Fast as lightning is not enough, what is the EVM chain really pushing for?

Original Title: Battle of the EVM Chains: Who's Winning the Giga Gas War?

Original Author: yusufxzy, Delphi_Digital Researcher

Original Translation: Dynamic Duo Deep

Editor's Note: The current focus of EVM-compatible chains (such as Sonic, MegaETH, Monad, Sei, Fuel) has shifted from decentralization and security to raw performance and ecosystem strategy. Each chain is competing in the market through differentiated paths (such as developer incentives, extreme speed, ecosystem pre-building, technical optimization, or Layer 2 innovation), but the ultimate winner must establish an advantage across comprehensive dimensions such as speed, user experience, economic model, and ecosystem maturity, rather than relying solely on throughput.

The following is the original content (rearranged for easier reading comprehension):

The blockchain space has entered a new dimension of competition. The early battle between L1 and L2 focused on decentralization, composability, and security. Now the battlefield has shifted to the raw performance track. Multiple EVM-compatible chains including Sonic, MegaETH, Fuel, Monad, and Sei are competing to break through the once-considered impossible scalability peak. But is raw performance the deciding factor? This article analyzes the strategic differences of these chains.

Sonic: Linking Developer Rewards to Ecosystem Contribution

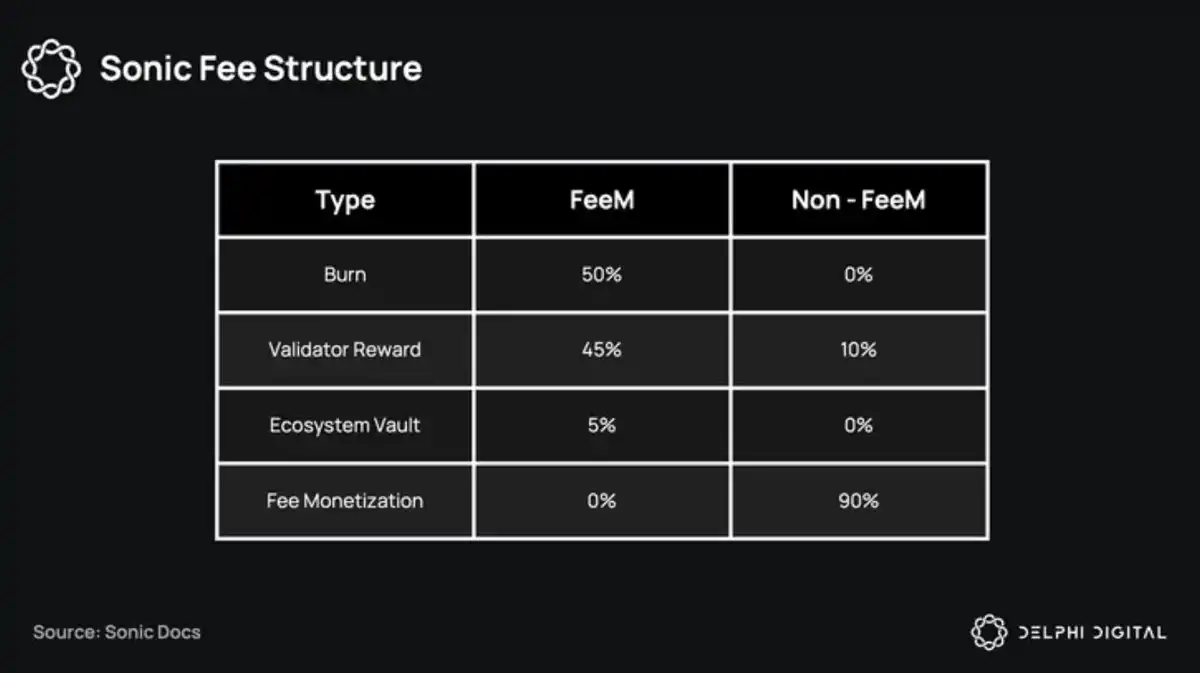

@SonicLabs (formerly Fantom) has completed a strategic transformation, and its core innovation, the "FeeM" mechanism, allocates 90% of transaction fees generated by applications to developers, with validators receiving only 10%.

