Week 48 On-chain Data: Market in Good Shape, Poised for Next Movement

Original Article Title: "Hesitation and Consolidation, Is the Market's Buying Power Still Here? | WTR 12.2"

Original Source: WTR Research Institute

Weekly Review

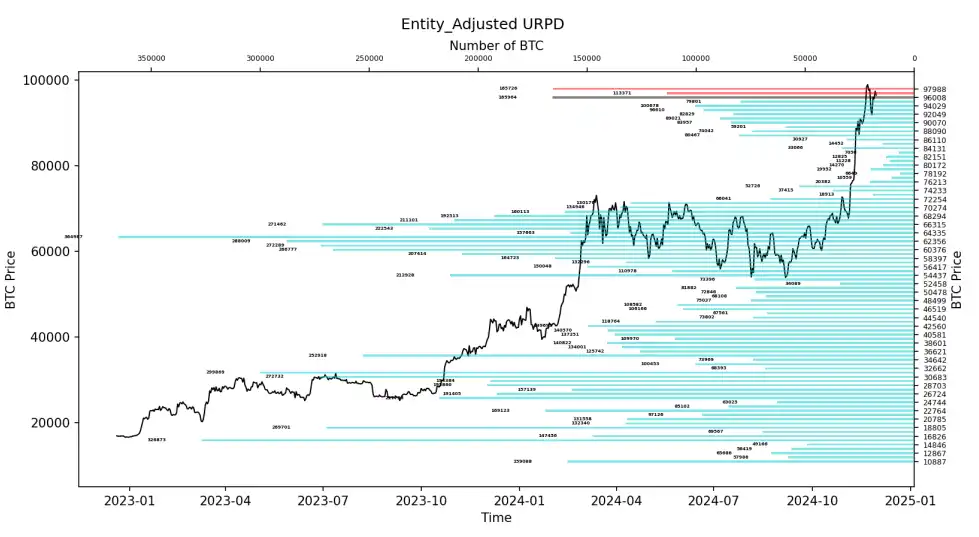

For the week from November 25th to December 2nd, the highest price of Bitcoin reached near $98,871, and the lowest approached $90,791, with a fluctuation range of about 8.17%. Looking at the chip distribution chart, there was a significant amount of chips traded around 96,000, providing some support or resistance.

• Analysis:

1. 2.24 million coins around 60,000-68,000;

2. 970,000 coins around 90,000-97,000;

• The probability of not breaking below 87,000 to 91,000 in the short term is 70%;

• The probability of not breaking above 100,000 to 105,000 in the short term is 60%.

Important News

Economic News

1. According to CME's "FedWatch": The probability of the Fed maintaining the current interest rate by December is 32.9%, and the cumulative probability of a 25 basis point rate cut is 67.1%.

2. J.P. Morgan's trading team believes the S&P 500 could reach close to 6,300 points by year-end.

3. New York Fed President Williams: Inflation is above the 2% target. Over time, it will be appropriate to allow rates to return to a neutral level.

4. German union confirms: About 66,000 Volkswagen workers are participating in a strike.

5. Intel CEO Pat Gelsinger is forced to leave the company, as the previous board lost confidence in his plan to turn the company around.

Crypto Ecosystem News

1. Coinbase's Chief Policy Officer: Expects rapid cryptocurrency regulation in the U.S. after Trump takes office.

2. Analyst Fournier points out, "The profit-taking phenomenon is evident, and a massive sell wall of over 4,000 bitcoins, approximately $384 million, must be cleared for a higher price to be reached.

3. 10x Research stated in a recent report that Bitcoin balances on cryptocurrency exchanges have reached an all-time low, and on-chain data indicates a sharp decline in the available Bitcoin for purchase.

4. Ethereum Price Rebound Drives NFT Market Recovery, with NFT Sales in November Reaching the Highest Value in Almost Six Months.

5. Hong Kong SFC: Licensing of Virtual Asset Trading Platforms in Hong Kong to be Announced by End of Year.

6. On November 30, according to Farside Investors data, yesterday's net inflow into the U.S. Ethereum spot ETF was $332 million, marking the first time in history that it exceeded the Bitcoin spot ETF (which was $320 million yesterday).

7. Trump Nominates 5 "Cryptocurrency Players" as New Government Cabinet Picks.

Long-term Insights: Used to observe our long-term situation; Bull Market / Bear Market / Structural Changes / Neutral State.

