SEC Announces "PoW Mining Does Not Constitute Securities Issuance" Action, Miners Welcome Regulatory Spring

Original Article Title: "SEC Announces 'PoW Mining Not Considered Securities,' Miners Do Not Need to Register, Welcoming a Major Regulatory Victory"

Original Article Author: Natalia Wu, BlockTempo

The U.S. Securities and Exchange Commission (SEC) announced regulatory guidance on Proof of Work (PoW) mining activities on the 20th, and for the first time concluded that "PoW mining activities do not constitute a securities offering," thus exempting them from federal securities law regulation, and mining participants do not need to register with the SEC.

This decision provides clear regulatory clarity for PoW miners and mining pools, alleviating their concerns about compliance with U.S. securities laws.

SEC Confirms PoW Mining Exempt from Securities Law Regulation

The SEC views PoW mining as an "administrative or transactional activity" rather than an investment contract. Miners validate transactions and secure the blockchain network by providing computational resources, earning newly minted cryptocurrency (referred to as "Covered Crypto Assets") as a reward. This process does not rely on third-party management or entrepreneurial efforts, which is a key criterion in the Howey test (used to determine whether an asset is a security).

The SEC considers "protocol mining" as the process of validating transactions and maintaining network security on a PoW blockchain. These networks are decentralized, permissionless systems, and miners add new blocks to the blockchain by solving complex cryptographic puzzles. Miners can participate without owning the network's native cryptocurrency, further distinguishing mining from securities issuance.

The SEC stated that its declaration covers only "protocol mining" activities involving:

• Miners mining cryptographic assets on a PoW network: The SEC emphasizes that these rewards come from the miners' own efforts, not third-party management, making them administrative tasks rather than securities transactions.

• The roles of mining pools and pool operators participating in the protocol mining process, including their roles in earning and distributing rewards. The SEC believes that miners' earnings in the pool are related to their computational contributions, not the pool operator's efforts, so these activities are also exempt from securities law regulation.

Cryptocurrency Mining Industry Regulatory Victory

This clarification is a significant victory for the PoW mining community. The SEC's confirmation that mining is not subject to securities regulation means that miners and pool operators can continue their operations without registering or complying with additional legal requirements. This decision may enhance confidence in the mining industry, especially in the context of ongoing regulatory scrutiny of mining due to energy consumption and environmental impact concerns.

It is worth noting that, after the Trump administration, the SEC has ushered in a crypto-friendly new leadership team and has been committed to providing a clearer regulatory stance. The SEC first defined the classification of digital assets at the end of February, categorizing Bitcoin as a digital commodity and determining that meme coins are not securities, with investors bearing the risk.

