What Is Proof of Reserves (PoR)? How WEEX Ensures Transparency and User Fund Safety

In recent months, the crypto-industry has been jolted yet again by alarming security incidents. Just this year, 2025 has seen over $2.17 billion stolen from crypto services, with recent incidents like the $128 million hack on the Balancer protocol and a significant breach at the Phemex exchange highlighting the ongoing risks. These events underscore a critical need for trust in platforms handling user funds, which is where Proof of Reserves comes into play. Proof of Reserves isn't just a buzzword—it's a vital mechanism that helps rebuild confidence in an industry plagued by opacity. As we dive deeper into what Proof of Reserves truly means, we'll explore how exchanges like WEEX are leading the charge in transparency, ensuring that your assets are as secure as they claim.

Understanding What Is Proof of Reserves

When you log into a crypto exchange and trust it with your funds, you’re implicitly relying on the idea that the platform holds your assets — and all other users’ assets — in reserve. But claims alone aren’t sufficient. That’s where Proof of Reserves comes in: it’s a mechanism for demonstrating that a platform’s holdings (its reserves) match or exceed the sum of user account balances (its liabilities). Put another way, What is Proof of Reserves? It’s evidence-based assurance that user funds are backed 1:1 or greater, and that the platform is solvent.

The idea behind Proof of Reserves is to bring transparency: instead of simply telling users that assets are safe, the platform shows — via on-chain data, cryptography and third-party audit — that reserves exist and liabilities are covered. That’s the heart of WEEX Proof of Reserves, a system designed to give users confidence in the platform’s financial health.

Why Proof of Reserves Matters in the Crypto World

Imagine lending your car to a friend who promises to keep it safe, but you have no way to check if it's still in their garage—that's the unease many felt in crypto before Proof of Reserves became standard. Why do we need Proof of Reserves in crypto? The answer lies in the industry's history of collapses, from the infamous FTX fallout to more recent 2025 exploits totaling billions in losses. These incidents often stem from platforms commingling funds or engaging in risky investments without disclosure, leaving users high and dry when things go south.

Proof of Reserves flips the script by proving that every dollar or token deposited is backed 1:1 by actual reserves, reducing the risk of insolvency. It's particularly relevant amid rising discussions on social media, where users frequently ask about the reliability of stablecoins and exchange solvency. On platforms like Twitter, topics around Proof of Reserves spike during market volatility, with recent threads highlighting how interconnected protocols can cascade failures if transparency is lacking. For example, debates over leveraged farming and recursive looping in DeFi projects emphasize that without Proof of Reserves, even seemingly stable systems can unravel quickly. In essence, Proof of Reserves isn't optional—it's the bedrock that prevents minor issues from turning into major crises, fostering a healthier ecosystem for everyone involved.

Breaking Down How Proof of Reserves Works

Diving into the mechanics, how does Proof of Reserves work? It starts with a platform compiling two key datasets: user liabilities (what they owe to customers) and their own asset reserves (what they actually hold). These are then hashed into a cryptographic structure, like a Merkle tree, which acts as a digital fingerprint—unalterable and verifiable. An independent auditor reviews this data, confirming the reserves match or exceed liabilities, often publishing the results on blockchain explorers or dedicated portals.

To make it relatable, picture Proof of Reserves as a recipe where ingredients (assets) must perfectly match the servings (user deposits). If there's a shortfall, the whole dish falls apart. Advanced implementations incorporate zero-knowledge proofs to enhance privacy, allowing verification without exposing individual balances. Recent updates in the space, such as Chainlink's integration for real-time Proof of Reserves in projects like SolvBTC, show how this technology is evolving to handle cross-chain complexities. Users often search for questions like "What assets count as reserves?" or "How often should audits happen?"—typically, liquid, on-chain holdings qualify, and best practices recommend monthly or quarterly checks to maintain ongoing trust.

