$2 Billion "Prediction Game": Is the Forecasting Market Approaching a "Turning Point" Moment?

Original Article Title: "Bitget Wallet Research: The $20 Billion "Probability Game": Is the Prediction Market Welcoming a "Singularity" Moment?"

Original Source: Bitget Wallet Research

Introduction

From the whimsical chatter of "Will Zelensky Wear a Suit" to the global focus on the U.S. election and Nobel Prize winners, the prediction market always seems to periodically "catch fire." However, since 2025Q3, a true storm seems to be brewing:

In early September, industry giant Polymarket received regulatory approval from the U.S. CFTC to re-enter the U.S. market after three years;

In early October, NYSE parent company ICE proposed to invest up to $20 billion in Polymarket;

In mid-October, the weekly trading volume of the prediction market hit a historic high of $20 billion.

With a wave of capital, regulatory opening, and market frenzy coinciding, there are rumors of the listing of the Polymarket token—where did this surge come from? Is it just another short-lived hype, or is it a "value singularity" in a brand-new financial track? Bitget Wallet Research will take you deep into this article to analyze the underlying logic and core value of the prediction market and make an initial judgment on its core dilemmas and development direction.

I. From "Dispersed Knowledge" to "Duopoly": The Evolutionary Path of the Prediction Market

The prediction market is not unique to the crypto world; its theoretical foundation can even be traced back to 1945. Economist Hayek proposed in his classic discourse:

Dispersed, local "dispersed knowledge" can be effectively aggregated by the market through the price mechanism. This idea is considered to have laid the theoretical foundation of the prediction market.

In 1988, the University of Iowa in the U.S. initiated the first academic prediction platform—the Iowa Electronic Markets (IEM), which allowed users to trade futures contracts on real-world events (such as presidential elections). In the following decades, extensive research generally confirmed that a well-designed prediction market often outperforms traditional opinion polls in accuracy.

However, with the emergence of blockchain technology, this niche tool found a new scalable landing ground. The transparency, decentralization, and global access characteristics of blockchain have provided the prediction market with nearly perfect infrastructure: through smart contracts for automatic settlement, it can break through the access barriers of traditional finance, allowing anyone globally to participate, thereby greatly expanding the breadth and depth of "aggregated information." The prediction market has gradually transformed from a niche gambling tool to a powerful on-chain financial sector, beginning to integrate deeply with the "crypto market."