Mid-term Exploration: Used to analyze the current stage we are in, how long this stage will continue, and what circumstances we will face.

Short-term Observations: Used to analyze short-term market conditions; as well as the appearance of trends and the likelihood of certain events under certain conditions.

Long-term Insights

• Exchange Whale Transfers

• ETF Fund Reserve Flows

• U.S. Session Buying Power

• Whale Status

(See Exchange Whale Transfers chart below)

Large exchanges transfers indicate that many high-net-worth participants are still showing a significant buying interest.

(See ETF Fund Reserve Flows chart below)

ETF fund reserves have returned to a positive direction, but not as dramatically and fiercely as before. The overall market sentiment is still relatively positive.

(See U.S. Session Buying Power chart below)

U.S. session buying power is trending positively, with a strong atmosphere in the Americas.

(See Whale Status chart below)

Whales continue to make purchases. Apart from a slightly increased pressure, the overall market is still being supported by relatively strong new entrants and buying power.

Mid-term Exploration

• Network Sentiment Positivity

• Whale Buying Power Composite Score

• USDC Buying Power Composite Score

• WTR Risk Observation Indicator 1

• ETF Channel Fund Inflow-Outflow Changes

(Network Sentiment Positivity)

Recently, there has been a noticeable decline in network sentiment, with the current value continuously decreasing. It is possible that overall on-chain transaction enthusiasm has decreased.

(Whale Comprehensive Score Model)

Whales still show a high score performance, indicating they may still have a strong holding intention, and the overall group's participation enthusiasm is high.

(USDC Buying Power Comprehensive Score)

USDC's buying power remains very strong, with a high score even during high volatility periods. U.S. session users may not have a collective intention to exit the current market.

(Risk Observation Index 1)

Comparing the risk between BTC and ETH, the current hidden risk within the market may still be concentrated on ETH. The recent rapid rise in ETH's risk coefficient may be a challenge the market needs to face.

(ETF Channel Fund Flow Changes)

The fund flow in the ETF channel has slowed down, with relatively cautious participation. The current market pace may experience an overall contraction, waiting for a significant turning point with momentum.

Short-Term Observation

• Derivative Risk Coefficient

• Options Intent-to-Trade Ratio

• Derivatives Trading Volume

• Options Implied Volatility

• Profit and Loss Transfer Amount

• New and Active Addresses

• Exchange Net Long/Short Ratio

• Ape1 Exchange Net Long/Short Ratio

• Heavy Selling Pressure

• Global Buying Power Status

• Stablecoin Exchange Net Long/Short Ratio

• Off-chain Exchange Data

Derivatives Rating: The risk coefficient is in the red zone, indicating an increase in derivative risk.

(Derivative Risk Coefficient)

Last week, the market was more inclined towards consolidation, with the risk coefficient close to the neutral zone. This week, the market still relies more on incremental changes, and derivatives have a relatively small impact on the market.

(Options Intent-to-Trade Ratio)

Put Option Sentiment is high, while trading volume is at a moderate level.

(Derivatives Trading Volume Chart)

Last week, it was mentioned to wait for the market to see the next move when derivative trading volume is low. After a small pullback last week, the trading volume has once again dropped to a low level, indicating that a new round of volatility is expected this week.

(Implied Volatility of Options Chart)

The implied volatility of options has not changed much.

Sentiment Status Rating: Neutral

(Profit/Loss Transfer Amount Chart)

Market sentiment has shifted from last week's greed to a neutral zone.

Positive market sentiment has slightly decreased, and panic sentiment has not risen significantly, indicating that the market is still in a healthy state.

(New and Active Address Chart)

New and active addresses are at a high level.

Spot Market and Selling Pressure Structure Rating: BTC is in a state of significant outflows, while ETH has overall cumulative inflows.

(Exchange Net Flows of BTC)

BTC exchange net flows continue to show significant outflows accumulation.

(Exchange Net Flows of ETH)

ETH exchange net flows, although showing some outflows, are still in an overall inflow accumulation status.

(High Weighted Selling Pressure)

Selling pressure from old addresses has eased slightly.

Buy Pressure Rating: Global Buy Pressure and Stablecoin Buy Pressure remain stable compared to last week, both in a positive recovery state.

(Global Buy Pressure Status Chart)

Global purchasing power is basically unchanged from last week.

