Understand the Market Like a Puzzle: Decoding the Inner Logic of Liquidity, Spread, and Market Movement

Original Article by: TradeStream | Improve Your Trading

Original Article Translated by: DeepFlow Tech

Trading: If we choose to act in a place where most people are willing to trade based on common sense... then this may mean that we do not have more valuable information than others.

One Metaphor of Market Behavior: Jigsaw Puzzle

I like to use a jigsaw puzzle to describe market behavior. You can imagine the overall market as a person trying to complete a puzzle, with the trading volume being the puzzle pieces. The market will strive to put all the pieces together. By analyzing the distribution of trading volume, we can more clearly see where "pieces" are missing. When the market finds areas with more pieces (i.e., higher trading volume and time accumulation), it will try to allocate these pieces to areas with fewer pieces (i.e., lower trading volume and time).

How the Market Chooses Direction

Sometimes, when both sides of the market lack "pieces," how can we determine which side it will fill first?

This reminds me of a theory about human behavior in the book "Atomic Habits." In such situations, we need to focus on two key points:

Attraction: People usually hope that their actions will bring rewards, and the market is the same because it reflects human behavioral patterns. As we discussed earlier, we tend to avoid overly crowded trading scenarios, and a more attractive strategy is often trading against the majority of mispositioned participants, especially when we have clear structural reasons.

Reducing Resistance: According to the "law of least effort," the more effort something requires, the less likely it is to happen. If the resistance is too high, the difficulty of achieving our goal will also increase.

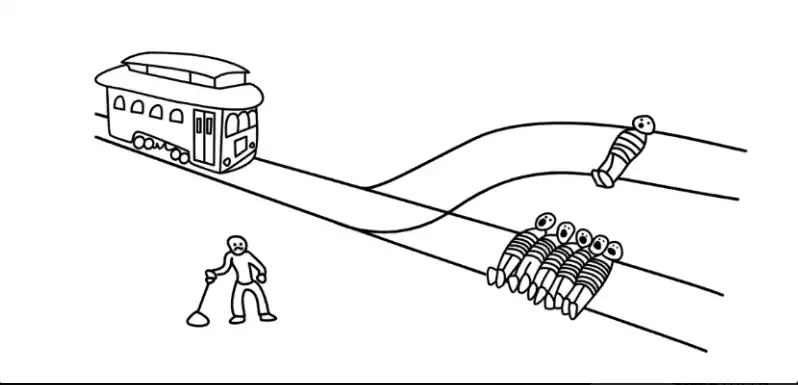

Another Metaphor of Market Behavior: Trolley Problem

Imagine the market as a train, and this train is like an "executioner" eager to "hunt." When we take action in the fair value area, both sides of the market are crowded with participants, making it difficult to predict which side the market will "hunt" more people. However, once the market chooses a side, the other side becomes the only choice, making our decision-making simpler.

What is Liquidity?

Liquidity refers to whether there are enough counterparties in the market to trade with. When we trade, we are either consuming liquidity or providing liquidity. If the price is stable in a certain area (i.e., a balance area) or unable to fluctuate smoothly, it is because buyers have not consumed enough liquidity; conversely, if the price can fluctuate smoothly, it means that buyers have successfully consumed enough liquidity.

Limit Order vs. Market Order

A limit order is a tool for "adding liquidity," while a market order is a tool for executing a trade and consuming this liquidity. Passive liquidity (limit orders) is often more impactful because limit orders typically determine market structure, while aggressive market orders will be absorbed at key points.

Why is a limit order more impactful? Because when you execute a market order, you need to cross the bid-ask spread, which means you will immediately be in an unrealized loss position after placing the order.

What is the Spread?

The spread is the difference between the asset's buy price (advertisement bid) and sell price (advertisement ask). Market makers provide liquidity through the spread, meaning the price to immediately buy an asset is usually slightly higher than the market price, while the price to immediately sell is slightly lower than the market price.

Let's assume an asset's current price is $10.00, and an asterisk (*) represents one contract. If we want to buy immediately, there is no $10.00 quote in the market because if there were, the market maker would not profit. Therefore, they would set the advertised liquidity slightly higher, for example, placing four contracts at $10.01 to capture this small difference.

