Why is it that recent acquisitions in the crypto space no longer include the token?

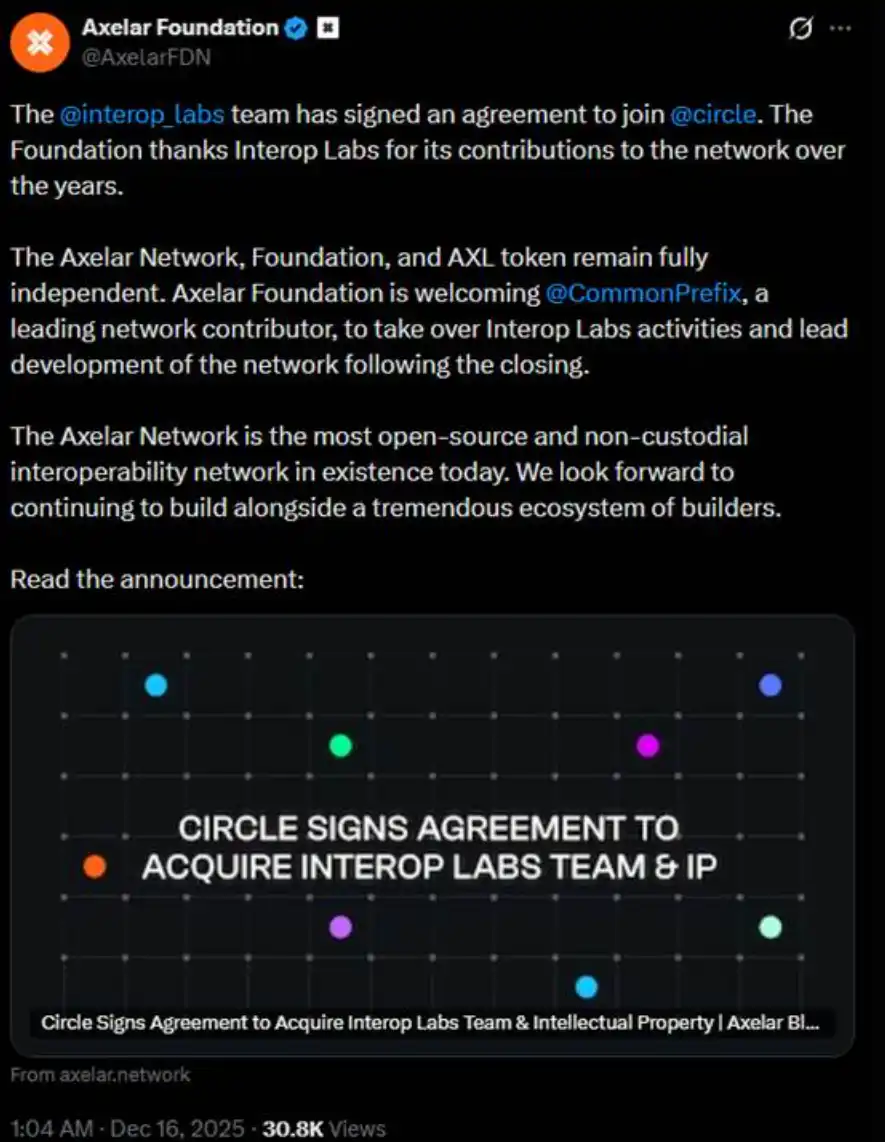

The day before yesterday, the Interop Labs team (the original developers of the Axelar Network) announced their acquisition by Circle to accelerate the development of their multi-chain infrastructure Arc and CCTP.

Normally, getting acquired is a good thing. However, the Interop Labs team's further elaboration in the same tweet caused quite a stir. They stated that the Axelar Network, foundation, and AXL token will continue to operate independently, and their development work will be taken over by CommonPrefix.

In other words, the core of this transaction is the "team joining Circle" to drive the application of USDC in the fields of privacy computing and compliant payments, rather than a full acquisition of the Axelar Network or its token ecosystem. The team and the technology are what Circle has acquired. Your original project is of no concern to Circle.

