Is USD0 the next UST? Will USUAL holders need to panic?

2024 was a big year for stablecoin projects, with an increasing number of innovative new stablecoin projects emerging in the market. Just in the second half of last year, at least 23 stablecoin projects received funding ranging from 2 million to 45 million. Apart from Ethena, which surpassed DAI in market share with its USDe, Usual became another eye-catching stablecoin project. Not only did it have the endorsement of French Member of Parliament Pierre Person's government background, but Usual also launched on Binance at the end of 2024, showcasing its performance in the market.

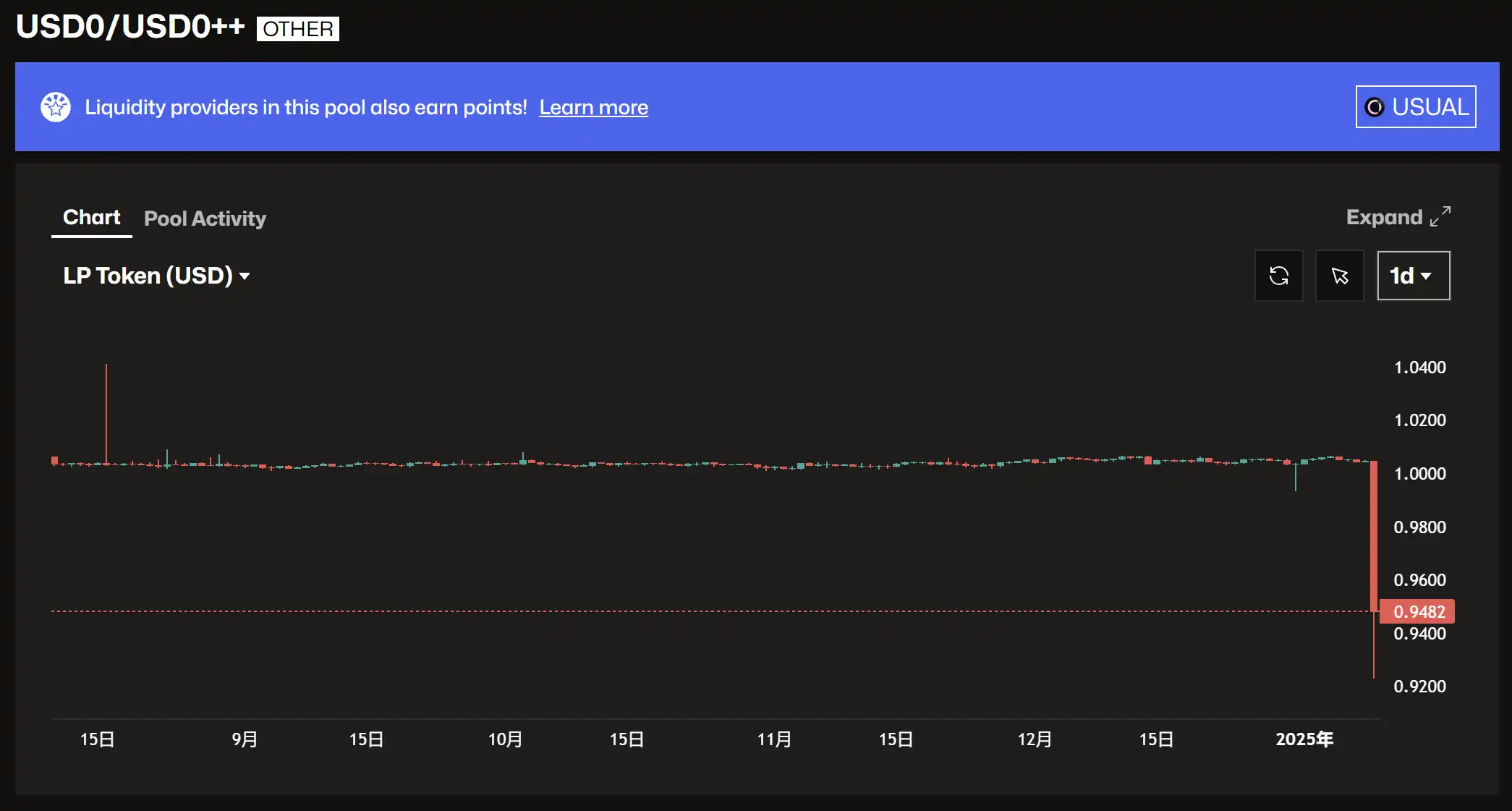

However, Usual, once a market darling, saw its token Usual plummet by over 30% in a week, and this morning its USD0++ token instantly dropped to around $0.946, where a USD0++ token can only be redeemed for approximately $0.94. Currently, in the Curve USD0/USD0++ pool, USD0++ accounts for a skewed 90.75%.

