Trading Strategy: Deep Dive into the xUSD Flash Crash Cause

Original Title: Oct 10th Red Friday: the root cause of Stream xUSD blowing up, the longer version

Original Author: Trading Strategy

Original Translation: Kaori, BlockBeats

Editor's Note: The collapse of xUSD has sounded a loud alarm for the entire DeFi world. This article delves into how Stream Finance, through black-box operations, extreme leverage, and liquidation priority design, violated the core spirit of DeFi. It also explores how the industry can ensure that capital flows into truly responsible, transparent, and robust projects by introducing measures such as a more rigorous treasury technical risk assessment.

False Neutrality Strategy

Stream xUSD is a "tokenized hedge fund" disguised as a DeFi stablecoin, claiming its strategy is "delta-neutral." However, Stream recently found itself in a situation of insolvency after a series of suspicious operations.

Over the past five years, several projects have attempted a similar pattern — generating income through the so-called "neutral yield strategy" to create initial liquidity for their native tokens. Successful examples include MakerDAO, Frax, Ohm, Aave, Ethena, and others.

Unlike these relatively "more genuine" DeFi projects, Stream severely lacks transparency in its strategy and position disclosure. Of the claimed $500 million TVL, only about $150 million can be seen on-chain through platforms like DeBank. It was later discovered that Stream actually allocated some funds to an off-chain proprietary trading strategy, with some of the traders being liquidated, resulting in a loss of about $100 million.

According to @CCNDotComNews, the $120 million hack on Balancer DEX this Monday is not related to the Stream collapse.

According to rumors (yet to be confirmed as Stream has not disclosed specific information), some of the losses are related to the off-chain "selling volatility" strategy.

In quantitative finance, "selling volatility" (also known as short volatility or short vol) refers to a profit-making trading strategy in which one profits when market volatility decreases or remains stable. The logic is that when the price of the underlying asset does not fluctuate much, the option value will shrink or even drop to zero, allowing the seller to retain the option premium as profit.

However, such a strategy carries extremely high risk — once the market experiences intense volatility (i.e., a surge in volatility), the seller may face enormous losses. This risk is often vividly referred to as "picking up pennies in front of a steamroller."

Systemic Collapse

On October 10th (October 11th in UTC+8 time), also known as "Red Friday," I experienced a severe surge in volatility.

This systemic leverage risk had long been accumulating in the crypto market and was ignited by the market frenzy surrounding Trump in 2025. When Trump announced new tariff policies on Friday afternoon, October 10th, all markets plunged into panic, and the panic swiftly spread to the cryptocurrency market.

In the panic, the early panickers profited — everyone began selling off liquid assets, triggering a chain liquidation.

Due to the previously accumulated leverage risk pushing systemic leverage to a peak, the depth of the perpetual futures market was insufficient to support the smooth liquidation of all leverage positions. In this scenario, the Auto Deleveraging (ADL) mechanism was triggered, starting to "socialize" some of the losses and distribute them among traders who were still profitable.

This further distorted the already frenzied market structure.

The volatility caused by this event can be described as a once-in-a-decade upheaval in the crypto market. Similar crashes occurred in the early days of crypto in 2016, but at that time, market data was scarce. Therefore, today's algorithmic traders mostly design their strategies based on data from the past few years of "smooth volatility."

Due to the lack of historical samples of such intense volatility, even leverage positions of just around 2x were liquidated across the board in this volatility.

After "Red Friday," the first "corpse" to surface was Stream.

The definition of a so-called "Delta Neutral Fund" is: theoretically cannot lose money.

If it does lose money, by definition, it is not Delta Neutral.

Stream has always claimed to be a Delta Neutral Fund, but in reality, it secretly allocated funds to opaque, off-chain proprietary strategies.

Of course, the concept of "Delta Neutral" is not an absolute black-and-white divide, but in hindsight, many experts believe that Stream's strategy carried excessive risk and could not truly be considered neutral — because once this strategy backfired, the consequences were extremely severe. And indeed, it turned out to be the case.

When Stream lost its principal in these high-risk transactions, it immediately became insolvent.

In DeFi, risk is inherent — losing money is not the end of the world.

