Solana's Crisis of Faith: Unbeatable Fundamentals, So Why is the Price 'Flatlining'?

Original Article Title: "SOL Sentinel's Faith Crisis: Fundamental Invincible, Why the Price 'Flatlined'?"

Original Author: CryptoLeo, Odaily Planet Daily

As a loyal SOL Sentinel, I have now lost some confidence in SOL.

From the perspective of token price, this cycle may not be over yet. However, among the top-ranked tokens by market capitalization, BTC, ETH, BNB, and even XRP have all hit new all-time highs in the second half of 2025, while SOL, after reaching a high of $295 in January, has not broken its previous high (during which there was a months-long Solana Meme coin craze).

Why has SOL not risen yet? It may be due to the token's inflation mechanism, the shift of meme craze to other networks, liquidity issues, and whale bearishness. One more thing to pay attention to is that Solana always seems to be one step behind in catching up with the hype.

(Group Chat Screenshot)

Recently, Grayscale released a report titled "Solana: Crypto's Financial Bazaar," analyzing Solana's technological aspects, network ecosystem, token supply, and value data indicators, providing some confidence to the "SOL Sentinel." Odaily Planet Daily summarized the key points of the report as follows:

Solana's Fundamentals: Technology, On-chain Activity, Transaction Volume

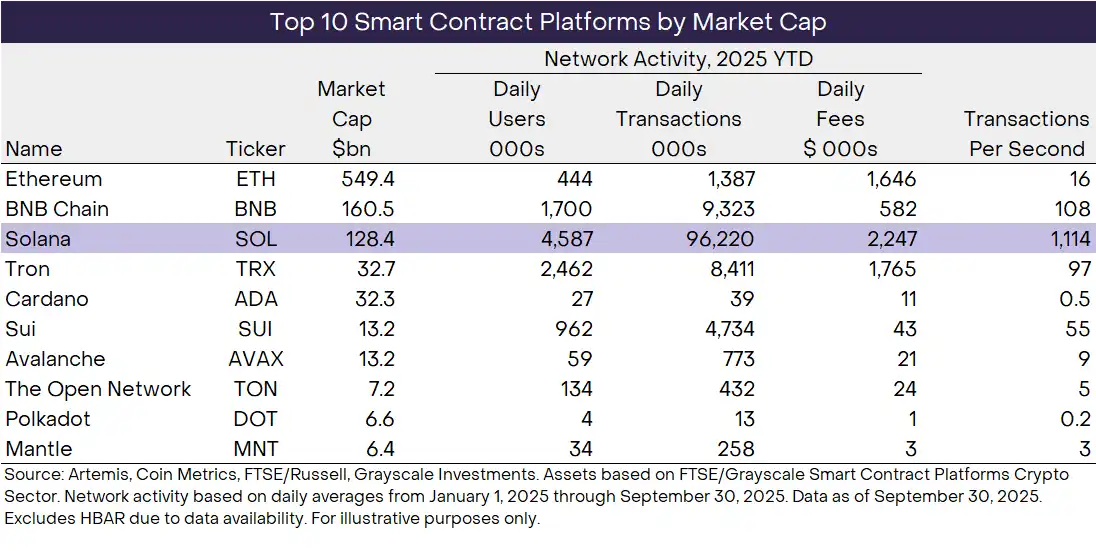

According to the report, compared to other networks such as Ethereum, BNB Chain, Tron, Cardano, and Sui, Solana has a significant advantage in the depth and diversity of on-chain activity. It is leading in terms of users, transaction volume, and transaction fees, with the Solana network having more users and economic activity, which translates to higher network value.

On-chain Data and Transaction Volume

As shown in the chart below, SOL ranks third in market capitalization, but it leads similar blockchains in daily active users, daily transaction volume, daily transaction fees, and transactions per second.

Ecosystem Applications and Network Revenue

Additionally, the Solana network hosts many industry-leading applications, such as:

1. Raydium DEX, also a core component of the Solana DeFi infrastructure. From the beginning of the year to date, the Solana DEX has processed a trading volume exceeding $1.2 trillion, surpassing any other blockchain ecosystem. Furthermore, Solana's leading DEX aggregator, Jupiter, is the cryptocurrency industry's largest aggregator in terms of trading volume;

2. pump.fun, a long-standing token launch platform, with approximately 2 million monthly active users and a daily revenue of around $1.2 million;

3. Helium, a DePIN project focused on mobile hotspots. Helium allows users to contribute to network capacity, thereby building a nationwide mobile hotspot network. These services are often cheaper than centralized alternatives, and Helium currently boasts 1.5 million daily active users, 112,000 hotspots, and has established partnerships with major telecom companies such as AT&T and Telefónica.

