Centralized Exchange (CEX)

Centralized Exchange (CEX), is a type of cryptocurrency exchange that operates through a central authority or intermediary. Unlike decentralized exchanges (DEXs), which allow users to trade directly with one another in a peer-to-peer manner, CEXs require users to create accounts and deposit their funds into the platform’s wallets. The exchange manages the trading process by maintaining an order book, which matches buy and sell orders from users.

The primary feature of a CEX is its user-friendly interface and robust liquidity. These platforms typically offer a wide range of trading pairs and advanced trading features, making it easier for users to execute trades quickly. Users can place various types of orders, including market orders and limit orders, allowing for flexible trading strategies. However, because users must trust the exchange to manage their funds, this model introduces certain risks.

One of the key advantages of centralized exchanges is their high liquidity. CEXs generally have a larger user base compared to DEXs, which means there are more participants in the market. This increased activity results in faster trade execution and reduced price slippage, making CEXs attractive for both novice and experienced traders.

However, CEXs also come with their own challenges. The requirement for Know Your Customer (KYC) verification often means that users must provide personal information, which can raise privacy concerns. Additionally, because funds are held in custodial wallets managed by the exchange, users face the risk of hacks or mismanagement. If a CEX is compromised, users may lose their assets.

For example, a user wishing to trade Bitcoin (BTC) for Ethereum (ETH) can create an account on a CEX like Binance or Coinbase. After depositing their BTC into the exchange, they can quickly place an order to trade for ETH, benefiting from the platform's liquidity and trading tools.

Overall, centralized exchanges play a crucial role in the cryptocurrency ecosystem by providing a reliable and efficient platform for trading digital assets. While they offer significant advantages in terms of liquidity and user experience, it is essential for users to be aware of the associated risks, including custodial concerns and regulatory scrutiny. As the cryptocurrency market continues to evolve, CEXs remain a central component of the trading landscape.

猜你喜歡

PYBOBO USDT 現已上線:Capybobo (PYBOBO) 幣在 WEEX 上線

WEEX 交易所已正式上線 Capybobo (PYBOBO) 幣,向其現貨市場引入 PYBOBO USDT 交易對。…

什麼是USOR加密貨幣?2026年USOR Meme幣代幣終極指南

2026年的USOR加密貨幣是什麼?了解USOR幣的運作機制、走紅原因、石油敘事、鏈上風險,以及交易者投資前應知曉的事項。

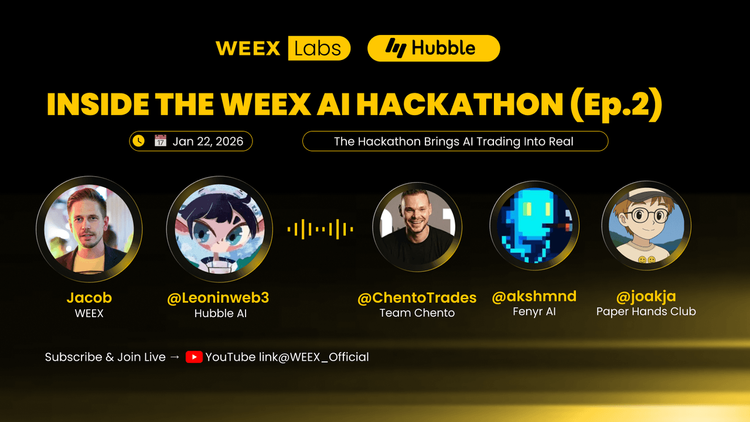

人工智能交易如何碾壓人類交易員:WEEX 180萬美元交易黑客馬拉松的5個關鍵經驗教訓

看看上海的 AI交易機器人如何在 WEEX 舉辦的 180 萬美元黑客馬拉松大賽中全天候超越人類。探索頂級團隊利用自主代理和即時風險控制的 5 種顛覆性策略。

介紹 Pump.fun 完整指南,了解 $PUMP 和空投機會

Pump.fun ($PUMP) 是一個加速的 meme 幣啟動平台,正在顛覆 Solana 生態系統,讓任何人都能在幾秒鐘內創建代幣並立即交易——沒有預售,沒有騙局,只有純粹的混亂樂趣。了解其代幣經濟學、生態系統影響,以及如何在 WEEX $50,000 $PUMP 空投中領取免費代幣,截止日期為 2026 年 2 月 3 日!

