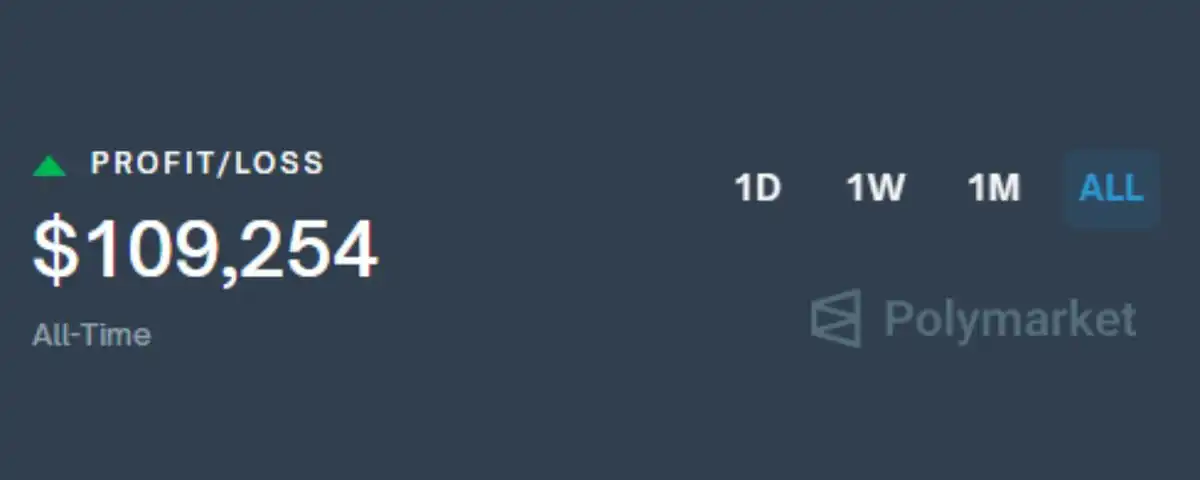

How Did I Make $100,000 in 3 Months on Polymarket?

Original Title: How I Made $100k Arbitraging Between Prediction Markets (Full Guide)

Original Author: @PixOnChain, Crypto Researcher

Original Translation: Deep in Motion

Abstract: Leveraging price differences between prediction markets for arbitrage, combining swift action and early exit strategies to earn risk-free profits

Editor's Note: This article details the author's strategy of earning $100k through arbitrage between prediction markets. The author utilizes price differences across platforms for the same event, locking in risk-free profits, with a focus on pricing errors in multi-outcome markets. Key steps include identifying spreads, swift action, automated monitoring, and early exits for APY optimization. The author emphasizes the importance of niche markets, volatility, and thorough rule scrutiny, providing an efficient Web3 arbitrage guide.

The following is the original content (lightly edited for readability):

Most people gamble on prediction markets.

I make money through arbitrage.

Here is my specific strategy to earn $100k from decentralized, inefficient prediction markets—completely devoid of gambling.

Step One: Understand the Rules

Prediction markets allow you to bet on real-world outcomes.

· "Will Ethereum reach $5000 by December?"

· "Will MrBeast run for president?"

· "Will Kanye West launch his own token?"

Each market has its own participant base.

Each group has its own biases.

This means that pricing for the same event on different platforms... will vary.

Herein lies the arbitrage opportunity.

If platform A's "Yes" price is 40 cents, and platform B's "No" price is 55 cents...

You can lock in a 5-cent profit regardless of the outcome.

This is arbitrage.

But there are even better opportunities...

Step 2: Find Your Edge

For me, what works well is the multi-outcome markets.

These markets are where issues are most likely to arise.

For example:

· Who will win this weekend's F1 race?

· Which party will win the UK General Election?

· Who will be the next one eliminated on the reality show?

More outcomes = higher complexity = more pricing errors.

In theory, the sum of the probabilities of all outcomes should be 100%.

In reality? I often see the market sum up to 110%.

Why? Because most platforms embed a hidden fee—the 'overround'.

Plus, many platforms let the crowd determine the odds.

This leads to lucrative yet inefficient arbitrage opportunities.

Step 3: How to Identify an Arbitrage Opportunity

The rules are as follows:

You find pricing for the same event on different platforms. Select the lowest price for each outcome. If the sum is less than 1 dollar, you've found an arbitrage opportunity.

Let me show you a real example.

Market: Who will be the next Pope?

Two platforms are running this market simultaneously.

