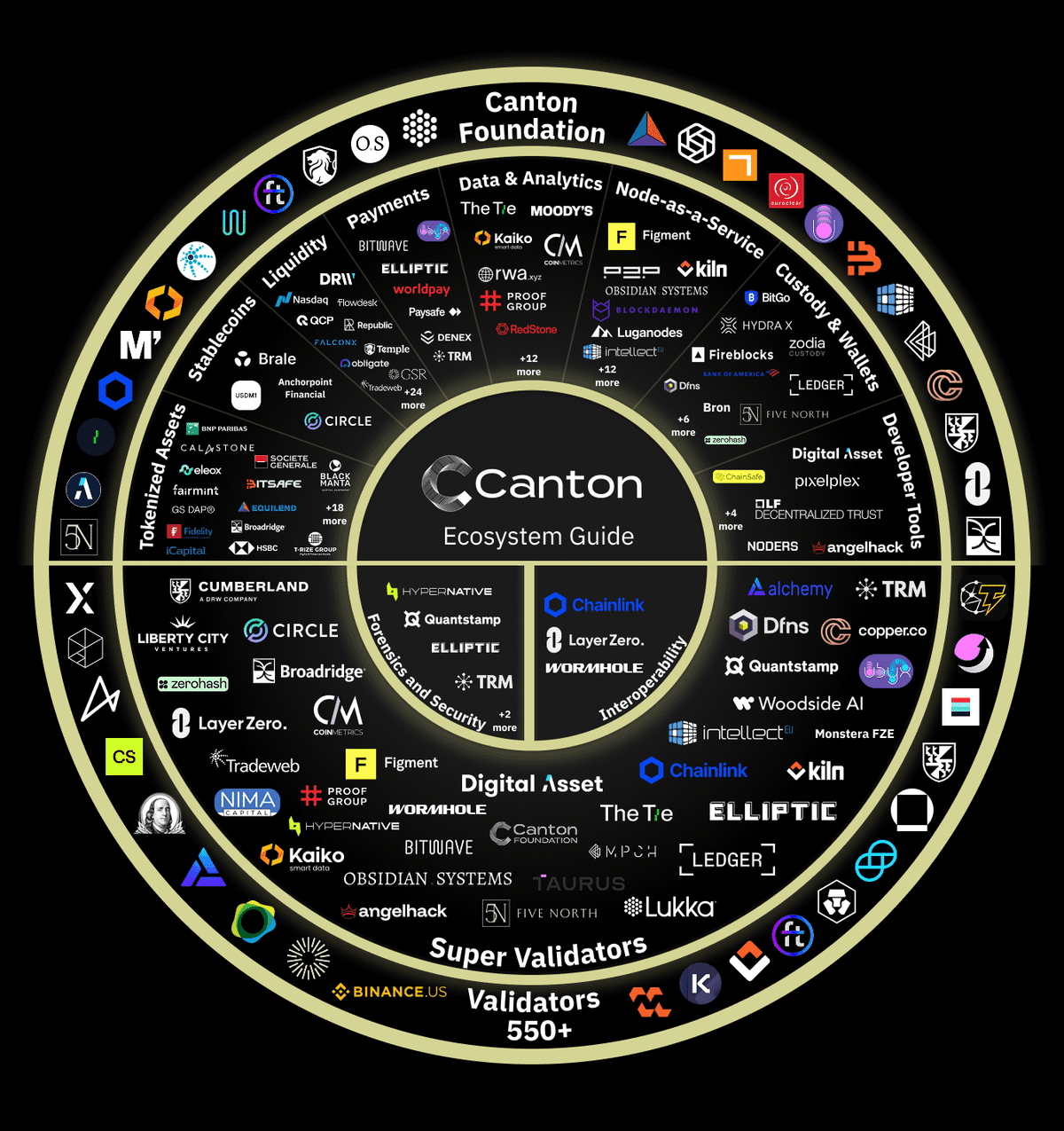

Think of it as a secure diplomatic summit: participants share only what’s required for the deal, but the entire agreement locks in atomically across borders. Governed by the independent Global Synchronizer Foundation under the Linux Foundation, the network now boasts over 600 validators and 31 super validators. Monthly transaction volume exceeds 15 million, with more than $6 trillion in assets tokenized. Major U.S. exchanges—Binance U.S., Crypto.com, Gemini, and Kraken—are fully integrated, turning institutional adoption into an unstoppable trend.

