Introduction to Canton Network: A New Era for Institutional-Grade Digital Assets

Canton Network is rapidly emerging as one of the most compelling blockchain projects in the financial technology space. Known for its native Canton Network coin (CC token), this public, permissionless blockchain was specifically designed for institutional-level finance. While many projects promise “financial infrastructure on-chain,” Canton Network stands out as the first settlement layer genuinely used by major institutions such as Microsoft, Deutsche Bank, and Morgan Stanley. Its focus is not hype—it’s about providing real-world utility for regulated assets and stablecoins.

Canton Network: Unlocking Institutional Assets

Over the past two years, discussions around Real-World Assets (RWA) on-chain have dominated the blockchain community, yet few projects have delivered tangible solutions. Canton Network addresses this gap by enabling the tokenization and seamless movement of institutional-grade assets such as government bonds, commercial papers, repo agreements, and mortgage-backed securities. By moving these assets onto a verifiable and auditable blockchain, Canton allows financial institutions to achieve:

- Cross-system collateral mobility, breaking down traditional silos.

- Regulatory-compliant auditability, ensuring all processes meet strict compliance requirements.

Capital efficiency, where assets aren’t just stored on-chain—they actively circulate and settle, reshaping the dynamics of institutional finance.

In other words, Canton Network doesn’t simply put financial assets on a blockchain; it makes them fluid, usable, and compliant, laying the foundation for a programmable financial ecosystem.

Canton Coin: Tokenomics Built for Real Utility

The Canton Coin (CC) token operates under a unique, transparent, and fair economic model:

- There are no pre-sales, no team allocations, and no VC holdings—CC is entirely community-produced.

- Gas fees paid with CC are automatically burned, creating a natural deflationary mechanism.

- New tokens are distributed every 10 minutes to nodes based on validation activity and application usage.

- A dynamic supply mechanism adjusts issuance according to transaction volume, ensuring balanced growth and scarcity.

This model encourages participants to earn tokens through meaningful network activity rather than speculation, aligning incentives between builders, validators, and users.

Institutional Adoption and Market Momentum

Canton Network has surpassed 500,000 daily transactions, demonstrating strong adoption from both traditional banks and crypto exchanges. Leading financial institutions such as Goldman Sachs, HSBC, and Broadridge, alongside U.S.-based exchanges like Binance U.S., Crypto.com, Gemini, and Kraken, are actively supporting its growth. The recent listing of CC tokens on Binance pre-market contracts and WEEX highlights the network’s increasing liquidity and growing institutional credibility.

Although the current price hovers around $0.127, Canton Network’s fundamentals are reminiscent of early-stage privacy-focused projects like Zcash, which once surged past $700. Unlike speculative projects, Canton Network is grounded in real institutional partnerships and a sustainable token-burning mechanism, positioning it for substantial long-term valuation potential.