The above applications represent only a small fraction of Solana's 500+ applications. Additionally, as a blockchain that almost fully replicates the functionalities of other mainstream networks, Solana ranks third in NFT transactions, fifth in stablecoin transaction volume, and seventh in tokenized assets. Recent use cases that have gained traction include Pokémon card collectibles trading and on-chain issuance of tokenized stocks.

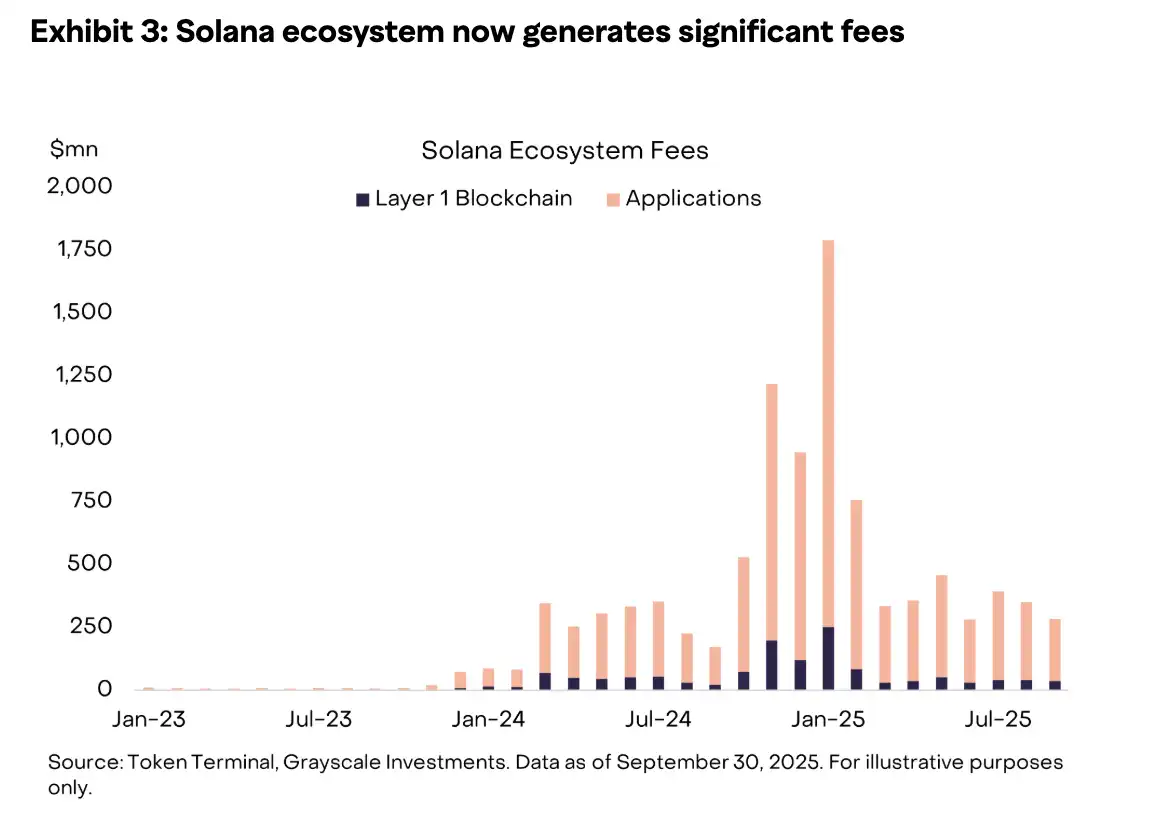

When measuring the Solana ecosystem, one should consider both the blockchain itself and the economic activities of its hosted applications. While these figures may evolve over time, the Solana ecosystem generates approximately $425 million in fees per month, with an annual income exceeding $5 billion. Grayscale believes that fees are the most direct indicator of measuring total demand for a blockchain and its applications, and all these data points indicate significant demand for Solana.