This model has proven effective—ecosystem DEX project @ShadowOnSonic

has quickly risen to the Top 4 in weekly revenue rankings. Meanwhile, Sonic's dual incentives through DeFi app interactions and token airdrops have driven TVL to a historical high of $9.62 billion.

Competitive Advantage:

• Direct economic incentives linking to developer loyalty

• High-yield-driven application ecosystem stickiness

• Early adoption to validate the effectiveness of the metric verification model

Potential Challenge:

• Decentralization is still at a nascent stage (currently around 35-40 validator nodes)

• Continued development momentum is needed to eliminate the impact of Fantom's brand history

MegaETH: The Balancing Act of Ultimate Speed and User Experience

The @megaeth_labs testnet set a performance record of one gigagas per second with a 0.1 millisecond block time, leveraging its L2 architecture to achieve this breakthrough by abandoning the consensus mechanism.

But the chain's ambition goes beyond data: it is the first to experimentally support EIP-7702, addressing a historical pain point since 2020 where users have lost over $300 million due to approval operations through innovations such as transaction batching and Gas abstraction.

In terms of community building, MegaETH, with a valuation of $2 million, completed a public sale in 10 minutes, raising $10 million, followed by an NFT fundraising round reaching a $6 million valuation, starkly in contrast to VC financing.

Competitive Advantages:

• Industry-leading testnet performance metrics

• First-mover advantage in UX innovation (EIP-7702)

• Community consensus achieved through fair token distribution

Potential Challenges:

• Dependency on the EigenDA data availability layer

• Aggressive performance targets awaiting real-world validation

Monad: Building an Ecosystem Before Going Live

Although the @monad_xyz mainnet has not yet launched, it has already built a complete infrastructure matrix: on the first day, it integrated with the Phantom wallet, attracted top DeFi protocols like Uniswap/Balancer, and integrated cross-chain solutions like LayerZero.

This "plug-and-play" strategy can be seen as a force multiplier in today's crowded blockchain space.

Competitive Advantages:

• Ready-to-use ecosystem infrastructure

• Launch-ready with high liquidity channels

Key Challenge:

• Need to transform early momentum into sustained growth

Sei: The Disruptive Challenge of Tech Prodigies

@SeiNetwork has achieved an internal scalability breakthrough through deep optimization of the consensus and storage layers, along with injecting funding into early developers. However, the current ecosystem still lacks flagship applications, struggles with user adoption and faces competition gaps, as its technical advantages have yet to translate into market influence.

Competitive Advantage:

• Proven scalability technology architecture

• Specialized grant programs for builders

Key Challenge:

• Low actual adoption rates

• Urgent need to create a phenomenon-level application

Fuel: Breaking Free from Ethereum's DA Shackles

@fuel_network's upcoming "Redacted" L2 adopts an alternative DA solution, aiming to achieve a throughput of 150,000 TPS, marking a strategic shift from Ethereum compatibility to performance prioritization. Its vision of 1-millisecond confirmations and 400,000 orders per second will redefine the performance benchmark for public chains.

Endgame Perspective: The Value War Beyond Throughput

While the market value of these tokens is still to be observed, the current L1 and L2 race has become saturated. With intense competition among chains in terms of liquidity, applications, developers, and users, valuations may show a downward trend.

As gas in the gigabyte range becomes the norm, the real winners will be those that can offer a higher value public chain, including speed advantages, incentive mechanisms, user experience, ecosystem completeness, and security guarantees among other comprehensive strengths. The gigabyte gas war is intensifying, but the ultimate key to victory is by no means limited to raw throughput.

