How to Trade Bitcoin Futures on WEEX?

Futures trading on WEEX offers an exciting opportunity to speculate on the price movements of cryptocurrencies, allowing you to potentially profit from both rising and falling markets. If you're looking to take your crypto trading experience to the next level, futures trading could be the perfect option.

This comprehensive guide will walk you through the process of trading futures on WEEX, drawing from the fundamentals covered in previous articles on account creation, security, and basic spot trading. Let’s dive into how you can start trading futures on WEEX today!

What Are Futures Contracts?

Before getting started with trading futures on WEEX, it’s essential to understand what a futures contract is. In simple terms, a futures contract is an agreement to buy or sell an asset (in this case, cryptocurrencies) at a predetermined price at a specific future date. Unlike spot trading, which involves immediate execution of trades at the current market price, futures contracts allow you to speculate on the price direction of cryptocurrencies, giving you more flexibility and the potential to profit from both market uptrends and downtrends.

Why Trade Futures on WEEX?

WEEX offers a range of features that make it an ideal platform for futures trading:

- Advanced Trading Tools: As covered in our previous article on spot trading, WEEX offers intuitive charts and market data, making it easier to analyze the markets and make informed trading decisions.

- Low Fees: Enjoy competitive trading fees for futures contracts, helping you maximize your profits.

- Leverage Options: WEEX allows you to trade with leverage, enabling you to open positions greater than your initial deposit (though it’s important to understand the risks involved with leveraged trading).

- Security Features: With advanced security protocols and the option to enable Two-Factor Authentication (2FA), WEEX ensures your account and funds remain safe.

Step-by-Step Guide: How to Trade Bitcoin Futures on WEEX

Now that you understand the basics, let's walk through the process of trading Bitcoin futures on WEEX. If you've already followed our guide on how to create an account on WEEX and set up 2FA for added security, you’re well-prepared to start futures trading.

Step 1: Log into Your WEEX Account

If you don’t already have an account, follow our step-by-step guide on creating an account on WEEX. Once you’re logged in, navigate to the Futures Trading section from your dashboard.

Step 2: Familiarize Yourself with the Futures Market Interface

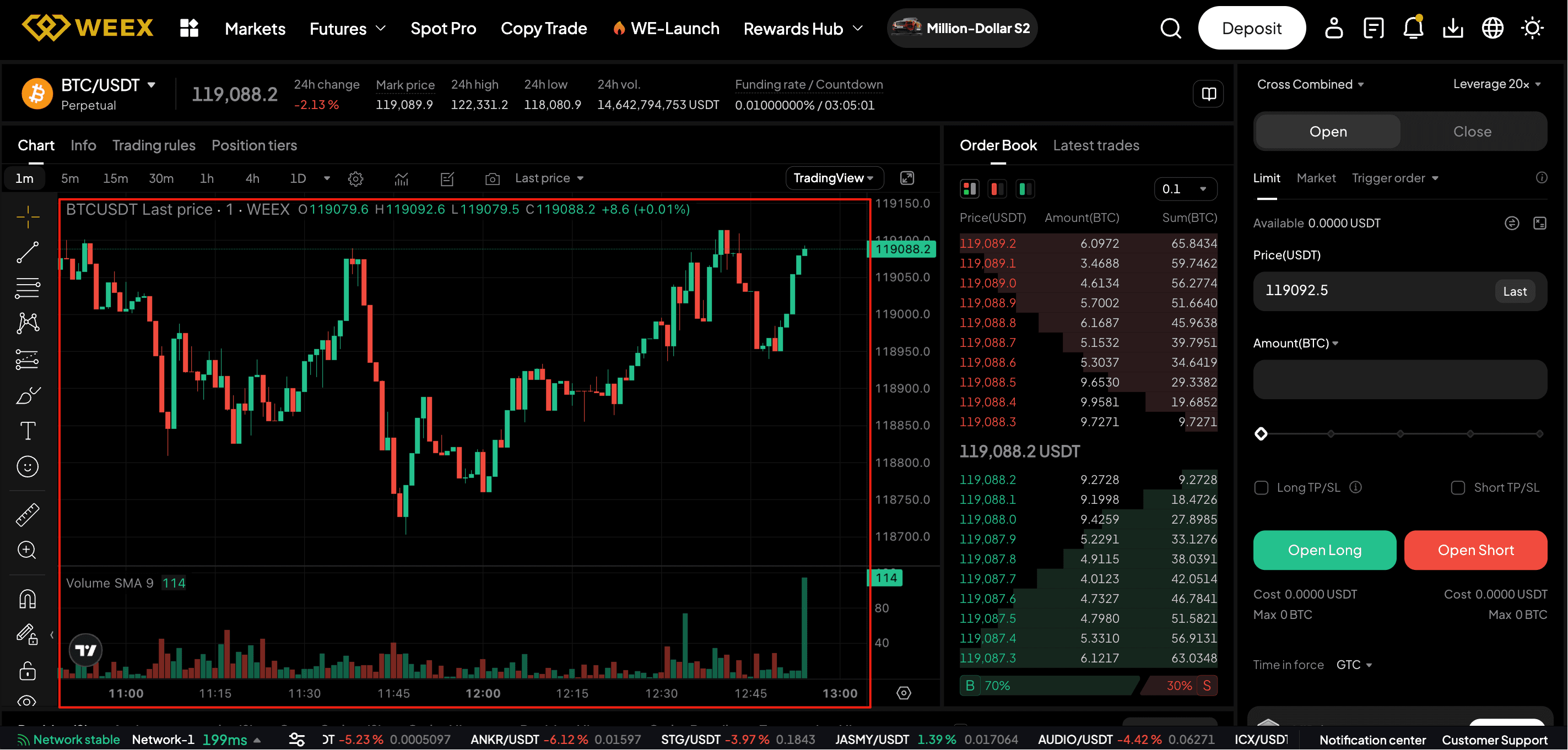

When you enter the futures trading section, you'll notice a more advanced interface compared to spot trading. Key features of the interface include:

- Order Book : Displays all open buy and sell orders for the selected futures contract.

- Position Information: Shows the details of your open futures positions, including leverage, margin, and unrealized profit/loss.

- Trading Pair: Select the crypto futures pair you want to trade (e.g., BTC/USDT).

- Charts & Data: Real-time price charts and indicators to help you analyze the market and make informed trading decisions.