(See USDC Exchange Net Headroom chart below)

Stablecoin purchasing power is at a similar level to last week, showing a positive rebound.

Off-chain Transaction Data Rating: Buying interest at 94000; Selling interest at 100000.

(See Coinbase Off-chain Data chart below)

Buying interest is seen around 84000-90000 and 94000;

Selling interest is seen around 100000.

(See Binance Off-chain Data chart below)

Buying interest is seen around 84000-90000;

Selling interest is seen around 100000.

(See Bitfinex Off-chain Data chart below)

Buying interest is seen around 84000-90000;

Selling interest is seen around 100000.

Weekly Summary

News Highlights

1. September 2024 became the fourth-largest rate-cutting month of the century, with a total of 26 central banks worldwide implementing rate-cutting policies.

2. This trend continued into November, marking a new phase in global monetary policy.

3. Looking ahead to 2025, the market generally expects the Federal Reserve to further cut rates by 1-1.5 percentage points.

4. Against this backdrop, major central banks worldwide may follow the Fed's lead to further improve the liquidity environment.

5. Optimism remains for the performance of the capital markets in 2025.

On-chain Long-term Insights:

1. Large exchanges' transfer of funds still indicates significant buying interest;

2. ETF fund reserve flows show a slight warming up of market buying interest;

3. Positive and Active Buying Power in the U.S. Session;

4. Whales' Leaders are Relatively Positive Buyers.

• Market Tone:

Buying support continues, needing to absorb the profit-taking pressure from long-term participants that occurred previously.

On-chain Medium-term Exploration:

1. Decline in on-chain participation enthusiasm;

2. Whale community still has a high willingness to hold;

3. U.S. userbase did not show a collective withdrawal phenomenon;

4. Current risk mainly concentrated on ETH;

5. ETF inflows have become cautious.

• Market Tone:

Cautious

The current phase is likely a moderation stage, with high on-chain key group participation enthusiasm, but overall participants have become somewhat cautious.

On-chain Short-term Observation:

1. Risk coefficient is in the red zone, derivative risk is increasing;

2. New active addresses are at a high level, market activity is high;

3. Market sentiment rating: Neutral;

4. Exchange net leaders overall show BTC in a large outflow state, with ETH in overall accumulation;

5. Global buying power and stablecoin buying power are steady compared to last week, both in a positive rebound state;

6. Off-chain transaction data shows willingness to buy at 94,000; willingness to sell at 100,000;

7. There is a 70% probability that the short-term price will not fall below 87,000 to 91,000; with a 60% probability that the short-term price will not rise above 100,000 to 105,000.

• Market Tone:

Market positive sentiment has shifted from high to neutral, and the overall short-term market status is good. The next wave is building up.

Risk Warning: The above is all market discussion and exploration, not directional opinions for investment; please handle with caution and beware of market black swan risks.

This article is contributed content and does not represent the views of BlockBeats.

Bạn cũng có thể thích

Để lại những ngày đầu hỗn loạn, các nhà sản xuất thị trường tiền điện tử đang ăn mừng sự ra đời của họ

Cuộc đấu tranh sống hay chết cho các nhà sản xuất thị trường tiền điện tử giống như sự tiến hóa loài trong điều kiện cực đoan.

Tại sao AI Trading Bots đang trở nên cần thiết trong 24/7 Crypto Markets

Thị trường tiền điện tử hoạt động liên tục và di chuyển nhanh hơn so với sự chú ý của con người có thể duy trì một cách đáng tin cậy. Giá phản ứng ngay lập tức với các sự kiện toàn cầu, chuyển động thanh khoản giữa các khu vực, và các cơ hội có thể giao dịch thường tồn tại trong vài phút thay vì vài giờ. Đối với nhiều nhà giao dịch, thách thức cốt lõi không còn là tạo ra ý tưởng, mà là thực hiện các quyết định liên tục mà không có sự giám sát liên tục hoặc can thiệp cảm xúc. Đây là nơi mà AI trading bots đang ngày càng được áp dụng - không phải là bảo đảm lợi nhuận, mà là công cụ được thiết kế để dịch các chiến lược được xác định trước thành thực hiện đáng tin cậy, có thể lặp lại.

