What is the secret behind XRP's surging price?

Original Article Title: Behind the XRP Breakout: Drivers and Dynamics

Original Article Author: KoreanDegen, Crypto Kol

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: The recent surge in XRP price has caught everyone's attention, resulting from a combination of multiple factors such as a technical breakout, renewed interest from Korean investors (along with the dismissal of the SEC lawsuit and the WisdomTree S-1 filing), and the absence of historical sell pressures from figures like Jed McCaleb. These factors together drove demand for XRP, leading to exceptional market performance.

Below is the original content (slightly reorganized for better readability):

The recent breakout of XRP has unveiled a complex interaction between technicals, market structure, and regional dynamics.

Market Background

On November 10, XRP surged above around $0.55, decisively breaking through the 100-week, 200-week, and 350-week moving averages.

Perpetual Contract CVD: Decreasing.

Open Interest Volume: Increasing.

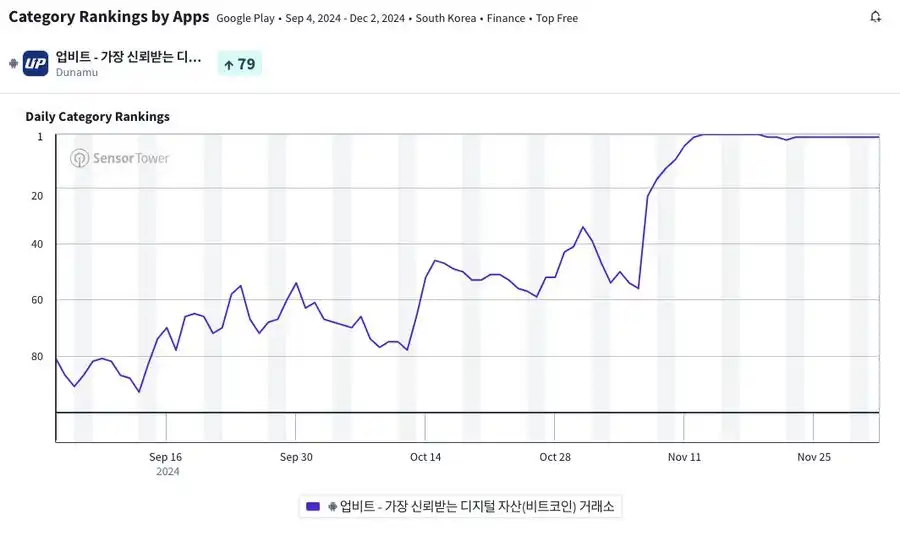

Simultaneously, Upbit's rankings on the App Store and Play Store started rising. The intersection of these factors hinted at brewing market activity.

November 12: Inflection Point

Upbit claimed the top spot in the Play Store rankings, considering Korea's user demographic — primarily older investors aged 50 to 60, predominantly on Android devices with Samsung holding a dominant position — this signal was particularly significant.

With the surge in demand, XRP crossed the ₩1,000 Korean Won mark (around $0.71). Arbitrageurs swiftly adjusted the market imbalance, leading to a significant number of short positions being liquidated.

Supply Void

In previous cycles, Jed McCaleb's continuous selling constrained XRP's upward momentum. However, this time he no longer has more coins to sell.

Structural Breakthrough

Only the historical charts of Bitstamp and Upbit can be traced back to 2017, showing a six-year continuous diagonal breakthrough. Meanwhile, Upbit's overwhelming advantage in spot trading volume has become a symbol of South Korea's investment enthusiasm.

Characteristics of the Demand Group

According to a recent report by the "Hankyung News," the role of older South Korean investors in the crypto market is becoming increasingly prominent:

Since 2021, the number of crypto accounts held by individuals aged 60 and above has increased by 30% (+188,000 new accounts).

The group of individuals aged 50 and above has seen a 22.5% increase in accounts (+356,000 accounts).

By September 2024, individuals aged 60 and above collectively hold $4.8 billion in crypto assets.