Step 3: Make Your First Trade

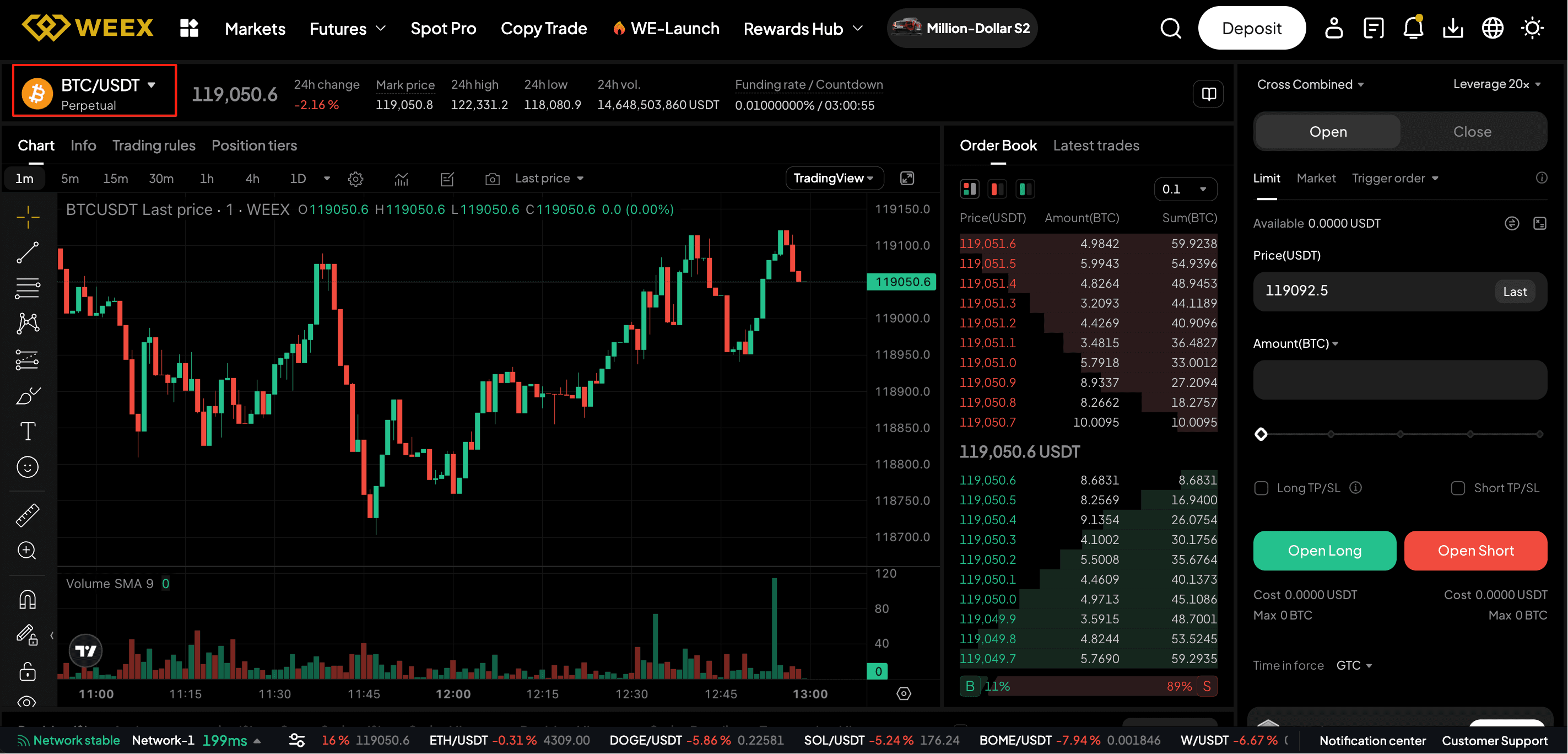

Select the BTC/USDT Futures to trade at the top left side of the page.

Use the [Price Chart] to identify potential trading setups based on patterns or any other technical indicator available on WEEX Futures.

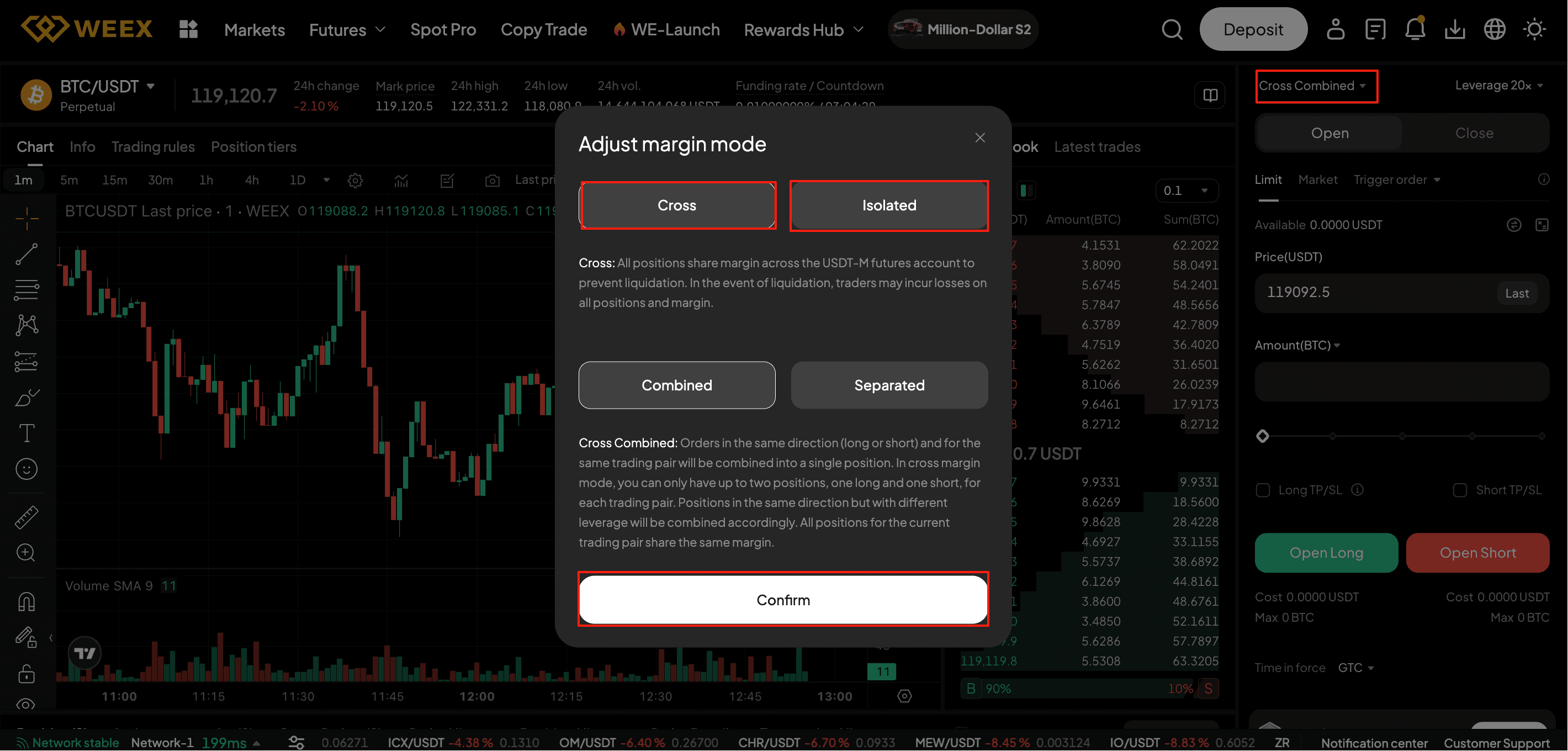

Select the [Margin Mode], which will only apply to the selected Futures Contract, then choose between [Cross] and [Isolated] and click [Confirm].