USD0++ Price Drop, Image Source: Curve

What exactly happened to Usual, and why did USD0++ suddenly experience a flash crash?

A Panic-Inducing Run on the Bank Triggered by a Single Announcement

The unpegging of USD0++ can be traced back to an announcement made by Usual's official team on the morning of January 10. In the announcement, the Usual team changed the redemption terms of USD0++, transitioning from the original 1:1 redemption to a brand-new dual-exit strategy. One of the ways is a conditional exit, where users can still exit USD0++ at a 1:1 ratio but will need to burn a portion of the yield upon exit. The other way is an unconditional exit, but unlike the previous deterministic 1:1, the official team set a minimum exit ratio of 0.87:1, gradually re-anchoring to $1 over time.

Usual Announcement on Two Exit Strategies, Image Source: Usual Website

Usual's announcement quickly spread within the usual community. Thus, under the fermentation of the new USD0++ redemption rules, panic gradually spread from large whale holders to retail investors. In this game of "running for your life," those who run first always suffer less loss than those who are slower. After today's announcement, under the fleeing of large holders and the spread of panic, retail investors also began to sell off. The outflow of USD0 not only accelerated but also "broke through" in the Curve USD0/USD0++ pool. As a large amount of USD0++ was redeemed, the USD0 ratio plummeted to an astonishing 8.18%.

Image Source: Curve

Let's rewind the timeline back to when USUAL was listed on Binance. Initially, the Usual team set up a redemption mechanism last year that allowed for a 1:1 redemption. Unlike Ethena, which leans more towards a B2B positioning, Usual's product leaned more towards a C2C approach, attracting many whales. In this scenario where Usual's official 1:1 redemption acted as a safety net, many whales not only took large positions but also continuously increased their leverage and capital efficiency through strategies like yield farming. This approach, essentially providing risk-free returns to all users, was viable as long as Usual's team didn't change the rules of the game. This meant that whales could gain USUAL rewards without incurring additional opportunity costs.

Simultaneously, the price of USUAL surged, leading to a skyrocketing APY, attracting more users to stake their assets. This positive feedback loop, underpinned by Usual's tight control of the token and the impressive paper APY, attracted more TVL, further driving up the price. Usual's strategy of controlling the token and using high paper APY to attract TVL almost seemed like an overt plan. Small retail holders could also follow the whales' lead under Usual's "follow the leader" model. Therefore, Usual's positive feedback loop quickly started spinning.

Usual's sky-high APY, Image Source: Usual Website

However, the key aspect of this mechanism lies in the exit strategy. For long-term holders, USUAL's issuance is tied to the overall protocol's income, where higher TVL translates to lower USUAL issuance, creating a deflationary mechanism. By reducing the token's supply on the supply side, Usual artificially introduced a level of scarcity. The team also didn't overlook the design of the USUAL mechanism; holders staking the USUAL token would receive USUALx, with these holders receiving 10% of the daily newly minted USUAL, incentivizing early adopters. Additionally, in the event of an early redemption at USD0++, 33% of the burned USUAL will be allocated to USUALx holders, creating an additional income source. Now, for short-term holders, the decision lies between selling off USUAL and running for the hills or continuing to hold USUAL and stake for more rewards. The dilemma is whether to choose "take the small benefits" or "cut and run." In a scenario where the coin price keeps rising, opting for an exit strategy will only yield the immediate USUAL returns, whereas standing the test of time will provide "staking rewards + USUAL token price appreciation + additional rewards." Usual's equilibrium is constantly being tugged in the economic game between short-term and long-term holders.

However, all gifts in fate already come with a price tag. The Usual team had hinted at the early imposition of an exit fee of USD0++, and almost all Usual participants tacitly understood the game, all vying to be the last one standing before the collapse of the tower.

Why the "Mysterious" 0.87?

So why did the team choose to set the proportion of unconditional exits to 0.87 in today's announcement? How did the team come up with this precise figure of 0.87?

