AI Agent Narrative Rise: Can Hype Trigger Price Explosion?

Original Article Title: AI Agents: Does Price Action Follow Attention?

Original Article Author: S4mmyEth, Crypto Kol

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: This article discusses the growing prominence of AI agents and their increasingly important role in DeFi. It analyzes the mismatch between AI agent attention and market value, suggesting that "smart interaction" may better reflect market potential. The article also introduces new platforms such as injective and modenetwork, emphasizing the importance of innovation, market leadership, and cash flow for AI agent success.

Below is the original content (slightly reorganized for better readability):

The current cryptocurrency market is experiencing volatility while awaiting Bitcoin's breakthrough into the six-digit territory. During this time, attention has shifted to two key areas: MEME coins and artificial intelligence.

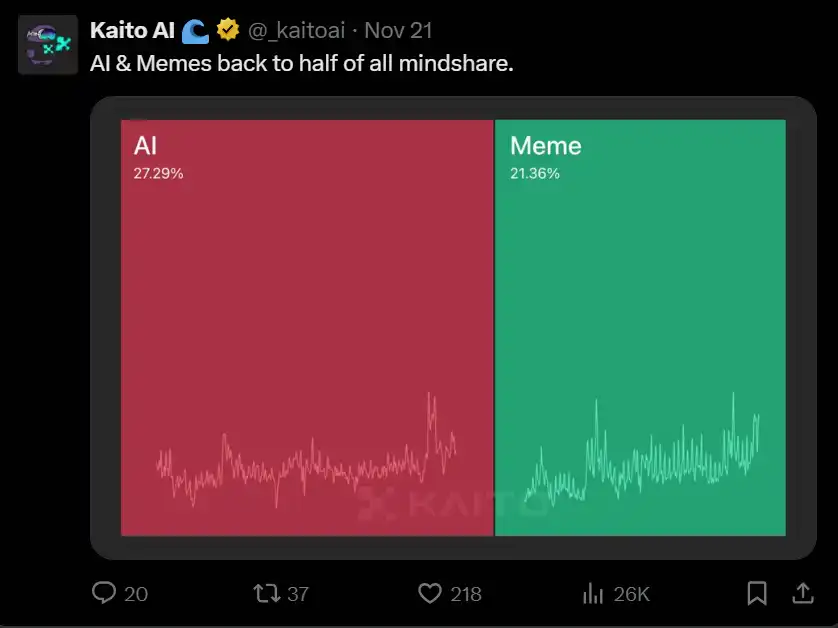

According to kaitoai's data, 48% of the attention on Crypto Twitter is focused on these two areas.

The article explores how these trends are shaping the cryptocurrency ecosystem, with a focus on the rise of AI agents and their evolving role in DeFi.

Table of Contents

1. The Rise of Web 4.0 and AI Integration

2. Evolution of AI Agents

3. Mindshare vs. Market Cap: AI Agent Performance Analysis

4. Case Study of ai16zdao: Breaking the Traditional Analytical Framework

5. Evaluating Key Metrics for AI Agents

6. Decentralized AI Dynamics: Other News and Developments

The Rise of Web 4.0 and AI Integration

Last week's discussion on Web 4.0 revealed the intersection of cryptocurrency and artificial intelligence, a topic that continues to garner widespread attention.

Binance's latest report highlights the tremendous potential of this emerging market, noting that DeFi integration and a collaborative community are key areas of growth.

While agency has long existed across industries, entering the crypto track has brought about a disruptive change. It has enabled true autonomy of AI agents by eliminating barriers of the traditional banking system.

This seamless integration has paved the way for exponential growth, as demonstrated by this continuously updated Crypto AI Agent and Protocol Tracker.

The Evolution of AI Agents

The field of AI agents is rapidly advancing at an unprecedented pace.

New developments, such as the cookiedotfun AI Agent Index, empower users to track participants in emerging markets.

The integration of decentralized technology has transformed AI agents from simple tools to autonomous entities capable of executing complex financial operations.

Key advancements include:

1. Greater autonomy achieved through blockchain integration.

2. Expansion of use cases within the DeFi ecosystem.

3. Seamless user experience driving accelerated adoption.

Mindshare vs. Market Cap: Analysis of AI Agent Performance

Is mindshare correlated with price trends?

Historically, funds often flow to areas of concentrated mindshare. However, in the AI agent field, the relationship between mindshare and market cap seems not to perfectly align.

Using November 24, 2024, as an example, the disparities between market cap and mindshare can be seen:

0xzerebro leads in mindshare but has only half the market cap of GOAT, despite its mindshare being 2.8 times higher.

dolos diary holds 60% of GOAT's mindshare but its market cap is only 20% of GOAT.

Starting with low initial mindshare, Aixbt agent saw a rapid surge in market cap within 12 hours despite not initially receiving attention.

While attention reflects market sentiment, it does not always directly translate into capital inflow. Instead, "Smart Interaction" (interaction from accounts with financial influence) may be more indicative of market potential.

A16z Case Study: Breaking the Traditional Analysis Framework

A16z's performance has surpassed the limits of traditional metrics such as Net Asset Value (NAV). Its price trades at a multiple far above NAV, attributed to an "AI Premium."

This premium reflects the potential value of its Large Language Model (LLM) performing above the market average.

The introduction of the elizawakesup framework has played a key role, with contributions collected through this framework directly adding value to A16z, driving its price well beyond traditional expectations.

This underscores the importance of the following factors:

Continual innovation from the development team.

Capturing significant attention.

Building mechanisms that can directly accrue value to the token.