猜你喜歡

Trust Wallet 遭黑客攻擊最大損失達350萬美元

Key Takeaways 最大受害者損失了約350萬美元,該錢包已休眠一年。 第二大損失達140萬美元,該錢包已休眠兩年以上。 黑客共竊取超過600萬美元加密資產,其中超過400萬美元已轉移至CEX。 自托管錢包面臨基礎設施漏洞的潛在風險。 WEEX Crypto News, 26 December 2025 近期,Trust Wallet 發生了一起嚴重的黑客事件,此次事件引發了業界廣泛關注。在這起事件中,Trust Wallet的一個錢包損失了價值高達350萬美元的加密資產,該錢包在此次攻擊前已經休眠了一年多。此外,另一個損失較大的錢包也損失了約140萬美元,在攻擊發生前已經休眠超過兩年。 Trust Wallet…

项目方將40萬美元BDXN代幣注入多個交易所

Key Takeaways 三個BDXN項目方相關的錢包地址向多個交易所存入價值約40萬美元的BDXN代幣。 這些代幣於兩個月前從項目方的錢包轉出。 相關監測由onchainschool.pro 提供。 代幣轉移涉及的地址包括0xD5682dcA35D78c13b5103eB85c46cDCe28508dfB等。 WEEX Crypto News, 26 December 2025 BDXN項目方關聯錢包的最新動向 近期,BDXN項目方的部分地址將價值40萬美元的BDXN代幣注入多家交易所。據onchainschool.pro的監測顯示,與BDXN項目方相關的三個主要錢包在過去三小時內完成這一轉移操作,而這批代幣則早在兩個月前便從項目方錢包中轉出。 監測機構報告及相關地址詳情 這次轉移操作首次由onchainschool.pro監測到,並在ChainCatcher等多家媒體上披露。根據報告的數據,涉及到的三個錢包地址分別是:0xD5682dcA35D78c13b5103eB85c46cDCe28508dfB、0xD0Fc2894Dd2fe427a05980c2E3De8B7A89CB2672以及0xAc245a570A914C84300f24a07eb59425bbdC1B48。這些地址攜帶的代幣價值總計約40萬美元。 轉移代幣的未來意圖及市場影響…

# 龐貝與互聯網:Base 網絡上的 PancakeSwap V3 池中流動性獎勵啟動

Key Takeaways PancakeSwap 透過 Brevis Incentra 在 Base 網絡引入了 12 個 V3 池並開始提供流動性獎勵。 使用者可以在 Optimism 平台上通過 Incentra 添加流動性,不僅獲得交易費用,還能賺取…

代幣 VS 股權,Aave 爭議的來龍去脈

12月26日市場關鍵情報,你錯過了多少?

加密聖誕劫:損失超600萬美元,Trust Wallet 擴展錢包遭駭分析

Trust Wallet 瀏覽器擴展陷入安全事件,損失超過600萬美元

Key Takeaways Trust Wallet 瀏覽器擴展遇到了重大安全問題,影響版本2.68的用戶。 安全問題發生後,用戶報告其錢包資金在短時間內被轉移。 Trust Wallet 建議受影響的用戶立即升級到版本2.69。 這起事件強調了強化加密錢包安全措施的必要性。 WEEX Crypto News, 26 December 2025 在2025年12月25日,Trust Wallet…

# 比特幣重新測試9萬美元關口的潛在路徑分析

Key Takeaways 比特幣價格在12月26日節禮日達到90,027美元,24小時內漲幅1.53%。 市場對即將到期的期權抱有關注,這一事件將影響比特幣的價格走勢。 技術分析顯示,比特幣可能會在近期上下波動,但長期趨勢仍未明朗。 儘管歷史數據顯示12月份通常的看漲趨勢,比特幣的中位回報可能會在11月疲弱後變成負值。 WEEX Crypto News, 26 December 2025 比特幣價格的近期動態 隨著全球金融市場在聖誕假期後逐步恢復交易活躍度,比特幣價格再次成為投資者關注的焦點。據HTX行情數據顯示,截止到12月22日,比特幣價格回升並突破90,000美元,現報90,027美元,顯示出市場對其未來走勢的樂觀情緒。 然而,比特幣的價格波動並不總是穩定的。根據另一來源,12月初的一次重大價格下挫把價格推回至89,259美元,這使得它成為自2025年4月22日以來的最低點。然而,目前比特幣的交易價格約為91,000美元,價格走勢顯示出強烈的震盪性。 市場對比特幣期權到期的影響 在12月26日節禮日,全球最大的加密貨幣期權交易所Deribit即將迎來270億美元的比特幣和以太坊期權合約到期。這一事件不僅影響市場情緒,還可能對比特幣的短期價格產生波動性影響。 Deribit的數據表明,這次到期會影響該平台超過50%的未平倉合約,並表現出看漲偏好。這樣大規模的期權到期事件常常會引發市場變動,因為交易者可能會展期或選擇讓合約到期,這可能對未來價格走勢構成轉折點。…

