Bitcoin Surges Towards $120K, Analysts Foresee Heightened Volatility Ahead

Bitcoin has staged a dramatic late-week rally, propelling it towards the crucial $120,000 resistance level as the weekly close approaches. Market participants are bracing for potentially larger price swings, with key liquidation zones and significant trading behavior dominating analyst discussions.

Key Takeaways:

- BTC exhibits a strong late-week comeback, targeting significant liquidation zones and aiming to retake critical price areas.

- Traders and analysts highlight specific price points that Bitcoin must conquer to sustain upward momentum.

- Volatility is expected based on large-volume trading behavior, analysis reports.

Bitcoin Volatility Surges as Weekly Close Looms

Data reveals Bitcoin’s determined ascent, now approaching a pivotal resistance zone. The BTC/USD trading pair is attempting to secure a daily close above its 10-day Simple Moving Average (SMA). This rebound, stemming from lows near $114,500, marks a significant recovery, seemingly overshadowing the memory of one of the largest Bitcoin sales in history.

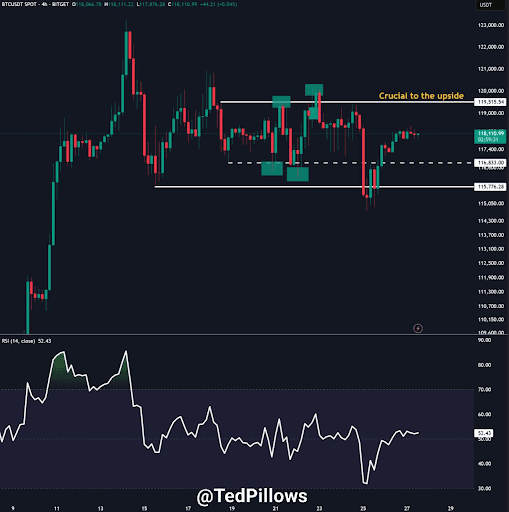

Crypto investor and entrepreneur Ted Pillows commented on X, stating, “$BTC needs to break above $119.5K for a big move. If that doesn’t happen, this consolidation will continue. I think BTC could break above this level next month, which will start the next leg up.”

“$BTC needs to break above $119.5K for a big move. If that doesn't happen, this consolidation will continue,” crypto investor and entrepreneur Ted Pillows summarized in a post on X.

“I think BTC could break above this level next month which will start the next leg up.”

Popular trader and analyst Rekt Capital eyed a slightly higher range ceiling just below the $120,000 mark.

“Bitcoin has Daily Closed above the blue Range Low, kickstarting a break back into the very briefly lost Range,” he told X followers alongside a print of the daily BTC/USD chart.

“Any dips into the Range Low (confluent with the new Higher Low) would be a retest attempt to confirm the reclaim.”

Others warned that price could still fill the daily downside wick left by the trip to $114,500.

In an X thread on the topic, fellow trader CrypNuevo identified a downside target confluent with an area of exchange order-book liquidity.

“If we zoom out, we can see that the main liquidation level is at $113.8k,” he commented.

“Larger Price Swings” Predicted as Liquidation Levels Come into Focus

Recent data places the “max pain” for Bitcoin shorts at approximately $119,650. Should Bitcoin push towards challenging all-time highs near $123,000, short liquidations could exceed a staggering $1.1 billion.

Crypto analysis platform Coinank, examining its own liquidity data, concurred with the resistance: “Strong resistance forming around 119,000–120,000, indicated by dense liquidation clusters.”

Analyst TheKingfisher further highlighted the potential for amplified volatility on shorter timeframes. Reporting on X on Sunday, they observed, “Seeing predominantly red on the BTC GEX+ chart. This indicates dealers are heavily short gamma, suggesting they may amplify volatility to hedge their positions.”

You may also like

AI Avatar (AIAV) Coin Price Prediction & Forecasts for January 2026 – Up 25% in a Day, Can It Sustain the Rally?

AI Avatar (AIAV) Coin has been turning heads in the crypto space after a sharp 24.95% surge in…

AssetX Labs (AXLT) Coin Price Prediction & Forecasts for January 2026: Potential Surge After December 2025 Launch?

