Web3 New Tale of Two Cities: Stablecoins and Money Market Funds

Original Article Title: Stablecoins and the parallels with Money Market Funds

Original Article Authors: @shawnwlim, @artichokecap Founders

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: The regulatory dispute over stablecoins bears resemblance to the experience of Money Market Funds (MMFs) half a century ago. MMFs were initially designed for corporate cash management but faced criticism due to lack of deposit insurance and vulnerability to runs, impacting bank stability and monetary policy. Nevertheless, MMF assets now exceed $7.2 trillion. The 2008 financial crisis led to the collapse of the Reserve Fund, and in 2023, the SEC is still pushing for MMF regulatory reform. The history of MMFs suggests that stablecoins may face similar regulatory challenges but could ultimately become a crucial part of the financial system.

The following is the original content (slightly edited for readability):

Stablecoins are exciting, and the upcoming stablecoin legislation in the US represents a rare opportunity to upgrade the existing financial system. Those studying financial history will notice parallels between it and the invention and development of Money Market Funds about half a century ago.

Money Market Funds were invented in the 1970s as a cash management solution, primarily for corporates. At that time, US banks were prohibited from paying interest on balances in checking accounts, and corporations were often unable to maintain savings accounts. If a business wanted to earn interest on idle cash, they had to buy US Treasuries, engage in repurchase agreements, invest in commercial paper, or certificates of deposit. Managing cash was a cumbersome and operationally intensive process.

The design of Money Market Funds was to maintain a stable share value, with each share pegged at $1. The Reserve Fund, Inc. was the first MMF. Launched in 1971, it was introduced as "a convenient alternative for investing temporary cash balances," which would typically be placed in money market instruments like Treasuries, commercial paper, bank acceptances, or CDs, with an initial asset size of $1 million.

Other investment giants quickly followed suit: Dreyfus (now part of BNYglobal), Fidelity, Vanguard_Group. In the 1980s, almost half of Vanguard's legendary mutual fund business growth was attributable to its Money Market Fund.

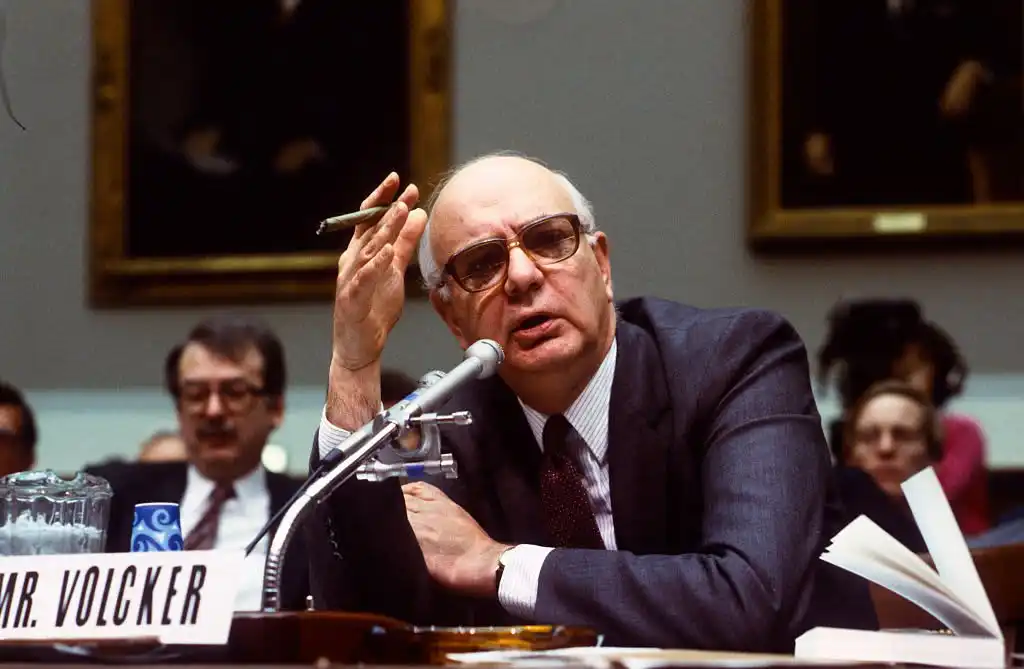

During his tenure as Chairman of the Federal Reserve from 1979 to 1987, Paul Volcker was highly critical of Money Market Funds (MMFs). He continued his criticism of MMFs as late as 2011.