比特幣期權到期將成為市場波動關鍵

Key Takeaways 本週五,約236億美元的比特幣期權於Deribit平台到期。 最大痛點價位為9.6萬美元,可能成為價位上下浮動的基準。 以太幣期權同日到期,總價值達38億美元,總體加密貨幣市場承受壓力加大。 場內分析顯示,比特幣看漲期權占優勢,市場情緒整體偏向樂觀。 WEEX Crypto News, 26 December 2025 創紀錄的比特幣期權到期將如何影響市場 本週五,加密貨幣市場將迎來有史以來最大的期權到期事件,價值達236億美元的比特幣期權合約將在Deribit平台結算。這一巨大數額的期權到期可能對近期比特幣價格走勢產生顯著影響,特別是在目前市場中出現的觀察到的波動性和交易活躍度上。 比特幣價格動向 目前,比特幣(BTC)保持在約8.7萬美元的區間波動,此次到期事件可能成為突破價格區間的契機。分析師指出,在聖誕節期間,比特幣往往會受到年末期權結算的波動影響,這是由於市場所承受的巨大拋壓及流動性降低所致。 市場整體情緒與分析 來自QCP…

# 比特幣市場風險放緩與未來趨勢

Key Takeaways 自10月中旬以來,比特幣市場情緒趨於謹慎,交易員推測市場可能在2026年依然承壓。 近期比特幣面臨波動率降低及風險偏好不足的挑戰,但市場倉位結構已出現變化。 歷史表明年底交易通常更加保守,但新年伊始資金配置和風險預算可能會加速變化。 下跌動能邊際放緩,但比特幣上行仍需新的推動因素。 投資者需密切關注比特幣期權到期的行權價分布,這是市場壓力與潛在機會的重要指標。 WEEX Crypto News, 26 December 2025 比特幣市場現狀 Matrixport 最新的周度報告指出,比特幣自今年10月中旬以來一直承受著市場回落的壓力。市場情緒已顯著轉為謹慎,這一趨勢使得交易員們開始預測在2026年,比特幣市場可能仍然處於承壓狀態。這一情形下,交易員普遍開始關注「四年周期」的提法,研究歷史模式以預測未來可能的發展走向。 技術和市場動態 儘管市場承壓,但從衍生品、ETF和其他關鍵技術指標來看,倉位結構正在發生微妙的變化。報告強調了歷史上年末時期市場通常更加保守,而隨著新年的開始,資本重新配置和風險預算恢復,市場情緒可能會快速反轉。…

以太坊價格趨勢:市場流動性減少,巨鯨持續加倉引發潛在上漲

Key Takeaways 近期以太坊價格在2800美元至3000美元之間震盪不已,陷入典型的“無交易區”。 假日期間市場流動性減少導致交易活躍度下降,但以太坊巨鯨悄然增加持倉。 日成交量較月均水平下降逾20%,短期波動率處於低位。 鯨魚地址在過去一週增持約22萬枚ETH,顯示對其長期價值的認可。 市場參與度恢復及價格站穩3000美元關口或將決定未來走勢。 WEEX Crypto News, 26 December 2025 以太坊價格波動與巨鯨活動背景 近期,以太坊(Ethereum,ETH)價格呈現橫盤整理態勢,主要在2800美元至3000美元之間波動,形成所謂的“無交易區”。這種情況主要受到假日期間市場流動性減少的影響,使得短線交易活躍度降低。然而,在此背景下,以太坊的巨鯨似乎對未來市場持樂觀態度,正悄然增加持倉,為後市經濟走向設下潛在伏筆。 鯨魚持倉增加的意義 根據鏈上數據顯示,過去一週內,持有1萬至10萬枚ETH的大額地址累計增持了約22萬枚ETH,總體持倉量明顯上升。這些大額地址通常以中長期配置為主,表明他們對以太坊長期價值的認可。這些巨鯨的行為在低波動率的市場中顯得尤為重要,預示著市場信心得到一定程度的支持。 市場情緒及短期價格走向…

