Silently claiming the top spot in the Solana DEX market share, how did HumidiFi achieve this?

Original Article Title: "Solana's 'Invisible Champion': Rising to First in Market Share Quietly, How Did Dark Pool HumidiFi Do It?"

Original Article Authors: TATO, azsui

Original Article Translation: Tim, PANews

PANews Editor's Note: PANews Flash on November 3 — HumidiFi's 30-day trading volume surpassed Meteora and Raydium, leading the Solana DEX market. Most of the market is unfamiliar with HumidiFi, and the project's official Twitter account has only 12,000 followers. For this "invisible champion," PANews has organized and translated the relevant content of authors TATO and azsui, including an introduction to the HumidiFi project and the upcoming ICO event.

Body:

What Is Prop AMM? And What Is HumidiFi?

Traditional Automated Market Maker (AMM):

• Allows any user to provide liquidity→earn trading fees

• Uses a passive pricing mechanism (x*y=k constant product formula)

• Requires TVL to achieve deep liquidity

• Liquidity Providers (LPs) face impermanent loss risk

Professional Market Maker Automated Market Maker (Prop AMM):

• All liquidity provided by professional market makers

• Pricing strategy continuously updated and independent of user trading behavior

• Algorithm actively manages inventory like a centralized exchange market maker

• No public liquidity providers (LPs) = retail users do not bear impermanent loss

Core Features of HumidiFi:

• Rapid quote updates, performing multiple repricings per second

• Private order flow mechanism reduces volatility and front-running risk

• Achieves capital efficiency by precisely concentrating liquidity in the highest-demand areas

• Operates entirely on-chain with an algorithm

• Accessible only through the Jupiter route

This can be understood as the on-chain version of Citadel Securities, a fully blockchain-native and permissionless market maker solution.

HumidiFi Achievements

Trading Volume Leadership

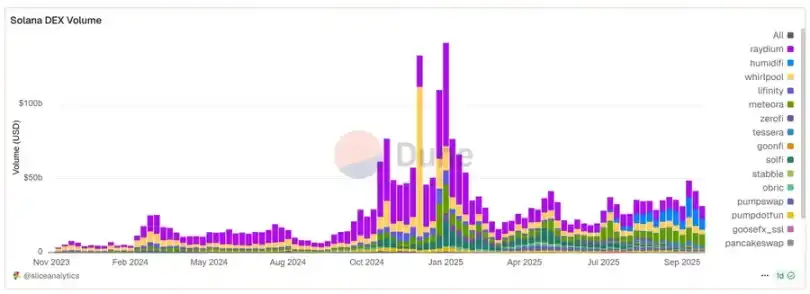

• Achieved approximately $1 trillion in total trading volume within 5 months

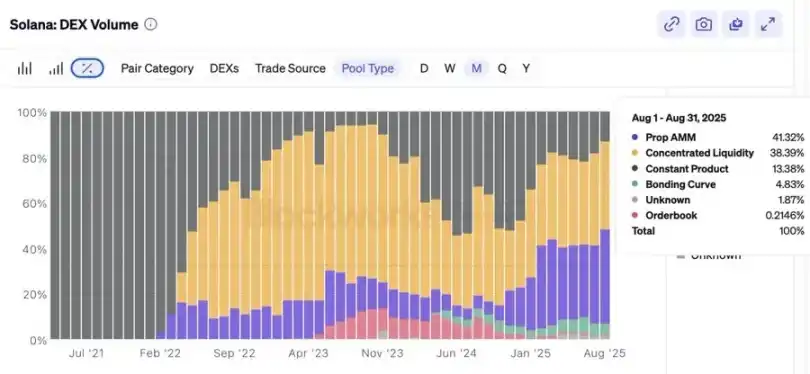

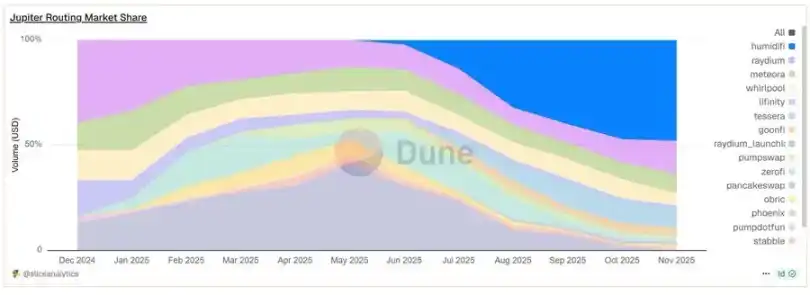

• Accounted for 35% of the total DEX trading volume on the Solana blockchain

• Daily trading volume consistently ranged from $10 billion to $190 billion

• Last month's trading volume reached $340 billion (surpassing the total of Raydium and Meteora)

Execution Quality

• Narrower spread for SOL/USDC compared to Binance

• More competitive quotes → lower slippage, close to minimal price impact

• 99.7% fill rate (almost zero trade failures)