If we decide to buy three contracts, we would transact at the $10.01 price. But what if we want to buy more, say 15 contracts? We would need to cross the spread until we find enough orders to fulfill the trade. As a result, the price would eventually be pushed to $10.03 because only at this price level are there enough contracts to meet our demand.

Through this example, we can understand why limit orders are usually more impactful. Small-scale traders have a negligible impact on the price as they will not encounter significant slippage. However, if someone wants to buy 500 contracts and there is not enough liquidity nearby, they will have to cross a significant spread, causing substantial price fluctuations.

If traders choose to place orders where liquidity is abundant, they can avoid significant slippage. So, where is liquidity usually concentrated? The answer is above swing highs and below swing lows. This is because most technical analysis-based traders exhibit similar behavior in setting stop-loss orders, and these locations are often where stop-losses cluster, making price reversals likely at these points.

So, their stop-loss is your entry point? Indeed.

Summary

· Impatient buyers or sellers are driving the price through market orders (taker), consuming liquidity.

· More patient buyers or sellers are preventing price fluctuations through limit orders (maker).

We can use a metaphor to describe this: market orders are like a hammer, while limit orders act as the floor or ceiling of a building. Breaking through the floor or ceiling requires sufficient hammer force to do so.

What happens when the floor is broken? The price quickly moves to the next floor.

Once the price reaches the next floor, upward movement becomes easier because the ceiling has been broken, creating a "gap" that allows the price to more easily fluctuate in areas of scarce liquidity.

Liquidity cascading is a very effective way to make money because at this point, we are trading with a price-insensitive group that is forced to transact (e.g., liquidated traders). But we need to be clear about what we are trading.

If you are trading liquidity premium, this effect is usually very short-lived, lasting a maximum of 10-15 seconds. In a cascading environment, this situation changes. In this case, you need to assess whether liquidity has fully recovered from the initial volatility.

Although the chain reaction of momentum shifts is not as reliable as liquidity premium, its sustainability is stronger (many people think they are trading liquidity premium when, in fact, they are trading this momentum effect).

The first method (liquidity premium) is more suitable for PNL attribution (i.e., analyzing the reason for making money) and is also the more ideal way to operate. The second method (momentum effect) captures the core part of large fluctuations but comes with greater volatility and looser risk control.

Overall, liquidity cascades lead to a supply-demand imbalance as a large number of price-insensitive traders enter, causing the order book to not withstand so many aggressive traders. But once the market stabilizes, the price will more easily return to those areas that failed to accumulate enough volume due to rapid fluctuations.

After all, the market is a two-way auction mechanism that usually tests low-volume areas for two reasons:

· There is less path resistance;

· The market seeks efficiency and will test these areas to see if anyone is willing to trade at those price levels.

As a result, the market will experience a "mechanical bounce back," as the order book needs time to rebalance. During this time, only a small amount of trading volume is needed to drive price fluctuations. Once the market settles, price movements will rely more on momentum, accompanied by increased volatility, but also allowing for greater profit potential.

Remember, high volatility often begets high volatility, while low volatility often begets low volatility, a phenomenon known as volatility clustering. Therefore, seize the opportunity and adjust your risk management strategy based on each change in market conditions.

