PAXG Token Overview: What Is PAX Gold and Is PAXG Crypto Worth Investing In?

As digital assets continue to evolve, tokenized real-world assets (RWAs) are becoming a key bridge between traditional finance and blockchain markets. Among these, PAX Gold (PAXG) stands out as one of the most established and regulated gold-backed crypto assets, offering investors direct exposure to physical gold through a blockchain-based structure.

This article explores what is PAX Gold, how the PAXG token works within Paxos’ broader tokenization strategy, how it compares with traditional gold investments, how the PAX gold price tracks physical gold, and whether PAXG is worth investing in. It also explains how to buy and trade PAX Gold efficiently through WEEX PAXG markets.

What Is PAX Gold (PAXG)?

PAX Gold (PAXG) is a regulated, asset-backed digital token issued by Paxos Trust Company, a New York State–chartered trust company regulated by the New York Department of Financial Services (NYDFS).

Each PAXG token represents one fine troy ounce of physical gold, stored in LBMA-accredited vaults in London. The underlying gold takes the form of 400-ounce “Good Delivery” bars held in Brink’s vaults. Token holders have direct, legally enforceable ownership rights to specific gold bars, with allocation details verifiable on-chain.

For investors asking what is PAX gold?, the key distinction is that PAXG is not a synthetic or derivative product. It is fully backed by allocated physical gold, with monthly attestation reports published by Withum and made publicly available through Paxos.

PAXG and Paxos’ Tokenization Strategy

PAX Gold plays a central role in Paxos’ broader tokenization strategy, which focuses on bringing traditional financial assets on-chain in a compliant and transparent manner. Paxos is also the issuer of regulated stablecoins and provides settlement infrastructure for institutional clients.

Through the PAXG token, Paxos demonstrates how physical commodities such as gold can be digitized, fractionalized, and traded globally while remaining within established regulatory frameworks. This approach has made PAX Gold particularly attractive to institutions, professional traders, and regulators seeking compliant exposure to tokenized assets.

In 2025, amid increased U.S. regulatory scrutiny of stablecoins and asset-backed tokens, Paxos continued to be referenced in policy discussions due to its full-reserve model and transparent audit framework. PAX Gold has been cited in regulatory commentary as a compliant example of tokenized gold.

PAX Gold vs Traditional Gold Investment

Compared with physical gold and gold ETFs, PAX Gold offers a distinct structural profile:

Aspect | Physical Gold | Gold ETFs | PAXG Token |

Ownership | Direct | Indirect | Direct |

Storage | Self-managed | Managed by issuer | Institutional vaults |

Trading Hours | Limited | Market hours | 24/7 |

Fractional Trading | No | Limited | Yes |

On-chain Transparency | No | No | Yes |

PAXG removes the operational friction associated with physical gold storage while avoiding the indirect exposure common in ETF structures. By settling on blockchain infrastructure, the PAXG token allows continuous trading and near-instant transferability without sacrificing physical backing.

