ETH bulls target $9K: Does the data support the lofty price target?

Ether is gaining momentum as supply constraints, surging demand, and bullish technical indicators converge, with ETH potentially targeting $9,000.

Key takeaways:

- ETH has surged 50% in just two weeks, with Elliott Wave analysis suggesting a possible peak of $9,000 by early 2026.

- Onchain fundamentals remain robust: 28% of ETH is staked, exchange reserves have hit their lowest level since 2016, and new investor inflows are accelerating.

- Despite multiple increases in block gas limits, network usage continues to operate near full capacity, underscoring sustained demand.

After a sluggish market cycle, $ETH’s 50% rally in two weeks has reignited investor interest. Yet, at $3,730, ETH remains 23% below its November 2021 all-time high. Analysts now speculate that its price could more than double from current levels.

Is Ethereum’s biggest rally still ahead? Onchain data, trading activity, and blockchain metrics all indicate that this uptrend may only be in its early stages.

ETH charts signal undervaluation

Despite its strong rally, ETH continues to trail broader market momentum. Glassnode data shows the MVRV Z-score — measuring Ethereum’s market cap against its realized cap (total capital invested) — remains significantly below previous cycle peaks. While ETH has exited the "bearish" zone, it still trades far from levels typically seen at market tops, suggesting room for further upside.

ETH MVRV Z-score. Source: Glassnode

Compared to Bitcoin, ETH remains significantly behind. Over the past year, BTC surged 74% while ETH declined 28%, widening the performance gap. However, BTC’s dominance now sits at historically high levels, suggesting ETH may be under-owned and undervalued. Analysts at Bitcoin Vector note that ETH appears primed for a catch-up rally, potentially signaling an upcoming market rotation.

In the near term, $4,000 serves as a crucial psychological and technical resistance level. A decisive breakout above this threshold could trigger accelerated upward momentum.

From a technical standpoint, Elliott Wave theory—which identifies recurring five-wave price patterns driven by market psychology—suggests ETH is currently in its third impulsive wave. An analysis by XForceGlobal (partially validated but slightly ahead of schedule) projects this phase could propel ETH toward $9,000 by early 2026, assuming supportive macro conditions. If this pattern holds, Ethereum could see a major breakout before the next market correction.

Onchain data confirms ETH's bullish momentum is structural, not just speculative

- Staking demand remains strong: Over 34 million ETH (28% of total supply) remains locked in staking, reducing circulating liquidity and demonstrating long-term holder conviction.

- Exchange reserves hit historic lows: Only 16.2 million ETH sits on exchanges—the smallest balance since 2016. This supply squeeze could amplify upward price pressure as demand increases.

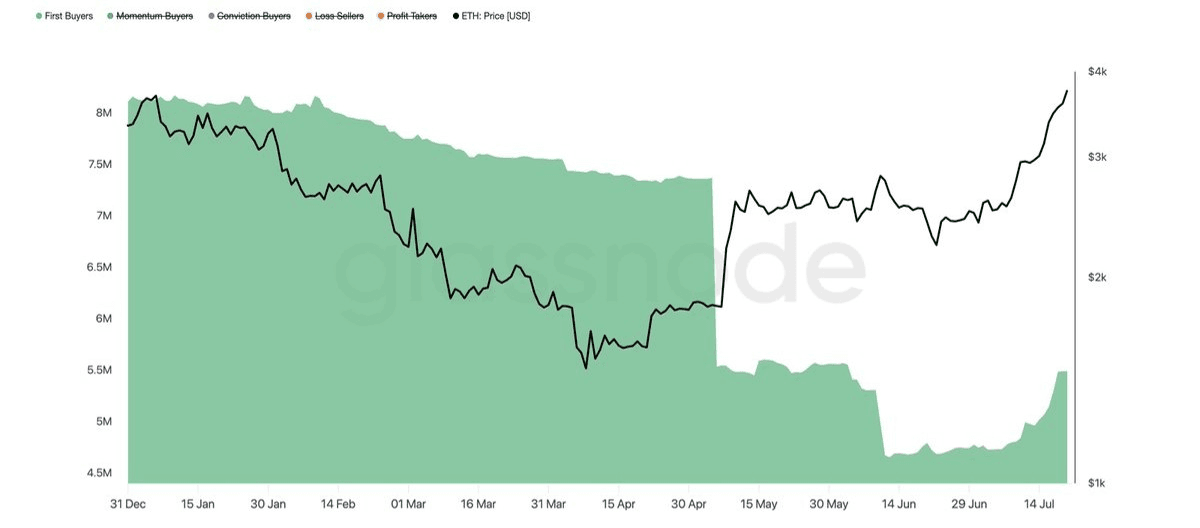

- New buyers are entering the market: Since early July, first-time ETH holders have surged ~16%, signaling renewed retail interest. Glassnode analysts highlight this as the first clear trend reversal in recent months.

These fundamentals suggest ETH's rally is supported by real capital inflows and supply constraints, not just speculative trading. With shrinking liquidity and growing adoption, the setup favors continued upside.

ETH supply by investor behavior: first buyers. Source: Glassnode

Ethereum activity: capacity expands, and demand keeps up

Beyond speculation, Ether’s value depends on actual usage, and that activity is growing in subtle but significant ways.

While average transaction fees have dropped to historic lows—just 0.0004 ETH per transfer—that doesn’t mean Ethereum is quiet. Rather, it reflects improved efficiency, especially with much of the load now handled by layer 2s. To properly gauge demand on the network, fees in ETH can mislead; gas offers a clearer view of the actual computational work being consumed.

