Analyzing WEEX Exchange: Markets, Liquidity, and Transparency

Introduction

This report provides a comprehensive analysis of WEEX's trading environment, focusing on the following key areas:

Liquidity Depth: Assessment of market depth for major trading pairs on futures markets.

Asset Diversity: Evaluation of the variety and number of assets listed on the platform.

Comparative Analysis: Benchmarking WEEX against other leading cryptocurrency exchanges in terms of liquidity, asset offerings.

For the analysis of markets, we selected the 10 most actively traded coins and tokens. The assets are grouped into:

For the futures market, the analysis focuses on top-of-book liquidity (±0.1%), assessing the available volume at the best bid and ask prices. This approach provides a more accurate representation of immediate execution liquidity in the futures market. The data snapshot took place in May 2025.

Markets Analysis

Liquidity Depth and Slippage Analysis on Futures Markets

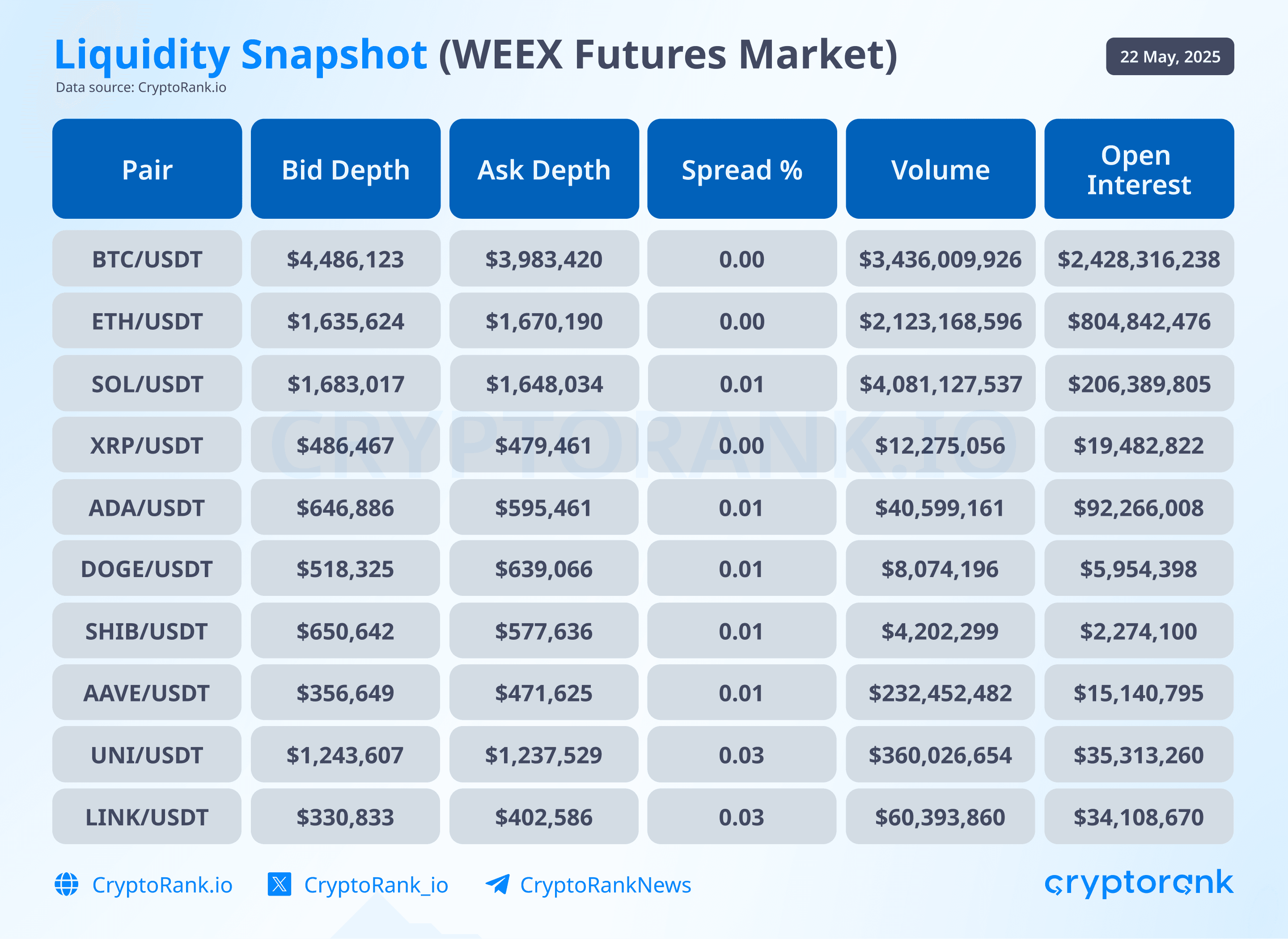

WEEX’s futures markets demonstrate varied liquidity conditions across major and mid-cap assets. Using ±2% depth and spread as proxies for execution quality, the analysis reveals that only a handful of contracts exhibit deep enough order books to reliably handle large trades with minimal slippage.

