How to Trade ETH Futures on WEEX?

What Are ETH Futures ?

A crypto futures contract is a binding agreement between two parties with opposing views on a cryptocurrency's future price. Traders use these contracts to speculate on price movements by taking long (betting on price increases) or short (betting on price decreases) positions.

Ethereum futures specifically track ETH's spot market price, enabling traders to gain exposure to Ethereum's price action without owning the actual asset. Both retail and institutional investors utilize these contracts to hedge against market volatility and protect their positions from sudden price swings.

Why Trade Futures on WEEX?

WEEX offers a range of features that make it an ideal platform for futures trading:

- Advanced Trading Tools: As covered in our previous article on spot trading, WEEX offers intuitive charts and market data, making it easier to analyze the markets and make informed trading decisions.

- Low Fees: Enjoy competitive trading fees for futures contracts, helping you maximize your profits.

- Leverage Options: WEEX allows you to trade with leverage, enabling you to open positions greater than your initial deposit (though it’s important to understand the risks involved with leveraged trading).

- Security Features: With advanced security protocols and the option to enable Two-Factor Authentication (2FA), WEEX ensures your account and funds remain safe.

Step-by-Step Guide: How to Trade ETH Futures on WEEX

Now that you understand the basics, let's walk through the process of trading Bitcoin futures on WEEX. If you've already followed our guide on how to create an account on WEEX and set up 2FA for added security, you’re well-prepared to start futures trading.

Step 1: Log into Your WEEX Account

If you don’t already have an account, follow our step-by-step guide on creating an account on WEEX. Once you’re logged in, navigate to the Futures Trading section from your dashboard.