Chiến dịch giao dịch mã hóa AI: Trang chủ » WEEX Alpha Awakens

Việc tích hợp trí tuệ nhân tạo vào giao dịch tiền mã hóa đã phát triển từ một thí nghiệm mới thành một tiện ích cốt lõi. Vào năm 2026, các công cụ được thúc đẩy bởi AI đã trở nên cần thiết cho các nhà giao dịch tìm kiếm kỷ luật nâng cao, tốc độ thực hiện vượt trội và ra quyết định có cấu trúc, dựa trên dữ liệu trong bối cảnh thị trường bất ổn. Hướng dẫn này cung cấp một mô tả thực tiễn, từng bước về cách tham gia WEEX Alpha Awakens, với một cuộc kiểm tra tập trung về cách các chiến lược này được thực hiện trong môi trường giao dịch trực tiếp.

Các K-line của cuộc sống không thể chữa khỏi lo âu, và các thị trường dự đoán không thể tính toán kết thúc.

Cuộc sống thực sự thường diễn ra bên ngoài K-line.

Làm thế nào AI giúp các nhà giao dịch tiền mã hóa phân tích thị trường, quản lý rủi ro và giao dịch thông minh hơn

Giao dịch crypto không còn là chỉ có một ý tưởng tốt - nó là về việc thực hiện liên tục trong một thị trường không bao giờ dừng lại. Khi khối lượng dữ liệu và tốc độ thị trường tăng lên, phân tích thủ công truyền thống đạt đến giới hạn. AI giúp các nhà giao dịch vượt quá những giới hạn này bằng cách thay đổi cách phân tích thị trường, cách diễn giải tình cảm và cách kiểm soát rủi ro. Bài viết này khám phá cách AI đang định hình lại giao dịch tiền mã hóa - và điều đó có ý nghĩa gì đối với các nhà giao dịch ngày nay.

WEEX × LALIGA: Bảy ngôi sao đại diện cho một tiêu chuẩn chung của sự xuất sắc

Sự xuất sắc trong bóng đá không bao giờ là ngẫu nhiên. Nó được xây dựng trên kỷ luật, nhất quán, và khả năng cung cấp dưới áp lực - mùa sau mùa. Các nguyên tắc tương tự áp dụng trong giao dịch chuyên nghiệp, nơi hiệu suất dài hạn quan trọng hơn động lực ngắn hạn. Là một đối tác chính thức của LALIGA, WEEX làm nổi bật bảy cầu thủ xuất sắc thể hiện tinh thần cạnh tranh của giải đấu và sức hấp dẫn toàn cầu. Mỗi phong cách mang đến một phong cách độc đáo cho sân, nhưng tất cả đều chia sẻ các giá trị phù hợp chặt chẽ với cam kết của WEEX đối với sự ổn định, chính xác và thực hiện chuyên nghiệp. Quan hệ đối tác này được xây dựng trên các tiêu chuẩn chung - nơi sự nhất quán và kiểm soát xác định hiệu suất dưới áp lực.

Từ Wuhan đến Thung lũng Silicon, Manus đã làm điều đó chỉ trong chín tháng.

Bạn có thể gọi nó là một “bọc”, nhưng nó đã bao bọc con đường của nó cho đến Meta.

WEEX hợp tác với LALIGA để mở rộng phạm vi toàn cầu và tích hợp Crypto vào văn hóa thể thao chủ đạo

Hong Kong, ngày 1 tháng 1 năm 2026. WEEX đã ký hợp tác mới với LALIGA, là đối tác khu vực chính thức của LALIGA tại Đài Loan và Hong Kong. Thỏa thuận này đưa WEEX vào mạng lưới cộng tác viên khu vực của LALIGA và mở ra cánh cửa cho các cách mới để thu hút cả người hâm mộ và thương nhân trong mùa giải.

Giao dịch AI trong Crypto: Làm thế nào các nhà giao dịch thực sự áp dụng AI trong thị trường crypto thực sự

Trí tuệ nhân tạo đã vượt ra ngoài thử nghiệm trong thị trường crypto. Năm 2025, các công cụ giao dịch do AI thúc đẩy ngày càng được sử dụng bởi các nhà giao dịch muốn có kỷ luật tốt hơn, thực thi nhanh hơn và ra quyết định có cấu trúc hơn trong các thị trường bất ổn. Hướng dẫn này giải thích cách AI thực sự được sử dụng trong giao dịch tiền mã hóa, từng bước - với trọng tâm về cách các chiến lược này được thực hiện trong môi trường giao dịch thực tế.