The Privacy Advantage: Why Canton Network Crypto Stands Apart

While most blockchains scream transparency, Canton whispers. Its synchronizers distribute encrypted messages only to relevant parties, enabling real-time settlement across bonds, treasuries, and even tokenized real estate—without the silos that trap capital in legacy systems. Just this week, Franklin Templeton’s Benji Token went live on the network, proving how Canton unlocks collateral mobility while staying MiCA-compliant.

This rare balance of decentralization and control makes Canton Network coin the backbone of RWAs. Assets aren’t just “on-chain”—they’re programmable, reusable, and regulator-friendly, delivering a capital efficiency revolution already powering institutional DeFi pilots.

Inside Canton Coin: The CC Token Powering a Fair, Utility-First Economy

Canton Coin (CC) isn’t built for hype—it’s engineered for real work. Outlined in the Canton Network whitepaper, CC is the native payment and incentive layer that rewards actual network contribution, not speculation. No pre-sales. No team allocations. No VC lockups. Tokens are minted only through verifiable utility: running validators, deploying applications, or driving traffic.

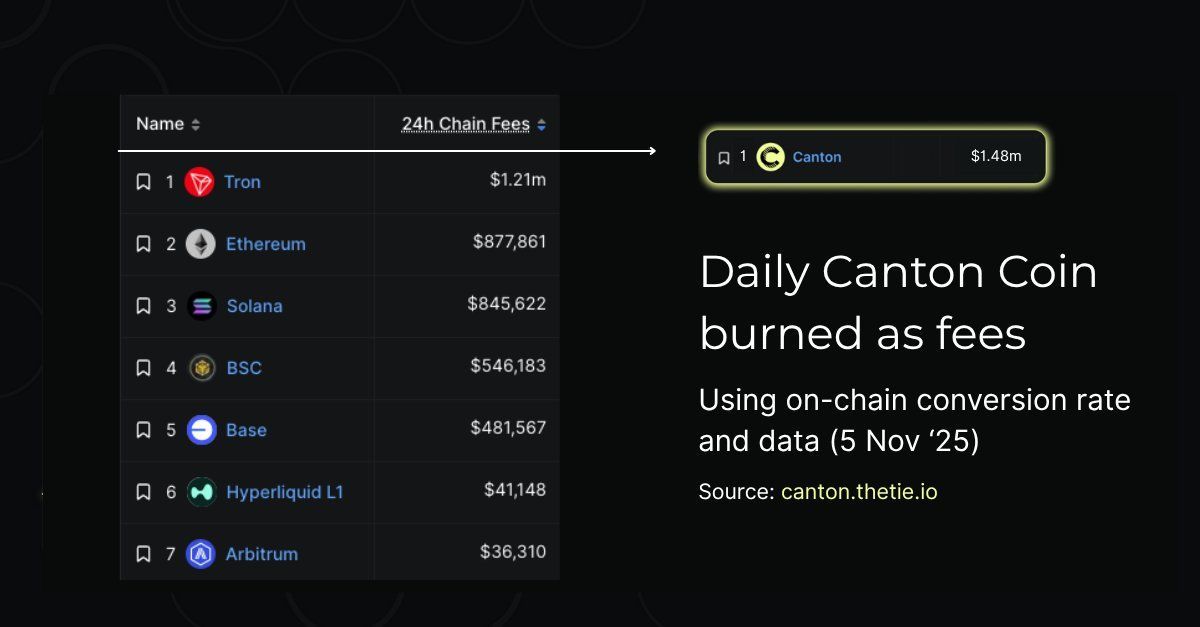

Every 10 minutes, in structured mining rounds, stakeholders earn redeemable coupons based on liveness, validation, and app activity. Pay gas in CC? It’s automatically burned. The more the network is used, the tighter supply becomes—creating a self-regulating deflationary loop tied directly to real economic activity. With 22 billion CC in circulation and a 100 billion cap over the first decade (followed by 2.5 billion annually), this model echoes Zcash’s privacy legacy but supercharges it with institutional-grade infrastructure.