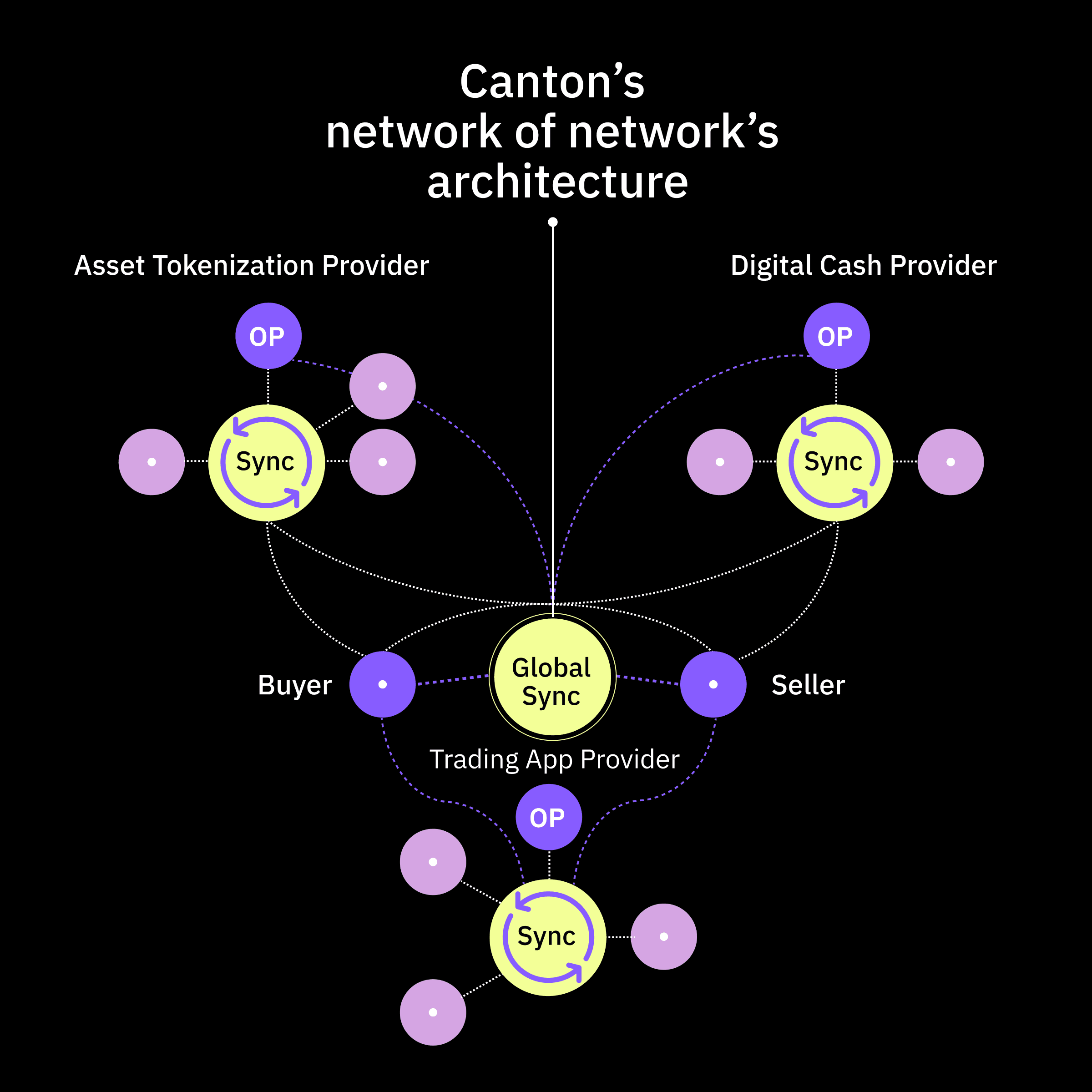

Exploring Canton Network’s Technology and Architecture

Canton Network’s architecture is designed as a “network of networks”, enabling multiple institutions to maintain private sub-ledgers while synchronizing securely through a shared layer. Key features include:

- Node and consensus design: Validator nodes store and execute contracts, while synchronizers manage encrypted transaction coordination.

- Privacy-first distribution: Only nodes specified in smart contracts receive relevant data, unlike many blockchains where all transactions are broadcast to all nodes.

- Global governance: The Global Synchronizer Foundation (GSF), under the Linux Foundation, ensures robust oversight while maintaining decentralization.

This infrastructure enables a secure, privacy-preserving environment suitable for high-value financial transactions while maintaining interoperability across institutions.

Canton Coin in Action

The Canton Coin application incentivizes stakeholders to contribute value to the network. Validators, Super Validators, and application providers can mint CC by performing network utility tasks rather than speculative investment. Canton Coin also serves as an optional payment method for transaction fees and application usage, providing public visibility into network activity without compromising privacy. This approach fosters a healthy network economy where utility drives token distribution, rather than hype or speculation.

Why does the Canton Network Matters?

Canton Network represents the bridge between DeFi and RealFi—bringing regulatory-compliant, interoperable financial infrastructure to blockchain. By enabling assets and stablecoins to move freely and settle efficiently, it is redefining institutional finance for the digital era. For early adopters, Canton Network offers a rare opportunity to participate in the foundational layer of a global, programmable settlement system.

For investors and users looking for a secure platform to trade and engage with CC trading pairs, WEEX exchange provides a reliable, user-friendly environment. With WEEX’s robust trading infrastructure, seamless fiat-crypto integration, and commitment to institutional-grade security, Canton Coin can be accessed and utilized safely by both retail and institutional participants.

Frequently Asked Questions (FAQ)

1. What is Canton Network and how does it differ from other blockchains?

Canton Network is a public blockchain designed specifically for institutional finance. Unlike traditional blockchains, it enables real-time settlement, private asset transfers, and compliance-ready audit trails, making it suitable for regulated financial markets.

2. What is the role of Canton Coin (CC token) in the network?

Canton Coin serves multiple purposes: it incentivizes validators and application providers, acts as a payment method for network fees and services, and provides visibility into network activity. Tokens are minted only by contributing utility, not through speculative pre-sales.

3. How can I access and trade CC tokens?

CC tokens are available on major exchanges including Binance, Kraken, Gate, and Bybit. For a secure and seamless experience, WEEX exchange allows users to trade CC tokens with institutional-grade security and liquidity, making it an ideal platform for both new and experienced participants.

4. What kind of assets can Canton Network handle?

Canton Network supports tokenization and on-chain settlement of institutional-grade assets such as government bonds, commercial papers, repo agreements, and mortgage-backed securities, allowing them to move, settle, and circulate efficiently on-chain.

5. Is Canton Network suitable for retail investors?

While Canton Network primarily targets institutional use, CC tokens can be accessed by retail investors via exchanges like WEEX. The tokenomics are designed to reward network participation and utility, making it accessible to those interested in supporting and engaging with the ecosystem.

Popular coins

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com