Evaluating Key Metrics for AI Agents

To discover undervalued AI agents, consider the following:

Smart Interaction: Accounts labeled as "smart" may signal early capital deployment.

Domain-Specific Dominance: Agents excelling in a specific domain typically hold higher value.

Cash Flow Potential: Agents with actual financial returns are more likely to attract sustained investment.

For example, AiXBT demonstrated significant value by providing extensive data insights, leading to a 50% price increase.

Conversely, personality-driven agents often attract attention but may not necessarily result in corresponding financial impact.

Decentralized AI Dynamics: Other News and Developments

·injective Launches AI Agent Platform

·nvidia References Agent AI in Earnings Report, AI Coin Skyrockets

·After its latest funding round, xai reaches a $500 billion market cap

·vvaifudotfun raises $90 million in funding, launches new AI agent paired with a token

·modenetwork introduces AiFi—driving the convergence of AI agent infrastructure with an app store

·polytraderAI—utilizing the Polymarket API for analysis and trading

You may also like

From Wuhan to Silicon Valley, Manus did it in just nine months.

You may call it a “wrapper,” but it wrapped its way all the way to Meta.

How AI Helps Crypto Traders Analyze Markets, Manage Risk, and Trade Smarter

Crypto trading is no longer just about having a good idea—it is about executing consistently in a market that never stops. As data volumes and market speed increase, traditional manual analysis reaches its limits. AI helps traders move beyond these limits by transforming how markets are analyzed, how sentiment is interpreted, and how risk is controlled. This article explores how AI is reshaping crypto trading — and what that means for traders today.

WEEX × LALIGA: Seven Stars That Represent a Shared Standard of Excellence

True excellence in football is never accidental. It is built on discipline, consistency, and the ability to deliver under pressure — season after season. The same principles apply in professional trading, where long-term performance matters more than short-lived momentum. As an official regional partner of LALIGA, WEEX highlights seven outstanding players who embody the league’s competitive spirit and global appeal. Each brings a unique style to the pitch, yet all share values that closely align with WEEX’s commitment to stability, precision, and professional execution. This partnership is built on shared standards — where consistency and control define performance under pressure.

Arkstream Capital: When Cryptocurrency Returns to 'Financial Logic' by 2025

The Year Trump Embraced Cryptocurrency

IOSG: Port and New City, Two Cryptoverse Views of BNB Chain and Base

WEEX Partners with LALIGA to Expand Global Reach and Integrate Crypto into Mainstream Sports Culture

Hong Kong, Jan. 1, 2026. WEEX has entered into a new partnership with LALIGA, as an official regional partner of LALIGA in Taiwan and Hong Kong. The agreement brings WEEX into LALIGA’s network of regional collaborators and opens the door to new ways of engaging both fans and traders during the season.

Perpetual Contract Genesis: Pricing Liquidity with a Magic Formula, Transparency Prevents it from Reaching its Full Potential

Decode Stock on Chain: Why Are Crypto Enthusiasts Investing in US Stocks While Wall Street Is Going Blockchain Unfriendly?

Key Market Intelligence as of December 31st, how much did you miss out on?

Long-standing domestic public blockchain NEO sees feud between two co-founders, with opaque finances as the core reason

Hong Kong Virtual Asset Trading Platform New Regulations (Part 2): New Circular Issued, Has the Boundary of Virtual Asset Business Been Redefined?

DeFi 2.0 Explosion Post-Disorderly Restructuring in 2026

Fed's Latest Meeting Minutes: Divergence Persists, But "Most" Officials Advocate Continued Rate Cuts

AI Trading in Crypto: How Traders Actually Apply AI in Real Crypto Markets

Artificial intelligence has moved beyond experimentation in crypto markets. In 2025, AI-driven trading tools are increasingly used by traders who want better discipline, faster execution, and more structured decision-making in volatile markets. This guide explains how AI is actually used in crypto trading, step by step — with a focus on how these strategies are executed in real trading environments.

The first large-scale adoption of a "yield-bearing stablecoin" was in China

Market Update — December 31

From South Korea and the OECD accelerating the implementation of crypto regulation and compliance frameworks, to the simultaneous development of TAO ETFs, privacy technologies, mining, and Bitcoin reserves, while security incidents and financial losses continue to rise, the crypto market has entered a new phase amid multiple challenges of "strong regulation + technological evolution + amplified risks."

Lighter Token Distribution Sparks Controversy, Zama Launches USDT Private Transfers, What is the Overseas Crypto Community Talking About Today?

From Wuhan to Silicon Valley, Manus did it in just nine months.

You may call it a “wrapper,” but it wrapped its way all the way to Meta.

How AI Helps Crypto Traders Analyze Markets, Manage Risk, and Trade Smarter

Crypto trading is no longer just about having a good idea—it is about executing consistently in a market that never stops. As data volumes and market speed increase, traditional manual analysis reaches its limits. AI helps traders move beyond these limits by transforming how markets are analyzed, how sentiment is interpreted, and how risk is controlled. This article explores how AI is reshaping crypto trading — and what that means for traders today.

WEEX × LALIGA: Seven Stars That Represent a Shared Standard of Excellence

True excellence in football is never accidental. It is built on discipline, consistency, and the ability to deliver under pressure — season after season. The same principles apply in professional trading, where long-term performance matters more than short-lived momentum. As an official regional partner of LALIGA, WEEX highlights seven outstanding players who embody the league’s competitive spirit and global appeal. Each brings a unique style to the pitch, yet all share values that closely align with WEEX’s commitment to stability, precision, and professional execution. This partnership is built on shared standards — where consistency and control define performance under pressure.