猜你喜歡

2025年預測市場複盤:總交易額超500億美元,雙巨頭市場佔有率超97.5%

1月9日關鍵市場資訊差,一定要看!|Alpha早報

懷俄明州推出 FRNT 穩定幣 — 美國首個州支持的穩定幣上市

懷俄明州發行了美國首個由州支持的法幣穩定幣FRNT。 FRNT的利息收益專項用於支持懷俄明州的教育,提供多樣化的公共資金來源。 該穩定幣已發布到七個主要區塊鏈中,展示了其多鏈運作能力。 懷俄明的策略重點在於推動公眾支付中的穩定幣應用,以降低傳統支付成本。 WEEX Crypto News, 2026-01-08 12:50:50 引言 懷俄明州近來在加密貨幣領域引起了巨大的關注,隨著該州推出其名為FRNT的穩定幣,成為美國首個發行法幣支持穩定幣的州。多年來的立法工作及監管障礙的克服,終於讓這一歷史性舉措成為現實。FRNT的推出不僅僅是政策實驗的終結,更是美元上鏈的創新開始,這對全球的金融市場都具有指標意義。 FRNT 穩定幣開始市場交易 懷俄明州州長馬克·戈登宣布FRNT立即可供市民選擇使用,使其成為美國第一個由公共機構發行的完全準備金、法幣支持的穩定幣。FRNT的發行是在懷俄明穩定幣法案的框架下進行的,由州穩定幣委員會監管。而該委員會成立於2023年3月,旨在研究州支持的數字美元能否在現有法律和財政框架內運行。這一全新的嘗試使得FRNT為迅速增長的3000億美元穩定幣市場注入了新的活力。 FRNT的持有資產全部由美元和短期美國國債作為準備金支持,並且根據懷俄明法律需維持2%的超額擔保。這些資產由Franklin Advisers管理,The Network Firm則負責月度審計及確認。而從這些資產中產生的利息收入將直接用於懷俄明州的教育資金系統,這不僅為公共服務創造了一種新的收入模式,也將資金的使用從致力於盈利轉向了公共利益。…

Ondo Finance 價格預測:2026年1月12日 ONDO 預估跌至 $0.331411

關鍵要點 Onto Finance 預估在未來五天內下跌22.89%,預估價位將達到 $0.331411。 市場情緒目前表現為看跌,恐懼與貪婪指數顯示為42,代表投資者情緒偏向恐懼。 近期30天內,Ondo Finance 走勢呈現負面趨勢,已損失10.64%。 技術分析顯示,Ondo Finance 關鍵支撐位為 $0.438576、$0.419397 和 $0.403551,而關鍵阻力位則為 $0.473600、$0.489447 和 $0.508625。…

Solana價格預測:摩根士丹利申請SOL ETF——這是否是華爾街下個加密熱潮的開始?

關鍵要點 摩根士丹利申請SOL ETF,表明大型機構對加密貨幣的興趣逐漸增加。 Solana的ETF吸引了大量資金流入,顯示其市場潛力和投資者的高度關注。 Solana的價格目標被設定在230美元,因為市場正處於正向動能的推動下。 Bitcoin Hyper利用Solana的平台,旨在提升比特幣的去中心化金融生態系統。 WEEX Crypto News, 2026-01-08 12:50:49 在全球金融市場上,摩根士丹利此舉無疑是在加密貨幣領域投下一顆重磅炸彈。這家位於美國的主要金融機構宣布,將推出與Solana相關的交易所交易基金(ETF),這一決定引發了人們對Solana價格預測的熱議。這是否意味著華爾街對於加密貨幣的胃口擴大,甚至預示著一場新的投資熱潮? Solana ETF的吸引力 在摩根士丹利宣布推出SOL ETF後,加密貨幣市場對Solana的信任顯著增加。這一行動明確展示了大型機構對於除比特幣之外的加密資產的濃厚興趣。特別值得注意的是,Solana ETF已經在短短六個月內吸引了逾8.01億美元的資金流入,彰顯了市場對Solana生態系統的認同與期待。…

币安推出以USDT結算的合規黃金和白銀永續合約

重要要點 WEEX Crypto News, 2026-01-08 12:50:50 币安推出名為TradFi的永續合約,允許交易者24小時不斷地進行傳統資產交易,如黃金和白銀。 币安透過阿布達比全球市場的全面牌照,成為全球首個獲此認證的數字資產平台。 永續合約不同於傳統期貨,無到期日,藉助資金機制保持價格與標的資產的對齊。 最近研究顯示,鏈上股票和商品的表現愈來愈受到關注,其資產量在2025年前已突破10億美元。 在加密貨幣世界的快速變遷中,币安(Binance)正在拓展其交易產品的多樣性。近期,币安推出了首批以USDT穩定幣結算的受監管黃金和白銀永續合約,這些合約以傳統金融資產為標的,進一步填補了傳統資產與數位資本市場之間的空隙。 TradFi永續合約的推出 TradFi永續合約是币安依循專業投資者的需求設計的產品,這類合約允許交易參與者不間斷地接觸到黃金和白銀等標的資產,並利用已廣泛存在於加密衍生品市場的永續合約結構進行交易。初期推出的合約包括XAUUSDT(黃金)和XAGUSDT(白銀),未来将增加更多的交易对,這樣的設計為交易者提供了靈活多變的選擇。 阿布達比全球市場的全面牌照 此次產品由Nest Exchange Limited公司發行,此公司是币安的一個分支,其運營受阿布達比全球市場(ADGM)金融服務監管局的監管。币安表示,其是全球首個在ADGM框架下獲得一套完整牌照的數字資產平台,因而得以在受監管的基礎上上架這類合約產品。這不僅為币安的業務提供了合規保障,也加強了投資者的信心。 與傳統期貨的差異…