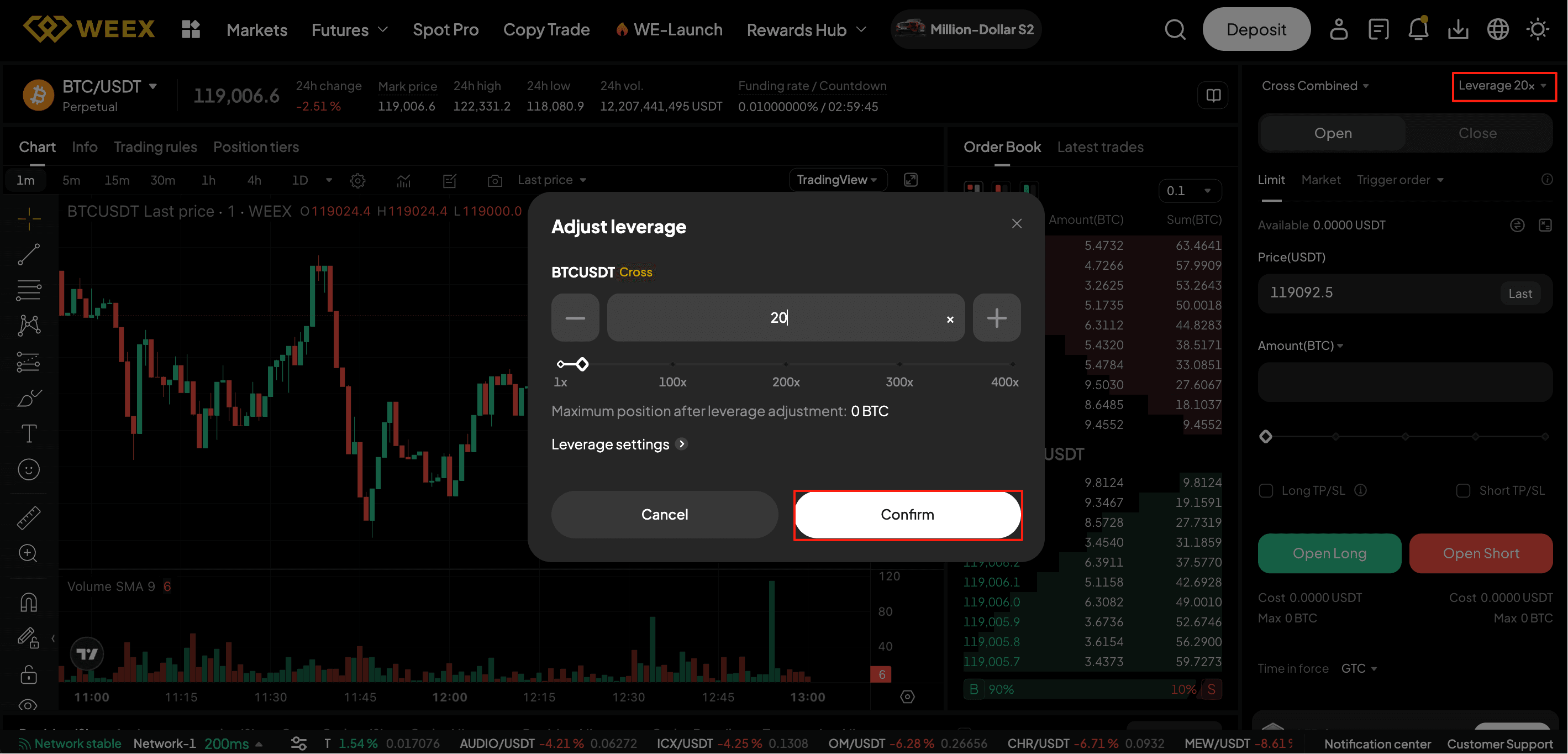

Now, you need to [Adjust Leverage] and click [Confirm]. Please note that using high leverage carries high risks and shouldn’t be done without a robust risk management strategy.

Pro Tip: When trading with leverage, be aware of the liquidation risk. If the market moves against you too far, your position may be liquidated, meaning you lose your initial investment.

Select [Type of Order] - [Price] - [Size], toggle the [TP/SL] feature to set up your [Take Profit] and [Stop Loss] orders, and choose between a [Open/Long] or [Open/Short] position.

Conclusion

Ready to put your WEEX Futures knowledge into practice?

Crypto derivatives trading enhances capital efficiency and helps hedge against market volatility—but always use proper risk management to protect against losses.

New to trading? Start risk-free with our mock trading feature to hone your strategies. When you're ready, switch to live trading on WEEX Futures, the world's leading crypto derivatives platform.

FAQs

- What is futures trading?

- Futures trading involves entering into contracts to buy or sell an asset at a predetermined price in the future. It allows you to speculate on the price movements of cryptocurrencies.

- Can I use leverage when trading futures on WEEX?

- Yes, WEEX offers leverage options for futures trading, allowing you to control larger positions with a smaller investment.

- How do I place a futures order on WEEX?

- Choose your trading pair, select your leverage, and choose an order type (Market or Limit). Then, enter the amount and click Buy or Sell to execute the trade.

- What is the risk of trading futures with leverage?

- Trading with leverage can magnify both profits and losses. If the market moves against you, there is a risk of liquidation, and you could lose your initial investment.

- How can I monitor my futures position?

- You can monitor your position from the Position Information section, which shows real-time profit/loss, margin level, and other key data points.

You may also like

The Best Crypto Copy Trading Platforms 2026: Why Choose WEEX Copy Trading?

Navigating the volatile cryptocurrency market demands both expertise and constant attention, a challenge for many aspiring traders. For those seeking a more accessible path, copy trading presents a powerful alternative. This guide will demystify Binance's Copy Trading feature, explaining its core mechanics and providing a clear, step-by-step walkthrough to launch your journey.

What Is Copy Trading?Copy trading, often referred to as social or mirror trading, is an investment method that allows individuals to automatically replicate the positions opened and managed by selected expert traders. This approach has transitioned from its roots in forex and stock markets to become a significant trend in the cryptocurrency space. It essentially serves as a form of collaborative investing, where knowledge and strategies are shared seamlessly between participants.

For newcomers, it eliminates the steep learning curve of market analysis, allowing them to participate in the crypto markets by leveraging the expertise of veterans. Conversely, for skilled traders, it offers an opportunity to build a following and earn additional income through rebates or profit-sharing models when others copy their successful trades.

Spot vs Futures Copy TradingCopy trading functions across both spot and futures markets. Spot copy trading involves the direct buying and selling of cryptocurrencies, typically carrying lower risk as it involves no leverage or liquidation. Futures copy trading, however, mirrors leveraged positions in derivatives markets. While this can amplify potential returns, it also significantly increases risk due to leverage, making built-in risk management tools on the platform essential for followers.

How to Choose the Best Crypto Exchange for Copy TradingSelecting the right platform is critical, as execution quality, transparency, and risk controls vary widely and directly impact returns.

Trader transparency: Opt for exchanges that provide comprehensive, verifiable performance data—including historical P&L, maximum drawdown, win rate, and current open positions.Risk management tools: Essential features include customizable stop-loss settings, maximum drawdown limits, leverage caps, and the ability to stop copying instantly.Fees and profit sharing: Compare trading fees and profit-sharing rates (typically 10%-30%). Lower costs preserve more of your profits over time.Market coverage: The best platforms support both spot and futures copy trading across a wide range of assets, including major cryptocurrencies and select altcoins.Liquidity and execution: Deep liquidity ensures copied trades are executed with minimal slippage, especially important in fast-moving markets.User experience: An intuitive interface with clear trader rankings and a simple dashboard makes monitoring and managing copied strategies easier.Security and reputation: Prioritize exchanges with a strong security track record, proof of reserves, and reliable uptime to safeguard your assets.The Best Crypto Copy Trading Platforms in 2026By 2026, copy trading has become a mainstream strategy, offering a bridge between market expertise and individual participation. The landscape is no longer defined by a single leader but by a selection of sophisticated platforms, each with a distinct focus to meet varied investor needs—from user-friendly global access to specialized multi-asset ecosystems. The following platforms represent the forefront of this evolution, combining automation, transparency, and risk management to empower traders of all experience levels.

WEEXLaunched in 2018, WEEX offers a transparent and user-friendly crypto copy trading platform, designed for accessibility across multiple regions. The service enables users to automatically replicate the trades of vetted expert traders in real-time, simplifying market participation. The platform provides clear performance metrics and supports both spot and derivatives markets.

Key features include flexible allocation controls, integrated risk management tools, and a straightforward commission structure where expert traders earn through rebates and profit-sharing. This setup aligns the interests of traders and followers, focusing on sustainable strategy performance within WEEX's secure trading ecosystem.

Read More: Crypto Copy Trading: A Game-Changer for Traders

BitgetFounded in 2018, Bitget is widely regarded as the industry pioneer and leader in crypto copy trading. It operates the largest dedicated social trading ecosystem, supporting both spot and futures markets. The platform grants access to thousands of vetted elite traders across major and trending cryptocurrencies, and excels in trader transparency by providing detailed analytics on performance and risk.

Key features include a robust risk management suite for setting stop-losses and controlling leverage, and a profit-sharing model capped at 20% only on profitable trades. A major differentiator is Bitget TradFi, which extends copy trading to tokenized traditional assets like forex and commodities, enabling diversified strategies within a single, integrated account.

BinanceBinance, as the world's largest crypto exchange, offers copy trading backed by its unparalleled market liquidity and vast user base. It supports both spot and futures copying with integrated risk controls. The main advantage is the convenience of accessing copy trading within Binance's all-in-one ecosystem of products and services, appealing to users who prefer a unified platform.

OKXOKX is a top-tier global exchange known for its comprehensive product suite and institutional-grade infrastructure. Its copy trading feature is integrated into this robust environment, offering transparency, strong security, and reliable execution for both spot and futures markets, suitable for users who want copy trading as part of a full-service professional platform.

MEXCMEXC is best known for its extensive altcoin listings and low trading fees. Its copy trading functionality, primarily focused on futures, allows users to follow strategies that may involve emerging or niche cryptocurrencies. This makes it an attractive option for followers seeking exposure to altcoin markets through copied trades.

Why Choose WEEX Copy Trading?WEEX offers a transparent and user-friendly crypto copy trading platform designed for global accessibility. The platform allows you to automatically replicate the real-time trades of vetted expert traders, enabling you to participate in the market without the need for constant monitoring or advanced trading knowledge.