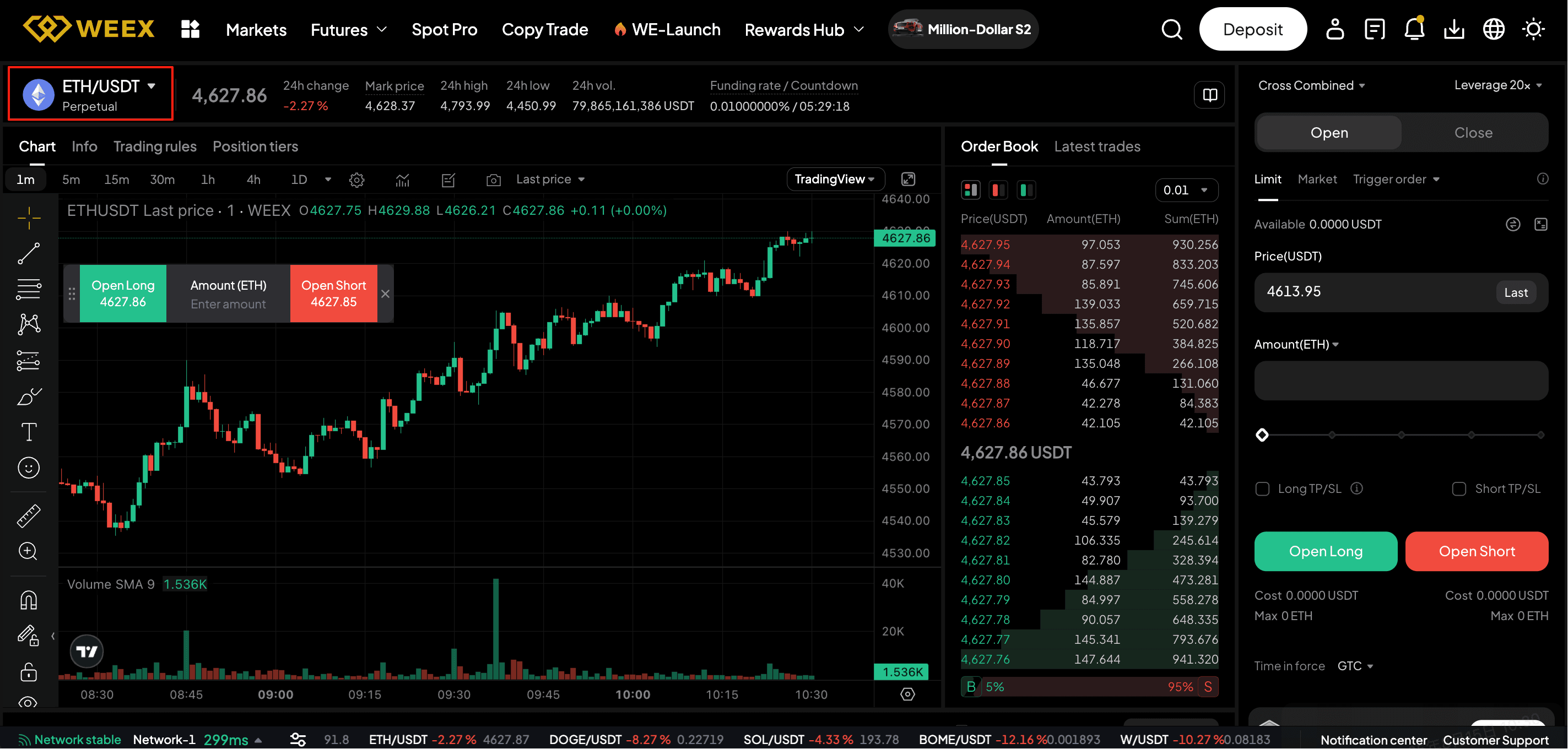

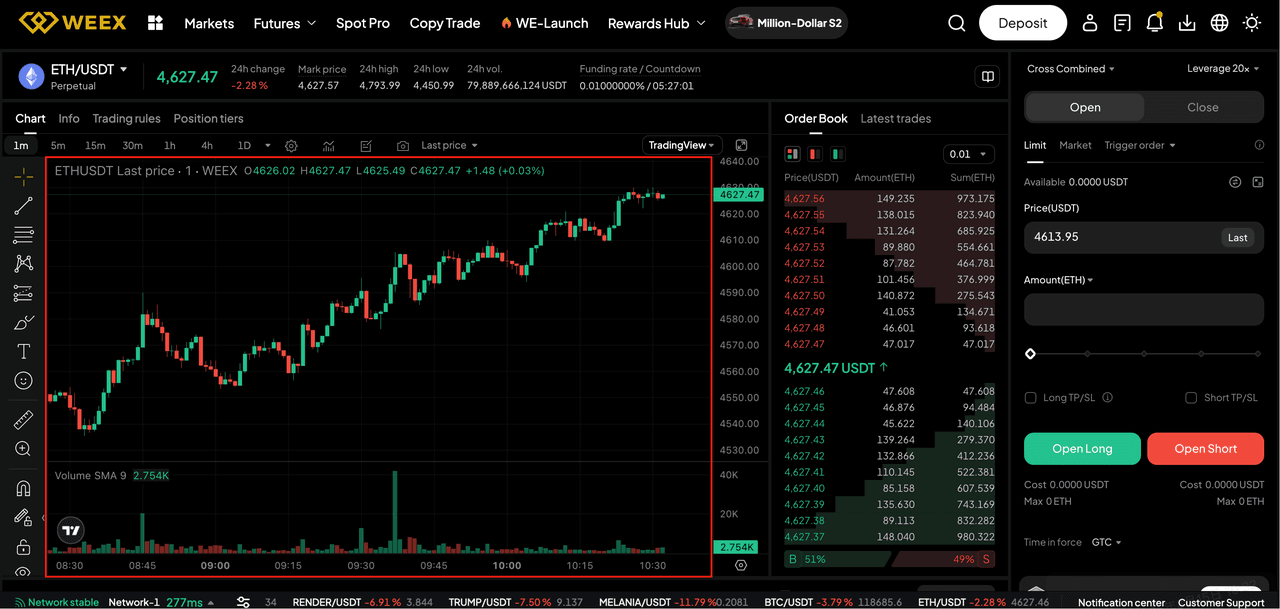

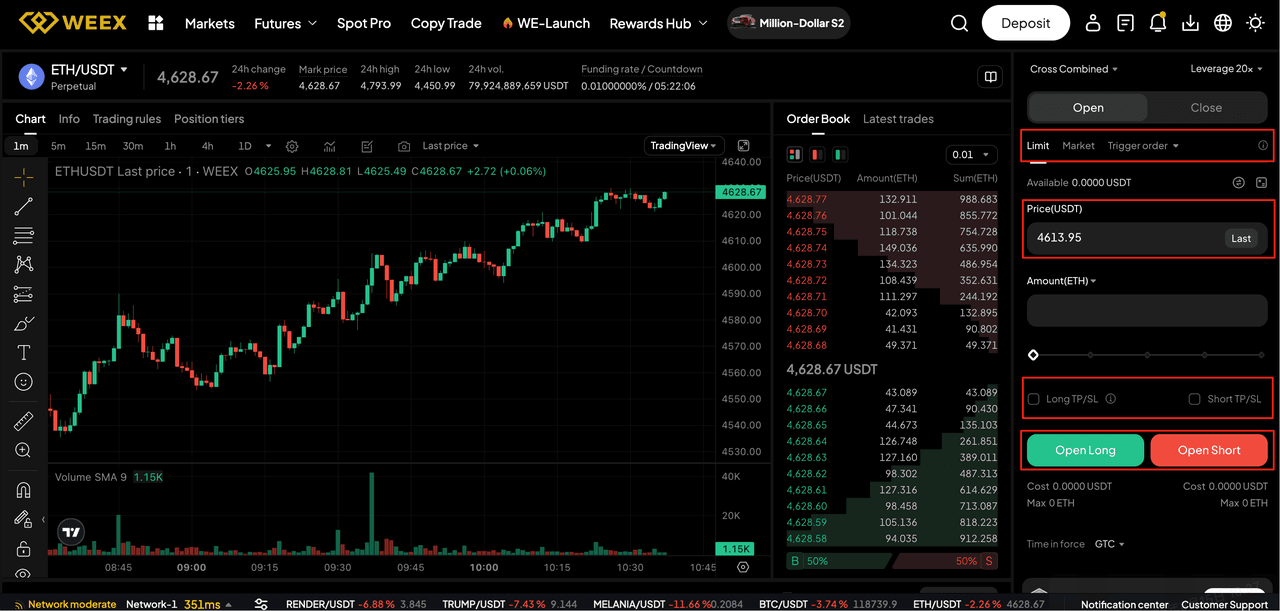

Step 2: Familiarize Yourself with the Futures Market Interface

When you enter the futures trading section, you'll notice a more advanced interface compared to spot trading. Key features of the interface include:

- Order Book : Displays all open buy and sell orders for the selected futures contract.

- Position Information: Shows the details of your open futures positions, including leverage, margin, and unrealized profit/loss.

- Trading Pair: Select the crypto futures pair you want to trade (e.g., BTC/USDT).

- Charts & Data: Real-time price charts and indicators to help you analyze the market and make informed trading decisions.

Step 3: Make Your First Trade

Select the ETH/USDT Futures to trade at the top left side of the page.

Use the [Price Chart] to identify potential trading setups based on patterns or any other technical indicator available on WEEX Futures.