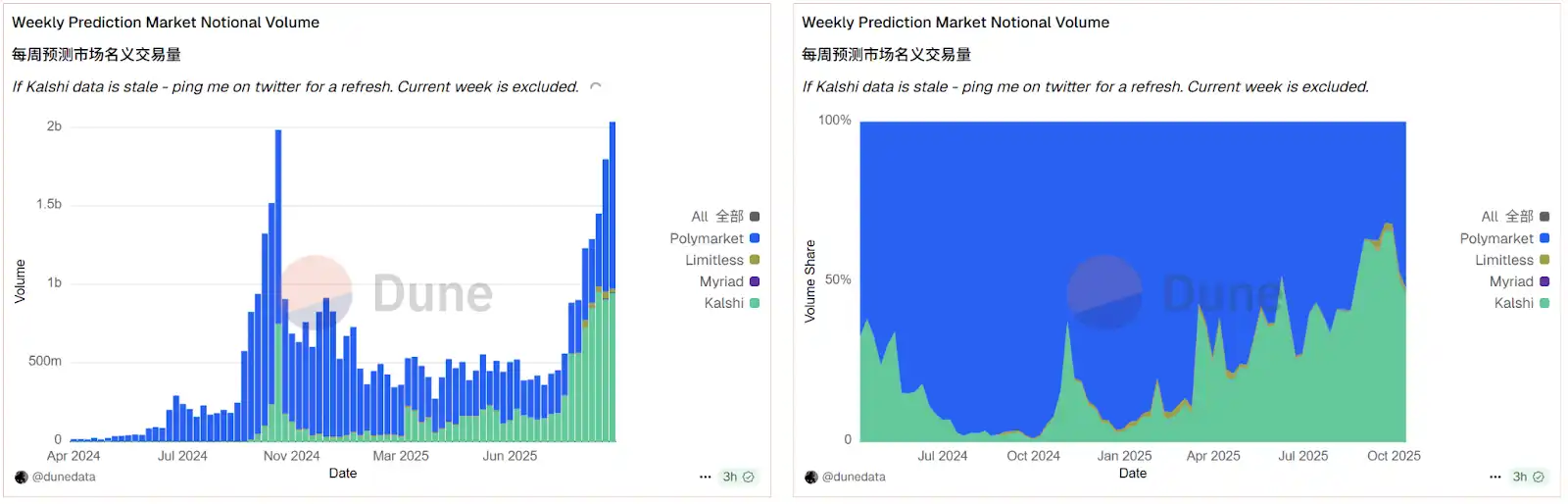

Data Source: Dune

Data from the Dune platform vividly confirms this trend. On-chain data shows that the current crypto prediction market has exhibited a highly monopolistic "duopoly" pattern: Polymarket and Kalshi, the two giants, have captured over 95% of the market share. Stimulated by both capital and regulatory tailwinds, this track is being activated as a whole. In mid-October, the weekly trading volume of the prediction market surpassed $2 billion, surpassing the previous pre-2024 U.S. election historical peak. In this round of explosive growth, Polymarket, with its key regulatory breakthroughs and potential token expectations, temporarily holds a slight advantage in the fierce competition with Kalshi, further solidifying its leading position.

II. "Event Derivatives": Beyond Gambling, Why Is Wall Street Betting?

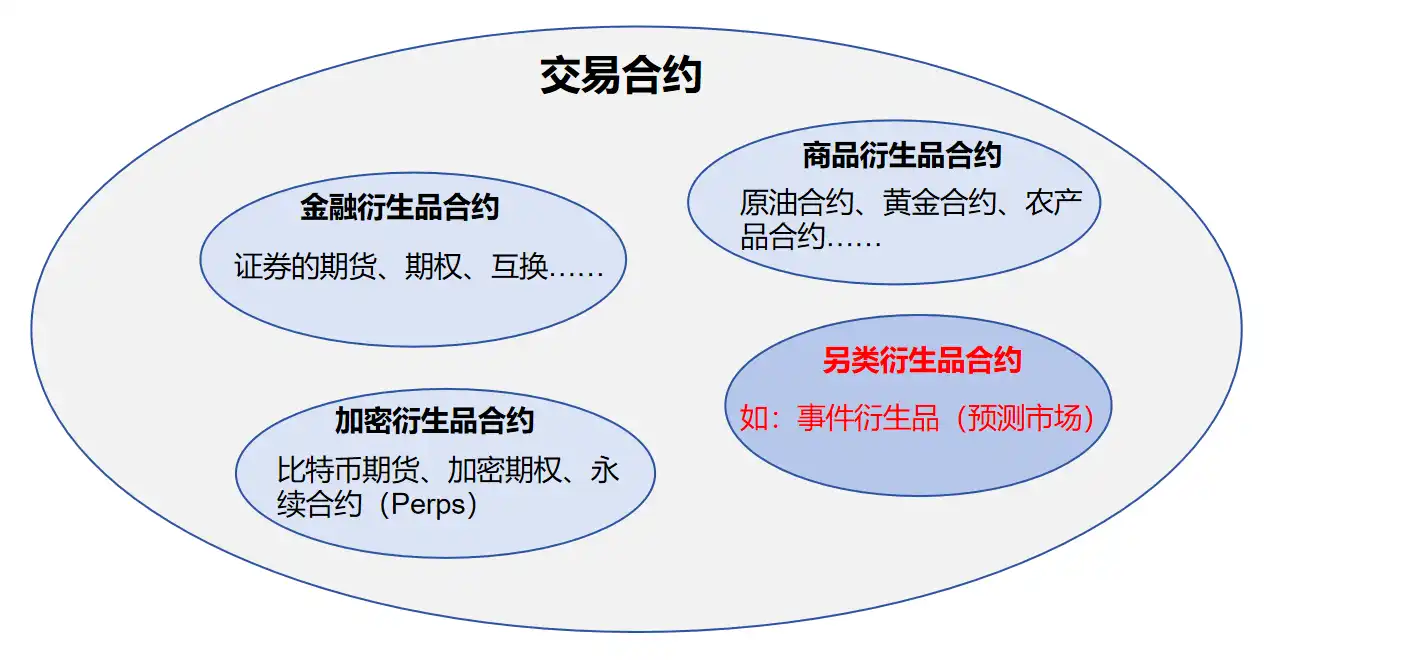

To understand why ICE made a heavy investment in Polymarket, one must strip away the "gambling" facade of the prediction market and see the core of its "financial instrument." The essence of the prediction market is an alternative type of trading contract, belonging to a category of "Event Derivatives."

