Bitcoin Surges Towards $120K, Analysts Foresee Heightened Volatility Ahead

Bitcoin has staged a dramatic late-week rally, propelling it towards the crucial $120,000 resistance level as the weekly close approaches. Market participants are bracing for potentially larger price swings, with key liquidation zones and significant trading behavior dominating analyst discussions.

Key Takeaways:

- BTC exhibits a strong late-week comeback, targeting significant liquidation zones and aiming to retake critical price areas.

- Traders and analysts highlight specific price points that Bitcoin must conquer to sustain upward momentum.

- Volatility is expected based on large-volume trading behavior, analysis reports.

Bitcoin Volatility Surges as Weekly Close Looms

Data reveals Bitcoin’s determined ascent, now approaching a pivotal resistance zone. The BTC/USD trading pair is attempting to secure a daily close above its 10-day Simple Moving Average (SMA). This rebound, stemming from lows near $114,500, marks a significant recovery, seemingly overshadowing the memory of one of the largest Bitcoin sales in history.

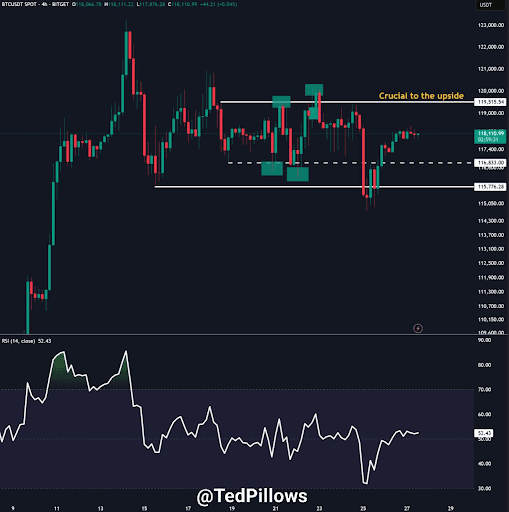

Crypto investor and entrepreneur Ted Pillows commented on X, stating, “$BTC needs to break above $119.5K for a big move. If that doesn’t happen, this consolidation will continue. I think BTC could break above this level next month, which will start the next leg up.”

“$BTC needs to break above $119.5K for a big move. If that doesn't happen, this consolidation will continue,” crypto investor and entrepreneur Ted Pillows summarized in a post on X.

“I think BTC could break above this level next month which will start the next leg up.”

Popular trader and analyst Rekt Capital eyed a slightly higher range ceiling just below the $120,000 mark.

“Bitcoin has Daily Closed above the blue Range Low, kickstarting a break back into the very briefly lost Range,” he told X followers alongside a print of the daily BTC/USD chart.

“Any dips into the Range Low (confluent with the new Higher Low) would be a retest attempt to confirm the reclaim.”

Others warned that price could still fill the daily downside wick left by the trip to $114,500.

In an X thread on the topic, fellow trader CrypNuevo identified a downside target confluent with an area of exchange order-book liquidity.

“If we zoom out, we can see that the main liquidation level is at $113.8k,” he commented.

“Larger Price Swings” Predicted as Liquidation Levels Come into Focus

Recent data places the “max pain” for Bitcoin shorts at approximately $119,650. Should Bitcoin push towards challenging all-time highs near $123,000, short liquidations could exceed a staggering $1.1 billion.

Crypto analysis platform Coinank, examining its own liquidity data, concurred with the resistance: “Strong resistance forming around 119,000–120,000, indicated by dense liquidation clusters.”

Analyst TheKingfisher further highlighted the potential for amplified volatility on shorter timeframes. Reporting on X on Sunday, they observed, “Seeing predominantly red on the BTC GEX+ chart. This indicates dealers are heavily short gamma, suggesting they may amplify volatility to hedge their positions.”

You may also like

Gainers

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com