Life charts can't cure anxiety, and predicting the market can't foresee the outcome

Source: TechFlow (Shenchao)

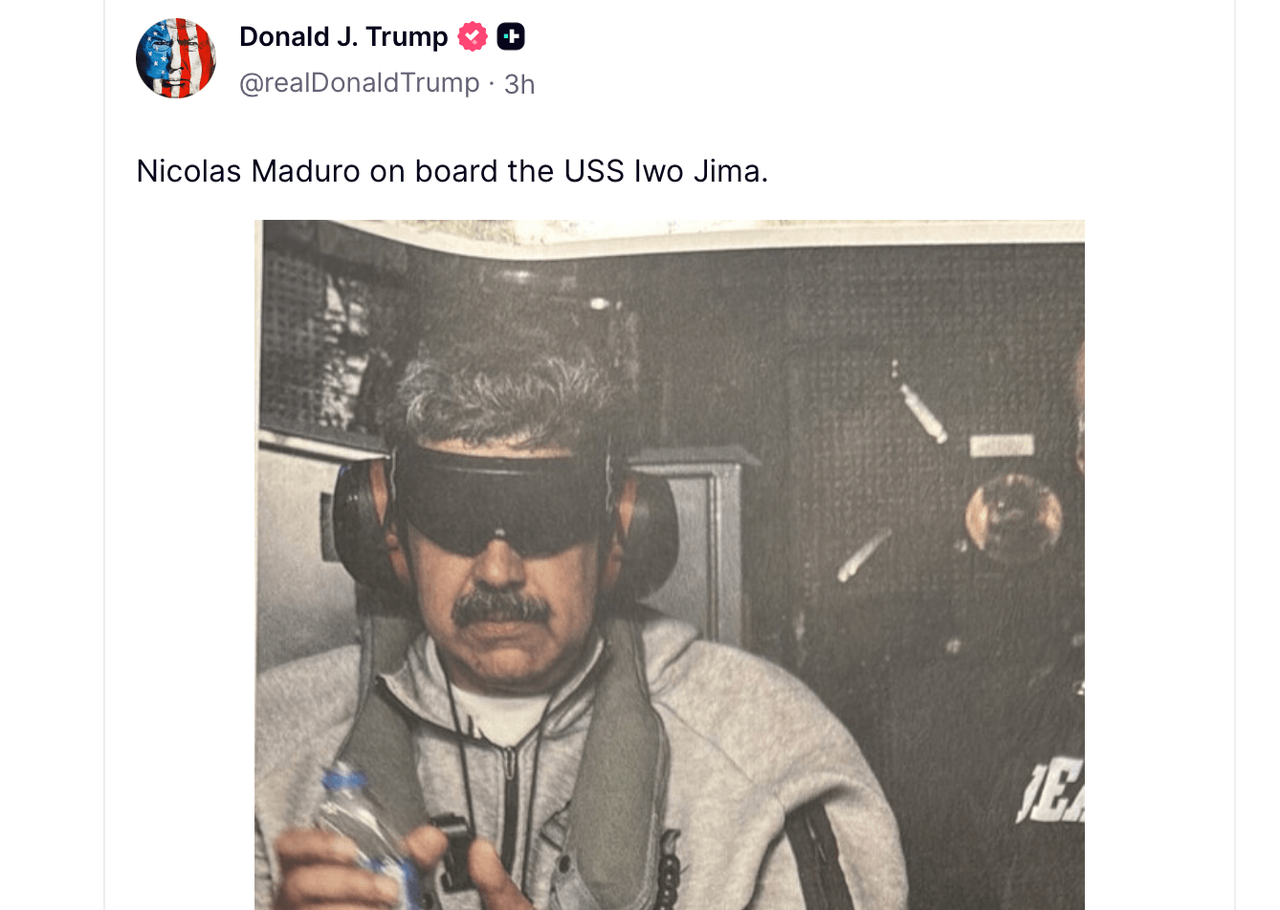

At the beginning of 2026, a sudden geopolitical event shocked the world: On January 3, the United States launched a military operation codenamed "Operation Absolute Resolve," successfully capturing President Nicolás Maduro and his wife Celia Flores, and quickly transporting them to New York to face criminal charges in Manhattan federal court, including drug terrorism conspiracy, cocaine import conspiracy, and weapons charges.

Despite the long-standing standoff between the US and Venezuela, the secrecy and explosiveness of this operation completely defied expectations. Just 24 hours before the raid, everything seemed normal in Caracas, with no public signs of a breakdown in diplomatic efforts. This event quickly made global headlines, not only for its political significance but also because it revealed a stark reality: true historical turning points often occur in the blink of an eye.

Just before the raid, contracts on Polymarket betting on Maduro's potential removal from power were trading at only about 5 to 7 cents, meaning the market generally considered him extremely safe in the short term. No one anticipated his arrest, which brought huge profits to traders who placed bets shortly before the operation was made public.

Despite the unpredictability of life, humanity's desire to predict the future has never been more urgent. At the end of 2025, two tools unexpectedly formed a kind of intertextuality: one is the "life chart," which visualizes the Chinese astrological system, and the other is a prediction market that presents odds on global events.

We attempt to use the former to calculate an individual's fate and the latter to predict the world's destiny. What they both promise is a quantifiable future.

Life charts, through symbolic visualization, provide a sense of certainty; prediction markets, through price signals, offer probabilistic certainty. It seems that by reading these signals early enough, we can prepare in advance, hedge against uncertainty, and seemingly gain a head start. But is this truly the case?