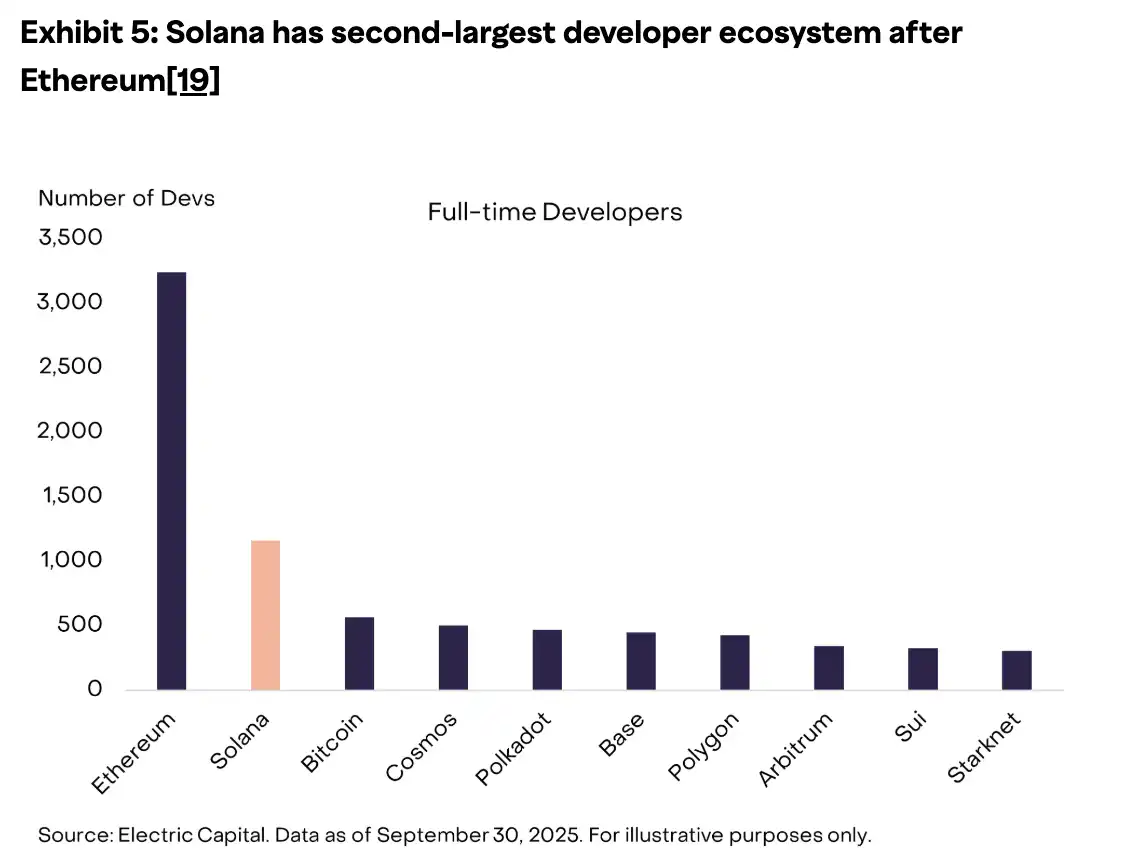

Solana's Advantages: Developer Scale Second Only to Ethereum, and Universally Accessible