BTC/USDT remains the most liquid futures pair, with a +2% depth of $4.49M and -2% depth of $3.98M, and a zero spread, which is ideal for large and frequent execution. ETH/USDT also shows solid liquidity, with approximately $1.6M on each side of the book, offering high availability for both retail and institutional traders. SOL/USDT performs similarly, maintaining tight spreads and order book depth exceeding $1.6M, indicating an active derivatives market.

UNI/USDT stands out with depth over $1.2M on each side and a moderate spread of 0.03%, suggesting stable market-making activity. Other pairs like DOGE/USDT, ADA/USDT, and SHIB/USDT maintain depth between $500k and $650k, with spreads holding around 0.01%, making them viable for moderate trading volume but vulnerable to slippage on larger orders.

Contracts such as AAVE/USDT, LINK/USDT, and XRP/USDT display more limited depth, ranging from $330k to $486k, with higher spreads (0.03% for LINK and UNI). These markets are better suited for smaller trades, as larger orders may lead to visible price movement.

Analyzing the Open Interest (OI) relative to trading volume, pairs like BTC/USDT and ETH/USDT indicate a healthy balance, suggesting sustainable liquidity and moderate speculative activity. XRP/USDT's high OI compared to its lower volume points to increased speculative positioning, possibly raising volatility risks.

Overall, WEEX provides high execution quality for top-traded assets like BTC, ETH, and SOL, while offering access to a wide range of altcoin derivatives with moderate to low liquidity. Traders should account for depth limitations and spread sensitivity when planning trade size and strategy across less liquid pairs.

Number of Listed Assets and Presence of Long-tail or Early-listed Tokens.