Today, many of the criticisms raised by policymakers against stablecoins echo those from half a century ago against Money Market Funds:

· Systemic Risk and Banking Safety Concerns: MMFs lack deposit insurance and a lender of last resort mechanism, unlike insured banks. Because of this, MMFs are susceptible to rapid runs, which could exacerbate financial instability and lead to contagion. There are also concerns that deposits shifting from insured banks to MMFs could weaken the banking sector as banks lose their low-cost and stable deposit base.

· Unfair Regulatory Arbitrage: MMFs provide bank-like services, maintaining a stable $1 share price, but without rigorous regulatory oversight or capital requirements.

· Weakening of Monetary Policy Transmission Mechanism: MMFs could weaken the Fed's monetary policy tools, as traditional monetary policy instruments like bank reserves are less effective when funds flow from banks to MMFs.

Today, MMFs have financial assets exceeding $7.2 trillion. For reference, M2 (excluding MMF assets) is $21.7 trillion.

In the late 1990s, the rapid growth in MMF assets was a result of financial deregulation (the Gramm-Leach-Bliley Act repealed the Glass-Steagall Act, fueling a wave of financial innovation), while the prosperity of the internet facilitated better electronic and online trading systems, speeding up fund inflows into MMFs.

Do you see a pattern here? (I would like to point out that even half a century later, the regulatory struggle around MMFs is far from over. The SEC adopted MMF reforms in 2023, including raising minimum liquidity requirements and removing fund manager restrictions on investor redemptions.)

Unfortunately, the Reserve Fund met its end after the 2008 financial crisis. It held some Lehman Brothers debt securities, which were written down to zero, leading to the fund's breaking of the buck event and significant redemptions.

Também poderá gostar de

WEEXPERIENCE Whales Night: Inteligência Artificial, Crypto Community & Crypto Market Insights

Em 12 de dezembro de 2025, a WEEX sediou a WEEXPERIENCE Whales Night, uma reunião da comunidade offline projetada para reunir membros da comunidade local de criptomoedas. O evento combinou compartilhamento de conteúdo, jogos interativos e apresentações de projetos para criar uma experiência offline relaxada e envolvente.

Riscos de negociação de IA em criptomoedas: Por que melhores estratégias de negociação de criptomoedas podem gerar maiores perdas?

O risco já não reside principalmente em má tomada de decisão ou erros emocionais. Vive cada vez mais na estrutura de mercado, caminhos de execução e comportamento coletivo. Entender essa mudança é mais importante do que encontrar a próxima estratégia “melhor”.

Agentes de IA estão substituindo a pesquisa de criptografia? Como a IA autônoma está reformulando o Crypto Trading

A IA está passando de auxiliar os comerciantes para automatizar todo o processo de pesquisa até execução nos mercados de criptomoedas. A vantagem mudou de insights humanos para tubulações de dados, velocidade e sistemas de IA prontos para execução, tornando os atrasos na integração de IA uma desvantagem competitiva.

Bots de negociação de IA e Copy Trading: Como estratégias sincronizadas reformulam a volatilidade do mercado de criptomoedas

Os comerciantes de criptomoedas de varejo enfrentam há muito os mesmos desafios: má gestão de risco, entradas atrasadas, decisões emocionais e execução inconsistente. As ferramentas de negociação AI prometeram uma solução. Hoje em dia, sistemas de negociação de cópia e bots de breakout apoiados por IA ajudam os comerciantes a dimensionar posições, definir paradas e agir mais rápido do que nunca. Além da velocidade e precisão, essas ferramentas estão silenciosamente reformulando os mercados - os traders não estão apenas negociando mais inteligentemente, eles estão se movendo em sincronia, criando uma nova dinâmica que amplifica tanto o risco quanto as oportunidades.

Trading de IA em Crypto Explicado: Como a negociação autónoma está reformulando os mercados de criptomoedas e as bolsas de criptomoedas

O AI Trading está rapidamente transformando a criptografia. As estratégias tradicionais lutam para acompanhar a volatilidade sem parar da criptomoeda e a complexa estrutura de mercado, enquanto a IA pode processar dados maciços, gerar estratégias adaptativas, gerenciar riscos e executar operações de forma autónoma. Este artigo orienta os usuários da WEEX pelo que é o trading de IA, por que a criptografia acelera sua adoção, como a indústria está evoluindo para agentes autônomos e por que a WEEX está construindo o ecossistema de negociação de IA da próxima geração.