Universal Technological Superiority

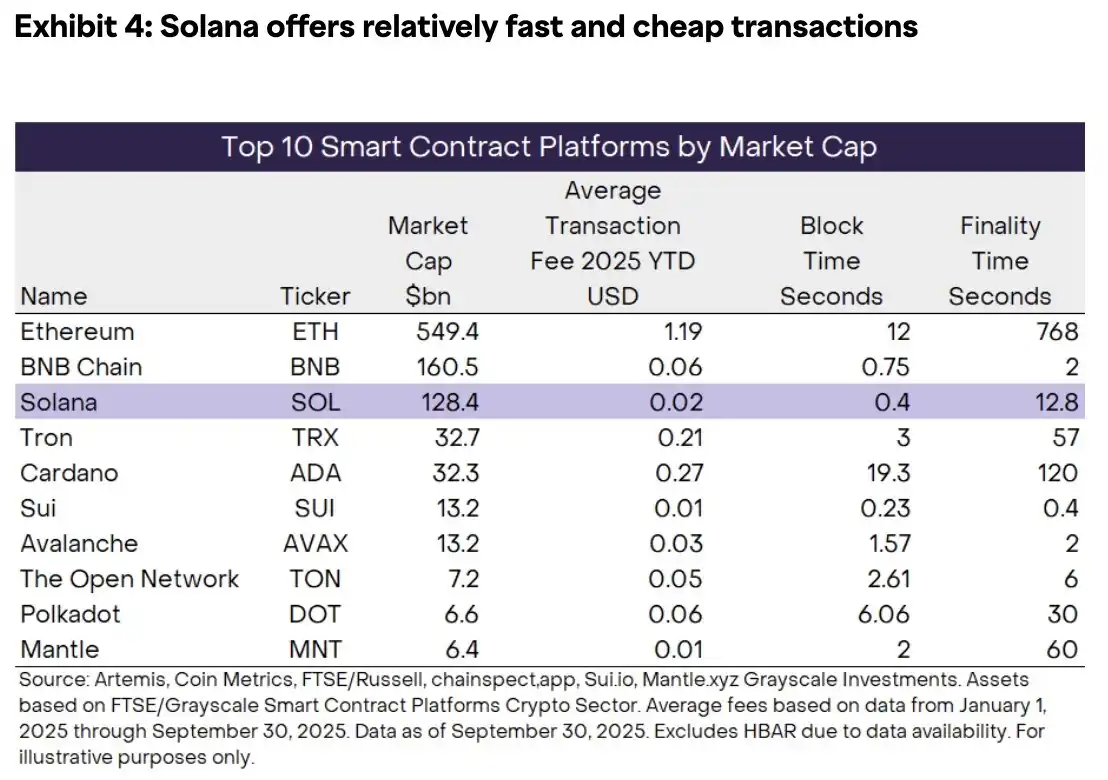

In addition to fundamental analysis, Grayscale also mentioned that Solana's good performance is due to its fast, low-cost transactions, and seamless user experience. The network generates a new block every 400 milliseconds, and transactions can be finalized in about 12-13 seconds. Apart from high throughput, transaction costs have also remained relatively low:

Solana uses a "local fee markets" technology, which restricts fee competition to specific applications. So far this year, the average transaction fee paid by users has been only $0.02, partly due to this feature. The median daily transaction fee this year is only $0.001. Solana's transaction speed and cost efficiency are faster and cheaper compared to similar blockchains. Its upcoming Solana upgrade, Alpenglow, is expected to reduce final confirmation time to 100-150 milliseconds.

Solana's user experience is mainly due to its "monolithic" (single-layer blockchain) design rather than a layered design (which avoids the need to bridge assets between network components), and the wallet infrastructure led by Phantom. In recent years, Solana's network failure rate has also been significantly lower than the industry average, which is also a foundational factor for user adoption.

Furthermore, Solana smart contracts do not rely on the Ethereum Virtual Machine (used by Ethereum and many other smart contract platforms like BNB Chain, Polygon, and Avalanche). Instead, they use Solana's unique Solana Virtual Machine (SVM) architecture. Applications based on the SVM cannot easily move to non-SVM blockchains, leading to stable user retention.

Second Only to Ethereum in Developer Count

Currently, there are over 1,000 full-time developers working on Solana and SVM applications, and in the past two years, the growth rate of developers focused on Solana has outpaced any other smart contract platform (as shown below), second only to Ethereum. Over time, this human capital can contribute to Solana's sustained innovation.