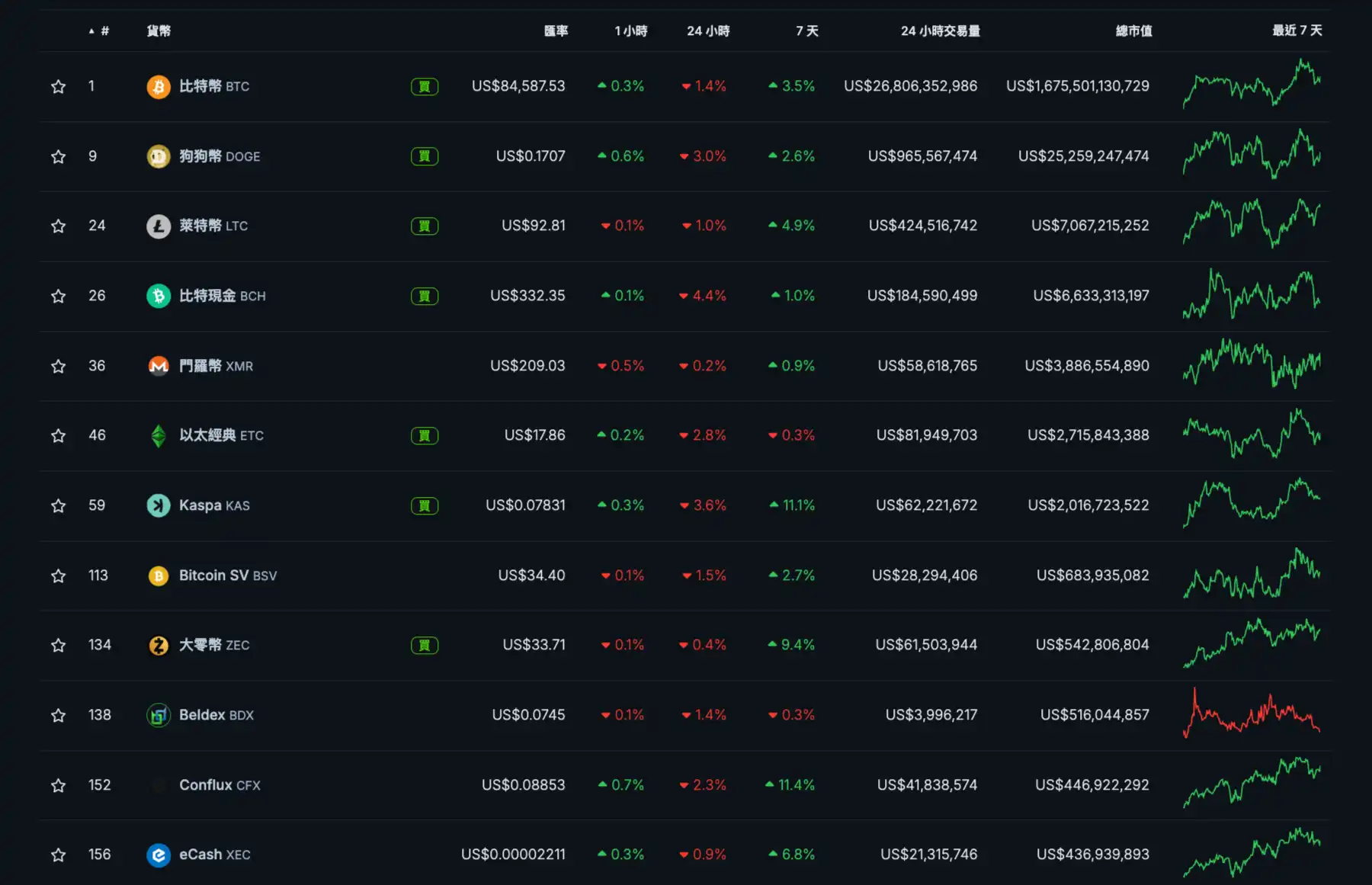

PoW Coins Experience Overall Decline in the Past 24 Hours

However, following the SEC's announcement, the prices of PoW tokens did not show a significant increase. In the past 24 hours, they followed the overall cryptocurrency market trend and experienced a general decline.

Due to the lack of highlights and substantial positive news in Trump's speech at the digital asset summit, as well as the escalating tariff war raising risk aversion sentiment, Bitcoin plummeted from $86,529 last night to a low of $83,642, a 3.3% drop, and has since slightly rebounded to $84,528, representing a 1.5% decline in the past 24 hours.

You may also like

Cryptocurrency people who use candlestick charts for fortune telling

When fortune telling is depicted on candlestick charts and placed within the context of the cryptocurrency world, its explosive popularity stems not from the accuracy of its mystical claims, but from the fact that traders' collective anxiety about uncertainty has finally found an outlet.

Holiday Season Markets: Understanding Low Liquidity and Trading Conditions

At WEEX, we recognize that the holiday season often brings a different trading experience for many users. As market participation slows, price behavior can feel less predictable and familiar trading rhythms may shift. For traders following AI news today or using AI trading tools, this period often highlights how market structure can influence model performance and short-term signals. Approaching these periods with clear expectations and a disciplined mindset can help traders better navigate seasonal market conditions.