CC Coin Tokenomics Breakdown: Minting, Burning, and Long-Term Alignment

The minting curve is deliberately bootstrapped: early years favor super validators to fund backbone infrastructure, but by year five, regular validators dominate rewards. The split starts 50/50 between infrastructure and applications, then shifts to 75% for app providers—ensuring builders, not just operators, thrive. External parties can delegate minting via AmuletRules_Transfer, but unredeemed rewards expire, keeping the system merit-driven and lean.

This design kills speculation at the root. Despite a post-listing dip to $0.126, CC sees $80 million in daily volume across top exchanges. Recent $540 million treasury commitments—including Tharimmune’s strategic pivot—signal growing conviction in CC’s long-term value, backed by $1.48 million in daily fees and real RWA throughput.

Canton Network’s 2025 Breakout: Listings, Integrations, and Real-World Traction

This year has been explosive for Canton Network crypto. CC launched October 31 at $0.11, rapidly listing on Gate.io, Bybit (via Launchpool with 355% APR staking), MEXC (zero-fee trading through November 24), and now WEEX—offering deep liquidity, tight spreads, and a seamless mobile experience for traders worldwide. Whether you’re spot trading CC/USDT or staking for yield, WEEX delivers institutional-grade execution with retail-friendly simplicity, making it a go-to platform for accessing Canton Network coin alongside KuCoin, Phemex, and others.

Network momentum is undeniable: Talos joined as a super validator this month, Chainlink’s SCALE integration unlocked oracle and cross-chain functionality across 22+ networks, and Broadridge now processes $4 trillion in monthly ledger repos on-chain. Copper Research reports over 500,000 daily transactions—proof that Canton isn’t promising the future; it’s running it.

On X, the conversation is electric. Threads dissect the $500 million treasury round from DRW and Liberty City Ventures. AMAs spotlight privacy’s role in institutional DeFi. One viral post sums it up: “Canton now has 598 validators and growing—this is what real on-chain adoption looks like.”

Why is Canton Network the Settlement Layer for RealFi?

Compare Canton to meme-driven chains chasing viral pumps, and its strength is clear: while others tokenize hype, Canton tokenizes reality—national debts, repurchase agreements, precious metals—making them liquid, auditable, and programmable. Its BFT consensus with privacy scales without gas wars. Partnerships like Nasdaq’s listings and HSBC’s pilots underscore a shift from DeFi speculation to RealFi—real finance, on-chain.

With a $4.5 billion market cap and year-end price targets between $0.08 and $0.17, CC’s upside isn’t driven by unlocks—it’s fueled by burn mechanics that reward usage. As stablecoins become settlement engines and RWAs go programmable, Canton Network coin isn’t just bridging TradFi and crypto—it’s fusing them.

This is the infrastructure where the future of global capital markets is being built, one private, atomic sync at a time.

Frequently Asked Questions (FAQ)

- What is Canton Coin (CC), and how is it different from other crypto tokens?

Canton Coin is the native utility token of Canton Network, designed to reward real network activity—validation, app deployment, traffic—rather than speculation. With no pre-mine or VC allocation, CC is minted only through contribution, and fees paid in CC are burned, creating a supply model tied directly to usage and long-term ecosystem health.

- Where can I buy and trade Canton Network coin (CC) right now?

CC is live on WEEX, KuCoin, Phemex, Gate.io, Bybit, and MEXC with USDT and USDC pairs. WEEX stands out for fast deposits, low-latency trading, and strong mobile support—ideal for active traders. Always use secure wallets and enable 2FA. DYOR before investing.

- What’s the outlook for Canton Network crypto in 2026 and beyond?

With 600+ validators, $6T in tokenized assets, and growing integrations (Chainlink, Talos, Franklin Templeton), analysts expect CC to rise as RWAs go mainstream. If repo volumes sustain $280B daily, valuation could double or more by 2027—positioning Canton as the default settlement layer for institutional blockchain.

Popular coins

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com