Key Market Intelligence on November 12th, how much did you miss?

Featured News

2. DUNI's market cap exceeds $7 million, with a 24-hour surge of over 84x

3. SOL and BSC-based meme coins traded lower today, mostly maintaining a narrow range of within 6%

4. Pre-market crypto concept stocks in the U.S. saw a general increase, with Strategy up 1.52%

5. Altcoins experienced a widespread decline, with KDA plunging over 59% in 24 hours

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

Here is the translation of the original content:

[ALLORA]

ALLORA gained significant attention today due to its listing on major exchanges such as Binance, OKX, Kraken, etc. The project innovatively combines AI and decentralized finance to create a predictive AI network. The community actively discussed its potential impact on AI and the crypto market, showing strong optimism. The listing was accompanied by airdrops and incentive measures, further driving interest and participation.

[BINANCE]

Discussions revolving around Binance today highlighted its crucial position in the crypto market, including the launch of trading features, a BNB Smart Chain trading competition, and participation in the Allora (ALLO) listing. Binance's reserves remain strong, and its influence in DeFi and AI projects is significant. The platform's strategic initiatives, such as partnerships and innovation, continue to solidify its reputation as a leading crypto exchange.

[WALLCHAIN]

WALLCHAIN has attracted attention due to the successful minting of the Quack Heads NFT series, which quickly sold out, with some stages lasting only seconds. The NFT minting price was 2.5 SOL, and the floor price has risen to 16 SOL, demonstrating strong demand and the potential profits for early participants. Discussions also revolve around algorithm adjustments on the InfoFi platform and the possibility of token distribution to NFT holders. The community is actively engaged, expressing optimism for future developments.

[KINDRED]

KINDRED has been frequently discussed for its AI capabilities and NFT products. Tweets highlight the popularity of Kindred AI, its collaboration with MemeCore, and the bullish sentiment surrounding the Klara NFT, which has seen a significant price increase. Discussions also involve the potential of Kindred AI in the digital economy transformation and integration with platforms like Sei Network. The upcoming Kindred x MemeCore AMA event further stirs community expectations.

Featured Articles

1.《From Queen Dream to Prison, Qian Zhimin and the Absurd $60 Billion Bitcoin Scam》

Very few scams in crypto history have combined such absurdity and scale. Qian Zhimin, a Chinese woman who claimed to be on the verge of being crowned queen of a "micronation," ultimately received an 11-year, 8-month prison sentence from a UK court for orchestrating a scam involving 60,000 bitcoins, totaling a staggering $60 billion. She once dreamed of being enthroned in a temple in Liberland, wearing a crown. Now, behind bars, she faces the collapse of the myth she wove with her own hands.

2.《Why the Prediction Market Is Still in an Exploratory Stage》

The prediction market is experiencing its moment in the sun. Polymarket's coverage of the presidential election made headlines, and Kalshi's regulatory victory has opened new frontiers, suddenly everyone wants to talk about this "world truth engine." But behind this wave of excitement lies a more intriguing question: if prediction markets are truly so good at forecasting the future, why haven't they become more mainstream?