If you can recover 100% of your principal, even after experiencing a 10% drawdown, it's not catastrophic, especially when your annualized return can reach 15%.

However, in Stream's case, the issue was this: it not only employed a risky strategy but also engaged in "recursive borrowing" leverage with another stablecoin, Elixir, amplifying the risk to the extreme.

Chaotic Risk Exposure

Recursive borrowing is a leverage yield farming strategy in the DeFi lending market. It involves repeatedly borrowing against already deposited collateral — usually using the borrowed asset as additional collateral — to amplify exposure to interest rates, liquidity mining rewards, or other lending protocol (such as Aave, Compound, or Euler) yields. This creates a "loop," allowing users to effectively double the capital invested without additional external funds, essentially letting users borrow from themselves and then borrow back to the protocol.

Stream's xUSD wallet holds 60% of the circulating xUSD, all of which is leveraged.

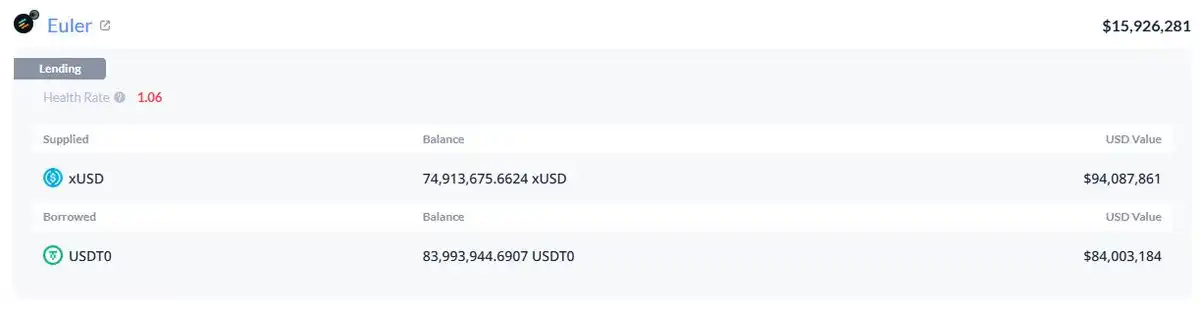

Due to the commingling of funds across their products, we cannot determine how much of it is achieved through recursive borrowing to support their own endorsement. But it is certain that this includes a $95 million position on Plasma Euler.

Stream's xUSD Primary Risk Exposures

The major risk exposures of xUSD include:

mHYPE (whose liquidity buffer appears to be empty).

RLP (with discrepancies between the numbers on its transparency page and the wallet data, and displaying a negative $25 million balance on Binance).

Another notable risk exposure is the allocation to other yield coins, such as rUSD. Approximately 30% of rUSD's support is rUSD itself.

Additionally, there's deUSD, of which 30% is backed by mF-ONE.

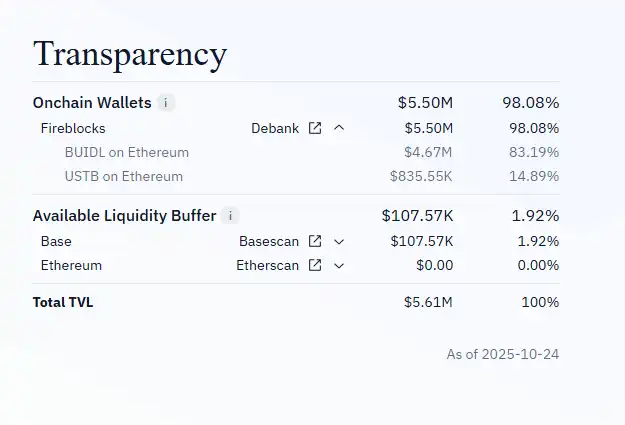

mF-ONE has most of its assets off-chain, claiming to have a $16 million "liquidity buffer," but this fund is actually 100% deposited into mTBILL.

mTBILL is missing approximately $15 million, but it only has a $100,000 "liquidity buffer," with an additional $5 million in BUIDL.