There are several key reasons to choose WEEX for your copy trading activities:

Simplicity & Accessibility: The platform is built with a focus on a seamless user experience. Getting started is straightforward—browse transparent performance profiles of expert traders, select one that matches your goals, and activate copying with just a few clicks.Performance-Driven Incentives: The commission structure aligns your interests with those of the expert traders. Traders primarily earn through a rebate and profit-sharing model, which incentivizes them to focus on generating sustainable, long-term gains for their followers rather than pursuing high-risk, short-term strategies.By combining ease of use, aligned incentives, and essential risk controls, WEEX Copy Trading serves as a practical gateway for both new and experienced investors looking to leverage the expertise of others in the crypto market.

ConclusionCrypto copy trading has matured into a mainstream strategy by 2026, offering a powerful way to participate in markets. The leading platforms—Bitget, Binance, OKX, and WEEX—each offer unique strengths.

Among them, WEEX stands out for its pioneering role, dedicated ecosystem, largest trader community, and continuous innovation. When choosing, prioritize transparency, risk controls, and a platform whose strengths align with your trading goals. With disciplined risk management, copy trading remains a highly effective tool for navigating the crypto landscape.

Stop hesitating. Register now and start your copy trading journey. With the right platform, your path to smarter market participation is just one click away.

Further ReadingCrypto Copy Trading on WEEX: All You Need to KnowWhich Crypto Will Go 1000x in 2026?Auto Earn vs. Staking: Which is Better for You?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How profitable is crypto copy trading?A: Crypto copy trading offers profit potential but comes with no guarantees. Your returns ultimately depend on market conditions, trader performance, and personal risk management. To improve outcomes, choose verified traders whose strategies match your risk tolerance and goals.

Q2: Is copy trading risky?A: Like any financial investment, copy trading involves its own risks. The funds you invest are subject to automated trading execution, so your success in copy trading depends entirely on the performance of the traders you copy. Like any investment, you are fully responsible for any losses sustained.

Q3: Does WEEX Have Copy Trading?A: Yes, WEEX offers a robust, native copy trading feature. This integrated system allows users to automatically replicate the trades of experienced master traders directly on the platform, complete with real-time monitoring and customizable risk controls.

WEEX Trade to Earn Phase 2: Trading Discipline and Risk Management in Uncertain Crypto Futures Markets

As 2026 begins, many traders are facing a familiar frustration: the market keeps moving, but clarity doesn’t. Short, volatile swings in Bitcoin and Ethereum put pressure even on experienced traders, often leading to hesitation, overtrading, or reactive decisions that undermine longer-term strategy.

In this environment, the real challenge isn’t just predicting market direction — it’s managing one’s own reactions. Emotional responses can magnify minor price movements, especially in leveraged futures trading. Consistency, however, is often overlooked.

This is where structured reinforcement becomes relevant. Initiatives such as WEEX Trade to Earn emphasize consistent participation, encouraging discipline without influencing individual trading decisions.

From Emotional Reaction to Risk ManagementWhen markets lack clear direction, emotional reactions often step in. Left unchecked, they tend to influence execution rather than strategy, adding unnecessary friction in volatile conditions.

This is where risk management becomes essential — not as theory, but as a practical framework for maintaining consistency in uncertain markets. In crypto, volatility is inevitable, but disciplined risk management helps reduce emotional errors and support more stable execution over time.

Core principles include:

Setting realistic position sizes and stop-loss levelsDiversifying exposure across multiple assetsAvoiding impulsive trades driven by short-term price swingsA structured approach does not eliminate volatility, but it helps traders navigate it with greater discipline and consistency. How does this translate into real trading behavior during volatile moments?

Staying Calm in Volatile Markets: Real ScenariosConsider a day when Bitcoin moves 3% within an hour. Traders reacting emotionally may exit positions too early or enter impulsively. If you’ve ever closed a trade, only to watch price move exactly as planned, this scenario likely feels familiar. Traders who stick to their plan, however, maintain execution discipline and avoid unnecessary losses.

In this context, programs that offer incremental recognition for consistent execution can serve as a subtle psychological buffer. By reinforcing measured decision-making, they support disciplined behavior without interfering with the underlying strategy.

This approach is particularly valuable for moderate leverage users or those exploring algorithmic strategies, where structured reinforcement helps reduce stress and maintain rational execution during short-term swings.

A Subtle Advantage: Trade to Earn Phase 2Structured reinforcement can play a meaningful role in helping traders maintain discipline during volatile periods. By offering small, visible incentives tied to consistent execution, such mechanisms encourage steadier behavior and reduce the tendency to react impulsively to short-term market fluctuations.

One example of this approach is WEEX Trade to Earn Phase 2. The program does not alter trading strategies or risk exposure, but provides tiered recognition in WXT tokens for consistent futures participation — reinforcing disciplined execution without interfering with decision-making.

The value lies not in the reward itself, but in its psychological effect: supporting composure, confidence, and adherence to a well-defined trading plan during periods of market uncertainty.

Key Takeaways for Rational TradingTo navigate early 2026 markets more effectively:

Treat price swings as signals, not threatsAdhere to pre-defined risk limits and execution rulesSupport consistent execution through structured, participation-based mechanismsPrioritize long-term consistency over avoiding every short-term lossThese principles are increasingly reflected in exchange-level mechanisms that emphasize consistency and disciplined participation, rather than short-term risk-taking.

By combining sound strategy with emotional control, traders can navigate volatile conditions with greater clarity, resilience, and execution quality over time.

Conclusion: Consistency Over ReactionIn range-bound markets, consistency depends less on prediction and more on execution quality. Effective risk control and emotional discipline are essential — particularly in leveraged futures trading.

Mechanisms like WEEX Trade to Earn Phase 2 reinforce disciplined participation through structured recognition, supporting composure without altering strategy or increasing risk.

Over time, progress comes not from trading more, but from executing calmly, minimizing emotional errors, and allowing consistency to compound.

About WEEXFounded in 2018, WEEX has grown into one of the world’s most trusted and innovative cryptocurrency exchanges, serving over 6.2 million users across 150+ countries and regions. With more than 2,000 trading pairs and up to 400× leverage, WEEX is known for its deep liquidity, smooth trading experience, and steadfast transparency. The platform’s 1,000 BTC Protection Fund reflects its unwavering commitment to user safety and reliability.

Beyond trading, WEEX continues to lead the frontier of intelligent finance — from launching the AI Trading Hackathon to fostering a global community of traders, builders, and innovators to shape the markets of tomorrow.

Risk & Disclaimer

-Futures trading involves risk. Please manage leverage and position sizes carefully.

-All rewards are subject to the official event rules and will be distributed after the event ends.

-This article is for educational and informational purposes only and does not constitute financial, investment, legal, tax, or other professional advice.

Follow WEEX on social media:X: @WEEX_Official

Instagram: @WEEX Exchange

TikTok: @weex_global

YouTube: @WEEX_Global

Discord: WEEX Community

Telegram: WeexGlobal Group

Buy Crypto with Easypaisa on WEEX P2P – 0 Fee & 24/7 PKR Ads

Easypaisa is a well-known and reliable platform in Pakistan for fast crypto purchases using PKR. With WEEX P2P, users can buy crypto directly through Easypaisa with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better PKR exchange rates, safer escrow protection, and more available ads for Easypaisa users.

As more users in Pakistan embrace crypto, secure and user-friendly access to digital assets is becoming a key need. With WEEX P2P, users can buy USDT, BTC, or ETH via Easypaisa with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for Easypaisa Users

WEEX P2P offers key advantages to users purchasing crypto with PKR via Easypaisa:

0% buyer fees:Save 2–8% compared to competing platforms and maximize the value of every tradeFast release times :Funds are typically released within 1–3 minutes, ensuring a smooth and efficient buying experienceOfficial escrow protection:Platform-managed escrow guarantees 100% transaction safetyFlexible trade sizes:Supports everything from small purchases to large-volume transactionsBest PKR exchange rates for Easypaisa users: Enjoy highly competitive pricing tailored for Easypaisa paymentsThousands of merchants online 24/7: Deep liquidity and constant availability at any time of dayMore Easypaisa ads than any competitor: Greater choice, faster matching, and higher deal completion ratesWhether you’re buying 1,000 PKR or 1,000,000 PKR, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with Easypaisa on WEEX P2P

Buying crypto with Easypaisa on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC verification Create your WEEX account and finish the basic identity verification process, which typically takes less than one minute to complete.Navigate to Buy Crypto → P2P Trading From the main menu, enter the P2P trading section and select PKR as your preferred fiat currency.Apply the “Easypaisa” filter Enable the Easypaisa payment filter to view only those merchant advertisements that support Easypaisa bank transfers.Select the most suitable merchant Review and compare available merchants based on key indicators, including:Exchange priceOrder completion rateTotal trading volumeReal-time online statusEnter the amount you wish to purchase Input your desired crypto amount, and the system will automatically calculate and display the exact payable amount in PKR.Complete the payment via Easypaisa Transfer the displayed amount using Easypaisa, following the bank details provided by the selected merchant.Confirm payment and notify the seller Click “Transferred, Notify Seller” after completing the transfer. The seller will then verify your payment and promptly release the cryptocurrency to your WEEX account.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with Easypaisa? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with Easypaisa safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with Easypaisa?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with Easypaisa Now!