This demographic shift indicates that older investors, particularly in South Korea, have played a key role in driving XRP demand.

Article Link: Hankyung Article

Broader Context

While South Korea's trading volume is a major factor, it is not the sole driving force. Other exchanges, such as Coinbase and Robinhood, have also contributed to XRP's surge. Currently, XRP's spot trading volume has exceeded $6.6 billion.

This is not just a regular uptrend. It is a convergence of the following factors:

1. Key Technological Breakthrough.

2. Retail Investors, especially Korean investors, regained interest (subsequently further fueled by SEC lawsuit dismissal and WisdomTree S-1 filing).

3. Major historical sell pressure sources like Jed McCaleb's supply absence.

When causality and multiple factors collide, the result is often extraordinary.

Você também pode gostar

Preliminary Round Participant Insights — AOT Matrix: Análise do cérebro esquerdo, decisões do cérebro direito no comércio de IA

No WEEX AI Trading Hackathon, a AOT Matrix escolheu um caminho mais cauteloso no design do sistema - um que é realmente mais difícil de arrancar em um ambiente de negociação ao vivo. Desde o início, eles fizeram escolhas claras sobre o papel que a IA deveria e não deveria desempenhar no sistema de negociação. Entrevistamos a AOT Matrix sobre sua lógica de tomada de decisão, as múltiplas iterações de sua arquitetura de sistema, e como é implementá-lo sob o ambiente de negociação real da WEEX e limitações de engenharia.

Por que os tokens de IA estão crescendo mais rápido do que o mercado mais amplo de criptomoedas

Os tokens de IA estão superando o desempenho — e não silenciosamente. Bitcoin está em movimento. Ethereum está segurando terreno. No entanto, alguns dos ganhos relativos mais fortes vêm de tokens etiquetados com IA, não majors, nem memes. À primeira vista, isso parece intuitivo. AI é tecnologia real. Ele está moldando indústrias muito além da criptografia. Mas os mercados raramente se movem apenas pela intuição — especialmente não tão rápido. Quando os preços aceleram antes da adoção, a pergunta mais útil não é “A IA é importante?” É a versão da história da IA que o mercado está comprando – agora.

Atualização de mercado — 7 de janeiro

Bitmine investiu mais 28 mil Ethereum, no valor de cerca de 91,16 milhões de dólares.

Deixando para trás os primeiros dias caóticos, criadores de mercado de criptomoedas estão celebrando sua chegada de idade

A luta de vida ou morte para criadores de mercado de criptomoedas é como uma evolução de espécies em condições extremas.

Por que os bots de negociação de IA estão se tornando essenciais nos mercados de criptomoedas 24/7.

Os mercados de criptomoedas operam continuamente e se movem mais rápido do que a atenção humana pode sustentar de forma confiável. Os preços reagem instantaneamente a eventos globais, mudanças de liquidez entre regiões e oportunidades negociáveis muitas vezes existem por minutos em vez de horas. Para muitos comerciantes, o desafio central já não é gerar ideias, mas executar decisões de forma consistente sem monitoramento constante ou interferência emocional. É aqui que os robôs de negociação de IA são cada vez mais adotados – não como garantias de lucro, mas como ferramentas projetadas para traduzir estratégias predefinidas em execução confiável e repetível.

AI Crypto Trading Competition: Guia completo para conhecer o WEEX Alpha Awakens

A integração da inteligência artificial no comércio de criptomoedas evoluiu de um experimento inovador para um utilitário de núcleo. Em 2026, as ferramentas orientadas por IA tornaram-se indispensáveis para os traders que buscam disciplina aprimorada, velocidade de execução superior e tomada de decisão estruturada e baseada em dados em meio à volatilidade do mercado. Este guia fornece um desdobramento prático, passo a passo de como participar do WEEX Alpha Awakens, com um exame focado de como essas estratégias são implementadas dentro de ambientes de negociação ao vivo.

