On-chain Data Academy (Part 1): Do you know what the average market-wide BTC cost is?

Original Article Title: "On-Chain Data School (Part 1): Do You Know What the Market-Wide BTC Average Cost Is?"

Original Article Author: Mr. Berg, On-Chain Data Analyst

TLDR

· This article will introduce "one on-chain analysis concept" and "three on-chain data points"

· MVRV represents the market-wide profit state

· Realized Price represents the average cost of holding BTC for the entire market

· Realized Cap can be thought of as "how much money the market collectively spent to buy BTC"

What Is Realized Cap?

Realized Cap, also known as Realized Market Cap, refers to "multiplying each unit of BTC by the price at the last transfer, and then summing them up".

In simple terms: Each transfer can be seen as a "transaction", so multiplying the corresponding amount of BTC by the price at the last transfer is equivalent to the cost of that transaction. Adding up these costs gives you the Realized Cap.

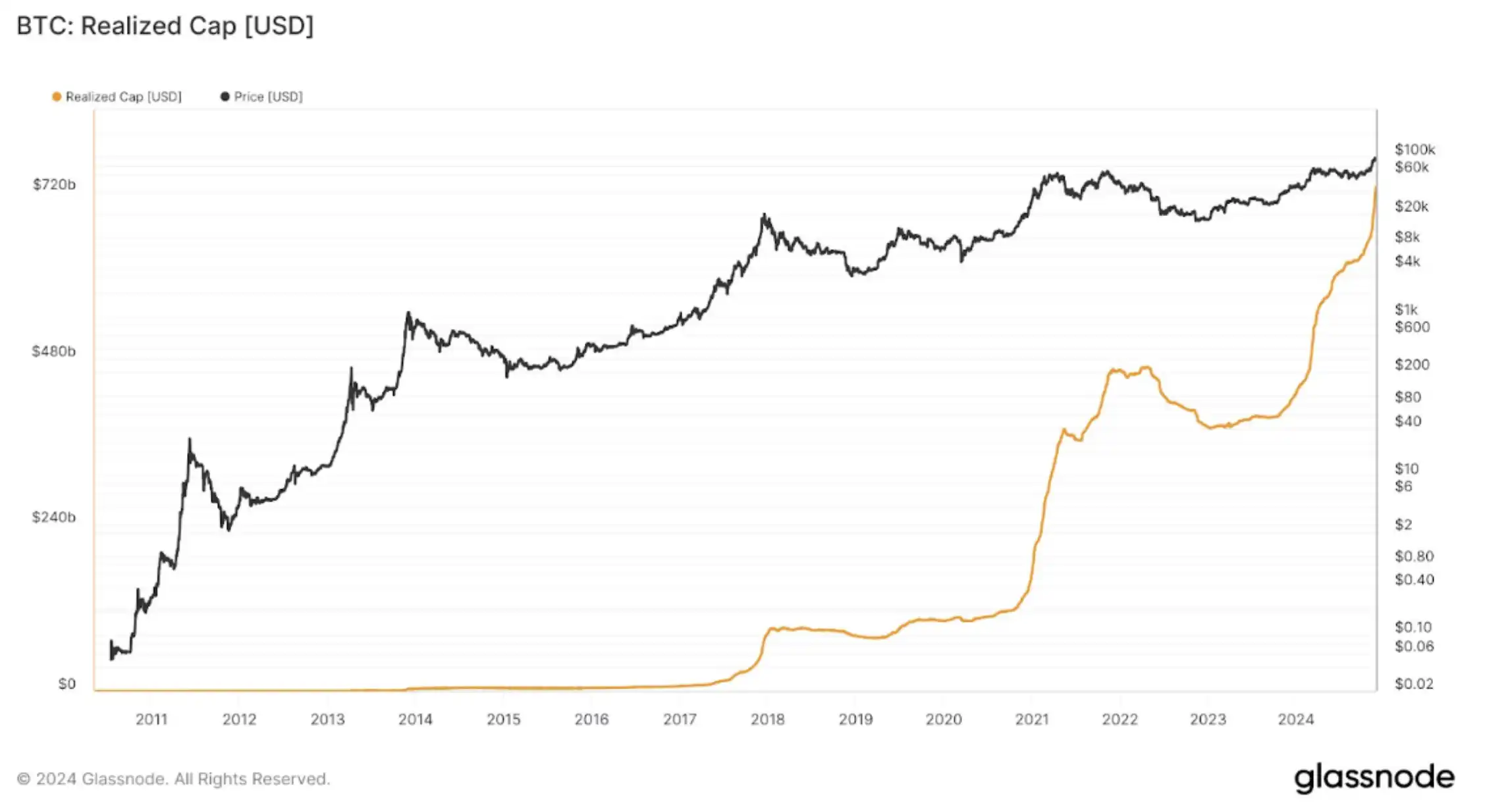

Realized Cap Chart

What Is Realized Price?

Realized Price (RP), also known as Realized Price, is the number obtained by dividing "Realized Cap by the current BTC circulating supply".

We can interpret this as: "Total cost of BTC purchased by the whole market / How many BTC were purchased".

In other words, this is the "average cost of BTC for the entire market". By the way, it's always a good buying opportunity when the price is below RP!

Realized Price Chart

(Price Below Realized Price)

What Is MVRV?

MVRV, short for MV divided by RV, represents the market's profitability status.

MV refers to the current BTC market value, i.e., "market price x circulating supply"; while RV is Realized Cap.

Moreover, if both the numerator and denominator of the formula are divided by the circulating supply, MVRV can also be expressed as "market price / RP." For example: if MVRV = 2, it represents an average market profitability of 100%.

MVRV Chart

Summary

The above is all the content of On-Chain Data School (Part One). For readers interested in delving deeper into on-chain data analysis, remember to track this series of articles!

If you want to see more analysis and educational content on on-chain data, feel free to follow my Twitter (X) account!

Hope this article has been helpful to you. Thank you for reading.

You may also like

Gainers

Latest Crypto News

Publicly traded company mF International plans to raise $500 million to launch the BCH Treasury.

If Ethereum falls below $2600, the cumulative long liquidation pressure on major CEXs will reach $993 million.

Net Outflow Ends Eight-Day Run, Yesterday's US Spot Ethereum ETF Sees Net Inflow of $55.7 Million

Grayscale Ethereum Trust (ETHE) has generated $7.9 million in staking rewards

In the last 24 hours, CEX net outflow of 1,502.14 BTC

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:[email protected]

VIP Services:[email protected]