以太坊2026:Glamsterdam和Hegota分叉提升擴展性

關鍵要點 Glamsterdam分叉將提高以太坊的處理能力,允許多線程併行處理交易和大幅提高gas上限,以促進以太坊L1層的擴展。 新的分叉將引入零知識證明(ZK)技術,預計10%的網絡將轉向此技術,這將為更高的交易數量提供可能。 將增加數據blob的數量,並強化以太坊2層(L2)協議的擴展性,每秒處理數十萬筆交易變得更為可行。 以太坊互操作層的計劃將改進跨鏈操作,並在年底引入的Heze-Bogota分叉將增強隱私和抵制審查的能力。 WEEX Crypto News, 2025-12-26 10:06:42 2026年對於以太坊的發展至關重要,Glamsterdam分叉將為以太坊帶來革命性的提升,改變現有的交易處理機制,並提升網絡的總體能力。目前,以太坊運行於單核心模式下,交易需要依序進行處理,導致效率較低。然而,Glamsterdam分叉將實現”完美”的併行處理,允許多個交易同時在不同的核心上運行。 Glamsterdam分叉:關鍵技術升級 第一個重要的技術升級是“區塊進入列表”(Block Access Lists,EIP-7928),儘管這聽起來像是一種審查機制,但實際上它實現了併行處理的可能性。這種升級允許以太坊網絡擁有如高速公路般的多通道交易處理能力,大大地增強了系統的處理速度。每個區塊都會包含一個映射,指示哪些交易相互影響,這讓系統能夠在多個處理核心上同時運行不同的交易,不會產生衝突。 連同“區塊進入列表”,另一個值得關注的技術是“內建提案者建造者分離”(Enshrined Proposer Builder…

聯儲局2026年第一季度展望:比特幣和加密市場的潛在影響

關鍵要點 聯儲局暫停利率降息可能對加密貨幣市場施壓,但“隱形量化寬鬆”或許能緩解下行風險。 流動性比降息更加重要,將在2026年第一季度塑造比特幣和以太坊的走向。 若持續通脹壓力,BTC或跌至70,000美元,ETH可能降至2,400美元。 “隱形量化寬鬆”策略可能在沒有激進降息的情況下穩定加密價格。 比特幣價格可能上升到92,000至98,000美元,以太坊或能推升至3,600美元。 WEEX Crypto News, 2025-12-26 10:06:42 隨著美國聯邦儲備系統在2025年內三度降息,主要是在最後一季,失業率上升及通脹顯露明顯緩和跡象。然而,加密貨幣市場反應却出人意料,並未因寬鬆政策而上揚,相反,比特幣、以太坊及主要替代幣銷售疲軟,總市值較10月的歷史高位縮減超過1.45萬億美元。本篇將深入分析央行政策至2026年三月的可能走勢,及其對整體加密市場的潛在影響。 聯儲局暫停降息可能導致比特幣、以太坊進一步下跌 儘管聯儲局連續三次下調0.25%的利率,多數官員包括紐約聯邦儲備銀行總裁約翰·威廉姆斯強調通脹和數據依賴風險,未提供進一步寬鬆的明確信號。威廉姆斯於12月19日表示:「我個人不急於立即在貨幣政策上採取進一步行動,因為我認為我們已作出的降息非常有效。」他補充說:「我希望看到通脹降至2%而不對勞動市場造成不必要的損害,這是一個平衡的行為。」 在這個背景下,11月的消費者物價指數(CPI)達到2.63%或提高2026年第一季度進一步降息的可能性。然而,美國政府的歷史性停擺干擾了勞工統計局的數據收集。一些經濟學家如羅賓·布魯克斯擔心這可能扭曲了11月的年通脹讀數。這種不確定性解釋了為何加密市場在過去幾個月未因降息消息而反彈。 BTSE交易所的首席運營官Jeff Mei指出,如果聯儲局在2026年第一季度保持利率不變,比特幣價格可能跌至70,000美元,以太坊價格則可能低至2,400美元。 聯儲局的“隱形量化寬鬆”可能穩定加密價格…

