Morgan Stanley 2026 Outlook: Global Economy to Experience Moderate Growth Alongside Deflation, Uncertainty Remains High, but US Stocks Will Continue to Outperform Global Markets

BlockBeats News, November 17th, according to Reuters, Morgan Stanley expects U.S. stocks to outperform global markets by 2026 and is optimistic about the performance of global equities relative to credit and government bonds. Its supporting logic comes from the growth in artificial intelligence-related capital expenditure and an improving policy environment.

"Driven by microeconomic fundamentals, accelerated AI capital expenditure, and favorable policies, risk assets are poised for strong performance in 2026," the Wall Street investment bank pointed out in a series of global economic and strategic outlook reports released on Monday. Although the Trump administration's fluctuating tariff policy has led to continued volatility in global financial markets this year, most trade uncertainties are gradually dissipating as 2026 approaches.

The bank predicts that 2026 will see "moderate" global economic growth alongside deflation, but emphasizes that "uncertainty remains high, with outcomes potentially highly divergent," with the "U.S. becoming a key variable."

In addition, Morgan Stanley expects the S&P 500 index to reach 7800 points by the end of 2026, representing about a 16% upside potential from current levels, mainly driven by robust corporate earnings growth and AI-driven efficiency improvements. Under the influence of the Fed's dovish policy, U.S. small-cap stocks will outperform large-cap stocks, and cyclical sectors will outperform defensive sectors. The U.S. dollar index is expected to fall to 94 in the first half of the year, then rebound to 99 by the end of 2026.

The bank also predicts that the price of gold will reach $4500 per ounce in 2026.

You may also like

Pantera Capital: How has Crypto as a Service affected us?

Pantera Capital: What changes have we made when crypto is treated as a service?

Wall Street Shorts ETH: Vitalik is aware and has front-run, while Tom Lee remains oblivious

Social Capital CEO: How Equity Tokenization is Reshaping Capital Markets from US Stocks to SpaceX?

CoinGecko Report: Surge of 346% vs Dip of 20.8%, The Wild Rise of DEX

a16z: The Real Opportunity of Stablecoins Lies Not in Disruption but in Filling Gaps

Mining Exodus: Someone Holds $12.8 Billion AI Order

March 6 Market Key Intelligence, How Much Did You Miss?

a16z: The True Opportunity of Stablecoins is in Complementing, Not Disrupting

Predict LALIGA Matches, Shoot Daily & Win BTC, USDT and WXT on WEEX

The WEEX × LALIGA campaign brought together football excitement and crypto participation through a dynamic interactive experience. During the event, users predicted matches, completed trading tasks, and took daily shots to compete for rewards including BTC, USDT, WXT, and exclusive prizes.

Ray Dalio Dialogue: Why I'm Betting on Gold and Not Bitcoin

Who Took the Money in the AI Era? A Must-See Investment Checklist for HALO Asset Trading

Wall Street Bears Target Ethereum: Vitalik In the Know Takes Flight, Tom Lee Remains Bullish

Pump.fun Hacker Steals $2 Million, Receives 6-Year Prison Sentence, Opts for 'Self-Detonation'

6% Annual Percentage Yield as Musk Declares War on Traditional Banks

36 years, 4 wars, 1 script: How does capital price the world in conflict?

Mining Companies' Great Migration: Some Have Already Secured $12.8 Billion in AI Orders

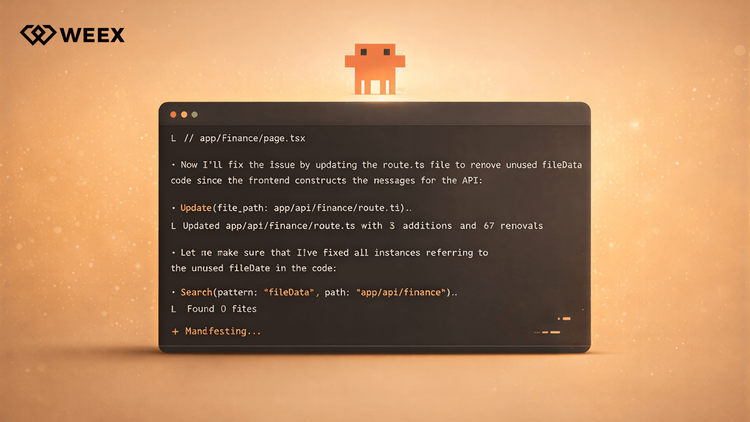

What Is Vibe Coding? How AI Is Changing Web3 & Crypto Development

What is vibe coding? Learn how AI coding tools are lowering the barrier to Web3 development and enabling anyone to build crypto applications.