SignalPlus Macro Analysis: ETH ETF Inflows Rebound, Potentially Fueling Further Altcoin Rally

Original Title: "SignalPlus Macro Analysis Special Edition: Final Stretch"

Original Source: SignalPlus

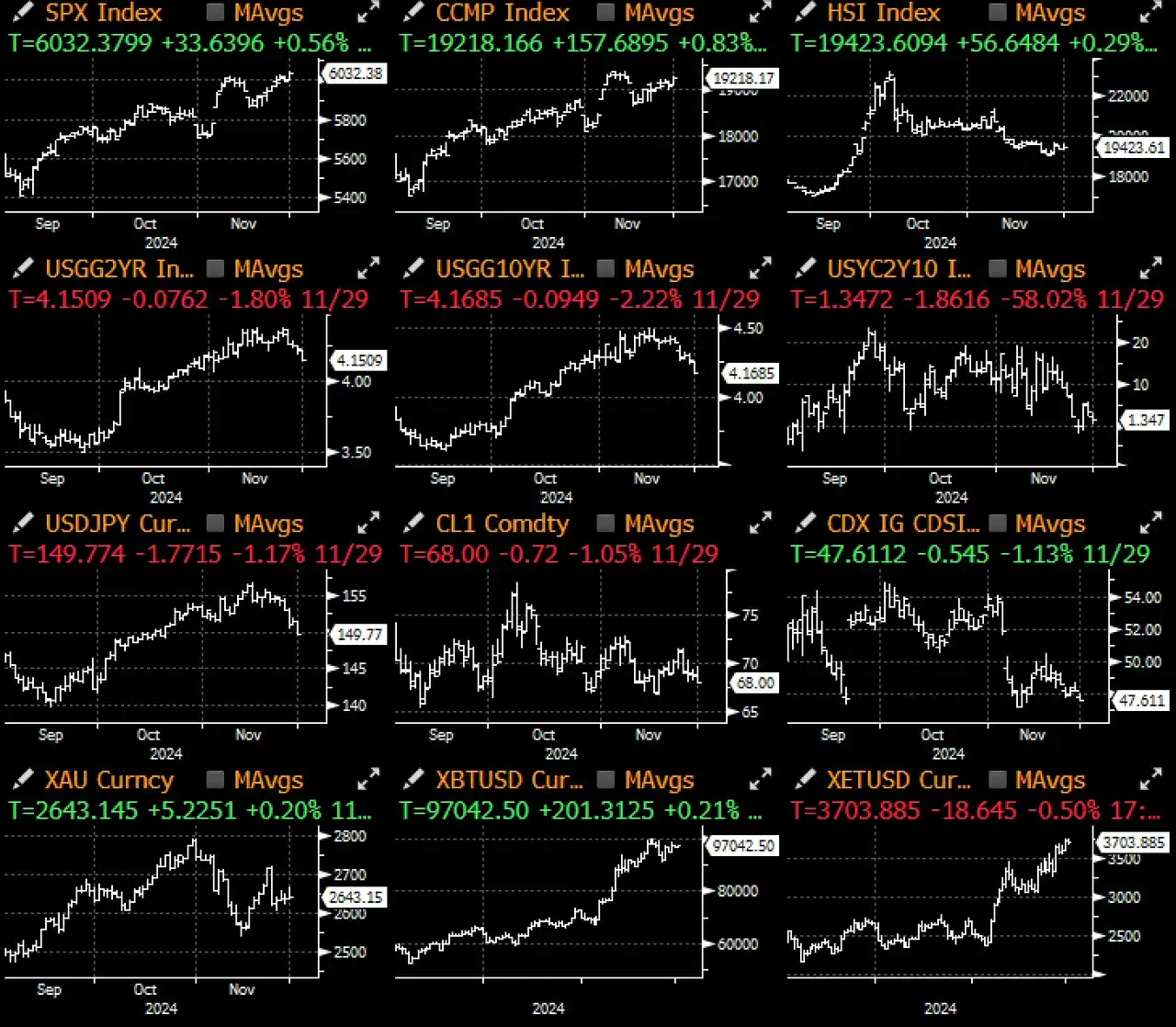

Last week was the Thanksgiving holiday in the United States, with light market trading volume maintaining an overall consolidation pattern. The U.S. stock market is set to make history once again, with 2024 poised to be one of the best-performing years in history, with 5 out of the past 6 years seeing double-digit returns.

Market breadth continues to be supportive, with the 52-week stock high-low quantity difference still appearing healthy. The upward trend remains intact, the volatility index (VIX) is trending downwards, and following Trump's announcement that Scott Bessent will be the Treasury Secretary, the bond market has calmed down, with the 10-year yield dropping nearly 35 basis points from its October high.

In addition to his so-called "pro-cryptocurrency" stance, Bessent is also a fiscal hawk and a supporter of an independent Federal Reserve. His proposed 3-3-3 plan (reduce the fiscal deficit to 3% of GDP, raise real GDP growth to 3%, and increase daily energy production by 3 million barrels) has brought relief to the U.S. fixed-income market. Since his nomination, the yield curve premium has remained stable at the current level.

While there are still doubts about his core views, journalists researching his early speeches have found that due to central bank accumulation, he has a "long-term bullish" view on gold. Whether this will have a spillover effect on Bitcoin, especially in the recent discussions about strategic reserve portfolios, remains to be seen. At the very least, the next four years are sure to be very interesting.