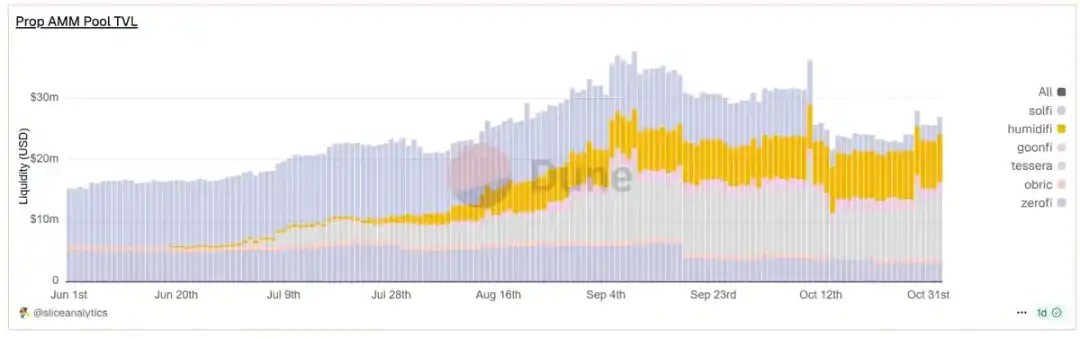

Capital Efficiency Marvel

• Processed $8.19 billion in daily trading volume with only $5.3 million TVL

• Achieved 154x capital efficiency (compared to around 1x for traditional AMMs)

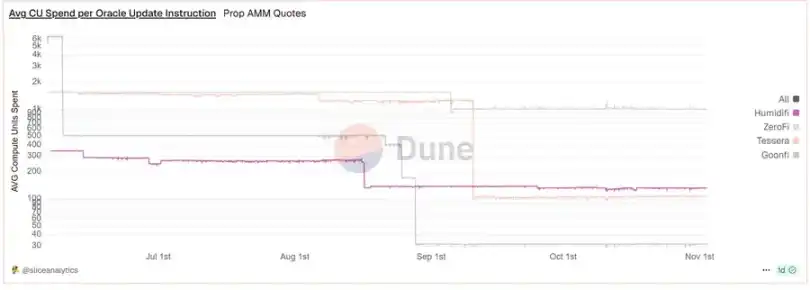

• Oracle updates require only 143 computation units (approximately 1000x lighter than regular swaps)

The result? Users get better prices, without even needing to know that HumidiFi is behind the operation.

Why Choose HumidiFi?

Technological Superiority

• Ultra-lightweight oracle updates require only 143 computation units

• Sub-Millisecond Price Refresh (Competitors take 15-30 seconds)

• Tight liquidity around oracle-based price aggregation = Ultimate capital efficiency

Jupiter Ecosystem Integration Advantage

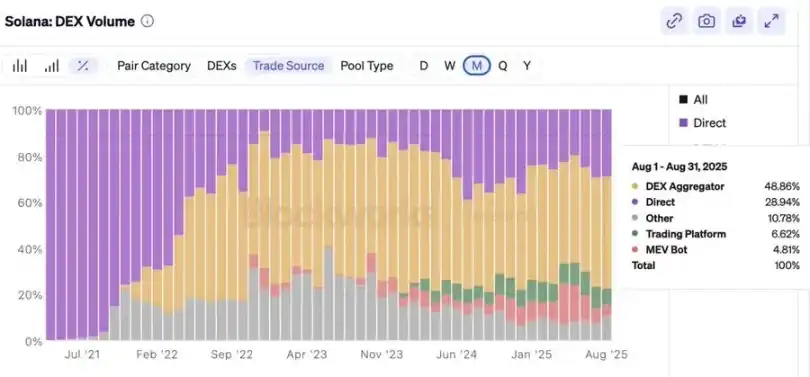

• Jupiter processes 80%+ of Solana's swap volume

• HumidiFi captures 54.6% of Jupiter's professional market maker route

• Better prices → More routing options → Higher trading volume → Price edge amplification (Flywheel Effect)

Stealth Advantage

• No front-end interface

• Private order flow reduces MEV attack risk

• Anonymous operation = Reduced regulatory target risk

First-Mover Scale Effect

While competitors aim for millions, HumidiFi achieves a billion-asset breakthrough directly. In the DeFi market, liquidity attracts liquidity, and they have seized the initiative.

The Future is Here: HumidiFi Will Lead Solana DeFi Development

In short, it always gives you the best quote. For users, this is our core need.

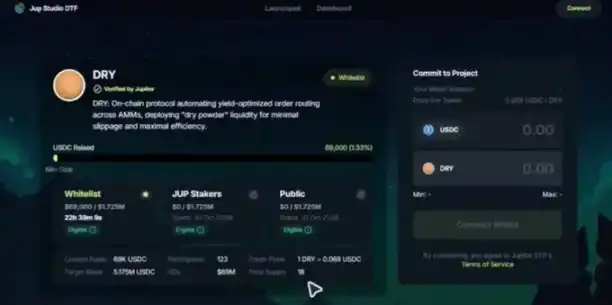

HumidiFi will launch its governance and utility token $WET on Jupiter's latest DTF Launchpad in November (specific date to be determined).

