Analysis: Short Positioning Could Be the Fuel for the Next Leg Up, Market Awaits Bitcoin Volatility Downtrend

BlockBeats News, October 24th, CryptoQuant analyst Axel Adler Jr posted that the macro-level Bitcoin heat has dropped to the bottom/accumulation area, indicating a recent decrease in speculative pressure. In a bull market, the decline in macro heat aligns with the holding accumulation period before the next growth phase. To achieve a rebound, volatility needs to decrease, and no negative trigger should occur globally within a week.

On the daily chart, Bitcoin's volatility remains high, but the slope has started to decline. As long as there is no external shock globally that could lead to a U.S. stock market decline, the market can cash out the accumulated short positions in preparation for the next round of rebound when the index starts to fall. Shorts have accumulated significant positions, and once volatility begins to decrease, these short positions will become the fuel for the next surge.

You may also like

Pantera Capital: How has Crypto as a Service affected us?

Pantera Capital: What changes have we made when crypto is treated as a service?

Wall Street Shorts ETH: Vitalik is aware and has front-run, while Tom Lee remains oblivious

Social Capital CEO: How Equity Tokenization is Reshaping Capital Markets from US Stocks to SpaceX?

CoinGecko Report: Surge of 346% vs Dip of 20.8%, The Wild Rise of DEX

a16z: The Real Opportunity of Stablecoins Lies Not in Disruption but in Filling Gaps

Mining Exodus: Someone Holds $12.8 Billion AI Order

March 6 Market Key Intelligence, How Much Did You Miss?

a16z: The True Opportunity of Stablecoins is in Complementing, Not Disrupting

Predict LALIGA Matches, Shoot Daily & Win BTC, USDT and WXT on WEEX

The WEEX × LALIGA campaign brought together football excitement and crypto participation through a dynamic interactive experience. During the event, users predicted matches, completed trading tasks, and took daily shots to compete for rewards including BTC, USDT, WXT, and exclusive prizes.

Ray Dalio Dialogue: Why I'm Betting on Gold and Not Bitcoin

Who Took the Money in the AI Era? A Must-See Investment Checklist for HALO Asset Trading

Wall Street Bears Target Ethereum: Vitalik In the Know Takes Flight, Tom Lee Remains Bullish

Pump.fun Hacker Steals $2 Million, Receives 6-Year Prison Sentence, Opts for 'Self-Detonation'

6% Annual Percentage Yield as Musk Declares War on Traditional Banks

36 years, 4 wars, 1 script: How does capital price the world in conflict?

Mining Companies' Great Migration: Some Have Already Secured $12.8 Billion in AI Orders

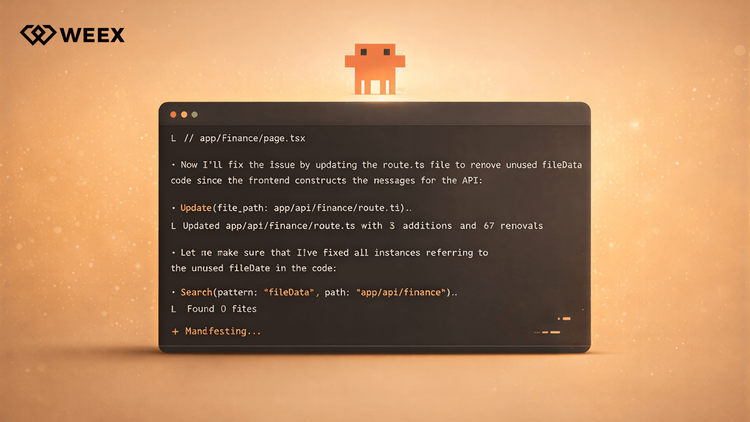

What Is Vibe Coding? How AI Is Changing Web3 & Crypto Development

What is vibe coding? Learn how AI coding tools are lowering the barrier to Web3 development and enabling anyone to build crypto applications.