Buy Crypto with Bank Transfer on WEEX P2P – 0 Fee & 24/7 PKR Merchants

Bank Transfer is widely recognized in Pakistan as a trusted and reliable option for fast and seamless cryptocurrency purchases using PKR. With WEEX P2P, users can buy crypto directly through Bank Transfer with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better PKR exchange rates, safer escrow protection, and more available ads for Bank Transfer users.

As crypto adoption continues to rise in Pakistan, secure and convenient access to digital assets has become increasingly important. With WEEX P2P, users can buy USDT, BTC, or ETH via Bank Transfer with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for Bank Transfer Users

WEEX P2P offers key advantages to users purchasing crypto with PKR via Bank Transfer:

0% buyer fees:Save 2–8% compared to competing platforms and maximize the value of every tradeFast release times :Funds are typically released within 1–3 minutes, ensuring a smooth and efficient buying experienceOfficial escrow protection:Platform-managed escrow guarantees 100% transaction safetyFlexible trade sizes:Supports everything from small purchases to large-volume transactionsBest PKR exchange rates for Bank Transfer users: Enjoy highly competitive pricing tailored for Bank Transfer paymentsThousands of merchants online 24/7: Deep liquidity and constant availability at any time of dayMore Bank Transfer ads than any competitor: Greater choice, faster matching, and higher deal completion ratesWhether you’re buying 1,000 PKR or 1,000,000 PKR, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with Bank Transfer on WEEX P2P

Buying crypto with Bank Transfer on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC verification Create your WEEX account and finish the basic identity verification process, which typically takes less than one minute to complete.Navigate to Buy Crypto → P2P Trading From the main menu, enter the P2P trading section and select PKR as your preferred fiat currency.Apply the “Bank Transfer” filter Enable the Bank Transfer payment filter to view only those merchant advertisements that support Bank Transfer bank transfers.Select the most suitable merchant Review and compare available merchants based on key indicators, including:Exchange priceOrder completion rateTotal trading volumeReal-time online statusEnter the amount you wish to purchase Input your desired crypto amount, and the system will automatically calculate and display the exact payable amount in PKR.Complete the payment via Bank Transfer Transfer the displayed amount using Bank Transfer, following the bank details provided by the selected merchant.Confirm payment and notify the seller Click “Transferred, Notify Seller” after completing the transfer. The seller will then verify your payment and promptly release the cryptocurrency to your WEEX account.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with Bank Transfer? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with Bank Transfer safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with Bank Transfer?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with Bank Transfer Now!

Buy Crypto with Raast on WEEX P2P – 0 Fee & 24/7 PKR Ads

Raast is a well-known and reliable platform in Pakistan for fast crypto purchases using PKR. With WEEX P2P, users can buy crypto directly through Raast with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better PKR exchange rates, safer escrow protection, and more available ads for Raast users.

As more users in Pakistan embrace crypto, secure and user-friendly access to digital assets is becoming a key need. With WEEX P2P, users can buy USDT, BTC, or ETH via Raast with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for Raast Users

WEEX P2P offers key advantages to users purchasing crypto with PKR via Raast:

0% buyer fees:Save 2–8% compared to competing platforms and maximize the value of every tradeFast release times :Funds are typically released within 1–3 minutes, ensuring a smooth and efficient buying experienceOfficial escrow protection:Platform-managed escrow guarantees 100% transaction safetyFlexible trade sizes:Supports everything from small purchases to large-volume transactionsBest PKR exchange rates for Raast users: Enjoy highly competitive pricing tailored for Raast paymentsThousands of merchants online 24/7: Deep liquidity and constant availability at any time of dayMore Raast ads than any competitor: Greater choice, faster matching, and higher deal completion ratesWhether you’re buying 1,000 PKR or 1,000,000 PKR, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with Raast on WEEX P2P

Buying crypto with Raast on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC verification Create your WEEX account and finish the basic identity verification process, which typically takes less than one minute to complete.Navigate to Buy Crypto → P2P Trading From the main menu, enter the P2P trading section and select PKR as your preferred fiat currency.Apply the “Raast” filter Enable the Raast payment filter to view only those merchant advertisements that support Raast bank transfers.Select the most suitable merchant Review and compare available merchants based on key indicators, including:Exchange priceOrder completion rateTotal trading volumeReal-time online statusEnter the amount you wish to purchase Input your desired crypto amount, and the system will automatically calculate and display the exact payable amount in PKR.Complete the payment via Raast Transfer the displayed amount using Raast, following the bank details provided by the selected merchant.Confirm payment and notify the seller Click “Transferred, Notify Seller” after completing the transfer. The seller will then verify your payment and promptly release the cryptocurrency to your WEEX account.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with Raast? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with Raast safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with Raast?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with Raast Now!

Buy Crypto with SadaPay on WEEX P2P – 0 Fee & 24/7 PKR Merchants

SadaPay is widely recognized in Pakistan as a trusted and reliable option for fast and seamless cryptocurrency purchases using PKR. With WEEX P2P, users can buy crypto directly through SadaPay with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better PKR exchange rates, safer escrow protection, and more available ads for SadaPay users.

As crypto adoption continues to rise in Pakistan, secure and convenient access to digital assets has become increasingly important. With WEEX P2P, users can buy USDT, BTC, or ETH via SadaPay with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for SadaPay Users

WEEX P2P offers key advantages to users purchasing crypto with PKR via SadaPay:

0% buyer fees:Save 2–8% compared to competing platforms and maximize the value of every tradeFast release times :Funds are typically released within 1–3 minutes, ensuring a smooth and efficient buying experienceOfficial escrow protection:Platform-managed escrow guarantees 100% transaction safetyFlexible trade sizes:Supports everything from small purchases to large-volume transactionsBest PKR exchange rates for SadaPay users: Enjoy highly competitive pricing tailored for SadaPay paymentsThousands of merchants online 24/7: Deep liquidity and constant availability at any time of dayMore SadaPay ads than any competitor: Greater choice, faster matching, and higher deal completion ratesWhether you’re buying 1,000 PKR or 1,000,000 PKR, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with SadaPay on WEEX P2P

Buying crypto with SadaPay on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC verification Create your WEEX account and finish the basic identity verification process, which typically takes less than one minute to complete.Navigate to Buy Crypto → P2P Trading From the main menu, enter the P2P trading section and select PKR as your preferred fiat currency.Apply the “SadaPay” filter Enable the SadaPay payment filter to view only those merchant advertisements that support SadaPay SadaPays.Select the most suitable merchant Review and compare available merchants based on key indicators, including:Exchange priceOrder completion rateTotal trading volumeReal-time online statusEnter the amount you wish to purchase Input your desired crypto amount, and the system will automatically calculate and display the exact payable amount in PKR.Complete the payment via SadaPay Transfer the displayed amount using SadaPay, following the bank details provided by the selected merchant.Confirm payment and notify the seller Click “Transferred, Notify Seller” after completing the transfer. The seller will then verify your payment and promptly release the cryptocurrency to your WEEX account.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with SadaPay? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with SadaPay safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with SadaPay?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with SadaPay Now!

Buy Crypto with NayaPay on WEEX P2P – 0 Fee & 24/7 PKR Ads

In Pakistan, NayaPay stands out as a reliable solution for fast crypto purchases with PKR. With WEEX P2P, users can buy crypto directly through NayaPay with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better PKR exchange rates, safer escrow protection, and more available ads for NayaPay users.