Profit Burning Theory

The 0.87:1 ratio set in the announcement prompted a delicate balance of interests among whales. With the previous 1:1 redemption strategy no longer in effect, losing official protection, whales now face the challenge of finding a general among the "shorts." If the team were to opt for a conditional redemption, investors would need to return a portion of their future profits to the project team, but the details of this profit clawback have not been disclosed by the team. Conversely, if they choose to accept unconditional redemption, the worst-case scenario would only secure 0.87, leaving the remaining 0.13 as the core of the game. When one of the two exit methods offers higher returns, funds will naturally vote for the most profitable exit method. However, a well-designed mechanism should allow users the flexibility to choose between the two options rather than a one-sided decision. Therefore, the existence of the 0.13 gap is likely the portion the team has yet to disclose as requiring profit burning, forcing users to make a decision between the two methods. From the user's perspective, if the subsequent payout of 0.13 for a downside cost is anticipated, it may be more prudent to sell at the current anchor price (currently holding at around 0.94). USD0++ will also shed its previous packaging and return to its bond's economic essence. The 0.13 is the discounted portion, while 0.87 reflects its intrinsic value.

Liquidation Floor Theory

Since Usual previously offered users a 1:1 peg to USD0++, allowing many whales to safely leverage their positions to nearly risk-free returns through protocols like Morpho and further increase leverage to enhance capital efficiency. Typically, users engaging in this leverage cycle would collateralize their USD0++, borrow a certain amount of USDC, exchange this USDC back into USD0++, and then start a new cycle. These users enthusiastic about leveraged loans provided Usual with a substantial TVL, soaring higher with one foot on the floor, but behind the perpetual motion machine of TVL lies a liquidation line.

In the Morpho protocol, the USD0 liquidation line is determined by the loan-to-value ratio (LLTV). LLTV is a fixed ratio, and when a user's loan-to-value ratio (LTV) exceeds LLTV, their position is at risk of liquidation. Currently, Morpho's liquidation line stands at 86%, just a step away from the team's 0.87 safety net in unconditional exits.

The settlement line for USD0++ in Morpho is 86%, Image Source: Morpho

The official announcement of 0.87 in Usual is precisely above Morpho's 0.86 settlement line. It can be said that the official setting of 0.87 is the final barrier set by the official to prevent systemic liquidation risks. Although the setting of 0.87 provides a final bottoming out, it maintains the dignity of a project for users.

However, this is also the reason why many whales are waiting on the sidelines. There is a space of 13 points in between for free fluctuation, and more people will interpret it as long as there is no final chain liquidation, the project will eventually be left to "free fall."

What are the short-term and long-term impacts after the anchor breaks?

So how will USD0++ end after breaking the anchor? The panic sentiment about USD0++ in the market has not ended yet. The vast majority of people are holding a risk-management attitude, staying put, and maintaining a wait-and-see approach. The market's consensus on the reasonable value of USD0++ stabilizes around 0.94, based on the situation after the temporary announcement. The official announcement regarding the "unconditional exit" in the exit mechanism, including how much burning and specific profit deductions will occur, has not been disclosed in detail yet and is expected to be further detailed next week. To be extreme, if next week the official does not follow the market's predicted 13-point space and instead burns 0.5% of USUAL, then USD0++ will quickly re-anchor at the 0.995 level. The re-anchoring of USD0++ will depend on the burning details announced by the Usual official next week.

Regardless of how the final mechanism details are decided, it will benefit the holders of the UsualX and USUAL tokens. The Usual official's design of a new exit method reduces the earnings of USD0++, leading to a decrease in the TVL of USUAL/USD0++ and a consequent rise in the price of the USUAL token. After the burning starts, USUAL will be consumed, further capturing token value, and the price will become more resilient as a result. From the design of Usual's mechanism, it can also be seen that in the design of the protocol flywheel, USUAL is a crucial part of the flywheel's rotation. Since its peak at 1.6, USUAL has fallen by about 58%, and another takeoff of USUAL is needed to turn the flywheel again.

USUAL Token Price Surges Over 58%, Image Source: TradingView

Amusingly, while a large number of arbitrageurs contributed a significant amount of TVL to Usual through Morpho's circular lending, the official announcement of the 0.87 floor seems more like a warning to those leveraged at the 0.86 liquidation line.

Usual has now removed the previous "privilege" of a 1:1 rigid redemption, correcting the previously "should-not-have-existed" mechanism. As for the USD0++ anchoring situation, the entire market is also awaiting Usual's official announcement next week, at which time Blockbeats will continue to follow up.