This sale will be conducted at a fixed price and will consist of three stages.

· Whitelist Stage

· $JUP Staker Stage

· Public Sale Stage

The key is that the $WET token has not received any investment from venture capital firms.

This means that if venture capital firms wish to purchase, they must participate in the ICO subscription or purchase from the secondary market after the token is publicly listed.

After the sale, $WET will immediately be available for trading in the liquidity pool on the Meteora platform.

Conclusion

HumidiFi is a professional AMM protocol, accounting for over 50% of total DEX trading volume.

$WET will be the first ICO project on the Jupiter DTF Launchpad platform.

$JUP stakers will be able to participate in this ICO sale.

You may also like

North Korean Hackers Enjoy 'Fat Years': Stole Record Amount in 2025, With Money Laundering Cycle of About 45 Days

What’s Driving Crypto Markets in Early 2026: Market Swings, AI Trading, and ETF Flows?

Imagine checking Bitcoin and Ethereum prices in a day — one minute up 5%, the next down 4%. Sharp moves, quick reversals, and sensitivity to macro signals marked the first week of 2026. After an early-year rally, both assets pulled back as markets recalibrated expectations around U.S. monetary policy and institutional flows. For traders — including those relying on AI or automated systems — this period offered a vivid reminder: abundant signals do not guarantee clarity. Staying disciplined in execution is often the real challenge.

America's First State-Backed Stablecoin FRNT: Can It Save Wyoming Amid Energy Slump?

ZCash Team Split, Bank of America Upgrades Coinbase Rating, What's the Overseas Crypto Community Talking About Today?

Key Market Info Discrepancy on January 9th - A Must-Read! | Alpha Morning Report

Aster Coin: A Deep Dive into Its Price, Potential, and Why It’s Catching Eyes in 2026

Have you ever stumbled upon a crypto project that seems poised for growth amid market volatility, only to…

Wyoming’s FRNT Stablecoin Launches — First State-Backed Stablecoin Hits Market

Key Takeaways Wyoming leads innovation in the U.S. by launching the first state-backed stablecoin, FRNT, representing a pivotal…

Solana Price Prediction: Morgan Stanley Just Filed for a SOL ETF – Is This the Beginning of Wall Street’s Next Crypto Obsession?

Key Takeaways Morgan Stanley’s filing for a SOL-based ETF signifies growing institutional interest in cryptocurrencies beyond Bitcoin, boosting…

All these uncommon things in the crypto world are listed on Idle Fish

USD 1 Billion Surge in Market Cap: Behind the Scenes with Trump Family Bet and CEX Shilling

Ranger Fund Takes a New Approach to Public Offering: Can a Grassroots Team Earn Market Trust?

Wyoming Stablecoin FRNT Goes Live on Solana, Polycule Bot Hacked, What's the Overseas Crypto Community Talking About Today?

Key Market Information Discrepancy on January 8th - A Must-See! | Alpha Morning Report

Start-of-the-Year Crypto Rally Stalls: What’s Next?

Key Takeaways The initial crypto market boost at the start of 2026 has lost momentum, primarily due to…

Nike Sells its NFT and Virtual Sneakers Amid Waning Interest in Digital Art

Key Takeaways Nike has discreetly sold its NFT and virtual sneakers subsidiary, RTFKT, as interest in digital collectibles…

Morgan Stanley Files for Ether Trust after Bitcoin and Solana ETF Proposals

Key Takeaways Morgan Stanley has made a significant move by filing for an Ethereum Trust with the SEC,…

2025 Crypto Bear Market: A Crucial Year for Institutional Repricing

Key Takeaways The 2025 crypto bear market witnessed significant corrections in the DeFi and smart contract sectors, setting…

Key Market Insights for January 7th, how much did you miss?

North Korean Hackers Enjoy 'Fat Years': Stole Record Amount in 2025, With Money Laundering Cycle of About 45 Days

What’s Driving Crypto Markets in Early 2026: Market Swings, AI Trading, and ETF Flows?

Imagine checking Bitcoin and Ethereum prices in a day — one minute up 5%, the next down 4%. Sharp moves, quick reversals, and sensitivity to macro signals marked the first week of 2026. After an early-year rally, both assets pulled back as markets recalibrated expectations around U.S. monetary policy and institutional flows. For traders — including those relying on AI or automated systems — this period offered a vivid reminder: abundant signals do not guarantee clarity. Staying disciplined in execution is often the real challenge.

America's First State-Backed Stablecoin FRNT: Can It Save Wyoming Amid Energy Slump?

ZCash Team Split, Bank of America Upgrades Coinbase Rating, What's the Overseas Crypto Community Talking About Today?

Key Market Info Discrepancy on January 9th - A Must-Read! | Alpha Morning Report

Aster Coin: A Deep Dive into Its Price, Potential, and Why It’s Catching Eyes in 2026

Have you ever stumbled upon a crypto project that seems poised for growth amid market volatility, only to…