Prices are as follows:

Polymarket/Myriad

We select the lowest price for each outcome:

· Pietro Parolin: 35.2 cents (Myriad)

· Luis Antonio Tagle: 30 cents (Polymarket)

· Others: 32.7 cents (Myriad)

· Total: 97.9 cents

You buy into all three outcomes.

One of them must prevail.

You guarantee to get back 1 dollar.

Profit: 2.1 cents per transaction = 2.1% risk-free return.

This is arbitrage.

You are not betting on who will become the Pope. You are betting on two platforms not being able to agree on the pricing of a potential candidate. When they disagree — you profit.

P.S. This is not the best opportunity, just one I found today.

Myriad has low liquidity, but two platforms still show a similar spread.

If you monitor more markets, you will find bigger opportunities.

I usually only enter when the Annual Percentage Yield (APY) is above 60% (APY = (spread / settlement days) × 365).

The market spread is 2.1%, with a settlement time of 29 days:

(0.021 / 29) × 365 ≈ 26.4% APY

Not good enough for me.

Locking funds for a month for only 26% APY? Pass.

But if the same spread settles in 7 days?

That's over 100% APY — I'm in.

How to find these high APY opportunities?

Step Four: Race Against Time

Predicting market arbitrage is a game of timing. Once a price discrepancy occurs, you usually have only minutes, not hours.

· Someone posts a rumor.

· One market updates its price.

· Another market lags behind.

This delay is your entire advantage. If possible — automate this part.

At the beginning, I had 7 platform tabs open simultaneously. I refreshed like a maniac. Used price alerts on Discord, Telegram, Twitter.

Sometimes, I could spot the spread just by muscle memory. The faster you act, the more you earn. Hesitate for 5 minutes, and the spread is gone.

The best spread I caught was 18%, and the trade volume was substantial.

Make sure you have enough liquidity available to deploy in each market and understand all fees.

Step Five: Early Exit

Most people wait for the outcome to be revealed. I don't. I've already made most of my profit when the outcome is unknown.

Assume I bought all outcomes at 94 cents. This locks in a 6-cent spread. One of the outcomes will pay out at $1.

But I don't have to wait.

If the market tightens — those same shares can now be sold for 98 cents or 99 cents collectively — I exit.

This is only effective when all outcome prices remain stable.

If one outcome skyrockets and the others plummet, there is no opportunity to exit.

So I need to monitor the entire portfolio. I exit when the total value goes up.

This can significantly increase your APY and allow you to rotate between different markets more quickly.

Additional Tips

· Look for overlapping events (e.g., "Trump wins the 2024 election" and "Republican victory") — hidden arbitrage opportunities are right there.

· Target small markets — more pricing errors, less competition.

· Use less popular platforms — more spreads, bigger advantages, plus potential airdrop rewards.

· Carefully read settlement rules — one word can change the outcome.

· Always triple-check the order book and your buy-in price. Include all fees in your calculations.

It took me 2.5 months to earn $100,000.

Some weeks had no opportunities. Some weeks were non-stop busy.

The larger the market fluctuation, the bigger the spread.

So if the market is quiet, don't rush, keep looking. There will always be another mispriced market.

Original tweet link: Tweet Link

猜你喜欢

中本聪也得给财神爷磕一个

风水成了最后的心理防线

代币VS股权,Aave纷争的来龙去脉

12月26日市场关键情报,你错过了多少?

加密圣诞劫:损失超600万美元,Trust Wallet扩展钱包被黑分析

三巨头下注1700万美元,FIN强势入局跨境支付

加密货币当圣诞礼物?Z 世代正在重新权衡

在风险与希望之间:ETH Cali与哥伦比亚以太坊社区

踏进稳定币浪潮六年,他看到的支付未来雏形

超600万美元被盗:Trust Wallet源码遭攻击,官方版本为何成黑客后门?

3天后TGE,Lighter和大户的电话会透露了哪些细节

IOSG创始人: 2025年加密表现「糟糕」,但却是新周期的起点

Uniswap代币销毁理提案通过,海外币圈今天在聊啥?

在 K 线图里算命的币圈人

当算命被画成 K 线并放进币圈语境时,它爆火的原因不在于玄学有多准,而在于交易者对不确定性的集体焦虑终于找到了一个出口。

30份预测,筛出五个2026年的加密共识

中期选举倒计时,美国加密法案能否闯关成功?

世界杯「大考」,如何解读明年的预测市场发展前景?

2025加密「造富榜」:12大赢家,谁押对了宝?

「宏观大师」Raoul Pal谈指数增长下的30倍空间:比特币终将超越黄金

中本聪也得给财神爷磕一个

风水成了最后的心理防线