WEEX Proof of Reserves: Verifiable Transparency in Action

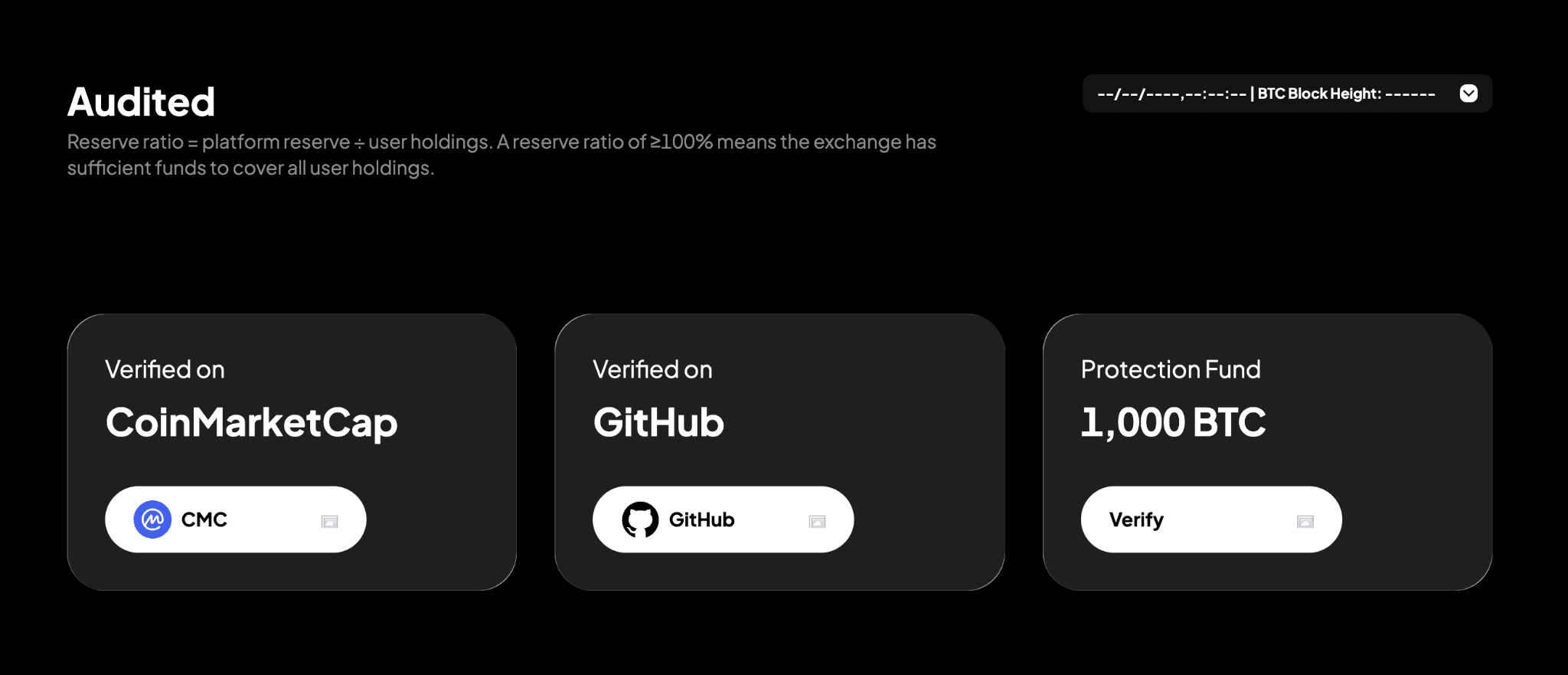

When a platform claims to follow Proof of Reserves, the real question is: how thoroughly? At WEEX, this commitment goes far beyond words. The WEEX Proof of Reserves system ensures every user asset is backed by an equivalent reserve through a strict 1:1 mechanism — meaning the reserve ratio (platform reserves ÷ user assets) is always at or above 100%.

To make this verifiable, WEEX publicly discloses wallet addresses and audit summaries so users can inspect and confirm the backing themselves. The platform’s 1,000 BTC Protection Fund serves as an added safeguard, reinforcing liquidity and covering unexpected losses — a proactive safety net for all users.

What truly distinguishes WEEX Proof of Reserves is its combination of real-time transparency and verified trust. The system is supported by third-party audits listed on CoinMarketCap and GitHub, allowing anyone to view live reserve data. In its recent AMA with Venom Foundation (November 5, 2025), WEEX further showcased how its Proof of Reserves architecture extends to tokenized real-world assets (RWAs) — a move that sparked industry-wide discussions on the future of transparency in crypto.

By maintaining a flawless security record and implementing continuous audits, WEEX sets a benchmark for reliability in the exchange landscape. Beyond transparency, it offers users both safety and performance — from copy trading for beginners to pro-level analytical tools — all underpinned by a verifiable Proof of Reserves system that transforms trust into tangible assurance.

Step-by-Step: How to Verify Proof of Reserves Yourself

Empowering yourself with knowledge is key, so let's walk through how to verify Proof of Reserves on platforms like WEEX. It begins with accessing the exchange's dedicated Proof of Reserves page, where you'll find hashed data and audit reports. Using tools like blockchain explorers, you can input your account details into a Merkle leaf verifier—essentially a digital checker that confirms your balance is included in the total without revealing others' info.

Common user queries, such as "How do I know if my account is covered?" or "What if the reserves dip below 100%?", are addressed through these self-verification steps, often taking just minutes. For WEEX Proof of Reserves specifically, their portal allows real-time checks, backed by data from reputable sources. This hands-on approach demystifies the process, turning abstract concepts into tangible assurance, and it's a practice gaining traction in Twitter conversations where users share tips on spotting red flags like delayed audits or opaque reporting.

Advanced Tips for Verifying WEEX Proof of Reserves

For those wanting to go deeper, compare WEEX Proof of Reserves ratios against industry averages—WEEX consistently shows over 100% backing, a stark contrast to platforms that skirt transparency. Analogous to checking a car's odometer before a purchase, these verifications reveal the true mileage of an exchange's trustworthiness, helping you avoid pitfalls seen in recent DeFi blowups.

Conclusion: Fostering Trust with Proof of Reserves and Transparency

In a landscape where security news can shift market sentiments overnight, embracing Proof of Reserves is more than a safeguard—it's a commitment to a sustainable crypto future. Platforms like WEEX exemplify this by weaving transparency into their core operations, from 1:1 asset backing to verifiable audits and protection funds. As users increasingly demand accountability, as seen in surging Google searches for "what is Proof of Reserves" and lively Twitter debates on DeFi risks, the path forward is clear: trust built on proof, not promises. By choosing exchanges that prioritize WEEX Proof of Reserves standards, you're not just protecting your funds—you're contributing to an ecosystem where innovation thrives alongside security.

Latest Updates on WEEX

WEEX Exchange’s WXT Token Surges 101%

If you want to buy WXT now, you can sign up for a WEEX account

WEEX Owen: Michael Owen Joins as Global Brand Ambassador

Championing a revolutionary crypto trading experience

You may also like

Gainers

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com