With more users turning to crypto, easy and secure access to digital assets is now a growing necessity. With WEEX P2P, users can buy USDT, BTC, or ETH via NayaPay with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for NayaPay Users

WEEX P2P offers key advantages to users purchasing crypto with PKR via NayaPay:

0% buyer fees:Save 2–8% compared to competing platforms and maximize the value of every tradeFast release times :Funds are typically released within 1–3 minutes, ensuring a smooth and efficient buying experienceOfficial escrow protection:Platform-managed escrow guarantees 100% transaction safetyFlexible trade sizes:Supports everything from small purchases to large-volume transactionsBest PKR exchange rates for NayaPay users: Enjoy highly competitive pricing tailored for NayaPay paymentsThousands of merchants online 24/7: Deep liquidity and constant availability at any time of dayMore NayaPay ads than any competitor: Greater choice, faster matching, and higher deal completion ratesWhether you’re buying 1,000 PKR or 1,000,000 PKR, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with NayaPay on WEEX P2P

Buying crypto with NayaPay on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC verification Create your WEEX account and finish the basic identity verification process, which typically takes less than one minute to complete.Navigate to Buy Crypto → P2P Trading From the main menu, enter the P2P trading section and select PKR as your preferred fiat currency.Apply the “NayaPay” filter Enable the NayaPay payment filter to view only those merchant advertisements that support NayaPay bank transfers.Select the most suitable merchant Review and compare available merchants based on key indicators, including:Exchange priceOrder completion rateTotal trading volumeReal-time online statusEnter the amount you wish to purchase Input your desired crypto amount, and the system will automatically calculate and display the exact payable amount in PKR.Complete the payment via NayaPay Transfer the displayed amount using NayaPay, following the bank details provided by the selected merchant.Confirm payment and notify the seller Click “Transferred, Notify Seller” after completing the transfer. The seller will then verify your payment and promptly release the cryptocurrency to your WEEX account.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with NayaPay? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with NayaPay safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with NayaPay?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with NayaPay Now!

Buy Crypto with Bank Accout on WEEX P2P – 0 Fee & 24/7 VND Ads

Bank Accout is a well-known and reliable platform in Vietnam for fast crypto purchases using VND. With WEEX P2P, users can buy crypto directly through Bank Accout with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better VND exchange rates, safer escrow protection, and more available ads for Bank Accout users.

As more users in Vietnam embrace crypto, secure and user-friendly access to digital assets is becoming a key need. With WEEX P2P, users can buy USDT, BTC, or ETH via Bank Accout with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for Bank Accout Users

WEEX P2P offers key advantages to users purchasing crypto with VND via Bank Accout:

0% buyer fees:Save 2–8% compared to competing platforms and maximize the value of every tradeFast release times :Funds are typically released within 1–3 minutes, ensuring a smooth and efficient buying experienceOfficial escrow protection:Platform-managed escrow guarantees 100% transaction safetyFlexible trade sizes:Supports everything from small purchases to large-volume transactionsBest VND exchange rates for Bank Accout users: Enjoy highly competitive pricing tailored for Bank Accout paymentsThousands of merchants online 24/7: Deep liquidity and constant availability at any time of dayMore Bank Accout ads than any competitor: Greater choice, faster matching, and higher deal completion ratesWhether you’re buying 1,000 VND or 1,000,000 VND, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with Bank Accout on WEEX P2P

Buying crypto with Bank Accout on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC verification Create your WEEX account and finish the basic identity verification process, which typically takes less than one minute to complete.Navigate to Buy Crypto → P2P Trading From the main menu, enter the P2P trading section and select VND as your preferred fiat currency.Apply the “Bank Accout” filter Enable the Bank Accout payment filter to view only those merchant advertisements that support Bank Accout bank transfers.Select the most suitable merchant Review and compare available merchants based on key indicators, including:Exchange priceOrder completion rateTotal trading volumeReal-time online statusEnter the amount you wish to purchase Input your desired crypto amount, and the system will automatically calculate and display the exact payable amount in VND.Complete the payment via Bank Accout Transfer the displayed amount using Bank Accout, following the bank details provided by the selected merchant.Confirm payment and notify the seller Click “Transferred, Notify Seller” after completing the transfer. The seller will then verify your payment and promptly release the cryptocurrency to your WEEX account.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with Bank Accout? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with Bank Accout safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with Bank Accout?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with Bank Accout Now!

Buy Crypto with MoMo on WEEX P2P – 0 Fee & 24/7 VND Merchants

MoMo is widely recognized in Vietnam as a trusted and reliable option for fast and seamless cryptocurrency purchases using VND. With WEEX P2P, users can buy crypto directly through MoMo with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better VND exchange rates, safer escrow protection, and more available ads for MoMo users.

As crypto adoption continues to rise in Vietnam, secure and convenient access to digital assets has become increasingly important. With WEEX P2P, users can buy USDT, BTC, or ETH via MoMo with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for MoMo Users

WEEX P2P offers key advantages to users purchasing crypto with VND via MoMo:

0% buyer fees:Save 2–8% compared to competing platforms and maximize the value of every tradeFast release times :Funds are typically released within 1–3 minutes, ensuring a smooth and efficient buying experienceOfficial escrow protection:Platform-managed escrow guarantees 100% transaction safetyFlexible trade sizes:Supports everything from small purchases to large-volume transactionsBest VND exchange rates for MoMo users: Enjoy highly competitive pricing tailored for MoMo paymentsThousands of merchants online 24/7: Deep liquidity and constant availability at any time of dayMore MoMo ads than any competitor: Greater choice, faster matching, and higher deal completion ratesWhether you’re buying 1,000 VND or 1,000,000 VND, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with MoMo on WEEX P2P

Buying crypto with MoMo on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC verification Create your WEEX account and finish the basic identity verification process, which typically takes less than one minute to complete.Navigate to Buy Crypto → P2P Trading From the main menu, enter the P2P trading section and select VND as your preferred fiat currency.Apply the “MoMo” filter Enable the MoMo payment filter to view only those merchant advertisements that support MoMo MoMos.Select the most suitable merchant Review and compare available merchants based on key indicators, including:Exchange priceOrder completion rateTotal trading volumeReal-time online statusEnter the amount you wish to purchase Input your desired crypto amount, and the system will automatically calculate and display the exact payable amount in VND.Complete the payment via MoMo Transfer the displayed amount using MoMo, following the bank details provided by the selected merchant.Confirm payment and notify the seller Click “Transferred, Notify Seller” after completing the transfer. The seller will then verify your payment and promptly release the cryptocurrency to your WEEX account.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with MoMo? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with MoMo safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with MoMo?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with MoMo Now!

Buy Crypto with Zalo on WEEX P2P – 0 Fee & 24/7 VND Ads

In Vietnam, Zalo stands out as a reliable solution for fast crypto purchases with PKR. With WEEX P2P, users can buy crypto directly through Zalo with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better PKR exchange rates, safer escrow protection, and more available ads for Zalo users.

With more users turning to crypto, easy and secure access to digital assets is now a growing necessity. With WEEX P2P, users can buy USDT, BTC, or ETH via Zalo with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for Zalo Users

WEEX P2P offers key advantages to users purchasing crypto with PKR via Zalo:

0% buyer fees:Save 2–8% compared to competing platforms and maximize the value of every tradeFast release times :Funds are typically released within 1–3 minutes, ensuring a smooth and efficient buying experienceOfficial escrow protection:Platform-managed escrow guarantees 100% transaction safetyFlexible trade sizes:Supports everything from small purchases to large-volume transactionsBest PKR exchange rates for Zalo users: Enjoy highly competitive pricing tailored for Zalo paymentsThousands of merchants online 24/7: Deep liquidity and constant availability at any time of dayMore Zalo ads than any competitor: Greater choice, faster matching, and higher deal completion ratesWhether you’re buying 1,000 PKR or 1,000,000 PKR, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with Zalo on WEEX P2P

Buying crypto with Zalo on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC verification Create your WEEX account and finish the basic identity verification process, which typically takes less than one minute to complete.Navigate to Buy Crypto → P2P Trading From the main menu, enter the P2P trading section and select PKR as your preferred fiat currency.Apply the “Zalo” filter Enable the Zalo payment filter to view only those merchant advertisements that support Zalo bank transfers.Select the most suitable merchant Review and compare available merchants based on key indicators, including:Exchange priceOrder completion rateTotal trading volumeReal-time online statusEnter the amount you wish to purchase Input your desired crypto amount, and the system will automatically calculate and display the exact payable amount in PKR.Complete the payment via Zalo Transfer the displayed amount using Zalo, following the bank details provided by the selected merchant.Confirm payment and notify the seller Click “Transferred, Notify Seller” after completing the transfer. The seller will then verify your payment and promptly release the cryptocurrency to your WEEX account.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with Zalo? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with Zalo safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with Zalo?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with Zalo Now!