比特幣資金流入枯竭,CryptoQuant CEO如是說

關鍵摘要 比特幣的資金流入減少,反映出交易市場結構的根本變化。 鯨魚的交易活動減少,表現出市場的結構性健康,而散戶投資者仍未活躍。 機構資金持續支持,使比特幣市場維持穩定態勢,但長期預測意見分歧。 貴金屬市場的興起可能是資本流出的原因之一。 長期持有策略如同陳年威士忌一樣需要耐心。 WEEX Crypto News, 2026-01-08 12:50:50 比特幣資金流入減少及市場結構轉變 CryptoQuant 的 CEO Ki Young Ju…

左手BTC右手AI算力:數智時代的黃金與石油

五角大廈比薩指數飆升1250%:下一個委內瑞拉會是誰?

從Manus肖弘說起,那些上桌的幣圈實習生

從理論到實盤市場: AOT矩陣的雙腦系統在WEEX AI交易哈克松

在加密市場——最不可原諒的非平穩系統之一——策略失敗很少是由模型過於簡單造成的。 之所以發生這種情況,是因為大多數策略從未真正受到實盤市場壓力的影響。 這正是 WEEX AI 交易黑客馬拉松設計要浮出水面的問題 — — 將重點從理論創新轉移到真正的可部署性、真正的執行力和真正的性能。 在參賽團隊中,AOT Matrix憑藉先進的人工智能驅動量化能力脫穎而出。 通過其V4.4雙腦架構,該系統實現了端到端的優化 — — 從核心邏輯到執行 — — 體現了平台對創新和現實性能的雙重重視。

幣圈這些不常見的東西,都在閒魚上

告別「空氣」投資:用這6大指標幫助你選擇爆款專案

USD1 30億市值狂飆背後:特朗普家族押注、CEX托舉

預測市場裡的反常識買單,誰在接你的對手單?

舊的山寨幣劇本已過時,帶你解讀新的市場體制

AI 交易風險在加密貨幣中: 為什麼更好的加密交易策略會造成更大的損失?

風險不再主要在於決策失誤或情緒錯誤。 它越來越多地生活在市場結構、執行路徑和集體行為中。 理解這一轉變比找到下一個“更好”的戰略更重要。

2500億美元、6723輪融資,加密VC們2025年把錢投向哪裡?

2025年預測市場複盤:總交易額超500億美元,雙巨頭市場佔有率超97.5%

1月9日關鍵市場資訊差,一定要看!|Alpha早報

懷俄明州推出 FRNT 穩定幣 — 美國首個州支持的穩定幣上市

懷俄明州發行了美國首個由州支持的法幣穩定幣FRNT。 FRNT的利息收益專項用於支持懷俄明州的教育,提供多樣化的公共資金來源。 該穩定幣已發布到七個主要區塊鏈中,展示了其多鏈運作能力。 懷俄明的策略重點在於推動公眾支付中的穩定幣應用,以降低傳統支付成本。 WEEX Crypto News, 2026-01-08 12:50:50 引言 懷俄明州近來在加密貨幣領域引起了巨大的關注,隨著該州推出其名為FRNT的穩定幣,成為美國首個發行法幣支持穩定幣的州。多年來的立法工作及監管障礙的克服,終於讓這一歷史性舉措成為現實。FRNT的推出不僅僅是政策實驗的終結,更是美元上鏈的創新開始,這對全球的金融市場都具有指標意義。 FRNT 穩定幣開始市場交易 懷俄明州州長馬克·戈登宣布FRNT立即可供市民選擇使用,使其成為美國第一個由公共機構發行的完全準備金、法幣支持的穩定幣。FRNT的發行是在懷俄明穩定幣法案的框架下進行的,由州穩定幣委員會監管。而該委員會成立於2023年3月,旨在研究州支持的數字美元能否在現有法律和財政框架內運行。這一全新的嘗試使得FRNT為迅速增長的3000億美元穩定幣市場注入了新的活力。 FRNT的持有資產全部由美元和短期美國國債作為準備金支持,並且根據懷俄明法律需維持2%的超額擔保。這些資產由Franklin Advisers管理,The Network Firm則負責月度審計及確認。而從這些資產中產生的利息收入將直接用於懷俄明州的教育資金系統,這不僅為公共服務創造了一種新的收入模式,也將資金的使用從致力於盈利轉向了公共利益。…