Lido DAO’s Increased Development and Market Dynamics Elevate LDO Price

Key Takeaways Lido DAO’s development activities have surged by 690%, signifying substantial growth. The Lido DAO token (LDO)…

Hyperliquid Whales Shift Strategies: BTC Longs Decline, ETH Shorts Dominate

Key Takeaways A significant reduction in Bitcoin long positions has been observed on Hyperliquid, with large holders decreasing…

Token VS Equity: The Aave Controversy

December 26th Market Key Intelligence, How Much Did You Miss?

Crypto Christmas Heist: Over $6 Million Lost, Trust Wallet Chrome Extension Wallet Hacked Analysis

Trust Wallet Browser Extension Security Incident Leads to Losses

Key Takeaways Trust Wallet identified a significant security breach in its browser extension version 2.68. Approximately over $6…

Bitcoin Surges Toward $90,000 as $27 Billion Crypto Options Expire

Key Takeaways Bitcoin’s price is nearing the $90,000 mark amid increased market activity following the holiday lull. The…

Bitcoin Options Set to Expire, Potentially Altering Price Beyond $87,000 Range

Key Takeaways A historic Bitcoin options expiry event, valued at $236 billion, is set to occur, potentially impacting…

Ethereum Price Prediction: Whales Accumulate as Market Awaits Key Break

Key Takeaways Ethereum’s price remains in a “no-trade zone” between $2,800 and $3,000 amid low market activity. Whale…

Matrixport Predicts Limited Downside for Bitcoin Amid Market Caution

Key Takeaways Matrixport’s report suggests Bitcoin’s downside risks are decreasing, with the market moving towards a phase where…

Bitcoin and Ethereum Options Expiry Shakes Market Stability

Key Takeaways The largest options expiry in cryptocurrency history is occurring today, involving over $27 billion in Bitcoin…

Trust Wallet Hack Results in $3.5 Million Loss for Major Wallet Holder

Key Takeaways A significant Trust Wallet hack led to the theft of $3.5 million from an inactive wallet.…

PancakeSwap Launches LP Rewards on Base Network

Key Takeaways PancakeSwap has introduced liquidity provider (LP) rewards for 12 v3 pools on the Base network, facilitated…

BDXN Wallets Deposit $400,000 in Tokens to Multiple Exchanges

Key Takeaways BDXN project wallets have transferred approximately $400,000 worth of tokens to various exchanges. The transfers involve…

Crypto Derivatives Volume Skyrockets to $86 trillion in 2025 as Binance Dominates

Key Takeaways Cryptocurrency derivatives volume has surged to an astronomical $86 trillion in 2025, equating to an average…

Ethereum in 2026: Glamsterdam and Hegota Forks, Layer 1 Scaling, and More

Key Takeaways Ethereum is poised for crucial developments in 2026, particularly with the Glamsterdam and Hegota forks. Glamsterdam…

Cryptocurrency people who use candlestick charts for fortune telling

When fortune telling is depicted on candlestick charts and placed within the context of the cryptocurrency world, its explosive popularity stems not from the accuracy of its mystical claims, but from the fact that traders' collective anxiety about uncertainty has finally found an outlet.

Holiday Season Markets: Understanding Low Liquidity and Trading Conditions

At WEEX, we recognize that the holiday season often brings a different trading experience for many users. As market participation slows, price behavior can feel less predictable and familiar trading rhythms may shift. For traders following AI news today or using AI trading tools, this period often highlights how market structure can influence model performance and short-term signals. Approaching these periods with clear expectations and a disciplined mindset can help traders better navigate seasonal market conditions.

Lido DAO’s Increased Development and Market Dynamics Elevate LDO Price

Key Takeaways Lido DAO’s development activities have surged by 690%, signifying substantial growth. The Lido DAO token (LDO)…

Hyperliquid Whales Shift Strategies: BTC Longs Decline, ETH Shorts Dominate

Key Takeaways A significant reduction in Bitcoin long positions has been observed on Hyperliquid, with large holders decreasing…

Token VS Equity: The Aave Controversy

December 26th Market Key Intelligence, How Much Did You Miss?

Popular coins

Latest Crypto News

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:[email protected]

VIP Services:[email protected]