The Long-Term Storage Value of the SOL Token (Inflation, Token Performance, and Competitor Competition)

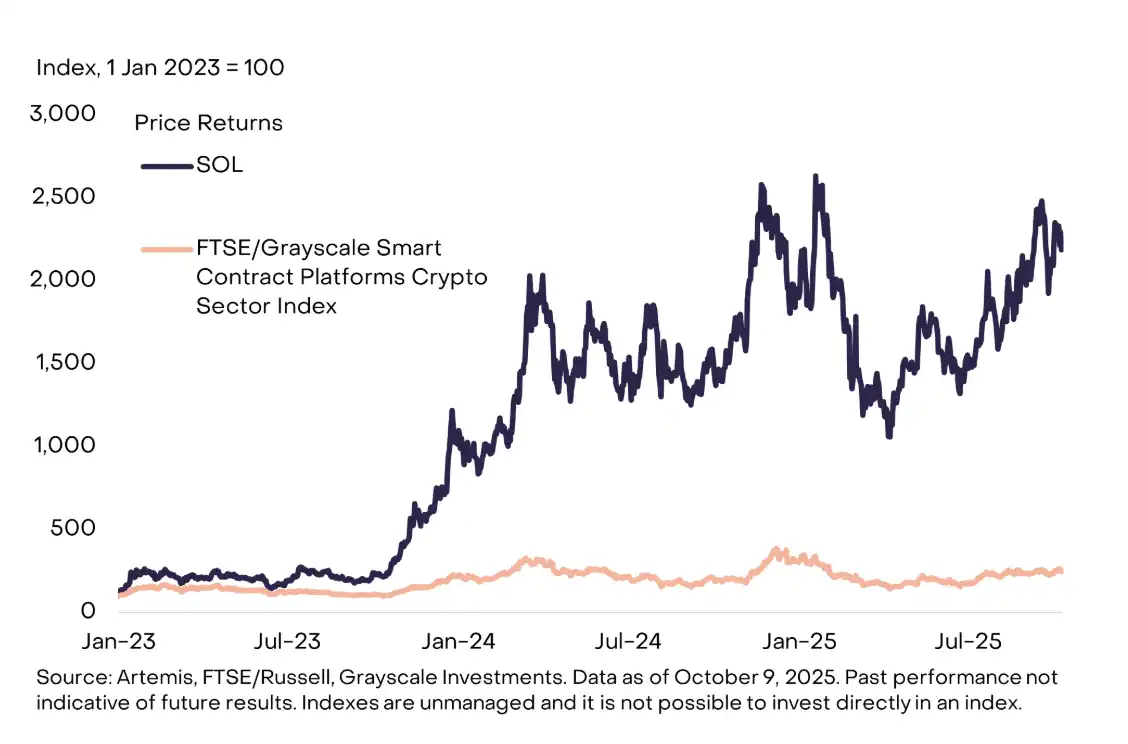

It is well known that due to FTX's collapse, the price of the SOL token plummeted from its peak of nearly $260 in November 2021 to just $2 in December 2022. Following FTX's bankruptcy, many retail investors felt uncertain about Solana's future, despite a significant number of SVM developers still remaining on Solana at the time.

However, starting from the end of 2023, the SOL token began to recover, outperforming notably the FTSE/Grayscale Smart Contract Platform Cryptocurrency Industry Index.

Currently, the SOL token's supply is increasing at a rate of around 4% to 4.5% per year, which, under unchanged conditions, can be seen as a reason for token holder value dilution. According to the network state, SOL stakers can receive around a 7% nominal yield, but the "actual" yield adjusted for inflation is approximately 2.5% to 3%. Currently, about two-thirds of unissued SOL tokens have been staked.

Grayscale states that SOL offers utility on the Solana network and may receive additional corresponding financial returns, but their value is tied to the network's scale, similar to other smart contract platform tokens, the investment thesis of the SOL token revolves around the potential growth of the Solana network. Like other assets, the SOL token price does not always move in line with the network's fundamentals. However, if the Solana network grows over time—acquiring more users, processing more transactions, and earning more fees—investors can expect the SOL price to rise.

Grayscale believes: Solana is envisioned as an "open, fast, low-cost blockchain for everyone". But its specific design leaves room for its competitors to seize or retain market share in certain use cases.

For example, other blockchains sometimes achieve faster and/or cheaper transactions by operating a more centralized network (e.g., using a small number of active network nodes). Even though centralization may bring risks, users may prefer this convenience. Other blockchains may compete with Solana by maintaining permissioning on their network (i.e., only allowing approved users and/or approved activities).