This is different from the familiar "price derivatives" such as futures and options. The underlying asset of the latter is the future price of assets (such as oil or stocks), while the former's underlying asset is the future outcome of a specific "event" (such as an election or climate). Therefore, the price of its contract represents the market's collective consensus on the "probability of event occurrence," not the asset's value.

Under the blessing of Web3, this difference is further amplified. Traditional derivatives rely on complex mathematical models like Black-Scholes for pricing and clear through brokers and centralized exchanges; whereas on-chain prediction markets execute automatically through smart contracts, rely on oracles for settlement, and have pricing (such as AMM algorithms) and pools completely transparent on-chain. This significantly lowers the entry barrier but also brings new risks (like oracle manipulation and contract vulnerabilities), contrasting sharply with traditional finance's counterparty and leverage risks.

Prediction Market vs Traditional Financial Derivatives Comparison Table

This unique mechanism is at the core of its attraction to mainstream financial institutions. It provides a triple-core value that traditional markets cannot reach, which is also the key focus of giants like ICE:

Firstly, it is an advanced "information aggregator" that reshapes the landscape of information equity. In today's world where AI-generated content, fake news, and information silos abound, the "truth" has become expensive and hard to discern. The prediction market provides a radical solution to this: truth is not defined by authorities or media but is "auctioned" by a decentralized, economically incentivized market. It responds to the growing distrust in traditional sources of information, especially among the younger generation, providing an alternative source of information that implements a "money-voting" system and is more honest. More importantly, this mechanism goes beyond traditional "information aggregation" itself, achieving real-time pricing of "truth," creating a highly valuable "real-time sentiment indicator," and ultimately achieving information equity across all dimensions.

Secondly, it commodifies the "information gap" itself, opening up a whole new investment track. In traditional finance, investment targets are ownership certificates such as stocks and bonds. The prediction market has created a new tradable asset—"event contracts." This essentially allows investors to directly transform their beliefs about the future or their information advantage into tradable financial instruments. For professional information analysts, quantitative funds, or even AI models, this represents an unprecedented dimension of profit. They no longer need to indirectly express their views through complex secondary market operations (such as longing/shorting related company stocks) but can directly "invest" in the event itself. The significant trading potential of this new asset class is a key interest point for exchange operators like ICE.

Lastly, it has created a "hedge everything" risk management market, greatly expanding the boundaries of finance. Traditional financial tools struggle to hedge the uncertainty of an "event" itself. For example, how can a shipping company hedge the geopolitical risk of "whether the canal will be closed"? How can a farmer hedge the climate risk of "whether the rainfall will be less than X millimeters in the next 90 days"? The prediction market provides a perfect solution for this. It allows participants from these real-world entities to transform abstract "event risks" into standardized tradable contracts for precise risk hedging. This is akin to opening up a brand-new "insurance" market for the real economy, providing a new entry point for finance to empower the real economy, with potential far beyond imagination.

errorBut in any case, a new era combining information, finance, and technology has begun. As top-tier traditional capital intensifies its focus on this racetrack, the leverage it will exert will far exceed a weekly trading volume of 20 billion US dollars. This may well be a true "singularity" moment — it heralds a new asset class (the pricing power of "belief" and "future") being embraced by the mainstream financial system.

This article is contributed content and does not represent the views of BlockBeats.

You may also like

Insight: 2026 Could Usher in a “Crypto Winter,” but Institutionalization and On-chain Transformation Are Accelerating

Key Takeaways Cantor Fitzgerald predicts Bitcoin could face an extended downtrend, signaling a potential “Crypto Winter” by 2026.…

Caixin: Digital RMB Wallet Balances to Begin Earning Interest in 2026

Key Takeaways: Starting January 1, 2026, digital RMB wallets will earn interest on balances. The operational structure will…

Key Market Information Discrepancy on December 30th – A Must-See!