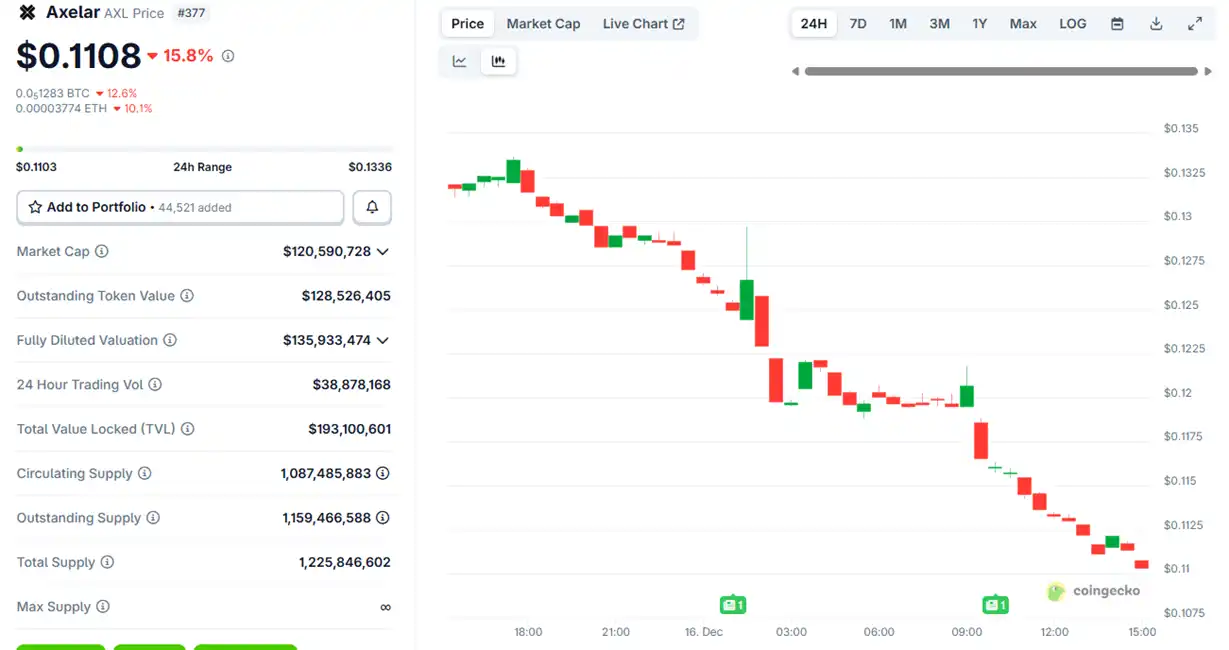

Following the announcement of the acquisition, the price of the Axelar token $AXL initially saw a slight increase before starting to decline, and it has now dropped by approximately 15%.

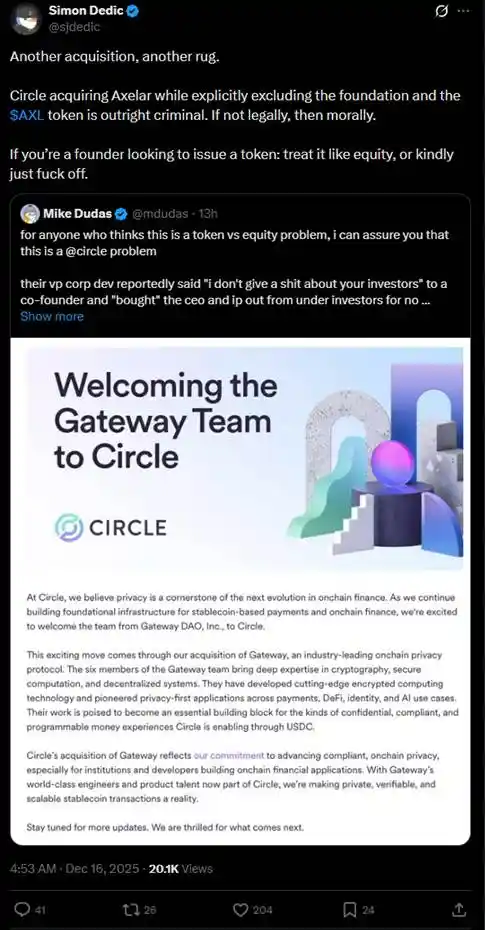

This arrangement quickly sparked a heated debate in the community about "token vs. equity." Many investors questioned whether Circle, by acquiring the team and intellectual property, effectively acquired the core assets while bypassing the rights of AXL token holders.

"If you are a founder and want to issue a token, either treat it like equity or get out."

Over the past year, similar cases of "wanting the team and the technology, but not the token" have occurred repeatedly in the crypto space, causing significant harm to retail investors.

In July, the foundation of Kraken's Layer 2 network, Ink, acquired the decentralized exchange platform Vertex Protocol based on Arbitrum, taking over its engineering team and trading technology stack, including synchronized order book, perpetual contract engine, and money market code. After the acquisition, Vertex closed its services on 9 EVM chains, and the $VRTX token was abandoned. Upon the announcement, $VRTX plummeted by over 75% on the same day, gradually approaching zero (currently valued at only $73,000).

However, holders of $VRTX still have a tiny bit of comfort because during the Ink TGE, they will receive a 1% airdrop (snapshot has ended). Next, there is something even worse: outright nullification with no compensation whatsoever.

