What is the secret behind XRP's surging price?

Original Article Title: Behind the XRP Breakout: Drivers and Dynamics

Original Article Author: KoreanDegen, Crypto Kol

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: The recent surge in XRP price has caught everyone's attention, resulting from a combination of multiple factors such as a technical breakout, renewed interest from Korean investors (along with the dismissal of the SEC lawsuit and the WisdomTree S-1 filing), and the absence of historical sell pressures from figures like Jed McCaleb. These factors together drove demand for XRP, leading to exceptional market performance.

Below is the original content (slightly reorganized for better readability):

The recent breakout of XRP has unveiled a complex interaction between technicals, market structure, and regional dynamics.

Market Background

On November 10, XRP surged above around $0.55, decisively breaking through the 100-week, 200-week, and 350-week moving averages.

Perpetual Contract CVD: Decreasing.

Open Interest Volume: Increasing.

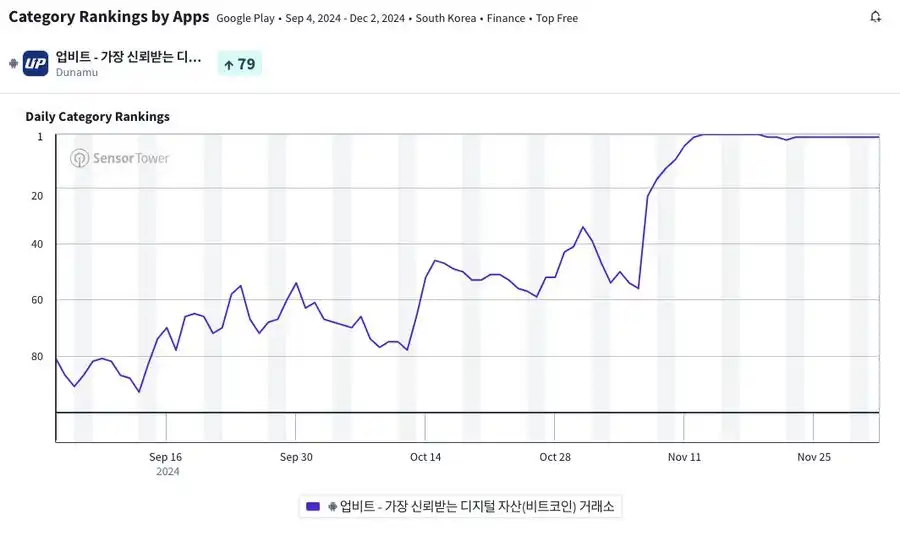

Simultaneously, Upbit's rankings on the App Store and Play Store started rising. The intersection of these factors hinted at brewing market activity.

November 12: Inflection Point

Upbit claimed the top spot in the Play Store rankings, considering Korea's user demographic — primarily older investors aged 50 to 60, predominantly on Android devices with Samsung holding a dominant position — this signal was particularly significant.

With the surge in demand, XRP crossed the ₩1,000 Korean Won mark (around $0.71). Arbitrageurs swiftly adjusted the market imbalance, leading to a significant number of short positions being liquidated.

Supply Void

In previous cycles, Jed McCaleb's continuous selling constrained XRP's upward momentum. However, this time he no longer has more coins to sell.

Structural Breakthrough

Only the historical charts of Bitstamp and Upbit can be traced back to 2017, showing a six-year continuous diagonal breakthrough. Meanwhile, Upbit's overwhelming advantage in spot trading volume has become a symbol of South Korea's investment enthusiasm.

Characteristics of the Demand Group

According to a recent report by the "Hankyung News," the role of older South Korean investors in the crypto market is becoming increasingly prominent:

Since 2021, the number of crypto accounts held by individuals aged 60 and above has increased by 30% (+188,000 new accounts).

The group of individuals aged 50 and above has seen a 22.5% increase in accounts (+356,000 accounts).

By September 2024, individuals aged 60 and above collectively hold $4.8 billion in crypto assets.

This demographic shift indicates that older investors, particularly in South Korea, have played a key role in driving XRP demand.

Article Link: Hankyung Article

Broader Context

While South Korea's trading volume is a major factor, it is not the sole driving force. Other exchanges, such as Coinbase and Robinhood, have also contributed to XRP's surge. Currently, XRP's spot trading volume has exceeded $6.6 billion.

This is not just a regular uptrend. It is a convergence of the following factors:

1. Key Technological Breakthrough.

2. Retail Investors, especially Korean investors, regained interest (subsequently further fueled by SEC lawsuit dismissal and WisdomTree S-1 filing).

3. Major historical sell pressure sources like Jed McCaleb's supply absence.

When causality and multiple factors collide, the result is often extraordinary.