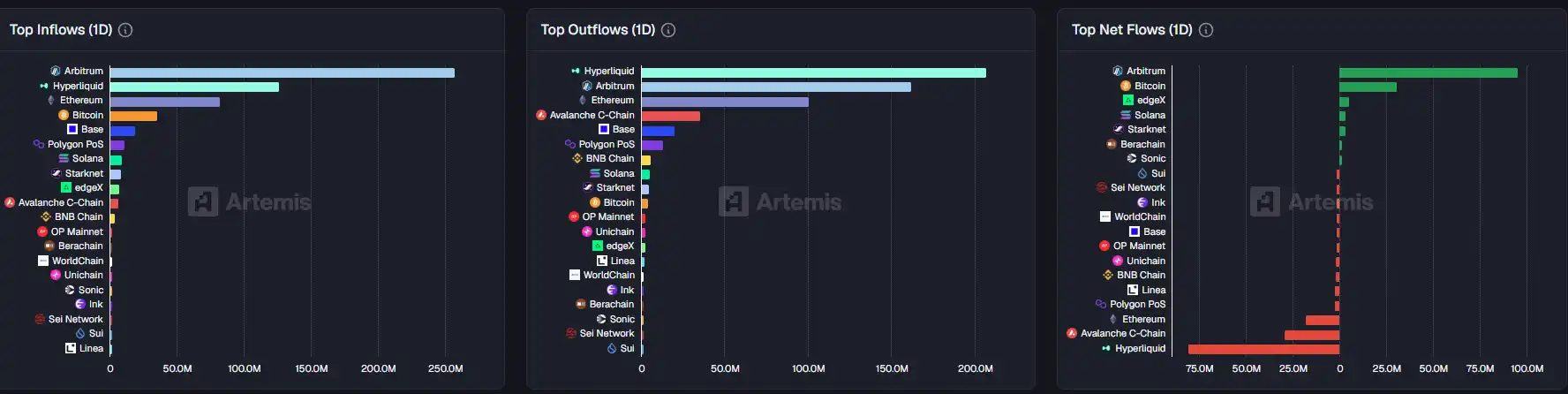

On-chain Data

On-chain Fund Flow for the Week of November 12

You may also like

From Wuhan to Silicon Valley, Manus did it in just nine months.

You may call it a “wrapper,” but it wrapped its way all the way to Meta.

How AI Helps Crypto Traders Analyze Markets, Manage Risk, and Trade Smarter

Crypto trading is no longer just about having a good idea—it is about executing consistently in a market that never stops. As data volumes and market speed increase, traditional manual analysis reaches its limits. AI helps traders move beyond these limits by transforming how markets are analyzed, how sentiment is interpreted, and how risk is controlled. This article explores how AI is reshaping crypto trading — and what that means for traders today.

The Year Trump Embraced Cryptocurrency

IOSG: Port and New City, Two Cryptoverse Views of BNB Chain and Base

Perpetual Contract Genesis: Pricing Liquidity with a Magic Formula, Transparency Prevents it from Reaching its Full Potential

Decode Stock on Chain: Why Are Crypto Enthusiasts Investing in US Stocks While Wall Street Is Going Blockchain Unfriendly?

Long-standing domestic public blockchain NEO sees feud between two co-founders, with opaque finances as the core reason

Hong Kong Virtual Asset Trading Platform New Regulations (Part 2): New Circular Issued, Has the Boundary of Virtual Asset Business Been Redefined?

DeFi 2.0 Explosion Post-Disorderly Restructuring in 2026

AI Trading in Crypto: How Traders Actually Apply AI in Real Crypto Markets

Artificial intelligence has moved beyond experimentation in crypto markets. In 2025, AI-driven trading tools are increasingly used by traders who want better discipline, faster execution, and more structured decision-making in volatile markets. This guide explains how AI is actually used in crypto trading, step by step — with a focus on how these strategies are executed in real trading environments.

Lighter Token Distribution Sparks Controversy, Zama Launches USDT Private Transfers, What is the Overseas Crypto Community Talking About Today?

Can't Beat the Stock Market, Can't Outdo Precious Metals, Is Crypto Really Becoming the Bull Market for "Outsiders"?

Why Did the Prediction Market Take Nearly 40 Years to Explode?

Key Market Intelligence on December 30th, how much did you miss out on?

Matrixdock 2025: The Practical Path to Sovereign-Grade RWA of Gold Tokenization

When Everyone Uses AI Trading, Where Does Cryptocurrency Alpha Go in 2026?

In 2025, AI trading has become the default, but Alpha hasn’t disappeared — it’s been eroded by crowding, as similar data, models, and strategies cause traders to act in sync and lose their edge.

Real Alpha has shifted to harder-to-copy layers like behavioral and on-chain data, execution quality, risk management, and human judgment in extreme markets, where acting differently — or not acting at all—matters more than better predictions.

Insight: 2026 Could Usher in a “Crypto Winter,” but Institutionalization and On-chain Transformation Are Accelerating

Key Takeaways Cantor Fitzgerald predicts Bitcoin could face an extended downtrend, signaling a potential “Crypto Winter” by 2026.…

Caixin: Digital RMB Wallet Balances to Begin Earning Interest in 2026

Key Takeaways: Starting January 1, 2026, digital RMB wallets will earn interest on balances. The operational structure will…

From Wuhan to Silicon Valley, Manus did it in just nine months.

You may call it a “wrapper,” but it wrapped its way all the way to Meta.

How AI Helps Crypto Traders Analyze Markets, Manage Risk, and Trade Smarter

Crypto trading is no longer just about having a good idea—it is about executing consistently in a market that never stops. As data volumes and market speed increase, traditional manual analysis reaches its limits. AI helps traders move beyond these limits by transforming how markets are analyzed, how sentiment is interpreted, and how risk is controlled. This article explores how AI is reshaping crypto trading — and what that means for traders today.