In October, pump.fun announced the acquisition of the trading terminal Padre. Upon the announcement of the Padre acquisition, pump.fun also stated that the Padre token would no longer be used on the platform and directly expressed that there were no future plans for the token. Due to the token nullification statement in the final reply of the thread, the token instantly doubled and then sharply fell, with $PADRE currently holding only a $100,000 market cap.

In November, Coinbase announced the acquisition of Solana trading terminal Vector.fun built by Tensor Labs. Coinbase integrated Vector's technology into its DEX infrastructure, but did not involve the Tensor NFT marketplace itself or the ownership of $TNSR, with some of the Tensor Labs team transitioning to Coinbase or other projects.

The trend of $TNSR is relatively stable compared to several examples, characterized by a surge followed by a fall back, with the current price returning to a level expected of an NFT market token and still higher than the low point before the acquisition announcement.

In Web2, it is legal for small companies to be acquired by large enterprises in a "we want the team, we want the technology IP, but we don't want the equity" manner, a situation known as "acquihire." Especially in the tech industry, "acquihire" allows large enterprises to rapidly integrate talented teams and technology through this method, avoiding the lengthy process of recruiting from scratch or internal development, thereby accelerating product development, entering new markets, or enhancing competitiveness. Although disadvantageous to small shareholders, it stimulates overall economic growth and technological innovation.

Nevertheless, "acquihire" must also adhere to the principle of "acting in the best interest of the company." The reason why these examples in the crypto industry have made the community so angry is precisely because the "small shareholders" who are token holders do not agree with the project teams in the crypto industry "acting in the best interest of the company" by being acquired for the better development of the project. Project teams often dream of going public on the stock exchange when the project itself can earn big money, and then when everything is just starting or hitting a dead end, they launch a token to make money (the most typical example being OpenSea). After these project teams make money from the token, they quickly find new homes for themselves, leaving behind the past projects only in their resumes.

So, does the retail investor in the crypto space have to keep gritting their teeth and swallowing the bitter pill? It was also just the day before yesterday that Ernesto, former Chief Technology Officer of Aave Labs, released a governance proposal titled "$AAVE Alignment Phase 1: Ownership," firing a shot in the crypto community to defend token rights.

The proposal advocates for the Aave DAO and Aave token holders to explicitly hold core rights such as protocol IP, brand, equity, and revenue. Aave service provider representative Marc Zeller and others publicly endorsed the proposal, calling it "one of the most influential proposals in Aave's governance history."

In the proposal, Ernesto mentioned, "Due to some events in the past, some previous posts and comments have held strong animosity towards Aave Labs, but this proposal strives to remain neutral. The proposal does not imply that Aave Labs should not be a contributor to the DAO, or lack the legitimacy or capability of contribution, but the decision should be made by the Aave DAO."

According to crypto KOL @cmdefi's analysis, the root of this conflict lies in Aave Labs replacing the front-end integration of ParaSwap with CoW Swap, resulting in fees flowing to Aave Labs' private address thereafter. In response, Aave DAO supporters view this as a form of pillaging, as with the existence of the AAVE governance token, all benefits should primarily flow to AAVE holders or remain in the treasury to be decided by the DAO vote. Additionally, previously, ParaSwap's revenue would continue to flow into the DAO; the new CoW Swap integration changed this status quo, further convincing the DAO that this was a form of pillaging.

This starkly reflects a conflict similar to that of a "shareholders' meeting versus management," once again highlighting the awkward position of token rights in the crypto industry. In the early days of the industry, many projects promoted token "value capture" (such as earning rewards through staking or directly sharing revenue). However, starting from 2020, SEC enforcement actions (such as the lawsuits against Ripple and Telegram) forced the industry to pivot towards "utility tokens" or "governance tokens," emphasizing usage rights rather than economic rights. As a result, token holders often cannot directly share in project dividends—the project's revenue may flow to the team or VC-held equity, while token holders act as powerless stakeholders.

As seen in the examples mentioned in this article, project teams often sell team, technical resources, or equity to VCs or large corporations while also selling tokens to retail investors, ultimately resulting in resource and equity holders taking priority in profits, leaving token holders marginalized or empty-handed. This is because tokens do not have legally recognized investor rights.

In order to circumvent the regulation that "tokens cannot be securities," tokens have been designed to be increasingly "useless." By avoiding regulation, retail investors have once again found themselves in a highly passive and unprotected position. The various incidents that have occurred this year have, in a sense, reminded us that the current issue of the crypto world's "narrative failure" may not actually be that people no longer believe in narratives—narratives are still convincing, profits are still good, but what exactly can we expect when we buy a token?