Cập nhật thị trường — 31 tháng 12

Từ Hàn Quốc và OECD đẩy nhanh việc thực hiện các khuôn khổ quy định và tuân thủ tiền mã hóa, đến sự phát triển đồng thời của ETF TAO, công nghệ bảo mật, khai thác và dự trữ Bitcoin, trong khi các sự cố an ninh và tổn thất tài chính tiếp tục tăng, thị trường tiền mã hóa đã bước vào một giai đoạn mới trong bối cảnh nhiều thách thức của "quy định mạnh + tiến hóa công nghệ + rủi ro gia tăng".

Khi mọi người sử dụng giao dịch AI, Cryptocurrency Alpha sẽ đi đâu vào năm 2026?

Trong năm 2025, giao dịch AI đã trở thành mặc định, nhưng Alpha đã không biến mất - nó đã bị xói mòn bởi sự đông đúc, khi dữ liệu, mô hình và chiến lược tương tự khiến các nhà giao dịch hành động đồng bộ và mất lợi thế.

Real Alpha đã chuyển sang các lớp khó sao chép hơn như dữ liệu hành vi và trên chuỗi, chất lượng thực hiện, quản lý rủi ro và phán đoán của con người ở các thị trường cực đoan, nơi hành động khác biệt - hoặc không hành động - quan trọng hơn so với dự đoán tốt hơn.

Cập nhật thị trường — 30/12

Brevis mở theo dõi AirDrop; Trend Research thêm hơn 46.000 ETH trong một ngày duy nhất.

Ten People Redefining the Power Boundaries of Crypto in 2025

Từ Wall Street đến Nhà Trắng, từ Thung lũng Silicon đến Thâm Quyến, một mạng lưới điện mới đang hình thành.

Ngay cả Satoshi Nakamoto cũng phải tôn vinh Thần Giàu.

Feng shui đã trở thành đường phòng thủ tâm lý cuối cùng.

WEEXPERIENCE Whales Night: AI Trading, Crypto Community & Crypto Market Insights

Vào ngày 12 tháng 12 năm 2025, WEEX đã tổ chức WEEXPERIENCE Whales Night, một cuộc họp cộng đồng ngoại tuyến được thiết kế để tập hợp các thành viên cộng đồng cryptocurrency địa phương. Sự kiện kết hợp chia sẻ nội dung, trò chơi tương tác và bản trình bày dự án để tạo ra trải nghiệm ngoại tuyến thoải mái nhưng hấp dẫn.

Rủi ro giao dịch AI trong tiền mã hóa: Tại sao các chiến lược giao dịch tiền mã hóa tốt hơn có thể tạo ra tổn thất lớn hơn?

Rủi ro không còn nằm chủ yếu trong việc đưa ra quyết định kém hoặc sai lầm về cảm xúc. Nó ngày càng sống trong cấu trúc thị trường, con đường thực thi, và hành vi tập thể. Hiểu được sự thay đổi này quan trọng hơn là tìm ra chiến lược “tốt hơn” tiếp theo.

Các đại lý AI đang thay thế Nghiên cứu Crypto? Làm thế nào AI tự trị đang định hình lại giao dịch crypto

AI đang chuyển từ việc hỗ trợ các nhà giao dịch sang tự động hóa toàn bộ quá trình nghiên cứu đến thi hành trong thị trường tiền điện tử. Lợi thế đã chuyển từ kiến thức của con người sang đường ống dẫn dữ liệu, tốc độ và các hệ thống AI sẵn sàng để thực hiện, làm cho sự chậm trễ trong tích hợp AI trở thành một nhược điểm cạnh tranh.

Bot giao dịch AI và Giao dịch sao chép: Cách các chiến lược đồng bộ hóa định hình lại sự biến động của thị trường crypto

Các nhà giao dịch crypto bán lẻ từ lâu đã phải đối mặt với những thách thức tương tự: quản lý rủi ro kém, đăng ký muộn, quyết định về cảm xúc và thực thi không nhất quán. Các công cụ giao dịch AI hứa hẹn một giải pháp. Ngày nay, các hệ thống giao dịch sao chép và robot breakout được hỗ trợ bởi AI giúp các nhà giao dịch kích thước vị trí, đặt điểm dừng và hành động nhanh hơn bao giờ hết. Ngoài tốc độ và độ chính xác, các công cụ này đang thay đổi thị trường một cách im lặng - các nhà giao dịch không chỉ giao dịch thông minh hơn, họ đang di chuyển đồng bộ, tạo ra một động lực mới làm tăng cả rủi ro và cơ hội.