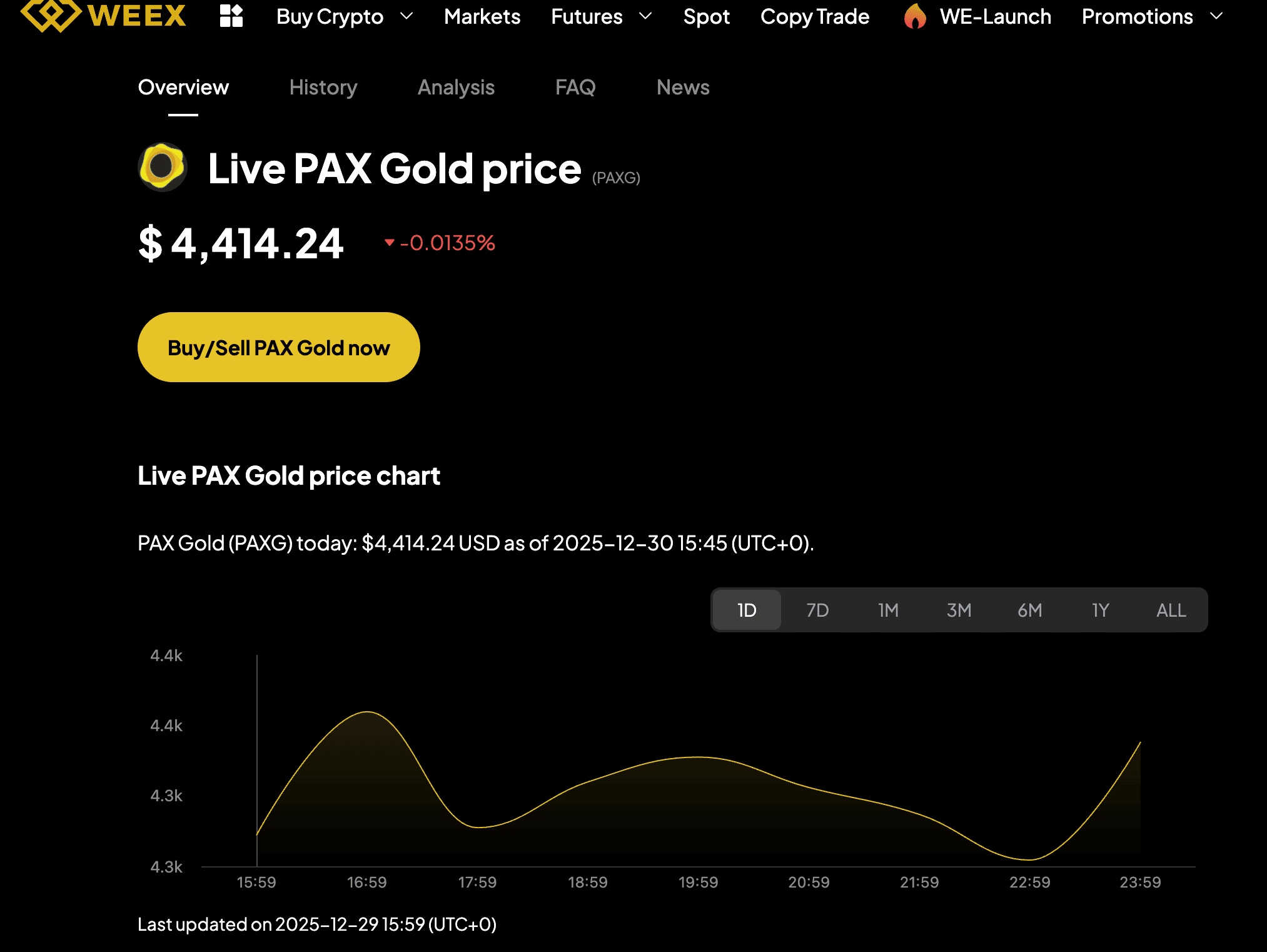

PAX Gold Price and PAXG Coin vs Gold Price

The PAX gold price is designed to closely track the global spot price of gold, as each PAXG token is backed by one fine troy ounce of physical gold. In practice, small deviations between the PAXG coin vs gold price can occur due to exchange liquidity conditions, transaction costs, and short-term demand fluctuations.

As of late 2025, PAX Gold’s total market capitalization surpassed 1.6 billion USD, with prices moving in line with spot gold as it traded above the 4,500 USD per ounce range. These dynamics reinforce PAXG’s role as a digital representation of gold rather than a speculative proxy.

Over time, pricing discrepancies tend to remain limited, making the PAXG token a reliable instrument for gold exposure within crypto markets.

Is PAX Gold a Good Investment?

Whether PAX Gold is a good investment depends on an investor’s objectives and risk profile. PAXG is commonly used as a portfolio stabilizer, an inflation hedge, and a diversification tool within crypto-native portfolios.

Key considerations include:

- Regulatory strength, supported by NYDFS oversight and monthly audits

- On-chain transparency and verifiable physical backing

- Liquidity across centralized and decentralized venues

- Exposure to macro-driven gold price volatility

By the end of 2025, on-chain and derivatives data showed increasing institutional engagement. Exchange hot wallets held approximately 920,000 ounces, representing around 74 percent of circulating supply. Derivatives markets reflected moderate bullish sentiment toward gold, while cross-chain flows to Solana-based liquidity pools indicated growing demand for yield-generating strategies using PAXG.

However, investors should also consider redemption fees and broader macroeconomic factors affecting gold prices when evaluating long-term holding strategies.

How to Buy Paxos Gold (PAXG) on WEEX

WEEX provides a centralized trading environment designed to support efficient execution and risk management for asset-backed tokens such as PAX Gold.

To trade WEEX PAXG markets, users typically follow these steps:

- Create an Account: Sign up for a WEEX account by logging in the official website.

- Complete Verification: Secure your account by completing the necessary identity verification steps.

- Deposit Funds: Add funds using your preferred payment method.

- Search for PAXG Coin: Use the search function to find PAXG/USDT on WEEX.

- Place Your Order: Select the amount of PAXG token you want to buy and submit your order.

- Confirm Purchase: Review your details and confirm the purchase.

WEEX integrates advanced risk control systems and deep liquidity support from leading liquidity providers, enabling efficient access to the PAXG token without the complexities of physical gold custody.

Conclusion: PAX Gold and WEEX as a Digital Gold Trading Solution

PAX Gold represents one of the most mature implementations of tokenized gold, combining physical backing, regulatory oversight, and blockchain efficiency. For investors exploring what is PAX gold?, tracking the PAX gold price, or evaluating PAXG coin vs gold price dynamics, PAXG offers a transparent and institution-ready solution.