You may also like

Hyperliquid Introduces Direct ETH Deposits and Withdrawals for Enhanced Spot Trading

Key Takeaways Hyperliquid has officially rolled out direct Ethereum deposits and withdrawals, streamlining its spot trading capabilities. The…

Solana Whale Sells $1M WhiteWhale, Leading to Steep Price Drop

Key Takeaways The White Whale cryptocurrency has recently experienced a significant decline with a drop of -11.1% within…

Solana Whale’s Massive WhiteWhale Token Sale Triggers Price Drop

Key Takeaways A single Solana whale wallet sold $1 million worth of WhiteWhale tokens, leading to a 20%…

Ethereum Whale Increases Holdings in Response to Market Rebound

Key Takeaways A significant Ethereum whale has purchased a substantial amount of ETH, indicating confidence in the cryptocurrency…

Solana Whale Affects WhiteWhale Token Price

Key Takeaways The White Whale token experienced a significant price drop of 20% after a Solana whale dumped…

Ethereum Whale Shifts Strategy: Significant Purchase and Withdrawal Strategies Unfold

Key Takeaways An Ethereum whale has made a strategic shift from short to long, purchasing 235,765 ETH at…

Solana Whale Sale Triggers WhiteWhale Token Plunge

Key Takeaways A massive sell-off of WhiteWhale tokens by a Solana whale resulted in a significant price drop…

Market Correction Slashes New Meme Coins as WhiteWhale Plunges 75%

Key Takeaways WhiteWhale’s Dramatic Fall: The cryptocurrency WhiteWhale has experienced a significant decline, falling 75% from its peak…

Market Correction Slashes Meme Coins as WhiteWhale Suffers Massive Drop

Key Takeaways WhiteWhale experiences a sharp decline of 32.3% in just one day, marking a 75% drop from…

Backers Seek Refunds as Trove Abandons Hyperliquid Integration for Solana

Key Takeaways: Trove pivots to Solana after raising over $11.5 million for Hyperliquid integration, leading to refund demands.…

Solana Price Prediction: $2.25B Volume, Coinbase Validator Boosts $140 Support Toward $151

Key Takeaways Trading Update: Solana currently trades at $142.51, maintaining support above $140 amidst significant $2.25 billion trading…

Solana’s Future Hinges on Relentless Innovation, Says Co-Founder

Key Takeaways Solana co-founder Anatoly Yakovenko emphasizes the need for continuous innovation to ensure the network’s longevity and…

XRP Price Prediction: $1.28B ETF Inflows Counter Bearish Signals Near $2.05

Key Takeaways: Despite a $1.28 billion inflow into XRP ETFs, XRP is facing a decline within a bearish…

Mortgage Lender Newrez Embraces Crypto Assets in Loan Decisions

Key Takeaways: Newrez plans to incorporate cryptocurrency holdings as qualifying assets in its mortgage underwriting process, potentially opening…

Ethereum Price Outlook: ETH Surpasses $3,312 as ETFs Boost with $474 Million and Buterin’s Vision Excites

Key Takeaways: Ethereum (ETH) shows significant recovery with its price above $3,312, spurred by Vitalik Buterin’s roadmap focusing…

XRP Price Prediction: While the Crypto Market Faces a Downturn, Substantial Investments Quietly Stream into XRP—What is Being Foreseen?

Key Takeaways Significant inflows into XRP-linked ETFs suggest a bullish outlook despite recent market declines. XRP’s rising ETF…

Crypto Price Forecast Today 16 January – XRP, Solana, Maxi Doge

Key Takeaways: Bitcoin remains strong above $95,000, presenting a solid backdrop for altcoin movements. XRP, Solana, and Maxi…

Solana Price Prediction: Wall Street Quietly Drops Millions Into SOL – Is This the Move That Triggers the Next Explosion?

Key Takeaways Institutional Investment: Wall Street firms have invested significantly in Solana exchange-traded funds (ETFs), reflecting growing institutional…

Hyperliquid Introduces Direct ETH Deposits and Withdrawals for Enhanced Spot Trading

Key Takeaways Hyperliquid has officially rolled out direct Ethereum deposits and withdrawals, streamlining its spot trading capabilities. The…

Solana Whale Sells $1M WhiteWhale, Leading to Steep Price Drop

Key Takeaways The White Whale cryptocurrency has recently experienced a significant decline with a drop of -11.1% within…

Solana Whale’s Massive WhiteWhale Token Sale Triggers Price Drop

Key Takeaways A single Solana whale wallet sold $1 million worth of WhiteWhale tokens, leading to a 20%…

Ethereum Whale Increases Holdings in Response to Market Rebound

Key Takeaways A significant Ethereum whale has purchased a substantial amount of ETH, indicating confidence in the cryptocurrency…

Solana Whale Affects WhiteWhale Token Price

Key Takeaways The White Whale token experienced a significant price drop of 20% after a Solana whale dumped…

Ethereum Whale Shifts Strategy: Significant Purchase and Withdrawal Strategies Unfold

Key Takeaways An Ethereum whale has made a strategic shift from short to long, purchasing 235,765 ETH at…