Traders are gearing up for a busy week as they approach the final non-farm payroll data release of the year. Despite concerns about rising inflation just beginning to emerge, the market still anticipates a roughly 65% chance of a rate cut. However, considering the strong economic conditions, the forward rate cut expectations for 2025-2027 have been significantly reduced. Regarding the employment data, the market expects an overall employment data rebound of around +160,000, while the unemployment rate is expected to hover around 4.3%. Given the recent weakness in PMI surveys and high-frequency employment data, the final data outcome also has the potential to come in below expectations. Nevertheless, unless there is an extremely surprising result, risk sentiment may still remain positive.

The optimistic sentiment in the cryptocurrency market continues to prevail. However, this week's focus is on Ripple. Against the backdrop of expectations that the government will withdraw its long-standing lawsuit, XRP has surged a stunning 73%. This significant upward trend has helped XRP surpass USDT to become the third-largest cryptocurrency by market capitalization. In anticipation of this development, whale addresses have been actively accumulating XRP over the past month (and are now selling).

The current uptrend is mainly concentrated in major coins (excluding ETH), with BTC leading the pack, while altcoins are still struggling to return to their January highs. Although recent successes in Layer 2 and blockchain protocol transformations (such as Hyperliquid) continue to dominate the cryptocurrency market's attention, we are seeing some improvement in Ethereum through inflows into ETH ETFs. Last Friday saw inflows exceeding $330 million. Will we see more rebounds of secondary mainstream coins before the year's end?

Nevertheless, the fundamental indicators of cryptocurrency remain optimistic as the market capitalization of stablecoins has finally exceeded the previous high during the Terra-Luna period. Stablecoins are usually the first entry point for most fiat users into the cryptocurrency market, and a higher market capitalization (with a fixed price, hence entirely quantity-driven) indicates greater mainstream participation.

With investors pouring in more new funds, will we see faster growth in the new year? Let's hope so!

猜你喜欢

第一轮参与者见解 — AOT 矩阵: AI交易中的左脑分析、右脑决策

在WEEX AI交易哈克松中,AOT Matrix选择了系统设计上更加谨慎的道路 — — 在实盘交易环境中,这条路实际上更难走完。 从一开始,他们就对AI在交易系统中应该和不应该扮演什么角色做出了明确的选择。 我们采访了AOT Matrix,了解他们的决策逻辑、系统架构的多次迭代,以及在WEEX的真实交易环境和工程约束下实现它的感受。

Trend Research:2026超越范式,WLFI开启金融生态新纪元

预赛选手解读——AOT Matrix:左脑分析,右脑决策的AI交易系统

在 WEEX AI Trading Hackathon 的参赛项目中,AOT Matrix 的系统设计选择了一条相对克制、但在真实交易环境下更难走的路径。在备赛初期,他们便围绕AI 在交易系统中的角色边界做出了明确取舍。围绕这一决策逻辑、系统架构的多次重构,以及在 WEEX 真实交易环境与工程约束下的实践过程,我们对 AOT Matrix 进行了采访。

目标六位数,2026年最值得刷的空投项目都在这

美国把人家总统都抓走了,特朗普旗下平台说这不算「侵略」

2025加密卡年度报告:月活4万,人均消费不到100美元

2026加密开门红,谨慎看涨的市场新起点

为什么人工智能令牌的增长速度比更广泛的加密市场更快

AI代币的表现要优于——而且不是悄悄的。 比特币正在移动。 以以太坊坊正在站稳脚跟。 然而,一些最强劲的相对涨幅来自AI标记的代币,而不是专业,也不是迷因。 乍一看,这感觉很直观。 AI是真正的技术。 它塑造了远远超出加密的行业。 但市场很少仅凭直觉而动——尤其是不会这么快。 当价格在采用之前加速时,更有用的问题不是“人工智能重要吗 ? ” 市场现在购买的是哪个版本的人工智能故事。

市场更新 — 一月月七日

Bitmine又以太坊押注了2.8万,价值约9116万美元。

别再执念Alpha,市场给你的Beta更重要

Dragonfly合伙人Haseeb眼里,谁是加密史上最伟大的VC?

隐私赛道,a16z关注的2026年重点趋势

Lighter之后,下一批值得刷的Perp DEX

单日翻倍也补不回98%的下跌,Parcl的「Polymarket故事」成立吗?

当山寨币失去共识,哪里还能找到超额收益?

Polymarket结算争议加剧、以太坊技术规划遭质疑,海外币圈今天在聊啥?

Solana上的“隐形税”

达利欧年度复盘:货币、美股与全球财富再分配

第一轮参与者见解 — AOT 矩阵: AI交易中的左脑分析、右脑决策

在WEEX AI交易哈克松中,AOT Matrix选择了系统设计上更加谨慎的道路 — — 在实盘交易环境中,这条路实际上更难走完。 从一开始,他们就对AI在交易系统中应该和不应该扮演什么角色做出了明确的选择。 我们采访了AOT Matrix,了解他们的决策逻辑、系统架构的多次迭代,以及在WEEX的真实交易环境和工程约束下实现它的感受。

Trend Research:2026超越范式,WLFI开启金融生态新纪元

预赛选手解读——AOT Matrix:左脑分析,右脑决策的AI交易系统

在 WEEX AI Trading Hackathon 的参赛项目中,AOT Matrix 的系统设计选择了一条相对克制、但在真实交易环境下更难走的路径。在备赛初期,他们便围绕AI 在交易系统中的角色边界做出了明确取舍。围绕这一决策逻辑、系统架构的多次重构,以及在 WEEX 真实交易环境与工程约束下的实践过程,我们对 AOT Matrix 进行了采访。