Để lại những ngày đầu hỗn loạn, các nhà sản xuất thị trường tiền điện tử đang ăn mừng sự ra đời của họ

Cuộc đấu tranh sống hay chết cho các nhà sản xuất thị trường tiền điện tử giống như sự tiến hóa loài trong điều kiện cực đoan.

Tại sao AI Trading Bots đang trở nên cần thiết trong 24/7 Crypto Markets

Thị trường tiền điện tử hoạt động liên tục và di chuyển nhanh hơn so với sự chú ý của con người có thể duy trì một cách đáng tin cậy. Giá phản ứng ngay lập tức với các sự kiện toàn cầu, chuyển động thanh khoản giữa các khu vực, và các cơ hội có thể giao dịch thường tồn tại trong vài phút thay vì vài giờ. Đối với nhiều nhà giao dịch, thách thức cốt lõi không còn là tạo ra ý tưởng, mà là thực hiện các quyết định liên tục mà không có sự giám sát liên tục hoặc can thiệp cảm xúc. Đây là nơi mà AI trading bots đang ngày càng được áp dụng - không phải là bảo đảm lợi nhuận, mà là công cụ được thiết kế để dịch các chiến lược được xác định trước thành thực hiện đáng tin cậy, có thể lặp lại.

Chiến dịch giao dịch mã hóa AI: Trang chủ » WEEX Alpha Awakens

Việc tích hợp trí tuệ nhân tạo vào giao dịch tiền mã hóa đã phát triển từ một thí nghiệm mới thành một tiện ích cốt lõi. Vào năm 2026, các công cụ được thúc đẩy bởi AI đã trở nên cần thiết cho các nhà giao dịch tìm kiếm kỷ luật nâng cao, tốc độ thực hiện vượt trội và ra quyết định có cấu trúc, dựa trên dữ liệu trong bối cảnh thị trường bất ổn. Hướng dẫn này cung cấp một mô tả thực tiễn, từng bước về cách tham gia WEEX Alpha Awakens, với một cuộc kiểm tra tập trung về cách các chiến lược này được thực hiện trong môi trường giao dịch trực tiếp.

Các K-line của cuộc sống không thể chữa khỏi lo âu, và các thị trường dự đoán không thể tính toán kết thúc.

Cuộc sống thực sự thường diễn ra bên ngoài K-line.

Làm thế nào AI giúp các nhà giao dịch tiền mã hóa phân tích thị trường, quản lý rủi ro và giao dịch thông minh hơn

Giao dịch crypto không còn là chỉ có một ý tưởng tốt - nó là về việc thực hiện liên tục trong một thị trường không bao giờ dừng lại. Khi khối lượng dữ liệu và tốc độ thị trường tăng lên, phân tích thủ công truyền thống đạt đến giới hạn. AI giúp các nhà giao dịch vượt quá những giới hạn này bằng cách thay đổi cách phân tích thị trường, cách diễn giải tình cảm và cách kiểm soát rủi ro. Bài viết này khám phá cách AI đang định hình lại giao dịch tiền mã hóa - và điều đó có ý nghĩa gì đối với các nhà giao dịch ngày nay.

WEEX × LALIGA: Bảy ngôi sao đại diện cho một tiêu chuẩn chung của sự xuất sắc

Sự xuất sắc trong bóng đá không bao giờ là ngẫu nhiên. Nó được xây dựng trên kỷ luật, nhất quán, và khả năng cung cấp dưới áp lực - mùa sau mùa. Các nguyên tắc tương tự áp dụng trong giao dịch chuyên nghiệp, nơi hiệu suất dài hạn quan trọng hơn động lực ngắn hạn. Là một đối tác chính thức của LALIGA, WEEX làm nổi bật bảy cầu thủ xuất sắc thể hiện tinh thần cạnh tranh của giải đấu và sức hấp dẫn toàn cầu. Mỗi phong cách mang đến một phong cách độc đáo cho sân, nhưng tất cả đều chia sẻ các giá trị phù hợp chặt chẽ với cam kết của WEEX đối với sự ổn định, chính xác và thực hiện chuyên nghiệp. Quan hệ đối tác này được xây dựng trên các tiêu chuẩn chung - nơi sự nhất quán và kiểm soát xác định hiệu suất dưới áp lực.