Kraken IPO 點燃加密貨幣的“中期”週期

重要要點 Kraken將進行IPO,有望吸引更多傳統金融(TradFi)資本進入加密貨幣市場。 比特幣價格曾突破歷史新高,但因19億美元的清算事件後回落。 一些分析師對比特幣牛市的持續性持不同意見,預測2026年可能是”冷淡年”。 市場趨勢受到全球流動性和主權採用的影響。 Nansen平台上的“聰明資金”交易者正預測市場短期下跌。 WEEX Crypto News, 2025-12-26 10:06:43 在加密貨幣界,Kraken這家知名的加密貨幣交易所計劃於明年進行首次公開募股(IPO),此舉可能為行業引入更多的傳統金融資金流入。加密貨幣市場的持續發展使眾多公司籌劃上市,而Kraken的IPO無疑為這一潮流增添了重要的一筆。面對近日的19億美元清算事件,全球最大的加密貨幣比特幣在10月6日達到了史無前例的126,000美元後,現跌至每枚87,015美元,兩周內下降了6%。但市場仍然顯得生機勃勃,具有巨大的投資潛力。 傳統金融資本的吸引力 Dan Tapiero,50T Funds的創始人兼首席執行官,表示比特幣牛市仍處於”中期”。Tapiero特別指出,像Kraken這樣的IPO以及愈發頻繁的兼併與收購活動(M&A),將成為為引進傳統金融資本進一步提升的催化劑。Kraken不僅成功籌集了8億美元的資金,市值達20億美元,並且於11月初已在美國申請IPO,為其上市鋪平了道路。 這些動向不僅僅只是資金的流動,也是一種市場信號,表明加密貨幣市場的成熟正在觸發一系列傳統金融的關注。資金充裕的平台才能在不穩定的市場中生存並茁壯成長,Kraken的IPO預示著新一輪資金流入的可能性,而這可能進一步推動市場上比特幣以及其他加密貨幣的價格動向。 多樣化的預測…

加密衍生品交易量達到86萬億美元,幣安佔據市場30%份額

重要提示 2025年,加密衍生品交易量驚人增加至86萬億美元,平均每日交易額達到2650億美元。 幣安在全球衍生品市場中佔據近30%的份額,其年度交易量達到25.09萬億美元。 市場從零售牽引型模式轉向以機構避險和ETF為主的複雜衍生品結構。 2025年,全球加密衍生品未平倉合約利息達到2359億美元的歷史高點,顯示市場波動和杠桿效應的增加。 在10月,因美國新政策引發市場恐慌,強制清算激增達到190億美元,揭示了市場風險及其脆弱性。 WEEX Crypto News, 2025-12-26 10:06:42 全球加密衍生品市場概況 2025年,全球加密衍生品市場以驚人的速度增長,年度交易總額達到了86萬億美元,這意味著每日的交易額達到平均2650億美元。在這個充滿挑戰與機遇的市場中,幣安無疑成為了領頭羊,佔據了全球29.3%的市場份額,其交易量達到25.09萬億美元。其餘的市場份額被OKX、Bybit和Bitget等主要交易平台瓜分,這些平台的年交易量在8.2萬億至10.8萬億美元之間。這四家交易所共同佔據了全球市場份額的62.3%。 隨著加密貨幣市場的演進,不同類型的衍生品層出不窮,市場模式也從以往由高杠桿驅動的零售市場轉向更為精細的組合,包括機構避險、基差交易和ETF基金的引入。這一轉變不僅重塑了市場格局,還引入了更深層次的杠桿鏈條和風險管理挑戰。 市場模式的巨變 衍生品市場的複雜化在2025年達到了一個新的高度。CoinGlass的報告指出,這一轉變不僅僅是形式上的,它還伴隨著機構進入的加速,特別是在Chicago Mercantile Exchange…