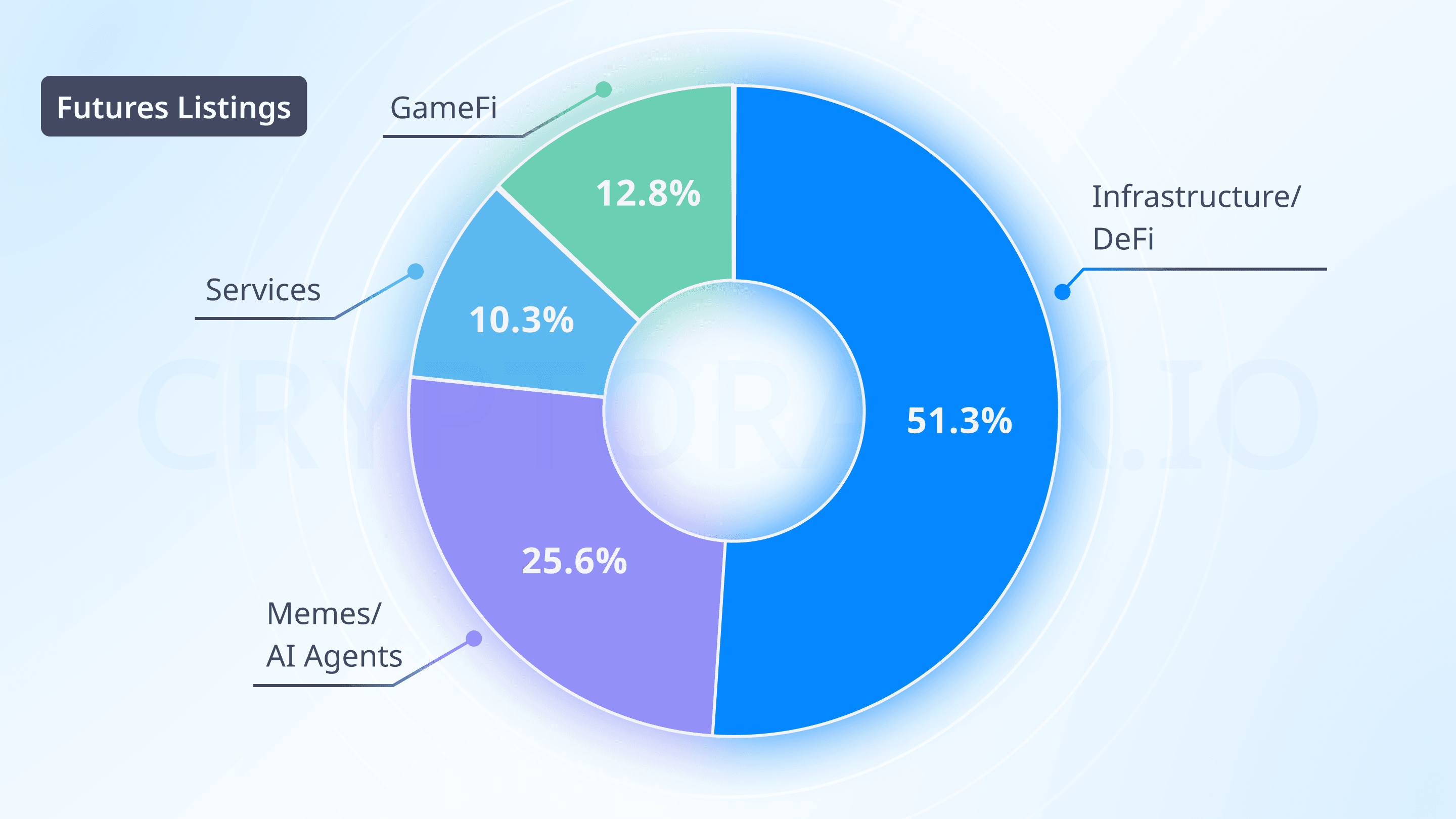

The number of futures trading pairs on WEEX exceeds 700. This highlights the dynamic nature of WEEX's futures offerings, which may appeal to traders seeking diverse derivative instruments. In the last month, WEEX introduced 39 new futures trading pairs.

The futures market prioritizes infrastructure and DeFi tokens (51.3% of new pairs), suggesting a focus on assets with stronger fundamentals or market stability, suitable for leveraged trading. The lower proportion of meme and AI agent tokens (25.6%) in futures indicates a more selective approach, likely to ensure liquidity and reduce risk in derivatives. The presence of GameFi (12.8%) and service-oriented tokens (10.3%) in futures further diversifies offerings, tapping into emerging trends like blockchain gaming.

The high volume of new listings (39 futures pairs in one month) underscores WEEX’s agility in responding to market trends. The emphasis on long-tail tokens in the spot market and early-listed projects across both markets, supported by the WE-Launch program, positions WEEX as a platform for discovering undervalued or emerging assets, appealing to a broad spectrum of traders.

WEEX demonstrates a notable presence of long-tail and early-listed tokens, enhancing its appeal for niche and emerging market traders. Long-tail tokens, defined as less popular or niche cryptocurrencies, are evident from recent listings on WEEX's new token announcements page, such as PUSSFi (PUSS), FARTGIRL, and 42069COIN, listed in April 2025. These tokens, often meme coins or projects with smaller market caps, are typically not widely traded on major exchanges, fitting the long-tail category.

Early-listed tokens, those listed shortly after launch, are supported through WEEX's WE-Launch program, which focuses on airdrops for early-stage crypto projects. The WE-Launch page details historical projects. The program's structure, requiring WXT staking for airdrops, further underscores WEEX's strategy to engage with emerging projects, likely attracting traders interested in growth opportunities.

In summary, WEEX lists around 700 for futures trading, with potential updates suggesting higher futures figures. The exchange actively supports long-tail and early-listed tokens, as evidenced by recent listings and the WE-Launch program, catering to a broad spectrum of trading preferences.