When traded through WEEX PAXG markets, investors gain access to professional-grade infrastructure, strong liquidity, and reliable execution. Together, PAX Gold and WEEX provide a practical framework for integrating gold exposure into modern crypto portfolios.

You may also like

PAX Gold Price in INR: Current Trends, Predictions for 2026, and Smart Buying Strategies

Ever wondered how you could tap into the timeless appeal of gold without dealing with heavy bars or…

PAX Gold Price History: A Deep Dive into the Evolution of Digital Gold from Launch to 2026

Gold has long served as a reliable hedge against economic uncertainty, but what if you could own it…

PAX Gold Price Prediction Tomorrow: Expert Insights for 2026 Traders

As a crypto investor who’s navigated the ups and downs of the market since the early days of…

PAX Gold Price Prediction 2025: What Investors Need to Know About PAXG Crypto’s Future

As someone who’s been trading crypto since the early days of Bitcoin, I’ve seen how assets like gold-backed…

PAX Gold Price on TradingView: Charts, Trends, and 2026 Predictions

As a crypto trader who’s been navigating the markets since the early days of Ethereum, I’ve seen how…

Pax Gold (PAXG): Your Guide to the Gold-Backed Crypto Stablecoin in 2026

As someone who’s traded crypto for over a decade, I’ve watched assets like gold find new life in…

PAX Gold Price Graph: Tracking Historical Trends and Forecasting Future Movements in 2026

As a crypto investor who’s watched gold-backed assets evolve since the early days of blockchain, I’ve seen how…

Where to Buy Pax Gold (PAXG): Your Complete Guide to Getting Started with This Gold-Backed Crypto

Have you ever thought about owning gold without dealing with the hassle of storing heavy bars in a…

Paxful Razer Gold: How to Trade Gaming Credits for Crypto and Exploring PAX Gold as a Digital Alternative

Ever wondered how gamers in places like Indonesia and Nigeria turn their Razer Gold credits into real cryptocurrency?…

Paxful Gold Explained: Trading Razer Gold on Paxful and Why PAXG Crypto Stands Out as True Digital Gold

Ever stumbled upon the term “paxful gold” while hunting for ways to trade digital assets or gaming credits,…

How to Buy PAXG: Your Step-by-Step Guide to Getting Started with Pax Gold Crypto

Ever wondered how you could own a piece of gold without dealing with the hassle of storing heavy…

Is PAXG a Stablecoin? Exploring the Gold-Backed Token in Today’s Crypto Landscape

You’ve probably heard about stablecoins as the steady anchors in the volatile world of crypto, but what if…

Is PAXG Legit? Unpacking the Reliability of Paxos Gold Token in 2026

As someone who’s spent years trading crypto and watching markets shift like tides, I remember the first time…

Is PAXG a Good Investment in 2026? Weighing the Pros, Cons, and Gold-Backed Potential

As someone who’s been trading crypto since the early days of Ethereum, I’ve seen plenty of tokens come…

PAXG Stock: Exploring PAX Gold as a Digital Gold Investment in 2026

Ever wondered if you could own gold without dealing with heavy bars or pricey vaults? As someone who’s…

PAXG Price Prediction 2026: Expert Insights on Pax Gold’s Future Amid Gold’s Bull Run

As a crypto investor who’s ridden the waves of market highs and lows since the early days of…

PAXG Crypto: Your Guide to Paxos Gold Token and Its Role in the 2026 Crypto Market

Ever wondered how you could own gold without dealing with heavy bars or secure vaults? That’s where PAXG…

PAXG to USD: Latest Conversion Rates, Price Insights, and Trading Strategies for PAX Gold

As someone who’s been trading crypto since the early days of Ethereum, I’ve seen how assets like gold-backed…

PAX Gold Price in INR: Current Trends, Predictions for 2026, and Smart Buying Strategies

Ever wondered how you could tap into the timeless appeal of gold without dealing with heavy bars or…

PAX Gold Price History: A Deep Dive into the Evolution of Digital Gold from Launch to 2026

Gold has long served as a reliable hedge against economic uncertainty, but what if you could own it…

PAX Gold Price Prediction Tomorrow: Expert Insights for 2026 Traders

As a crypto investor who’s navigated the ups and downs of the market since the early days of…

PAX Gold Price Prediction 2025: What Investors Need to Know About PAXG Crypto’s Future

As someone who’s been trading crypto since the early days of Bitcoin, I’ve seen how assets like gold-backed…

PAX Gold Price on TradingView: Charts, Trends, and 2026 Predictions

As a crypto trader who’s been navigating the markets since the early days of Ethereum, I’ve seen how…

Pax Gold (PAXG): Your Guide to the Gold-Backed Crypto Stablecoin in 2026

As someone who’s traded crypto for over a decade, I’ve watched assets like gold find new life in…

Popular coins

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:[email protected]

VIP Services:[email protected]