Call to Join AI Wars: WEEX Alpha Awakens — Competição Global de Negociação de IA com $880,000 Prize Pool

Agora, estamos chamando comerciantes de IA de todo o mundo para se juntarem a AI Wars: WEEX Alpha Awakens, uma competição global de negociação de IA com um pool de prêmios de US$ 880.000.

Negociação de IA em Mercados de Cripto: De robôs de negociação automatizados a estratégias algoritmicas

O comércio impulsionado por IA está mudando a criptomoeda da especulação de varejo para a concorrência de nível institucional, onde a execução e a gestão de risco importam mais do que a direção. À medida que as negociações de IA aumentam, o risco sistêmico e a pressão regulatória aumentam, tornando o desempenho a longo prazo, sistemas robustos e conformidade os principais diferenciais.

Análise de sentimentos de IA e volatilidade de criptomoedas: O que move os preços de criptomoedas

O sentimento da IA está influenciando cada vez mais os mercados de criptomoedas, com mudanças nas expectativas relacionadas à IA se traduzindo em volatilidade para os principais ativos digitais. Os mercados de criptomoedas tendem a amplificar as narrativas de IA, permitindo que os fluxos impulsionados pelo sentimento superem os fundamentos a curto prazo. Compreender como o sentimento da IA se forma e se espalha ajuda os investidores a antecipar melhor os ciclos de risco e posicionar oportunidades em todos os ativos digitais.

AI Wars: Guia do Participante

Neste confronto decisivo, os melhores programadores, quants e traders de todo o mundo vão libertar os seus algoritmos em batalhas no mercado real, competindo por um dos maiores pools de prémios da história do trading de cripto com IA: 880 000 USD, incluindo um Bentley Bentayga S para o campeão. Este guia orienta em todos os passos necessários, desde a inscrição até ao início oficial da competição.

Segunda semana do Banco Central e volatilidade do mercado de criptomoedas: Como as decisões de taxa de juros moldam as condições de negociação na WEEX

As decisões de juros de grandes bancos centrais como a Reserva Federal são eventos macroeconômicos significativos que afetam os mercados financeiros globais, influenciando diretamente as expectativas de liquidez do mercado e o apetite de risco. À medida que o mercado de criptomoedas continua a se desenvolver e sua estrutura de negociação e participantes amadurecem, o mercado de criptomoedas está sendo gradualmente incorporado ao sistema de preços macroeconômicos.

Guerras da IA: WEEX Alpha Awakens | Guia do processo de teste do WEEX Global Hackathon API

AI Wars: O registro do WEEX Alpha Awakens está agora aberto. e este guia descreve como acessar o teste da API e concluir com sucesso o processo.

O que é o WEEX Alpha Awakens e como participar? Um guia completo

Para acelerar os avanços na interseção de IA e criptografia, a WEEX está lançando o primeiro hackathon global de negociação de IA – AI Wars: Alpha despertou.

Juntar-se a AI Wars: WEEX Alpha despertou!Global Call for AI Trading Alphas

AI Wars: WEEX Alpha Awakens é um hackathon global de negociação de IA em Dubai, chamando equipes de quantidade, traders algoritmicos e desenvolvedores de IA para lançar suas estratégias de negociação de criptomoedas de IA em mercados ao vivo por uma parte de um pool de prêmios de US $ 880,000.

WEEX revela o comércio para ganhar: Até 30% de reembolso instantâneo + $2M WXT Buyback

A WEEX tem o prazer de anunciar o lançamento do nosso programa Trade to Earn, que automaticamente concede até 30% de desconto nas taxas de negociação. Todas as recompensas são creditadas diretamente à sua conta spot em $WXT - apoiado pelo nosso plano de compra de $2.000.000 WXT que alimenta o valor de token a longo prazo.

Novo: Preço estimado de liquidação no app candlestick gráficos

WEEX introduziu um novo preço de liquidação estimado (Est. Liq. Preço) recurso no gráfico do candlestick para ajudar os traders a gerenciar melhor o risco e identificar intervalos seguros para suas posições.

WEEX AI Hackathon Guia: Encontre o seu WEEX UID e registe

De agora até fevereiro de 2026, a WEEX lança AI Wars: WEEX Alpha Awakens, o primeiro hackathon mundial de negociação de criptomoedas AI. Venha o seu UID e registre-se para o WEEX Global AI Trading Hackathon.

