MicroStrategy Pauses Bitcoin Buys Amidst Massive Equity Offering Push

The crypto world’s most prominent Bitcoin accumulator, MicroStrategy, has signaled a shift in its immediate strategy, opting to pause its Bitcoin acquisition activities last week. This move coincides with a significant push to bolster its capital through a substantially upsized equity offering, redirecting focus and resources.

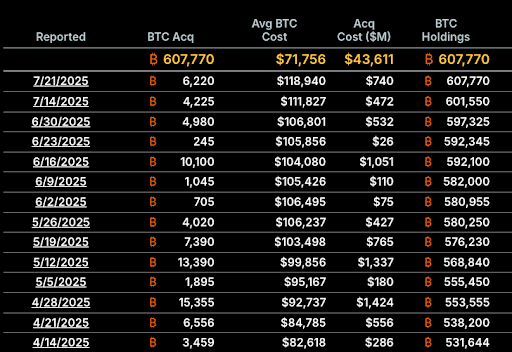

As the world’s largest public holder of Bitcoin, MicroStrategy reported no new Bitcoin purchases in the past week. This decision comes despite the digital asset experiencing notable volatility and testing new all-time highs mid-July. The company’s substantial Bitcoin holdings remained unchanged at 607,770 BTC as of last Monday, according to a filing with the U.S. Securities and Exchange Commission (SEC).

Interestingly, the pause in MicroStrategy’s buying did not deter Bitcoin’s upward momentum. The cryptocurrency saw its price climb from approximately $118,000 to over $119,000 throughout the week. This resilience occurred even amidst MicroStrategy’s inactivity and reports of an 80,000 BTC sale by an early investor on Friday, according to CoinGecko data.

July Bitcoin Acquisitions Plummet 39% Month-Over-Month

Last week’s hiatus highlights a broader trend of decelerated buying activity for MicroStrategy throughout July. The company documented just two Bitcoin acquisitions for the month: a purchase of 4,225 BTC on July 14th and another 6,220 BTC on July 21st, totaling 10,445 BTC. This figure represents a significant 39% drop compared to the 17,075 BTC acquired in June.

The acquisition pace in prior months was even more robust, with purchases of 26,695 BTC in May and 25,370 BTC in April. Prior to skipping buys in the first week of July, MicroStrategy had previously reported no purchases in the first week of April as well.

The company bought even more Bitcoin in the previous months, reporting purchases of 26,695 BTC in May and 25,370 BTC in April.

Prior to skipping the buy in the first week of July, Strategy previously reported no buys in the first week of April.

Upsized STRC Offering Signals Strategic Capital Reallocation

The slowdown in MicroStrategy’s Bitcoin purchasing strategy directly correlates with its aggressive capital raising efforts. Last Friday, the company announced it had upsized its Series A perpetual stretch preferred stock (STRC) offering to an impressive $2.521 billion, a substantial increase from its initially planned $500 million.

Priced at $90 per share, the issuance and sale are slated to settle on Tuesday, subject to customary closing conditions.

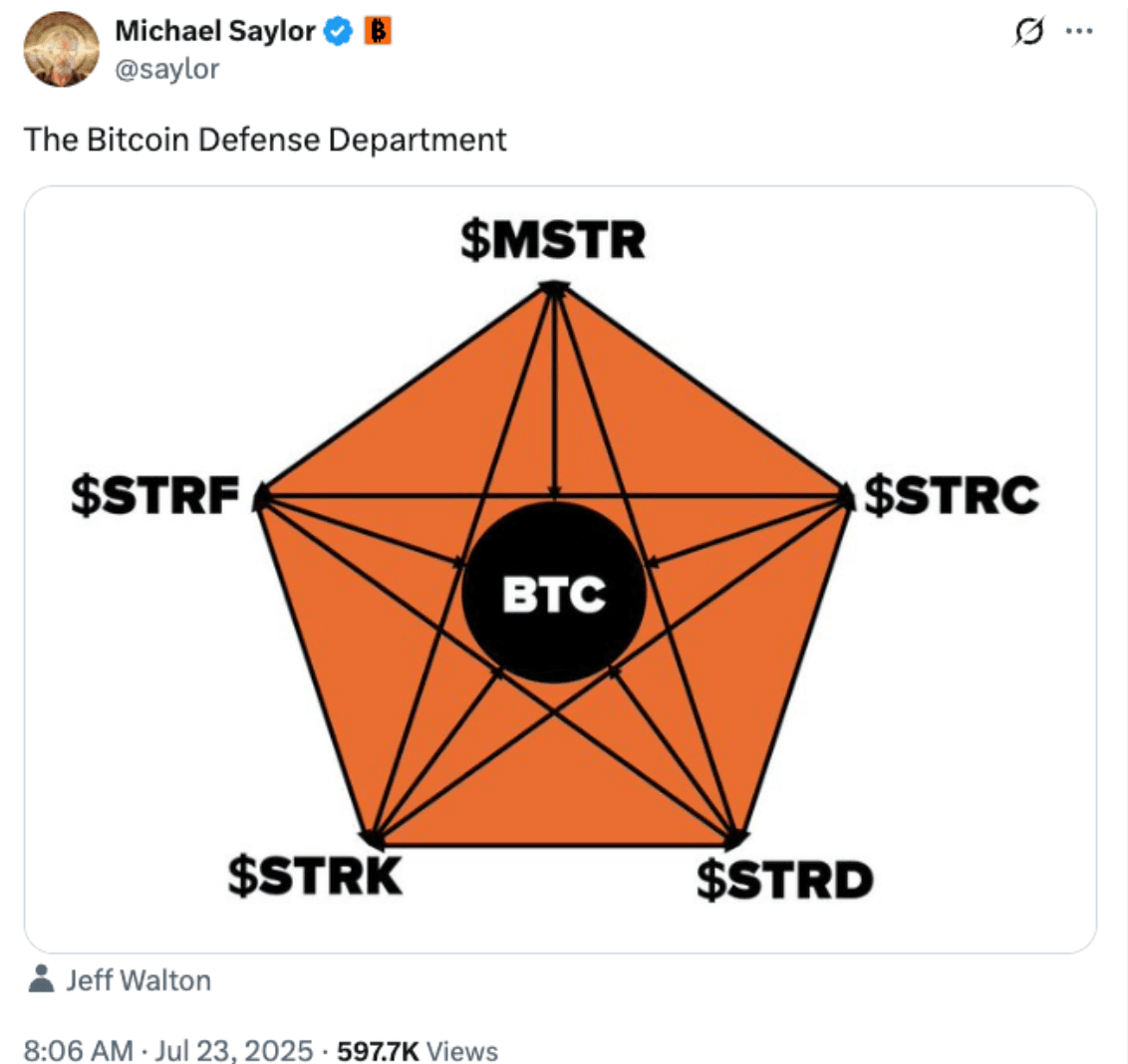

Similar to four previous MicroStrategy offerings, including the Series A perpetual strike preferred stock (STRK), the new STRC program functions as an equity-raising mechanism. Its core purpose is to empower the company to gradually sell newly issued shares, thereby generating capital to continue its Bitcoin accumulation strategy.

Michael Saylor, MicroStrategy’s co-founder, took to X (formerly Twitter) on Wednesday to refer to STRC as one of the four pillars of the company’s “Bitcoin defense department.” This statement underscores the strategic importance of this financing round in supporting MicroStrategy’s long-term commitment to Bitcoin, even as its immediate purchasing cadence adjusts.

You may also like

Gainers

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:[email protected]

VIP Services:[email protected]