AssetX Labs (AXLT) Coin burst onto the scene with its launch on December 25, 2025, positioning itself as…

Ecorpay Token (ECOR) Coin Price Prediction & Forecasts for January 2026 – Potential Rally Amid Payment Sector Growth

Ecorpay Token (ECOR) has been making waves since its launch on December 24, 2025, as a revolutionary multi-blockchain…

ForTON (FRT) Coin Price Prediction & Forecasts for January 2026 – Fresh Launch Sparks Potential Rally

ForTON (FRT) just hit the market on December 31, 2025, as a fresh entrant in the TON ecosystem,…

Mind Predict (MKIT) Coin Price Prediction & Forecasts for January 2026: Could It Surge 50% Post-Launch?

Mind Predict (MKIT) Coin has just hit the crypto scene, launching on December 31, 2025, as the first…

PAX Gold Price History: A Deep Dive into the Evolution of Digital Gold from Launch to 2026

Gold has long served as a reliable hedge against economic uncertainty, but what if you could own it…

PAX Gold Price Prediction 2025: What Investors Need to Know About PAXG Crypto’s Future

As someone who’s been trading crypto since the early days of Bitcoin, I’ve seen how assets like gold-backed…

PAX Gold Price Graph: Tracking Historical Trends and Forecasting Future Movements in 2026

As a crypto investor who’s watched gold-backed assets evolve since the early days of blockchain, I’ve seen how…

Paxos Gold Staking: A Beginner’s Guide to Earning Rewards with PAXG Crypto in 2026

As someone who’s been trading crypto since the early days of Bitcoin, I’ve seen how assets like gold…

Where to Buy Pax Gold (PAXG): Your Complete Guide to Getting Started with This Gold-Backed Crypto

Have you ever thought about owning gold without dealing with the hassle of storing heavy bars in a…

Paxos Gold Price Prediction 2026: Insights and Forecasts for PAXG Investors

Ever wondered how you could own a piece of gold without ever touching a physical bar? That’s the…

Paxful Razer Gold: How to Trade Gaming Credits for Crypto and Exploring PAX Gold as a Digital Alternative

Ever wondered how gamers in places like Indonesia and Nigeria turn their Razer Gold credits into real cryptocurrency?…

Paxful Gold Explained: Trading Razer Gold on Paxful and Why PAXG Crypto Stands Out as True Digital Gold

Ever stumbled upon the term “paxful gold” while hunting for ways to trade digital assets or gaming credits,…

How to Buy PAXG: Your Step-by-Step Guide to Getting Started with Pax Gold Crypto

Ever wondered how you could own a piece of gold without dealing with the hassle of storing heavy…

Is PAXG Legit? Unpacking the Reliability of Paxos Gold Token in 2026

As someone who’s spent years trading crypto and watching markets shift like tides, I remember the first time…

Is PAXG a Good Investment in 2026? Weighing the Pros, Cons, and Gold-Backed Potential

As someone who’s been trading crypto since the early days of Ethereum, I’ve seen plenty of tokens come…

PAXG Whitepaper: Exploring the Foundations of Pax Gold Crypto and Its Gold-Backed Stability

Have you ever wondered how a digital token can give you real ownership of physical gold without ever…

PAXG Crypto: Your Guide to Paxos Gold Token and Its Role in the 2026 Crypto Market

Ever wondered how you could own gold without dealing with heavy bars or secure vaults? That’s where PAXG…

AI Avatar (AIAV) Coin Price Prediction & Forecasts for January 2026 – Up 25% in a Day, Can It Sustain the Rally?

AI Avatar (AIAV) Coin has been turning heads in the crypto space after a sharp 24.95% surge in…

AssetX Labs (AXLT) Coin Price Prediction & Forecasts for January 2026: Potential Surge After December 2025 Launch?

AssetX Labs (AXLT) Coin burst onto the scene with its launch on December 25, 2025, positioning itself as…

Ecorpay Token (ECOR) Coin Price Prediction & Forecasts for January 2026 – Potential Rally Amid Payment Sector Growth

Ecorpay Token (ECOR) has been making waves since its launch on December 24, 2025, as a revolutionary multi-blockchain…

ForTON (FRT) Coin Price Prediction & Forecasts for January 2026 – Fresh Launch Sparks Potential Rally

ForTON (FRT) just hit the market on December 31, 2025, as a fresh entrant in the TON ecosystem,…

Mind Predict (MKIT) Coin Price Prediction & Forecasts for January 2026: Could It Surge 50% Post-Launch?

Mind Predict (MKIT) Coin has just hit the crypto scene, launching on December 31, 2025, as the first…

PAX Gold Price History: A Deep Dive into the Evolution of Digital Gold from Launch to 2026

Gold has long served as a reliable hedge against economic uncertainty, but what if you could own it…