The viral popularity of life charts reflects a psychological need for certainty. Users input their birth information, AI automatically generates a chart, predicts major life cycles, and outputs a candlestick chart; the fluctuations of the graph provide a readable life curve. Under the dual pressures of employment and emotional fluctuations, it acts as a coordinate axis, providing a framework for self-narration and emotional catharsis. This candlestick chart doesn't sell science, but rather meaning and comfort—unquestionable emotional value.

Prediction markets, on the other hand, promise verifiable predictions through financialized language. In 2025, Polymarket and Kalshi dominated the prediction market sector, with sports, political, and economic events becoming predictable and betting targets, and trading volume extending from peak election periods to everyday life. Platforms allowed users to place bets with real money, and prices formed a probabilistic consensus amidst liquidity and divergence.

Amidst the triple anxieties of economic volatility, geopolitical tensions, and AI disruption, young people don't need accurate predictions, but rather the illusion that their destiny is in their hands. These two types of tools offer two heterogeneous forms of "control," seemingly allowing them to hedge against macroeconomic risks and gain an edge in an uncertain world by simulating life and event trajectories in advance.

However, such preparation inevitably has limitations and even carries significant risks. Cultural biases introduced by model training, algorithmic black boxes, and "black swan" events like Maduro's arrest all demonstrate the questionable accuracy of future predictions.

But such preparation inevitably has limitations and carries significant risks. Cultural and algorithmic biases introduced by model training, and the risks of black swan events, all indicate that the true accuracy of future predictions is questionable. The risks of over-focusing on predictions cannot be ignored. While life charts may be presented as entertainment, they can influence crucial individual choices. Cases of market manipulation are frequent, with insider trading and large-scale price manipulation being proven realities.

But this isn't the most dangerous aspect. A deeper crisis lies in the fact that the act of observation itself can interfere with the system, a concept already metaphorically described by Heisenberg's uncertainty principle. The more users blindly trust the probabilities output by tools, the more likely they are to lose their keen intuition for sudden risks. We stare at dashboards for so long that we forget to look up and see where we're going.

Predictive tools can identify trends, but they can never foresee true turning points. They are rearview mirrors, reflecting current anxieties and consensus, but unable to become searchlights illuminating the fog.

Ultimately, uncertainty is the underlying code of the world. After the frequent black swan events of 2025, the best preparation is not staring at candlestick charts or odds on a screen, but acknowledging the limitations of algorithms.

After all, real life often unfolds beyond the candlestick charts. Going with the tide and building individual resilience amidst immense uncertainty may be the only true path we can truly grasp.

You may also like

Key Market Intelligence on January 6th, how much did you miss out on?

Coinbase Slams ‘Political’ Banking Rule Impacting Crypto Firms

Key Takeaways Coinbase challenges a banking regulation it labels “political,” highlighting the pressure banks face to cut ties…

Leaving behind the chaotic early days, crypto market makers are celebrating their coming of age

The life-or-death struggle for crypto market makers is like a species evolution under extreme conditions.

How to Flip Real Estate in the Prediction Market

Lurking in 600 Scam Groups, He Wants to Intercept Illicit Funds

Tether, which has "enriched" itself through stablecoins, is now heavily investing in AI

If you are long on oil, Maduro's arrest is not good news

Life’s K-lines can’t cure anxiety, and prediction markets can’t calculate the ending.

Real life often unfolds beyond the K-lines.

Built on Compliance and Security, AI Empowering Users, KuCoin is Redefining the Crypto Partner

Why AI Trading Bots Are Becoming Essential in 24/7 Crypto Markets

Cryptocurrency markets operate continuously and move faster than human attention can reliably sustain. Prices react instantly to global events, liquidity shifts across regions, and tradeable opportunities often exist for minutes rather than hours. For many traders, the core challenge is no longer generating ideas, but executing decisions consistently without constant monitoring or emotional interference. This is where AI trading bots are increasingly being adopted — not as profit guarantees, but as tools designed to translate predefined strategies into reliable, repeatable execution.

AI Crypto Trading Competition: Full Guide to Knowing WEEX Alpha Awakens

The integration of artificial intelligence into cryptocurrency trading has evolved from a novel experiment into a core utility. In 2026, AI-driven tools have become indispensable for traders seeking enhanced discipline, superior execution speed, and structured, data-informed decision-making amid market volatility. This guide provides a practical, step-by-step breakdown of how to participate in WEEX Alpha Awakens, with a focused examination of how these strategies are implemented within live trading environments.

Japanese Finance Ministry Ushers in 2026 as “Digital First Year” with Focus on Digital Assets

Key Takeaways Japan’s Minister of Finance, Okatsuka Katsuki, has declared 2026 as Japan’s “Digital First Year,” highlighting the…

Dissecting Polymarket’s Top 10 Whales’ 27,000 Transactions: The Smart Money Mirage and the Law of Survival

Key Takeaways Prediction markets have gained popularity, with smart money’s arbitrage strategies being particularly notable. A detailed analysis…

The Accelerating Implementation of Stablecoin Bills in the US and Hong Kong

Key Takeaways The United States Senate and the Hong Kong Legislative Council have both advanced legislation pertaining to…

Multicoin: Why Are We Bullish on Stablecoins as FinTech 4.0?

2025 Crypto Violence Retrospective: 65 Physical Assaults, 4 Fatal Incidents

Is a Stablecoin Considered Cash? Accounting Standards for Stablecoins May Be Adjusted Post-Genius Bill

The US can't control Latin America, so they took out Maduro

Key Market Intelligence on January 6th, how much did you miss out on?

Coinbase Slams ‘Political’ Banking Rule Impacting Crypto Firms

Key Takeaways Coinbase challenges a banking regulation it labels “political,” highlighting the pressure banks face to cut ties…

Leaving behind the chaotic early days, crypto market makers are celebrating their coming of age

The life-or-death struggle for crypto market makers is like a species evolution under extreme conditions.