什麼是USOR加密貨幣?您需要了解的一切

USOR(美國石油儲備)是一種基於高速Solana區塊鏈構建的加密貨幣。該平台旨在提供與美國石油儲備相關的主題的透明、基於區塊鏈的原生呈現。必須理解的是,USOR是一種基於敘事的數字資產,而非對實物石油桶的直接索賠權。

無界(ZKC硬幣)是好的投資額嗎?無界(ZKC硬幣)價格預測2026

對於那些已經做過研究的人來說,知道"如何在weex交易所買入無界(ZKC ) " 是很簡單的。WEEX提供安全網關。

什麼是Sentient(SENT)?去中心化人工智能代幣終極指南

對於認同其願景的投資者而言,了解"如何在weex交易所買入Sentient(SENT)"其實很簡單。WEEX為獲取SENT代幣提供安全且受監管的平台。

PENGUIN 2026價格預測:逐步購買PENGUIN加密貨幣

PENGUIN本質上是一個建立在Solana網絡上的投機性數字資產,故意缺乏功能性實用性、明確的發展計劃或旨在產生收入的經濟模型。其整個本質和感知價值是由病毒式的在線文化、諷刺幽默和存在主義或哲學的表情包品牌構成的,明顯與以技術進步或現實應用為驅動的項目形成鮮明對比。

什麼是 Moonbirds (BIRB) 幣?

隨著加密市場不斷演進,Moonbirds (BIRB) 幣於 2026年1月26日全新上市於 [WEEX](https://www.weex.com/wiki/article/birb-usdt-first-launch-moonbirds-coin-on-weex-45412),吸引了眾多投資者的目光。該代幣被稱為首個「Phygital」惡搞資產,這意味著 BIRB 不僅僅依賴於投機,而是基於 Orange Cap Games 的實體產品和其豐厚收益來增長品牌影響力。投資者現在可以在 WEEX 進行 BIRB-USDT 交易。 Moonbirds 介紹 Moonbirds…

What is Shrimp Coin (SHRIMP)?

在最新的加密市場事件中,Shrimp Coin (SHRIMP)於2026年1月26日正式在WEEX平台上市。這項令人期待的加密貨幣,以Twitter社群的虾币meme為靈感,結合了愉快和投資潛力,吸引了眾多加密愛好者的目光。如今,興奮的投資者們可以透過[SHRIMP Coin上市於WEEX](https://www.weex.com/wiki/article/shrimp-usdt-now-on-weex-shrimp-coin-exclusive-listing-45393)的內部鏈接進一步了解這款代幣的特性與潛力。 Shrimp Coin 簡介 Shrimp Coin (SHRIMP)是一款結合了meme和社群力量的加密貨幣。其獨特性在於其以Twitter上虾币的meme為藍本,成功吸引了大眾的目光。與此同時,隨著它在WEEX的獨家上市,投資者獲得了新的投資機會,並能在此平台上進行交易。 Shrimp Coin (SHRIMP)由誰創建? Shrimp Coin的創建源自於一個熱衷於虾币meme的社群。這群人將他們的熱情化為行動,開發出了一款不僅僅是個笑話的代幣,並希望藉此創造出社群參與和增長的新機會。 Shrimp Coin的運作原理是什麼? Shrimp…

What is ZERO-HUMAN COMPANY (ZHC) Coin?

近日,ZERO-HUMAN COMPANY (ZHC) 幣以其獨特的背景故事和強大的社區影響力,於 2026 年 1 月 26 日正式在 WEEX 上市。這款幣的上線引起了廣泛關注,並激發了對其未來潛力的猜測。你可以在 [WEEX 上查看這新上市的 ZHC](https://www.weex.com/wiki/article/exclusive-zhc-usdt-pair-trading-live-on-weex-exchange-45368)。 ZERO-HUMAN COMPANY (ZHC)…

什麼是AlphaPride (ALPHA) 幣?