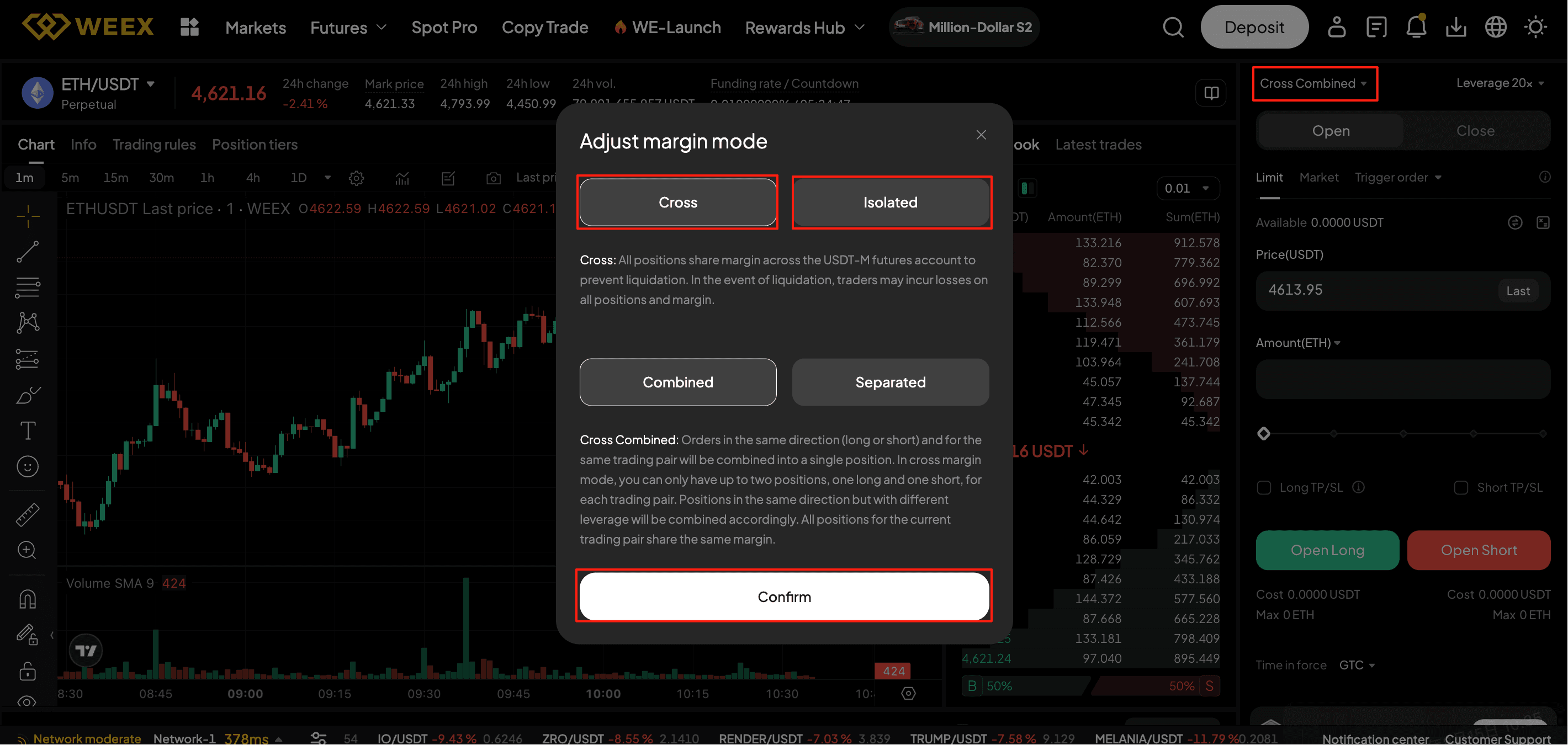

Select the [Margin Mode], which will only apply to the selected Futures Contract, then choose between [Cross] and [Isolated] and click [Confirm].