Buy crypto with T-Bank on WEEX P2P – 0 Fee & Fast RUB Trades

In 2025, T-Bank remains one of the most popular and reliable ways for users in Russia to buy cryptocurrency with RUB. With WEEX P2P, users can buy crypto directly through T-Bank with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better RUB exchange rates, safer escrow protection, and more available ads for T-Bank users.

As crypto adoption grows in Russia, fast and secure access to digital assets has become essential. With WEEX P2P, users can buy USDT, BTC, or ETH via T-Bank with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for T-Bank Users in 2025

WEEX P2P offers key advantages to users purchasing crypto with RUB via T-Bank:

0% fee for buyers (save 2-8% vs competitors)Fast release times (1–3 minutes on average)Official escrow protection – 100% safeSupport from small amounts to large-volume tradesBest RUB exchange rates for T-Bank usersThousands of merchants online 24/7More T-Bank ads than any competing platformWhether you’re buying 1,000 RUB or 1,000,000 RUB, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with T-Bank on WEEX P2P

Buying crypto with T-Bank on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC Takes less than 1 minute.Go to Buy Crypto → P2P Trading Select RUB as your fiat currency.Filter by “T-Bank” You will now only see advertisements that support T-Bank transfers.Select the best merchant Compare based on:PriceCompletion rateVolumeOnline statusEnter the amount you want to buy The system will show your exact cost in RUB.Make the payment via T-Bank Transfer the amount shown using the merchant’s bank details.Tap “Transferred, Notify Seller” The seller will verify your payment and release crypto.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with T-Bank? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with T-Bank safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with T-Bank?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with T-Bank Now!

Buy Crypto with SBP-Fast Bank Transfer on WEEX P2P – 0 Fee & Ultra-Fast RUB Trades

SBP-Fast Bank Transfer is a top-choice option in Russia, offering users a fast and reliable way to buy crypto using RUB. With WEEX P2P, users can buy crypto directly through SBP-Fast Bank Transfer with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better RUB exchange rates, safer escrow protection, and more available ads for SBP-Fast Bank Transfer users.

With crypto adoption rising across Russia, reliable and fast access to digital assets has turned into a key requirement for users. With WEEX P2P, users can buy USDT, BTC, or ETH via SBP-Fast Bank Transfer with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for SBP-Fast Bank Transfer Users

WEEX P2P offers key advantages to users purchasing crypto with RUB via SBP-Fast Bank Transfer:

0% fee for buyers (save 2-8% vs competitors)Fast release times (1–3 minutes on average)Official escrow protection – 100% safeSupport from small amounts to large-volume tradesBest RUB exchange rates for SBP-Fast Bank Transfer usersThousands of merchants online 24/7More SBP-Fast Bank Transfer ads than any competing platformWhether you’re buying 1,000 RUB or 1,000,000 RUB, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with SBP-Fast Bank Transfer on WEEX P2P

Buying crypto with SBP-Fast Bank Transfer on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC Takes less than 1 minute.Go to Buy Crypto → P2P Trading Select RUB as your fiat currency.Filter by “SBP-Fast Bank Transfer” You will now only see advertisements that support SBP-Fast Bank Transfer transfers.Select the best merchant Compare based on:PriceCompletion rateVolumeOnline statusEnter the amount you want to buy The system will show your exact cost in RUB.Make the payment via SBP-Fast Bank Transfer Transfer the amount shown using the merchant’s bank details.Tap “Transferred, Notify Seller” The seller will verify your payment and release crypto.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with SBP-Fast Bank Transfer? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with SBP-Fast Bank Transfer safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with SBP-Fast Bank Transfer?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with SBP-Fast Bank Transfer Now!

Buy Crypto with Alfa-bank on WEEX P2P – 0 Fee & 24/7 RUB Ads

Alfa-bank is consistently recognized as one of the most efficient and popular methods for Russian users looking to acquire cryptocurrency using RUB. With WEEX P2P, users can buy crypto directly through Alfa-bank with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better RUB exchange rates, safer escrow protection, and more available ads for Alfa-bank users.

As more people in Russia embrace crypto, the need for convenient and secure access to digital assets has never been greater. With WEEX P2P, users can buy USDT, BTC, or ETH via Alfa-bank with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for Alfa-bank Users

WEEX P2P offers key advantages to users purchasing crypto with RUB via Alfa-bank:

0% fee for buyers (save 2-8% vs competitors)Fast release times (1–3 minutes on average)Official escrow protection – 100% safeSupport from small amounts to large-volume tradesBest RUB exchange rates for Alfa-bank usersThousands of merchants online 24/7More Alfa-bank ads than any competing platformWhether you’re buying 1,000 RUB or 1,000,000 RUB, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with Alfa-bank on WEEX P2P

Buying crypto with Alfa-bank on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC Takes less than 1 minute.Go to Buy Crypto → P2P Trading Select RUB as your fiat currency.Filter by “Alfa-bank” You will now only see advertisements that support Alfa-bank transfers.Select the best merchant Compare based on:PriceCompletion rateVolumeOnline statusEnter the amount you want to buy The system will show your exact cost in RUB.Make the payment via Alfa-bank Transfer the amount shown using the merchant’s bank details.Tap “Transferred, Notify Seller” The seller will verify your payment and release crypto.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with Alfa-bank? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with Alfa-bank safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with Alfa-bank?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with Alfa-bank Now!

Buy Crypto with Monobank on WEEX P2P – 0 Fee & 24/7 UAH Ads

Monobank is widely regarded as one of the fastest and most popular options for Ukrainian users to buy cryptocurrency with UAH. With WEEX P2P, users can buy crypto directly through Monobank with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better UAH exchange rates, safer escrow protection, and more available ads for Monobank users.

As more people in Ukraine embrace crypto, the need for convenient and secure access to digital assets has never been greater. With WEEX P2P, users can buy USDT, BTC, or ETH via Monobank with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for Monobank Users

WEEX P2P offers key advantages to users purchasing crypto with UAH via Monobank:

0% buyer fees:Save 2–8% compared to competing platforms and maximize the value of every tradeFast release times :Funds are typically released within 1–3 minutes, ensuring a smooth and efficient buying experienceOfficial escrow protection:Platform-managed escrow guarantees 100% transaction safetyFlexible trade sizes:Supports everything from small purchases to large-volume transactionsBest UAH exchange rates for Monobank users: Enjoy highly competitive pricing tailored for Monobank paymentsThousands of merchants online 24/7: Deep liquidity and constant availability at any time of dayMore Monobank ads than any competitor: Greater choice, faster matching, and higher deal completion ratesWhether you’re buying 1,000 UAH or 1,000,000 UAH, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with Monobank on WEEX P2P

Buying crypto with Monobank on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC verification Create your WEEX account and finish the basic identity verification process, which typically takes less than one minute to complete.Navigate to Buy Crypto → P2P Trading From the main menu, enter the P2P trading section and select UAH as your preferred fiat currency.Apply the “Monobank” filter Enable the Monobank payment filter to view only those merchant advertisements that support Monobank bank transfers.Select the most suitable merchant Review and compare available merchants based on key indicators, including:Exchange priceOrder completion rateTotal trading volumeReal-time online statusEnter the amount you wish to purchase Input your desired crypto amount, and the system will automatically calculate and display the exact payable amount in UAH.Complete the payment via Monobank Transfer the displayed amount using Monobank, following the bank details provided by the selected merchant.Confirm payment and notify the seller Click “Transferred, Notify Seller” after completing the transfer. The seller will then verify your payment and promptly release the cryptocurrency to your WEEX account.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with Monobank? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with Monobank safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with Monobank?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with Monobank Now!