You may also like

Introducing 0G: Complete Guide to $0G and Airdrop Opportunities

0G ($0G) is the world's first Decentralized AI Operating System (DeAIOS), a modular Layer-1 blockchain designed to power scalable, on-chain AI applications. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 LISA airdrop until Jan.02 2026!

LIQUID Coin Price Prediction & Forecasts for December 2025 – Potential Rally Amid Meme Hype?

Just a day after its launch on December 24, 2025, LIQUID Coin has already stirred up buzz in…

What is Liquid (LIQUID) Coin?

The Liquid (LIQUID) token listed on WEEX is making waves in the crypto world. With trading officially starting…

LIQUID USDT Pair Listed: Trade LIQUID Coin on WEEX Spot

LIQUID USDT spot trading is live on WEEX Exchange. Discover the new LIQUID (LIQUID) Coin listing, check the schedule, and start trading this meme token now.

Nockchain (NOCK) Coin Price Prediction & Forecasts for December 2025: Surging 14% Amid Meme Token Buzz

Nockchain (NOCK) Coin has just hit the scene on the Base chain, launching today at 12:00 UTC on…

JPMorgan Chase Tokenized Stock (Ondo) (JPMON) Coin Price Prediction & Forecasts for December 2025 – Steady Climb Post-Launch

The JPMorgan Chase Tokenized Stock (Ondo) (JPMON) Coin just hit the market on December 23, 2025, offering tokenized…

REALGARRYTAN Coin Price Prediction & Forecasts for December 2025 – Fresh Launch Sparks Meme Token Rally Potential

The REALGARRYTAN Coin, a new meme token tied to Garry Tan and launched on the Base chain just…

Walmart Tokenized Stock (Ondo) (WMTON) Coin Price Prediction & Forecasts for December 2025 – Could It Rebound After Recent Dip?

As of December 2025, Walmart Tokenized Stock (Ondo) (WMTON) Coin has just hit the market, offering tokenized exposure…

What is Costco Tokenized Stock (COSTON) Coin?

The Costco Tokenized Stock, known by its abbreviation COSTON, has made its way to WEEX, officially listed on…

Goldman Sachs Tokenized Stock (Ondo) (GSON) Coin Price Prediction & Forecasts for December 2025 – Surge Potential Amid RWA Momentum

The Goldman Sachs Tokenized Stock (Ondo) (GSON) Coin has been making waves in the real-world asset (RWA) space,…

Linde plc Tokenized Stock (Ondo) (LINON) Coin Price Prediction & Forecasts for December 2025 and Beyond

Linde plc Tokenized Stock (Ondo) (LINON) Coin has just entered the spotlight as a tokenized version of Linde…

What is Linde plc Tokenized Stock (LINON) Coin?

The Linde plc Tokenized Stock (LINON) coin has been a noteworthy addition to the crypto trading landscape with…

ServiceNow Tokenized Stock (Ondo) (NOWON) Token Price Prediction & Forecasts for December 2025: Could It Rally Amid RWA Momentum?

The ServiceNow Tokenized Stock (Ondo) (NOWON) Token just hit the market today, December 23, 2025, at 18:10 UTC,…

What is ServiceNow Tokenized Stock (NOWON) Coin?

ServiceNow Tokenized Stock, abbreviated as NOWON, is the latest crypto asset to be listed on WEEX, available for…

Nike Tokenized Stock (Ondo) (NKEON) Token Price Prediction & Forecasts for December 2025 – Potential Rebound Amid Market Volatility?

Nike Tokenized Stock (Ondo) (NKEON) has been making waves in the real-world asset (RWA) space by tokenizing shares…

What is Nike Tokenized Stock (NKEON) Coin?

The Nike Tokenized Stock (NKEON) Coin, listed on WEEX, offers an innovative way for non-US retail and institutional…

Salesforce Tokenized Stock (Ondo) (CRMON) Coin Price Prediction & Forecasts for December 2025: Could It Surge Amid RWA Momentum?

As a seasoned crypto investor who’s traded through multiple bull and bear cycles, I’ve seen how tokenized assets…

What is Salesforce Tokenized Stock (CRMON) Coin?

The Salesforce Tokenized Stock (CRMON) Coin offers a unique opportunity for crypto enthusiasts to dive into the world…

Introducing 0G: Complete Guide to $0G and Airdrop Opportunities

0G ($0G) is the world's first Decentralized AI Operating System (DeAIOS), a modular Layer-1 blockchain designed to power scalable, on-chain AI applications. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 LISA airdrop until Jan.02 2026!

LIQUID Coin Price Prediction & Forecasts for December 2025 – Potential Rally Amid Meme Hype?

Just a day after its launch on December 24, 2025, LIQUID Coin has already stirred up buzz in…

What is Liquid (LIQUID) Coin?

The Liquid (LIQUID) token listed on WEEX is making waves in the crypto world. With trading officially starting…

LIQUID USDT Pair Listed: Trade LIQUID Coin on WEEX Spot

LIQUID USDT spot trading is live on WEEX Exchange. Discover the new LIQUID (LIQUID) Coin listing, check the schedule, and start trading this meme token now.

Nockchain (NOCK) Coin Price Prediction & Forecasts for December 2025: Surging 14% Amid Meme Token Buzz

Nockchain (NOCK) Coin has just hit the scene on the Base chain, launching today at 12:00 UTC on…

JPMorgan Chase Tokenized Stock (Ondo) (JPMON) Coin Price Prediction & Forecasts for December 2025 – Steady Climb Post-Launch

The JPMorgan Chase Tokenized Stock (Ondo) (JPMON) Coin just hit the market on December 23, 2025, offering tokenized…

Popular coins

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:[email protected]

VIP Services:[email protected]