Ondo Finance 價格預測:2026年1月12日 ONDO 預估跌至 $0.331411

關鍵要點 Onto Finance 預估在未來五天內下跌22.89%,預估價位將達到 $0.331411。 市場情緒目前表現為看跌,恐懼與貪婪指數顯示為42,代表投資者情緒偏向恐懼。 近期30天內,Ondo Finance 走勢呈現負面趨勢,已損失10.64%。 技術分析顯示,Ondo Finance 關鍵支撐位為 $0.438576、$0.419397 和 $0.403551,而關鍵阻力位則為 $0.473600、$0.489447 和 $0.508625。…

Solana價格預測:摩根士丹利申請SOL ETF——這是否是華爾街下個加密熱潮的開始?

關鍵要點 摩根士丹利申請SOL ETF,表明大型機構對加密貨幣的興趣逐漸增加。 Solana的ETF吸引了大量資金流入,顯示其市場潛力和投資者的高度關注。 Solana的價格目標被設定在230美元,因為市場正處於正向動能的推動下。 Bitcoin Hyper利用Solana的平台,旨在提升比特幣的去中心化金融生態系統。 WEEX Crypto News, 2026-01-08 12:50:49 在全球金融市場上,摩根士丹利此舉無疑是在加密貨幣領域投下一顆重磅炸彈。這家位於美國的主要金融機構宣布,將推出與Solana相關的交易所交易基金(ETF),這一決定引發了人們對Solana價格預測的熱議。這是否意味著華爾街對於加密貨幣的胃口擴大,甚至預示著一場新的投資熱潮? Solana ETF的吸引力 在摩根士丹利宣布推出SOL ETF後,加密貨幣市場對Solana的信任顯著增加。這一行動明確展示了大型機構對於除比特幣之外的加密資產的濃厚興趣。特別值得注意的是,Solana ETF已經在短短六個月內吸引了逾8.01億美元的資金流入,彰顯了市場對Solana生態系統的認同與期待。…

币安推出以USDT結算的合規黃金和白銀永續合約

重要要點 WEEX Crypto News, 2026-01-08 12:50:50 币安推出名為TradFi的永續合約,允許交易者24小時不斷地進行傳統資產交易,如黃金和白銀。 币安透過阿布達比全球市場的全面牌照,成為全球首個獲此認證的數字資產平台。 永續合約不同於傳統期貨,無到期日,藉助資金機制保持價格與標的資產的對齊。 最近研究顯示,鏈上股票和商品的表現愈來愈受到關注,其資產量在2025年前已突破10億美元。 在加密貨幣世界的快速變遷中,币安(Binance)正在拓展其交易產品的多樣性。近期,币安推出了首批以USDT穩定幣結算的受監管黃金和白銀永續合約,這些合約以傳統金融資產為標的,進一步填補了傳統資產與數位資本市場之間的空隙。 TradFi永續合約的推出 TradFi永續合約是币安依循專業投資者的需求設計的產品,這類合約允許交易參與者不間斷地接觸到黃金和白銀等標的資產,並利用已廣泛存在於加密衍生品市場的永續合約結構進行交易。初期推出的合約包括XAUUSDT(黃金)和XAGUSDT(白銀),未来将增加更多的交易对,這樣的設計為交易者提供了靈活多變的選擇。 阿布達比全球市場的全面牌照 此次產品由Nest Exchange Limited公司發行,此公司是币安的一個分支,其運營受阿布達比全球市場(ADGM)金融服務監管局的監管。币安表示,其是全球首個在ADGM框架下獲得一套完整牌照的數字資產平台,因而得以在受監管的基礎上上架這類合約產品。這不僅為币安的業務提供了合規保障,也加強了投資者的信心。 與傳統期貨的差異…