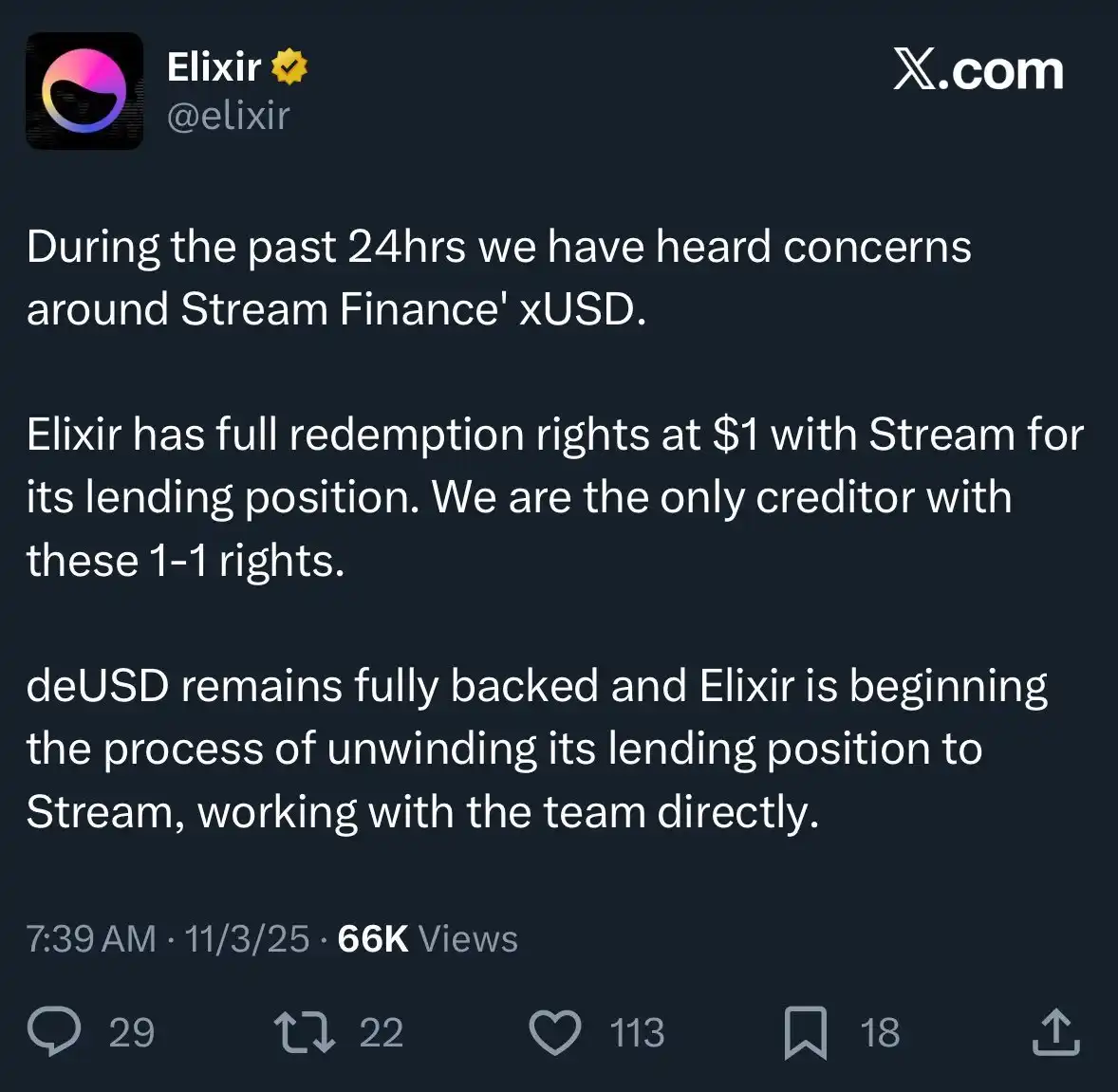

To make matters worse, Elixir also claims to have "settlement seniority" in an off-chain agreement—meaning that if Stream were to go bankrupt, Elixir could reclaim its principal first, while other DeFi users who invested in Stream would only be able to reclaim a smaller amount of money, or even nothing at all.