Key Takeaways Meta’s massive acquisition of Manus is poised to reshape the tech landscape, indicating significant growth in…

From Failures to Success: Building Crypto Products That Truly Matter

Key Takeaways Building infrastructure in crypto doesn’t guarantee success; understanding user needs is critical. Products aimed at younger…

Lighter Founder’s Latest Response on Token Launch Progress, What Was Said

Lighter’s Founder, Vladimir Novakovski, clarifies key concerns in an AMA, focusing on detecting and resolving bot account manipulations…

Cryptocurrency Trends and Insights: Navigating the 2025 Landscape

Key Takeaways Cryptocurrency continues to evolve rapidly, with new trends reshaping the market. Blockchain technology’s applications extend beyond…

Lighter: Airdrop Successful and Token Trading Imminent

Key Takeaways: The Lighter Discord community recently announced the successful distribution of LIT tokens, marking the beginning of…

The Eve of a Federal Pivot: Evaluating the Looming Change in the U.S. Central Bank

Key Takeaways Investors are gearing up for potential changes in Federal Reserve policy, with concerns about independence and…

UNI Burn Arbitrage Opportunity, Ondo Tokenized Stock Liquidity Debate, What’s the Overseas Crypto Community Talking About Today?

Key Takeaways The crypto market is buzzing with multi-threaded discussions, from macro trends to specific protocols and scams.…

6-Week, 3-Auditor Swap Sees Trump Crypto Firm Alt5 Sigma Mired in Financial Turbulence

Key Takeaways Alt5 Sigma, linked to the Trump family, faces financial reporting chaos and potential delisting risks due…

Announcement: The Fed to Release Minutes of its Monetary Policy Meeting Soon

Key Takeaways The Federal Reserve is anticipated to disclose the minutes from its latest monetary policy meeting, offering…

Yield Farming at 86% APY? How to Use Bots to “Earn While You Sleep” on Polymarket

Key Takeaways Polymarket presents untapped opportunities for bot utilization, despite existing competition. A proprietary trading bot streamlines the…

6-Week, 3-Auditor Switch Undermines Trump-Led Crypto Firm Alt5 Sigma

Key Takeaways Alt5 Sigma, tied to the Trump family, faces financial and operational turmoil marked by rapid auditor…

The Fed’s Monetary Policy Minutes and the Crypto Trading Insights

Key Takeaways The Federal Reserve is set to disclose the minutes from its recent monetary policy meeting, highlighting…

“Elon Musk’s Nemesis Trade” Colossal ETH Short Sparks Debate in Crypto Circles

Key Takeaways A colossal short position was secured against Ethereum (ETH) worth approximately $106 million by a single…

Dragonfly Partner Foresees BTC Surpassing $150K by 2026 but Market Share Decline

Key Takeaways Bitcoin is anticipated to climb over $150,000 by the end of 2026, although its market dominance…

Elon Musk Liquidation Wall: Liquidates $106M Short Position, Faces $479K Loss

Key Takeaways A $106 million ETH short position was liquidated after just 15 hours, resulting in a $479,000…

Unstable Stablecoins: Understanding the Market’s Concerns and Dynamics

Key Takeaways Recent financial reports indicate concerns and instability in the stablecoin market. Circle, a leading stablecoin issuer,…

Insight: 2026 Could Usher in a “Crypto Winter,” but Institutionalization and On-chain Transformation Are Accelerating

Key Takeaways Cantor Fitzgerald predicts Bitcoin could face an extended downtrend, signaling a potential “Crypto Winter” by 2026.…

Caixin: Digital RMB Wallet Balances to Begin Earning Interest in 2026

Key Takeaways: Starting January 1, 2026, digital RMB wallets will earn interest on balances. The operational structure will…

Key Market Information Discrepancy on December 30th – A Must-See!

Key Takeaways Meta’s massive acquisition of Manus is poised to reshape the tech landscape, indicating significant growth in…

From Failures to Success: Building Crypto Products That Truly Matter

Key Takeaways Building infrastructure in crypto doesn’t guarantee success; understanding user needs is critical. Products aimed at younger…

Lighter Founder’s Latest Response on Token Launch Progress, What Was Said

Lighter’s Founder, Vladimir Novakovski, clarifies key concerns in an AMA, focusing on detecting and resolving bot account manipulations…

Cryptocurrency Trends and Insights: Navigating the 2025 Landscape

Key Takeaways Cryptocurrency continues to evolve rapidly, with new trends reshaping the market. Blockchain technology’s applications extend beyond…

Popular coins

Latest Crypto News

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:[email protected]

VIP Services:[email protected]