最近,我注意到一個新鮮出爐的加密貨幣交易對剛在WEEX上架——AlphaPride (ALPHA)現已提供與USDT的交易對。從2026年1月26日開始,投資者可以在WEEX上進行交易,並充分利用這一新機會。這項新上架引起了相當多的討論和興趣。這篇文章將深入探討ALPHA幣,並幫助投資者了解這個代幣的潛力與如何進行交易。 AlphaPride 簡介 AlphaPride (ALPHA) 是一種由BEP20協議支持的生態系統代幣。它為用戶提供了獨特的投資機會,讓用戶參與並受益於不斷發展的加密生態系統。AlphaPride以其分散化和創新為核心理念,定位自身以滿足投資者的多樣需求。據 [CoinMarketCap](https://coinmarketcap.com/zh/currencies/alphapride) 顯示,目前已在Bitstorage及其他交易所上市。 誰創建了AlphaPride 幣? AlphaPride由一群對於區塊鏈技術充滿熱情的開發者和加密貨幣專家團隊所創建。他們專注於提供一個透明和高效的交易平台,讓整個加密社區能夠獲得更多的參與機會。這項目團隊通過不斷的創新和技術升級,努力提高平台的效率和用戶體驗。 AlphaPride加密貨幣的運作方式 AlphaPride主要是在其所建立的生態系統內運行。利用BEP20協議,該幣可確保安全、快速和成本效益高的交易。每一個ALPHA幣都被設計用來增強用戶的交易靈活性,同時注重網絡的去中心化與透明性。 如何使用AlphaPride加密貨幣? 使用AlphaPride幣的方式多種多樣,從交易、支付到參與不同的去中心化應用程式 (dApps)。特別是對於那些尋求參加生態系統中各種活動的用戶來說,ALPHA提供了一個穩定且可靠的工具。 如何購買AlphaPride…

月鳥幣(BIRB)2026年一月價格預測與展望——能否從15%跌幅中反彈?

Moonbirds(BIRB)代幣剛剛登陸加密貨幣市場,將於2026年一月26日作為獨家首發項目推出……

蝦幣價格預測與展望:2026年一月推出後飆升150%

蝦幣(SHRIMP)於2026年一月26日閃亮登場,作為WEEX交易所的獨家首發項目……

ZERO-HUMAN COMPANY(ZHC)幣價格預測與展望(2026年一月)——這枚Meme幣在人工智能炒作中真的能漲50%嗎?

ZERO-HUMAN COMPANY (ZHC) 幣剛剛在昨天登場,於一月在 WEEX 交易所獨家推出...

AlphaPride (ALPHA) 幣2026年一月價格預測與展望:推出波動率後的潛在反彈

AlphaPride(ALPHA)幣剛剛登陸加密貨幣市場,於2026年一月26日在熱鬧非凡的市場中推出……

AlphaPride (ALPHA) 幣在 WEEX 現貨上市,交易對為 ALPHA USDT

AlphaPride (ALPHA) 幣新近在 WEEX 交易所上市。今天開始交易 ALPHA USDT 交易對,以訪問全球忠誠生態系統和數字獎勵。

ZHC/USDT 獨家交易對在 WEEX 交易所實時交易

獨家房源預告:ZERO-HUMAN COMPANY (ZHC) Coin 現已在 WEEX 上線。閱讀我們的 ZHC USDT現貨交易指南,安全進入 AI 模代幣市場。

PYBOBO USDT 現已上線:Capybobo (PYBOBO) 幣在 WEEX 上線

WEEX 交易所已正式上線 Capybobo (PYBOBO) 幣,向其現貨市場引入 PYBOBO USDT 交易對。…

什麼是USOR加密貨幣?2026年USOR Meme幣代幣終極指南

2026年的USOR加密貨幣是什麼?了解USOR幣的運作機制、走紅原因、石油敘事、鏈上風險,以及交易者投資前應知曉的事項。

人工智能交易如何碾壓人類交易員:WEEX 180萬美元交易黑客馬拉松的5個關鍵經驗教訓

看看上海的 AI交易機器人如何在 WEEX 舉辦的 180 萬美元黑客馬拉松大賽中全天候超越人類。探索頂級團隊利用自主代理和即時風險控制的 5 種顛覆性策略。

介紹 Pump.fun 完整指南,了解 $PUMP 和空投機會

Pump.fun ($PUMP) 是一個加速的 meme 幣啟動平台,正在顛覆 Solana 生態系統,讓任何人都能在幾秒鐘內創建代幣並立即交易——沒有預售,沒有騙局,只有純粹的混亂樂趣。了解其代幣經濟學、生態系統影響,以及如何在 WEEX $50,000 $PUMP 空投中領取免費代幣,截止日期為 2026 年 2 月 3 日!

什麼是USOR加密貨幣?您需要了解的一切

USOR(美國石油儲備)是一種基於高速Solana區塊鏈構建的加密貨幣。該平台旨在提供與美國石油儲備相關的主題的透明、基於區塊鏈的原生呈現。必須理解的是,USOR是一種基於敘事的數字資產,而非對實物石油桶的直接索賠權。

無界(ZKC硬幣)是好的投資額嗎?無界(ZKC硬幣)價格預測2026

對於那些已經做過研究的人來說,知道"如何在weex交易所買入無界(ZKC ) " 是很簡單的。WEEX提供安全網關。