As linhas K da vida não podem curar a ansiedade, e os mercados de previsão não podem calcular o fim.

A vida real muitas vezes se desenrola além das linhas K.

Como a IA ajuda os traders de criptomoedas a analisar os mercados, gerenciar o risco e negociar de forma mais inteligente

Negociação de criptomoedas já não é apenas sobre ter uma boa ideia - é sobre executar consistentemente em um mercado que nunca pára. À medida que os volumes de dados e a velocidade do mercado aumentam, a análise manual tradicional atinge seus limites. A IA ajuda os traders a ultrapassar esses limites transformando a forma como os mercados são analisados, como o sentimento é interpretado e como o risco é controlado. Este artigo explora como a IA está reformulando o comércio de criptomoedas – e o que isso significa para os traders hoje.

WEEX × LALIGA: Sete estrelas que representam um padrão comum de excelência

A verdadeira excelência no futebol nunca é acidental. É construído sobre disciplina, consistência e capacidade de entregar sob pressão – temporada após temporada. Os mesmos princípios se aplicam na negociação profissional, onde o desempenho a longo prazo importa mais do que o impulso de curta duração. Como parceiro regional oficial da LALIGA, a WEEX destaca sete jogadores notáveis que encarnam o espírito competitivo da liga e o apelo global. Cada um traz um estilo único ao palco, mas todos compartilham valores que se alinham estreitamente com o compromisso da WEEX com estabilidade, precisão e execução profissional. Esta parceria é construída sobre padrões compartilhados – onde consistência e controle definem o desempenho sob pressão.

De Wuhan ao Vale do Silício, Manus conseguiu isso em apenas nove meses.

Você pode chamá-lo de um “envelope”, mas envolveu seu caminho até Meta.

A WEEX faz parceria com a LALIGA para expandir o alcance global e integrar a criptomoeda na cultura esportiva mainstream

Hong Kong, 1 de janeiro de 2026. A WEEX entrou em nova parceria com a LALIGA, como parceira regional oficial da LALIGA em Taiwan e Hong Kong. O acordo traz a WEEX para a rede de colaboradores regionais da LALIGA e abre a porta para novas formas de envolver fãs e comerciantes durante a temporada.

Negociação de IA em Crypto: Como os traders aplicam a IA nos mercados reais de criptomoedas

A inteligência artificial passou para além da experimentação nos mercados de criptomoedas. Em 2025, as ferramentas de negociação impulsionadas por IA são cada vez mais usadas por traders que querem uma melhor disciplina, execução mais rápida e tomada de decisão mais estruturada em mercados voláteis. Este guia explica como a IA é realmente usada na negociação de criptomoedas, passo a passo - com foco em como essas estratégias são executadas em ambientes de negociação reais.

Atualização do mercado — 31 de dezembro

Desde a Coréia do Sul e a OCDE acelerando a implementação de quadros de regulamentação e conformidade de criptomoedas, ao desenvolvimento simultâneo de ETFs TAO, tecnologias de privacidade, mineração e reservas de Bitcoin, enquanto os incidentes de segurança e perdas financeiras continuam a aumentar, o mercado de criptomoedas entrou em uma nova fase em meio a múltiplos desafios de "regulação forte + evolução tecnológica + riscos amplificados".

Quando todos usam AI Trading, para onde vai a Cryptocurrency Alpha em 2026?

Em 2025, o comércio de IA tornou-se o padrão, mas o Alpha não desapareceu — ele foi erodido pela multidão, já que dados, modelos e estratégias semelhantes fazem com que os comerciantes agam de forma sincronizada e perdem sua vantagem.

O Real Alpha mudou para camadas mais difíceis de copiar, como dados comportamentais e em cadeia, qualidade de execução, gerenciamento de risco e julgamento humano em mercados extremos, onde agir de forma diferente - ou não agir de forma alguma - importa mais do que melhores previsões.

Atualização do mercado — 30 de dezembro

Brevis abre o rastreamento de aterragens; Trend Research adiciona mais de 46.000 ETH em um único dia.