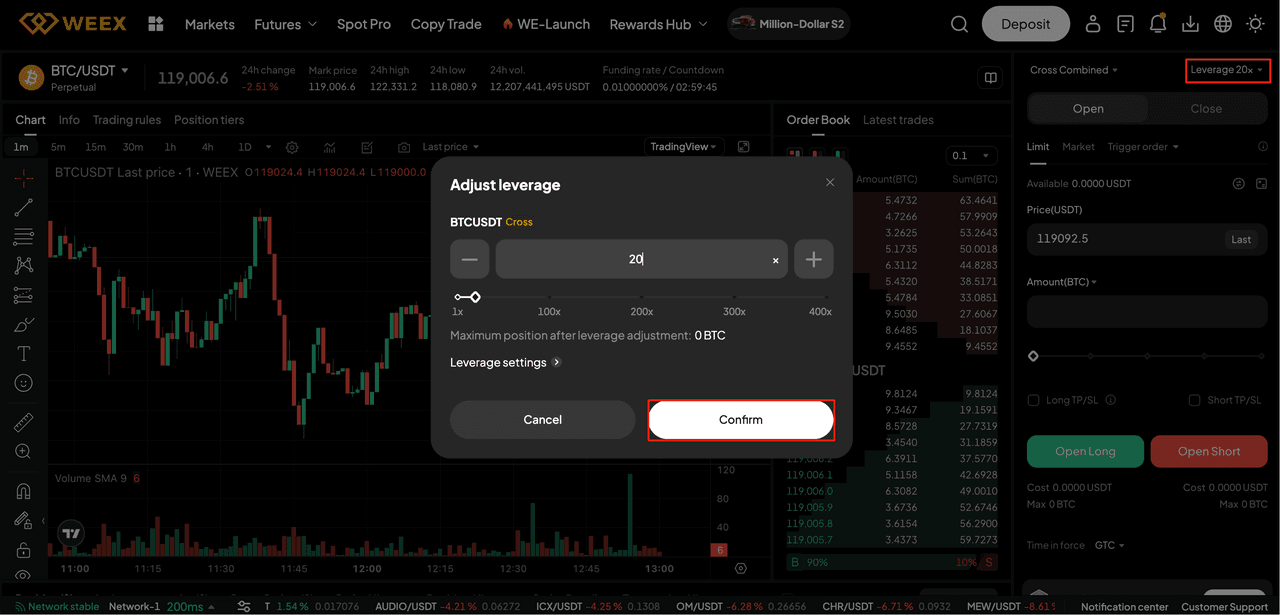

Now, you need to [Adjust Leverage] and click [Confirm]. Please note that using high leverage carries high risks and shouldn’t be done without a robust risk management strategy.

Pro Tip: When trading with leverage, be aware of the liquidation risk. If the market moves against you too far, your position may be liquidated, meaning you lose your initial investment.

Select [Type of Order] - [Price] - [Size], toggle the [TP/SL] feature to set up your [Take Profit] and [Stop Loss] orders, and choose between a [Open/Long] or [Open/Short] position.

Conclusion

Ready to put your WEEX Futures knowledge into practice?

Crypto derivatives trading enhances capital efficiency and helps hedge against market volatility—but always use proper risk management to protect against losses.

New to trading? Start risk-free with our mock trading feature to hone your strategies. When you're ready, switch to live trading on WEEX Futures, the world's leading crypto derivatives platform.

FAQs

- What is futures trading?

- Futures trading involves entering into contracts to buy or sell an asset at a predetermined price in the future. It allows you to speculate on the price movements of cryptocurrencies.

- Can I use leverage when trading futures on WEEX?

- Yes, WEEX offers leverage options for futures trading, allowing you to control larger positions with a smaller investment.

- How do I place a futures order on WEEX?

- Choose your trading pair, select your leverage, and choose an order type (Market or Limit). Then, enter the amount and click Buy or Sell to execute the trade.

- What is the risk of trading futures with leverage?

- Trading with leverage can magnify both profits and losses. If the market moves against you, there is a risk of liquidation, and you could lose your initial investment.

- How can I monitor my futures position?

- You can monitor your position from the Position Information section, which shows real-time profit/loss, margin level, and other key data points.

Gainers

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:[email protected]

VIP Services:[email protected]

WE-Launch

WE-Launch