社交工程讓加密貨幣在2025年損失數十億:專家教你如何保護自己

核心要點 2025年,加密貨幣行業遭受了超過34億美元的盜竊,主要由於社交工程和人為因素。 駭客透過使用人工智慧加強的社交工程來進行高度個人化的攻擊,這些攻擊更難以偵測。 專家建議使用自動化防禦和強化身份驗證來減少人為失誤並提升防禦效率。 部分駭客開始利用AI創造深度偽造來進行社交工程攻擊,具挑戰性。 物理攻擊如扳手攻擊雖然不常見,但加密持有者應該在網上低調以避免成為目標。 WEEX Crypto News, 2025-12-26 10:06:42 2025年,加密貨幣行業的安全挑戰來到了新高度,駭客利用社交工程手段造成了大量損失。這些攻擊不再僅僅依賴於技術漏洞,而是利用人的信任和失誤,這使得防範的重心從技術轉向了人性。在這篇文章中,我們將深入解析這些安全威脅的本質與對策,幫助你在新的風險環境中保護自己。 社交工程的崛起 社交工程作為一種操控人類心理以獲得敏感信息的攻擊手段,在2025年非常猖獗。根據加密貨幣交易所Kraken的首席安全官Nick Percoco指出,駭客往往不再嘗試撬開技術防護的大門,取而代之的是被“邀請”進入系統。這説明,攻擊通常從一次看似善意的對話開始,而非複雜的惡意代碼。 Chainalysis的數據顯示,從今年1月至12月,曾經的安全重鎮Bybit遭到了大規模的資源外流事件,光是一次攻擊就讓整個行業損失過半。在這次事件中,攻擊者通過社交工程方式進入系統,注入了惡意的JavaScript,從而竊取資金。 社交工程攻擊的核心是在心智層面上作戰。Percoco強調,安全不再是建造更高的圍牆,而是要培養能夠辨識操控的心理素養。明確不因他人話術或製造恐慌而交出重要信息,是每個人的重任。 駕馭科技的防禦策略…

聖誕快樂,Caroline Ellison:獲早期釋放的新聞

主要收穫 Caroline Ellison,前Alameda Research首席執行官,將於1月提前獲釋。 Ellison因牽涉FTX的資金濫用和相關不法交易被判兩年徒刑。 由於好行為獎勵及重返社會計畫,她的實際服刑時間縮短。 釋放後,她將被禁止在未來十年內擔任任何加密貨幣交易所或其他公司的管理職位。 WEEX Crypto News, 2025-12-26 10:08:41 前Alameda Research首席執行官Caroline Ellison因牽涉到FTX的倒閉事件而受到公眾的高度關注。她被判刑兩年,並將於1月21日獲得釋放,提前結束她的聯邦監禁期。根據美國聯邦監獄管理局提供的資料,Ellison原本預計要到明年2月20日才能獲釋,但現在她在紐約市的一個重返社會管理辦事處度過最後的刑期。 Ellison的早期釋放引發了關注,許多人對這個決定的原因感到好奇。雖然官方沒有公開具體原因,但不少聯邦囚犯有資格獲得好行為信用和重返社會計畫,這通常會減少他們的服刑時間。 Ellison在加入Alameda Research後成為了一個公眾人物,並曾經與FTX的前首席執行官Sam…