Due to Stream's highly opaque operation, coupled with the presence of recursive leverage and proprietary trading strategies, we actually do not know the exact losses of ordinary users. Currently, the price of the Stream xUSD stablecoin has plummeted to only $0.6 per $1.

Even more infuriating is that none of this was communicated to investors beforehand. Many users are now furious with Stream and Elixir—not only did they lose money, but they found out that their losses were "socialized," allowing those from Wall Street who cashed out early to walk away with profits.

This event has also affected other lending protocols and their asset managers:

"Everyone who thought they were participating in collateralized borrowing on Euler was actually extending uncollateralized loans through an agent."—Rob from InfiniFi

Furthermore, due to Stream's lack of publicly transparent on-chain data and the non-disclosure of its positions and P&L, users are now suspicious that it may have misappropriated user profits for team management or internal use after this event.

Stakers of Stream xUSD rely on the project's self-reported "oracle" data to calculate earnings, and this data cannot be verified by third parties nor is there any way to verify if the calculations are accurate or fair.

How can this issue be addressed?

Events like this involving Stream are entirely preventable—especially in an industry like DeFi that is still in its early stages.

The rule of "high risk, high reward" always holds true, but to apply it, you must truly understand the risks.

Not all risks are created equal, and some risks are entirely unnecessary.

In fact, there are also some reputable yield aggregation, lending, or "hedge fund in the form of a stablecoin" protocols in the market that are relatively transparent in terms of risk, strategy, and position disclosure.

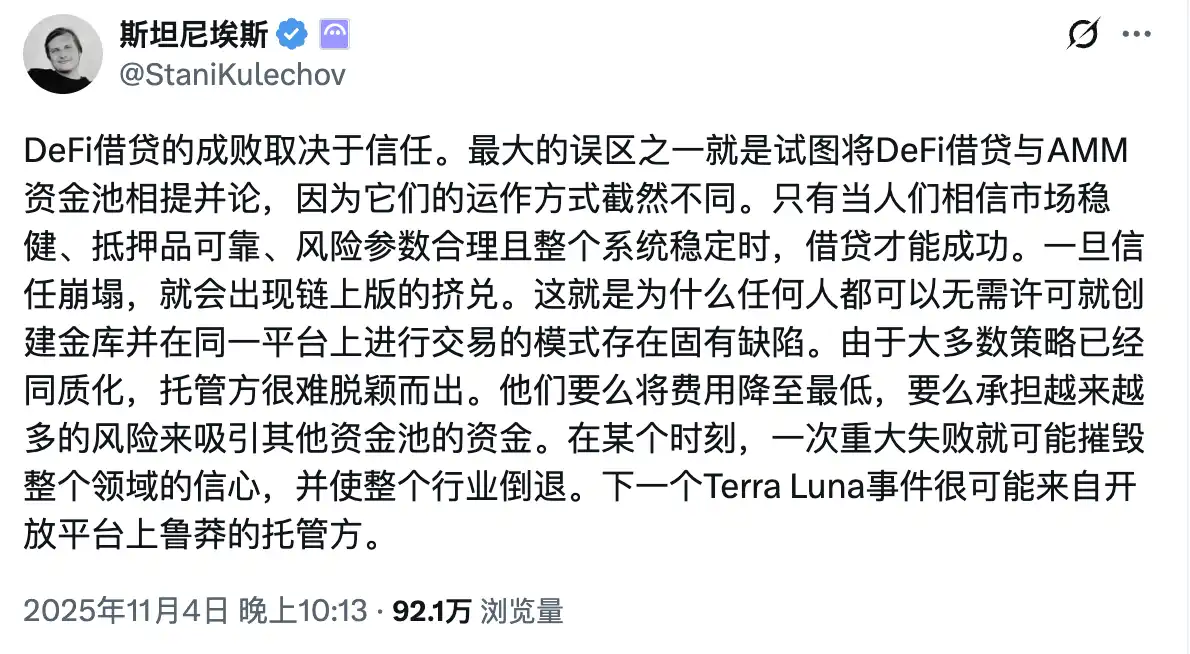

Aave founder @StaniKulechov has discussed the DeFi protocol's "curator" mechanism and when the risk of excessive risk-taking behavior might arise:

Vault Risk Framework

To help the market better distinguish between "good vaults" and "bad vaults," the Trading Strategy team has introduced a new metric in their latest DeFi Vault report: Vault Technical Risk Score.