On the other hand, compared to Bitcoin or Ethereum, the SOL token may not be as suitable as a long-term "store of value" currency asset. This to some extent reflects SOL's relatively high nominal supply inflation: scarcity is a key feature of any long-term value store. But a more important factor may be the network's ability to resist third-party interference. For a digital asset to be used as a long-term store of value, users need to have confidence that they will be able to transact under almost all circumstances in the future. One way to support this outcome is to maintain low node requirements to keep the network highly decentralized and easy to replicate. Solana's efficiency comes at the cost of relatively high hardware and bandwidth requirements, so many network nodes operate in data centers. In theory, over time, this could become a source of centralization and a conduit for third-party interference with the network.

Of course, these are complex and unresolved issues, and investors' views on cryptocurrency as a long-term store of value may change over time.

Conclusion

Finally, Grayscale believes that the three most important metrics for measuring on-chain activity are users, transaction volume, and transaction fees, and Solana is currently the leading network in these metrics of on-chain activity. While the Solana network faces many powerful competitors, the depth and diversity of the Solana on-chain economy have laid a solid foundation for SOL's valuation, which is also a necessary condition for its future growth.

A network with strong performance, a large number of users, leading transaction volume and transaction fees, having gone through a phoenix-like rebirth, leading the Meme trend. In addition, Solana also has a large SOL treasury to support it. Aside from the inflation mechanism, SOL seems to have no significant flaws that would impact the token's value, seemingly holding the script of a "cool protagonist," yet it has failed to reach new highs. At the time of the end of this article, the SOL token price has dropped back to $185, and the SOL guards seem to be at a loss.

قد يعجبك أيضاً

ارتفاع سعر البيتكوين بعد تجاوز حاجز 90 ألف دولار وسط توترات جيوسياسية

Key Takeaways شهدت العملات الرقمية، بما فيها البيتكوين، ارتفاعًا ملحوظًا مع استمرار التوترات الجيوسياسية بين روسيا وأوكرانيا. سجل…

توقعات مظلمة لشركات التشفير قبل عام 2026

Key Takeaways معظم شركات التشفير تواجه توقعات قاتمة بحلول عام 2026 وفقاً لآلتان توتر، مما يسهم في انخفاض…

“ترقية Hegota لـ Ethereum متوقعة في أواخر 2026 وسط تسارع خارطة الطريق”

تتضمن ترقية Ethereum الجديدة المسماة Hegota ابتكارات في هيكل البيانات، مثل Verkle Trees، لتحسين كفاءة العقد وتقليل متطلبات…

2026: عام التوسع الهائل لإيثريوم بفضل تقنية ZK

النقاط الرئيسية: إيثريوم يعتمد تقنية ZK-proofs لتوسعة الشبكة نحو 10000 معاملة في الثانية بحلول 2026. سوف يتم تقليل…

هبوط Bitcoin وصعود الذهب والفضة في ظل تصاعد التوترات الجيوسياسية

النقاط الرئيسية شهدت العملات الرقمية انخفاضاً ملحوظاً في قيمتها، حيث تراجعت Bitcoin إلى ما دون 87,000 دولار وسط…

Ethereum في عام 2026: تحديثات فورك Glamsterdam و Hegota وتطورات L1

النقاط الرئيسية في عام 2026، سيشهد تحسنًا كبيرًا في معالجة المعاملات على Ethereum من خلال فورك Glamsterdam. زيادة…

معظم الخزائن الكريبتو ستختفي وسط توقعات قاتمة لعام 2026: تنبؤات المسؤولين التنفيذيين

نقاط رئيسية العديد من الشركات المتخصصة في الخزائن الرقمية سوف تنهار مع حلول عام 2026 بسبب الضغوطات المتزايدة…

انقسام مجتمع Aave: هوية وعلامة فارقة

النقاط الرئيسية دخل مجتمع Aave في انقسام حاد حول السيطرة على العلامة التجارية والأصول المرتبطة بها، مما يثير…

أصول ETF الخاصة بـXRP تتجاوز حاجز 1.25 مليار دولار ولكن حركة السعر تظل متواضعة

النقاط الرئيسية تجاوزت أصول ETF الخاصة بـXRP حاجز 1.25 مليار دولار دون تغييرات كبيرة في السعر. تتراوح أسعار…

Uniswap تنفذ حرق 100 مليون UNI بعد موافقة حوكمة الرسوم

النقاط الرئيسية Uniswap نفذت حرقًا كبيرًا للرموز بعد موافقة الحوكمة على اقتراح حرق الرسوم، مما أدى إلى إزالة…

عشرة أشخاص يعيدون تعريف حدود قوة العملات المشفرة في عام 2025

من وول ستريت إلى البيت الأبيض، ومن وادي السيليكون إلى شنتشن، تتشكل شبكة قوة جديدة.