針對新手、老鳥和懷疑者的加密貨幣建議:來自一位失去7億美元比特幣的比特幣投資者

重點摘要 新手應在進入加密貨幣市場前透徹了解其運作和目的,以避免不當投資。 加密貨幣老鳥應不斷測試其加密錢包的備份機制,確保資金安全。 懷疑者在形成任何結論前,應實際使用加密貨幣來理解其價值和潛力。 避免追逐華爾街和政界的認可,重點應放在推進點對點加密採用。 WEEX Crypto News, 2025-12-26 10:08:40 在2026年,一位因錯丟8,000枚比特幣而成名的比特幣老手James Howells,分享了他對於加密貨幣新手、老鳥和懷疑者的建議。過去12年中,Howells持續努力試圖從垃圾場中追回那價值7億美元的比特幣,而不再讓損失定義他的生活。他給予了新進入這個行業的投資者、經驗豐富的投資者以及批評者一些關鍵的建議和決心。 新手踏入加密市場前需先透徹了解 許多新手在不瞭解加密貨幣究竟是什麼的情況下,便貿然進入市場。Howells強調,急於投資之前應該先深入學習他們要購買的加密貨幣及其試圖解決的現實問題。他指出:「先了解區塊鏈怎麼運作,為什麼去中心化金融存在,及其解決的問題。」 法幣體系將權力集中在政府和中介機構手中,而區塊鏈技術則提供給個人一個不需要第三方許可的退出選擇。「理解這點比購買任何硬幣更重要。」 新手應小額嘗試並慎重實驗 在掌握基本知識後,Howells建議新手應該在各種加密協議、服務和錢包上進行實驗,但不應投入真實金錢。「錯誤和損失是學習的一部分,關鍵在於確保這些教訓只損失一點小錢,而不是整個薪水。」 這可以讓投資者從錯誤中進步,如Howells所說,沒人會在損失$0.10時抱怨技術問題,卻在損失$20或更多時歸咎於整個技術。…

Trust Wallet 遭黑客攻擊最大損失達350萬美元

Key Takeaways 最大受害者損失了約350萬美元,該錢包已休眠一年。 第二大損失達140萬美元,該錢包已休眠兩年以上。 黑客共竊取超過600萬美元加密資產,其中超過400萬美元已轉移至CEX。 自托管錢包面臨基礎設施漏洞的潛在風險。 WEEX Crypto News, 26 December 2025 近期,Trust Wallet 發生了一起嚴重的黑客事件,此次事件引發了業界廣泛關注。在這起事件中,Trust Wallet的一個錢包損失了價值高達350萬美元的加密資產,該錢包在此次攻擊前已經休眠了一年多。此外,另一個損失較大的錢包也損失了約140萬美元,在攻擊發生前已經休眠超過兩年。 Trust Wallet…

项目方將40萬美元BDXN代幣注入多個交易所

Key Takeaways 三個BDXN項目方相關的錢包地址向多個交易所存入價值約40萬美元的BDXN代幣。 這些代幣於兩個月前從項目方的錢包轉出。 相關監測由onchainschool.pro 提供。 代幣轉移涉及的地址包括0xD5682dcA35D78c13b5103eB85c46cDCe28508dfB等。 WEEX Crypto News, 26 December 2025 BDXN項目方關聯錢包的最新動向 近期,BDXN項目方的部分地址將價值40萬美元的BDXN代幣注入多家交易所。據onchainschool.pro的監測顯示,與BDXN項目方相關的三個主要錢包在過去三小時內完成這一轉移操作,而這批代幣則早在兩個月前便從項目方錢包中轉出。 監測機構報告及相關地址詳情 這次轉移操作首次由onchainschool.pro監測到,並在ChainCatcher等多家媒體上披露。根據報告的數據,涉及到的三個錢包地址分別是:0xD5682dcA35D78c13b5103eB85c46cDCe28508dfB、0xD0Fc2894Dd2fe427a05980c2E3De8B7A89CB2672以及0xAc245a570A914C84300f24a07eb59425bbdC1B48。這些地址攜帶的代幣價值總計約40萬美元。 轉移代幣的未來意圖及市場影響…

# 龐貝與互聯網:Base 網絡上的 PancakeSwap V3 池中流動性獎勵啟動

Key Takeaways PancakeSwap 透過 Brevis Incentra 在 Base 網絡引入了 12 個 V3 池並開始提供流動性獎勵。 使用者可以在 Optimism 平台上通過 Incentra 添加流動性,不僅獲得交易費用,還能賺取…