Dez pessoas redefinindo os limites do poder da criptomoeda em 2025

De Wall Street à Casa Branca, do Vale do Silício a Shenzhen, uma nova rede de energia está se formando.

Mesmo Satoshi Nakamoto teria que prestar homenagem ao Deus da Riqueza.

Feng shui se tornou a última linha de defesa psicológica.

WEEXPERIENCE Whales Night: Inteligência Artificial, Crypto Community & Crypto Market Insights

Em 12 de dezembro de 2025, a WEEX sediou a WEEXPERIENCE Whales Night, uma reunião da comunidade offline projetada para reunir membros da comunidade local de criptomoedas. O evento combinou compartilhamento de conteúdo, jogos interativos e apresentações de projetos para criar uma experiência offline relaxada e envolvente.

Preliminary Round Participant Insights — AOT Matrix: Análise do cérebro esquerdo, decisões do cérebro direito no comércio de IA

No WEEX AI Trading Hackathon, a AOT Matrix escolheu um caminho mais cauteloso no design do sistema - um que é realmente mais difícil de arrancar em um ambiente de negociação ao vivo. Desde o início, eles fizeram escolhas claras sobre o papel que a IA deveria e não deveria desempenhar no sistema de negociação. Entrevistamos a AOT Matrix sobre sua lógica de tomada de decisão, as múltiplas iterações de sua arquitetura de sistema, e como é implementá-lo sob o ambiente de negociação real da WEEX e limitações de engenharia.

Por que os tokens de IA estão crescendo mais rápido do que o mercado mais amplo de criptomoedas

Os tokens de IA estão superando o desempenho — e não silenciosamente. Bitcoin está em movimento. Ethereum está segurando terreno. No entanto, alguns dos ganhos relativos mais fortes vêm de tokens etiquetados com IA, não majors, nem memes. À primeira vista, isso parece intuitivo. AI é tecnologia real. Ele está moldando indústrias muito além da criptografia. Mas os mercados raramente se movem apenas pela intuição — especialmente não tão rápido. Quando os preços aceleram antes da adoção, a pergunta mais útil não é “A IA é importante?” É a versão da história da IA que o mercado está comprando – agora.

Atualização de mercado — 7 de janeiro

Bitmine investiu mais 28 mil Ethereum, no valor de cerca de 91,16 milhões de dólares.

Deixando para trás os primeiros dias caóticos, criadores de mercado de criptomoedas estão celebrando sua chegada de idade

A luta de vida ou morte para criadores de mercado de criptomoedas é como uma evolução de espécies em condições extremas.

Por que os bots de negociação de IA estão se tornando essenciais nos mercados de criptomoedas 24/7.

Os mercados de criptomoedas operam continuamente e se movem mais rápido do que a atenção humana pode sustentar de forma confiável. Os preços reagem instantaneamente a eventos globais, mudanças de liquidez entre regiões e oportunidades negociáveis muitas vezes existem por minutos em vez de horas. Para muitos comerciantes, o desafio central já não é gerar ideias, mas executar decisões de forma consistente sem monitoramento constante ou interferência emocional. É aqui que os robôs de negociação de IA são cada vez mais adotados – não como garantias de lucro, mas como ferramentas projetadas para traduzir estratégias predefinidas em execução confiável e repetível.

AI Crypto Trading Competition: Guia completo para conhecer o WEEX Alpha Awakens

A integração da inteligência artificial no comércio de criptomoedas evoluiu de um experimento inovador para um utilitário de núcleo. Em 2026, as ferramentas orientadas por IA tornaram-se indispensáveis para os traders que buscam disciplina aprimorada, velocidade de execução superior e tomada de decisão estruturada e baseada em dados em meio à volatilidade do mercado. Este guia fornece um desdobramento prático, passo a passo de como participar do WEEX Alpha Awakens, com um exame focado de como essas estratégias são implementadas dentro de ambientes de negociação ao vivo.