توقعات الفيدرالي الأمريكي للربع الأول من 2026: الأثر المحتمل على Bitcoin وسوق العملات المشفرة

النقاط الرئيسية استقرار معدلات الفائدة قد يضغط على سوق العملات المشفرة، لكن “التيسير الكمي الخفي” قد يخفف من…

شبكات البلوكشين تستعد بهدوء للتهديد الكمي بينما تناقش Bitcoin الجدول الزمني

بعض شبكات البلوكشين مثل “Aptos” و”Solana” تعمل على دمج دعم التوقيعات المقاومة لكم للحيطة المستقبلية. قسم مهم من…

Here’s what happened in crypto today

النقاط الرئيسية شهدت أساسيات سوق Bitcoin قوة ملحوظة في عام 2025 رغم التحديات السعرية والدعوات للحذر. ارتفعت قيمة…

ارتفاع Canton token بنسبة 27% بعد خطط DTCC لتجزئة الخزينة

Key Takeaways نسبة ارتفاع Canton Coin بلغت 27% عقب إعلان DTCC عن خطط لتجزئة الأوراق المالية للخزانة الأمريكية.…

التحضير للتهديد الكمومي من قبل Blockchains والجدل حول Bitcoin

النقاط الرئيسية تتخذ Blockchains مثل Ethereum وSolana خطوات مبكرة لمواجهة تهديد الكمبيوتر الكمومي المحتمل، بينما لا يزال مجتمع…

من غير المحتمل أن تصل Ethereum إلى مستويات جديدة في عام 2026: بن كوين

النقاط الرئيسية يعتقد المحلل بن كوين أن Ethereum لن تحقق مستويات قياسية جديدة في عام 2026. يمكن أن…

Ethereum unlikely to reach new highs in 2026: Ben Cowen

Key Takeaways: محلل العملات المشفرة بن كاون يرى أن وصول Ethereum إلى ارتفاعات جديدة في عام 2026 غير…

ارتفاع سعر البيتكوين بعد تجاوز حاجز 90 ألف دولار وسط توترات جيوسياسية

Key Takeaways شهدت العملات الرقمية، بما فيها البيتكوين، ارتفاعًا ملحوظًا مع استمرار التوترات الجيوسياسية بين روسيا وأوكرانيا. سجل…

توقعات مظلمة لشركات التشفير قبل عام 2026

Key Takeaways معظم شركات التشفير تواجه توقعات قاتمة بحلول عام 2026 وفقاً لآلتان توتر، مما يسهم في انخفاض…

“ترقية Hegota لـ Ethereum متوقعة في أواخر 2026 وسط تسارع خارطة الطريق”

تتضمن ترقية Ethereum الجديدة المسماة Hegota ابتكارات في هيكل البيانات، مثل Verkle Trees، لتحسين كفاءة العقد وتقليل متطلبات…

2026: عام التوسع الهائل لإيثريوم بفضل تقنية ZK

النقاط الرئيسية: إيثريوم يعتمد تقنية ZK-proofs لتوسعة الشبكة نحو 10000 معاملة في الثانية بحلول 2026. سوف يتم تقليل…

هبوط Bitcoin وصعود الذهب والفضة في ظل تصاعد التوترات الجيوسياسية

النقاط الرئيسية شهدت العملات الرقمية انخفاضاً ملحوظاً في قيمتها، حيث تراجعت Bitcoin إلى ما دون 87,000 دولار وسط…

Ethereum في عام 2026: تحديثات فورك Glamsterdam و Hegota وتطورات L1

النقاط الرئيسية في عام 2026، سيشهد تحسنًا كبيرًا في معالجة المعاملات على Ethereum من خلال فورك Glamsterdam. زيادة…

العملات الرائجة

أحدث أخبار العملات المشفرة

دعم العملاء:@weikecs

التعاون التجاري:@weikecs

التداول الكمي وصناع السوق:[email protected]

خدمات (VIP):[email protected]