猜你喜欢

相比于Gas期货市场,ETHGas更想做的是实时执行层

AI 如何帮助加密交易者分析市场、管理风险并更智能地进行交易

加密交易不再仅仅是一个好主意 — — 而是在一个永不停止的市场中始终如一地执行。 随着数据量和市场速度的增加,传统的人工分析达到了极限。 AI通过改变市场分析、情绪解读和风险控制的方式,帮助交易者超越这些限制。 本文探讨了人工智能如何重塑加密交易 — — 以及这对当今交易者意味着什么。

WEEX × LALIGA: 代表共同卓越标准的七星

真正的足球卓越绝非偶然。 它建立在纪律、一致性和在压力下交付的能力之上 — — 一季又一季。 同样的原则也适用于专业交易,长线表现比空头势头更重要。 作为LALIGA的官方区域合作伙伴,WEEX重点推荐了七位体现联盟竞争精神和全球申诉的杰出球员。 每款产品都为球场带来独特的风格,但所有产品都拥有与WEEX对稳定性、计算精度和专业执行的承诺紧密一致的价值观。 这种伙伴关系建立在共同标准之上——一致性和控制力决定了压力下的业绩。

Arkstream Capital:当加密资产2025年重归「金融逻辑」

从武汉到硅谷,Manus 只用了九个月就做到了。

你可以称它为“包装器”,但它一直包裹在Meta上。

特朗普拥抱加密货币的这一年

IOSG:港口与新城,BNB Chain与Base的两种加密世界观

WEEX 与 LALIGA 合作,扩大全球影响力,将加密技术融入主流体育文化

Hong Kong, Jan. 1, 2026. WEEX与LALIGA建立了新的合作伙伴关系,成为LALIGA在台湾和香港的官方区域合作伙伴。 该协议将WEEX引入LALIGA的区域合作伙伴网络,并为赛季期间球迷和交易商的参与打开了新途径。

永续合约前传:用魔法公式为流动性定价,透明度让其无法发扬光大

读懂美股上链:为何币圈人转投美股,华尔街却反向上链?

老牌国产公链NEO两位创始人撕逼,财务不透明为核心原因

香港虚拟资产交易平台新规(下):新通函发布,虚拟资产业务的边界被重新划清了?

2026年失序重组下的DeFi2.0爆发

加密中的人工智能交易: 交易者如何在真实加密市场中实际应用人工智能

人工智能已经超越了加密市场的实验。 2025年,人工智能驱动的交易工具越来越多地被交易者使用,他们希望在动荡的市场中获得更好的纪律、更快的执行和更有条理的决策。 本指南将逐步解释人工智能在加密交易中的实际应用 — — 重点是如何在真实交易环境中执行这些策略。

美联储最新会议纪要:分歧仍存,但「大多数」官员主张继续降息

市场更新 — 十二月月31日

从韩国和OECD加速实施加密监管合规框架,到TAO ETF、隐私技术、矿业、比特币储备等同时发展,安全事件和资金损失持续上升,加密市场在“强监管+技术演进+风险放大”的多重挑战中,进入新阶段。

第一个大规模采用「收益型稳定币」的,是中国

Lighter代币分配引争议、Zama上线USDT隐私转账,海外币圈今天在聊什么?

相比于Gas期货市场,ETHGas更想做的是实时执行层

AI 如何帮助加密交易者分析市场、管理风险并更智能地进行交易

加密交易不再仅仅是一个好主意 — — 而是在一个永不停止的市场中始终如一地执行。 随着数据量和市场速度的增加,传统的人工分析达到了极限。 AI通过改变市场分析、情绪解读和风险控制的方式,帮助交易者超越这些限制。 本文探讨了人工智能如何重塑加密交易 — — 以及这对当今交易者意味着什么。

WEEX × LALIGA: 代表共同卓越标准的七星

真正的足球卓越绝非偶然。 它建立在纪律、一致性和在压力下交付的能力之上 — — 一季又一季。 同样的原则也适用于专业交易,长线表现比空头势头更重要。 作为LALIGA的官方区域合作伙伴,WEEX重点推荐了七位体现联盟竞争精神和全球申诉的杰出球员。 每款产品都为球场带来独特的风格,但所有产品都拥有与WEEX对稳定性、计算精度和专业执行的承诺紧密一致的价值观。 这种伙伴关系建立在共同标准之上——一致性和控制力决定了压力下的业绩。

Arkstream Capital:当加密资产2025年重归「金融逻辑」

从武汉到硅谷,Manus 只用了九个月就做到了。

你可以称它为“包装器”,但它一直包裹在Meta上。