Novembro de 2025 Revisão do Mercado de Cripto: Correção de Preços, Redempções de ETFs e Evolução da Blockchain

Novembro de 2025 viu volatilidade pronunciada e uma correção estrutural dentro do ecossistema blockchain mais amplo, impulsionado principalmente por previsões macroeconômicas flutuantes e dinâmicas específicas de fluxo de capital.

WEEX lança Hackathon Global de Negociação de IA com $880,000 Prize Pool e Bentley para Campeão

Guerras AI: WEEX Alpha Awakens é mais do que uma competição — é um palco global onde a inovação, a estratégia e o domínio algorítmico convergem. Desde a pré-inscrição até as finais ao vivo em Dubai, os participantes irão navegar pela volatilidade real do mercado, enfrentar desafios extremos e mostrar suas habilidades de negociação de IA para recompensas sem precedentes. Com prêmios de US$ 880.000, incentivos do WXT, um Bentley Bentayga S para o campeão e o apoio de parceiros líderes da indústria, este evento reforça a visão estratégica da WEEX para liderar a negociação impulsionada por IA, expandir sua influência global e cultivar uma comunidade de inovadores de ponta. A arena está aberta – a WEEX chama equipes ambiciosas em todo o mundo para se juntarem, competirem e moldarem a próxima era de negociação de criptomoedas impulsionada por IA.

WEEXPERIENCE Whales Night: Inteligência Artificial, Crypto Community & Crypto Market Insights

Em 12 de dezembro de 2025, a WEEX sediou a WEEXPERIENCE Whales Night, uma reunião da comunidade offline projetada para reunir membros da comunidade local de criptomoedas. O evento combinou compartilhamento de conteúdo, jogos interativos e apresentações de projetos para criar uma experiência offline relaxada e envolvente.

Riscos de negociação de IA em criptomoedas: Por que melhores estratégias de negociação de criptomoedas podem gerar maiores perdas?

O risco já não reside principalmente em má tomada de decisão ou erros emocionais. Vive cada vez mais na estrutura de mercado, caminhos de execução e comportamento coletivo. Entender essa mudança é mais importante do que encontrar a próxima estratégia “melhor”.

Agentes de IA estão substituindo a pesquisa de criptografia? Como a IA autônoma está reformulando o Crypto Trading

A IA está passando de auxiliar os comerciantes para automatizar todo o processo de pesquisa até execução nos mercados de criptomoedas. A vantagem mudou de insights humanos para tubulações de dados, velocidade e sistemas de IA prontos para execução, tornando os atrasos na integração de IA uma desvantagem competitiva.

Bots de negociação de IA e Copy Trading: Como estratégias sincronizadas reformulam a volatilidade do mercado de criptomoedas

Os comerciantes de criptomoedas de varejo enfrentam há muito os mesmos desafios: má gestão de risco, entradas atrasadas, decisões emocionais e execução inconsistente. As ferramentas de negociação AI prometeram uma solução. Hoje em dia, sistemas de negociação de cópia e bots de breakout apoiados por IA ajudam os comerciantes a dimensionar posições, definir paradas e agir mais rápido do que nunca. Além da velocidade e precisão, essas ferramentas estão silenciosamente reformulando os mercados - os traders não estão apenas negociando mais inteligentemente, eles estão se movendo em sincronia, criando uma nova dinâmica que amplifica tanto o risco quanto as oportunidades.

Trading de IA em Crypto Explicado: Como a negociação autónoma está reformulando os mercados de criptomoedas e as bolsas de criptomoedas

O AI Trading está rapidamente transformando a criptografia. As estratégias tradicionais lutam para acompanhar a volatilidade sem parar da criptomoeda e a complexa estrutura de mercado, enquanto a IA pode processar dados maciços, gerar estratégias adaptativas, gerenciar riscos e executar operações de forma autónoma. Este artigo orienta os usuários da WEEX pelo que é o trading de IA, por que a criptografia acelera sua adoção, como a indústria está evoluindo para agentes autônomos e por que a WEEX está construindo o ecossistema de negociação de IA da próxima geração.

Call to Join AI Wars: WEEX Alpha Awakens — Competição Global de Negociação de IA com $880,000 Prize Pool

Agora, estamos chamando comerciantes de IA de todo o mundo para se juntarem a AI Wars: WEEX Alpha Awakens, uma competição global de negociação de IA com um pool de prêmios de US$ 880.000.

Moedas populares

Últimas notícias cripto

Apoio ao cliente:@weikecs

Cooperação empresarial:@weikecs

Trading quant. e criação de mercados:[email protected]

Serviços VIP:[email protected]