The so-called "technical risk" refers to the likelihood of funds in a DeFi vault being lost due to improper technical execution.

The Vault Technical Risk Framework provides an intuitive tool for categorizing DeFi vaults into high-risk and low-risk categories.

This scoring system cannot eliminate market risks (such as trading errors, contagion risk, etc.),

but it can ensure that third parties are able to independently assess and quantify these risks, enabling users to have a clearer understanding of their risk exposure.

When DeFi users can access more comprehensive, transparent information, capital naturally flows to projects that are responsible, compliant, and operate soundly.

As a result, events like the one with Stream will become less frequent in the future.

You may also like

North Korean Hackers Enjoy 'Fat Years': Stole Record Amount in 2025, With Money Laundering Cycle of About 45 Days

Why Is On-Chain Fixed-Rate Lending Hard to Come By? "Basis Swap" Trading Is the Way Out

ZCash Team Split, Bank of America Upgrades Coinbase Rating, What's the Overseas Crypto Community Talking About Today?

Key Market Info Discrepancy on January 9th - A Must-Read! | Alpha Morning Report

Aster Coin: A Deep Dive into Its Price, Potential, and Why It’s Catching Eyes in 2026

Have you ever stumbled upon a crypto project that seems poised for growth amid market volatility, only to…

Left Hand BTC, Right Hand AI Computing Power: The Gold and Oil of the Data Intelligence Era

Farewell to "Air" Investments: Use These 6 Key Metrics to Identify a Winning Project

The old altcoin script is outdated, take you to decipher the new market structure

Coin Ownership or Equity Ownership? The Real Question Is Being Asked Wrong

Ranger Fund Takes a New Approach to Public Offering: Can a Grassroots Team Earn Market Trust?

CoinDesk 20 Performance Update: Uniswap (UNI) Dips 1.5% as Index Experiences Downturn

Key Takeaways Uniswap (UNI) experienced a notable drop of 1.5% as the CoinDesk 20 Index saw a decline.…

Crypto Markets Today: Bitcoin Slides as Asia-Led Sell-Off Hits Altcoins

Key Takeaways: Bitcoin could not surpass the $94,500 mark and fell to roughly $91,530, contributing to a wider…

Start-of-the-Year Crypto Rally Stalls: What’s Next?

Key Takeaways The initial crypto market boost at the start of 2026 has lost momentum, primarily due to…

Karatage Welcomes Shane O’Callaghan as Senior Partner in Strategic Move

Key Takeaways Karatage, a London-based hedge fund, appoints Shane O’Callaghan as a senior partner to enhance its institutional…

JPMorgan Targets Canton Network for Next Phase of JPM Coin

Key Takeaways JPMorgan’s Kinexys unit is set to advance the use of JPM Coin by integrating it with…

2025 Crypto Bear Market: A Crucial Year for Institutional Repricing

Key Takeaways The 2025 crypto bear market witnessed significant corrections in the DeFi and smart contract sectors, setting…

Trend Research: 2026 Beyond Paradigm, WLFI Initiates Financial Ecosystem New Era

2026 Crypto New Year's Rally: Cautiously Bullish Market Sets Sail

North Korean Hackers Enjoy 'Fat Years': Stole Record Amount in 2025, With Money Laundering Cycle of About 45 Days

Why Is On-Chain Fixed-Rate Lending Hard to Come By? "Basis Swap" Trading Is the Way Out

ZCash Team Split, Bank of America Upgrades Coinbase Rating, What's the Overseas Crypto Community Talking About Today?

Key Market Info Discrepancy on January 9th - A Must-Read! | Alpha Morning Report

Aster Coin: A Deep Dive into Its Price, Potential, and Why It’s Catching Eyes in 2026

Have you ever stumbled upon a crypto project that seems poised for growth amid market volatility, only to…