Buy Crypto with PUMB on WEEX P2P – 0 Fee & Fast UAH Trades

PUMB remains a leading and dependable option for buying cryptocurrency with UAH in Ukraine. With WEEX P2P, users can buy crypto directly through PUMB with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better UAH exchange rates, safer escrow protection, and more available ads for PUMB users.

With crypto adoption accelerating in Ukraine, seamless and trustworthy access to digital assets has never been more critical. With WEEX P2P, users can buy USDT, BTC, or ETH via PUMB with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for PUMB Users in 2025

WEEX P2P offers key advantages to users purchasing crypto with UAH via PUMB:

0% buyer fees:Save 2–8% compared to competing platforms and maximize the value of every tradeFast release times :Funds are typically released within 1–3 minutes, ensuring a smooth and efficient buying experienceOfficial escrow protection:Platform-managed escrow guarantees 100% transaction safetyFlexible trade sizes:Supports everything from small purchases to large-volume transactionsBest UAH exchange rates for PUMB users: Enjoy highly competitive pricing tailored for PUMB paymentsThousands of merchants online 24/7: Deep liquidity and constant availability at any time of dayMore PUMB ads than any competitor: Greater choice, faster matching, and higher deal completion ratesWhether you’re buying 1,000 UAH or 1,000,000 UAH, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with PUMB on WEEX P2P

Buying crypto with PUMB on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC verification Create your WEEX account and finish the basic identity verification process, which typically takes less than one minute to complete.Navigate to Buy Crypto → P2P Trading From the main menu, enter the P2P trading section and select UAH as your preferred fiat currency.Apply the “PUMB” filter Enable the PUMB payment filter to view only those merchant advertisements that support PUMB bank transfers.Select the most suitable merchant Review and compare available merchants based on key indicators, including:Exchange priceOrder completion rateTotal trading volumeReal-time online statusEnter the amount you wish to purchase Input your desired crypto amount, and the system will automatically calculate and display the exact payable amount in UAH.Complete the payment via PUMB Transfer the displayed amount using PUMB, following the bank details provided by the selected merchant.Confirm payment and notify the seller Click “Transferred, Notify Seller” after completing the transfer. The seller will then verify your payment and promptly release the cryptocurrency to your WEEX account.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with PUMB? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with PUMB safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with PUMB?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with PUMB Now!

Buy Crypto with Privat Bank on WEEX P2P – 0 Fee & Ultra-Fast UAH Trades

Privat Bank continues to stand out as one of the most efficient and commonly used methods for users in Ukraine to purchase crypto using UAH. With WEEX P2P, users can buy crypto directly through Privat Bank with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better UAH exchange rates, safer escrow protection, and more available ads for Privat Bank users.

As crypto adoption continues to expand in Ukraine, the demand for convenient and secure access to digital assets keeps growing. With WEEX P2P, users can buy USDT, BTC, or ETH via Privat Bank with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for Privat Bank Users in 2025

WEEX P2P offers key advantages to users purchasing crypto with UAH via Privat Bank:

0% buyer fees:Save 2–8% compared to competing platforms and maximize the value of every tradeFast release times :Funds are typically released within 1–3 minutes, ensuring a smooth and efficient buying experienceOfficial escrow protection:Platform-managed escrow guarantees 100% transaction safetyFlexible trade sizes:Supports everything from small purchases to large-volume transactionsBest UAH exchange rates for Privat Bank users: Enjoy highly competitive pricing tailored for Privat Bank paymentsThousands of merchants online 24/7: Deep liquidity and constant availability at any time of dayMore Privat Bank ads than any competitor: Greater choice, faster matching, and higher deal completion ratesWhether you’re buying 1,000 UAH or 1,000,000 UAH, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with Privat Bank on WEEX P2P

Buying crypto with Privat Bank on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC verification Create your WEEX account and finish the basic identity verification process, which typically takes less than one minute to complete.Navigate to Buy Crypto → P2P Trading From the main menu, enter the P2P trading section and select UAH as your preferred fiat currency.Apply the “Privat Bank” filter Enable the Privat Bank payment filter to view only those merchant advertisements that support Privat Bank bank transfers.Select the most suitable merchant Review and compare available merchants based on key indicators, including:Exchange priceOrder completion rateTotal trading volumeReal-time online statusEnter the amount you wish to purchase Input your desired crypto amount, and the system will automatically calculate and display the exact payable amount in UAH.Complete the payment via Privat Bank Transfer the displayed amount using Privat Bank, following the bank details provided by the selected merchant.Confirm payment and notify the seller Click “Transferred, Notify Seller” after completing the transfer. The seller will then verify your payment and promptly release the cryptocurrency to your WEEX account.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)

Q1: Are there any fees when paying with Privat Bank? A: 0% fee for buyers. Only sellers pay a small fee.

Q2: How fast will I receive Crypto? A: Usually 1–5 minutes after marking payment as sent.

Q3: Is buying with Privat Bank safe on WEEX? A: Yes. All trades use official escrow.

Q4: Do I need full KYC? A: Basic KYC is required for P2P trading.

Ready to Buy Crypto with Privat Bank?

Start buying crypto in under 3 minutes — fast, safe, and 0% fee for buyers!

Start Buying Crypto on WEEX P2P with Privat Bank Now!

Buy Crypto with UPI on WEEX P2P – 0 Fee & 24/7 INR Ads

UPI is recognized across India as a leading solution for fast and seamless cryptocurrency purchases using INR. With WEEX P2P, users can buy crypto directly through UPI with zero fees, access 24/7 verified merchants, and enjoy ultra-fast release times.

Compared with Binance, Bybit, and local OTC platforms, WEEX consistently offers better INR exchange rates, safer escrow protection, and more available ads for UPI users.

With more users in India turning to crypto, having easy and safe access to digital assets has become increasingly important. With WEEX P2P, users can buy USDT, BTC, or ETH via UPI with instant processing, 0% buyer fees, and professional merchant support.

What is P2P Trading?

Peer-to-Peer (P2P) trading allows users to buy and sell crypto directly with other users, while the platform acts as a secure intermediary.

On WEEX P2P:

Crypto is held in escrowSellers release assets only after payment is confirmedTrades are processed quickly and safelyThis ensures zero counterparty risk and allows users to pay via local banking methods for a seamless experience.

Why WEEX P2P is the Best Choice for UPI Users

WEEX P2P offers key advantages to users purchasing crypto with INR via UPI:

0% buyer fees:Save 2–8% compared to competing platforms and maximize the value of every tradeFast release times :Funds are typically released within 1–3 minutes, ensuring a smooth and efficient buying experienceOfficial escrow protection:Platform-managed escrow guarantees 100% transaction safetyFlexible trade sizes:Supports everything from small purchases to large-volume transactionsBest INR exchange rates for UPI users: Enjoy highly competitive pricing tailored for UPI paymentsThousands of merchants online 24/7: Deep liquidity and constant availability at any time of dayMore UPI ads than any competitor: Greater choice, faster matching, and higher deal completion ratesWhether you’re buying 1,000 INR or 1,000,000 INR, WEEX ensures fast, safe, and cost-efficient crypto purchases.

How to Buy Crypto with UPI on WEEX P2P

Buying crypto with UPI on WEEX is simple and fast. Follow these steps:

Register on WEEX and complete basic KYC verification Create your WEEX account and finish the basic identity verification process, which typically takes less than one minute to complete.Navigate to Buy Crypto → P2P Trading From the main menu, enter the P2P trading section and select INR as your preferred fiat currency.Apply the “UPI” filter Enable the UPI payment filter to view only those merchant advertisements that support UPI bank transfers.Select the most suitable merchant Review and compare available merchants based on key indicators, including:Exchange priceOrder completion rateTotal trading volumeReal-time online statusEnter the amount you wish to purchase Input your desired crypto amount, and the system will automatically calculate and display the exact payable amount in INR.Complete the payment via UPI Transfer the displayed amount using UPI, following the bank details provided by the selected merchant.Confirm payment and notify the seller Click “Transferred, Notify Seller” after completing the transfer. The seller will then verify your payment and promptly release the cryptocurrency to your WEEX account.Your Crypto will arrive instantly in your WEEX wallet — safe, fast, and with zero fees.

Frequently Asked Questions (FAQ)