Comparison with Other Exchanges

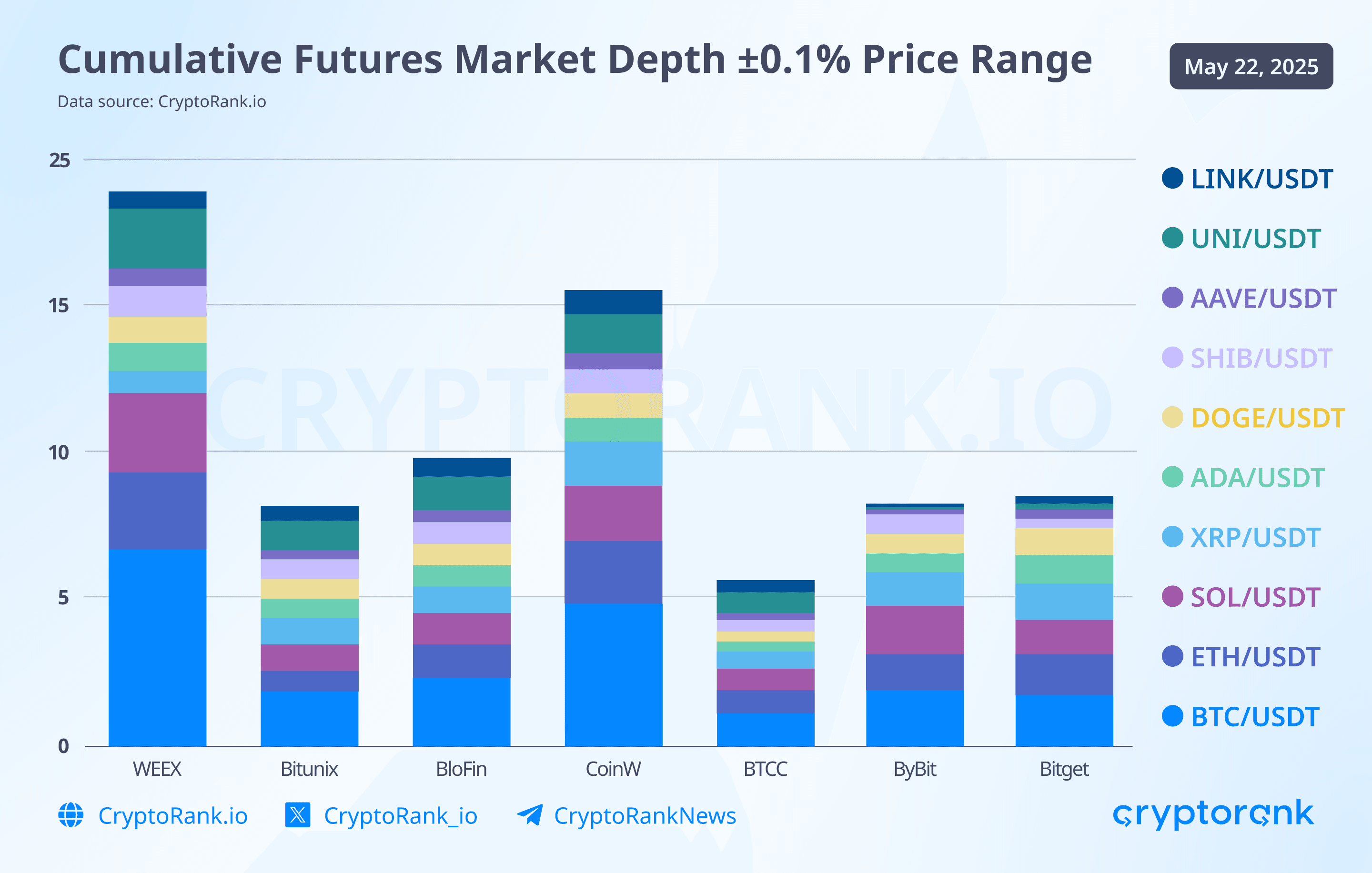

When WEEX is evaluated against other cryptocurrency exchanges, such as Bitunix, CoinW, BloFin, BTCC, Bybit, Bitget, in futures markets, several distinct patterns emerge regarding liquidity depth, execution quality, and asset coverage.

In the futures segment, WEEX offers more than 700 contracts, the largest among the compared platforms. This includes not only high-cap assets but also speculative tokens, AI-themed coins, and meme derivatives. Most competitors support 300–550 pairs, placing WEEX ahead in market exposure and product variety.

WEEX shows strong immediate liquidity on major trading pairs. For the BTC/USDT pair, WEEX offers the highest among all analyzed exchanges at the top of the book, surpassing both institutional platforms like Bitget and Bybit. Similar trends are observed for ETH/USDT and SOL/USDT well above top-of-book levels at competitors such as Bitunix, BloFin, and BTCC.

Bitget and Bybit show relatively low top-of-book volume, These platforms maintain a dense layer of small, rapidly replenished limit orders close to the mid-price. While this enables high-frequency trading and nearly instant execution for small orders, it means actual top-of-book depth appears limited in snapshots, even though liquidity increases significantly at slightly deeper levels such as within 0.1% of the mid-price. At these depths, WEEX and other mid-tier exchanges currently cannot compete with the scale and algorithmic liquidity density of Bybit and Bitget.

Liquidity on futures for pairs like SOL/USDT, ETH/USDT, and DOGE/USDT is sufficient for moderate volume trading. Notably, spreads on WEEX remain exceptionally low (0.00–0.01%), even on mid- and low-cap contracts, offering reliable execution conditions.

While it does not yet match the institutional-level liquidity of Bybit or Bitget on core futures pairs, WEEX remains highly competitive in spread efficiency and continues to build market depth. For traders focused on variety, early access, and efficient execution in liquid majors, WEEX represents a uniquely positioned alternative in the current exchange landscape.

Security and Transparency

WEEX maintains a strict 1:1 reserve ratio, ensuring that all user assets are fully backed. The platform provides a Proof of Reserves system, allowing users to verify that their holdings are matched by equivalent reserves. This system enhances trust and transparency by demonstrating the platform's solvency.

To safeguard user assets, WEEX has established a 1,000 BTC Protection Fund, serving as an emergency reserve to cover potential losses. The platform employs advanced security measures, including two-factor authentication (2FA), cold storage solutions, and regular security audits. WEEX has also undergone independent security assessments, affirming its commitment to maintaining high-security standards.

Conclusion

WEEX presents itself as a fast-evolving exchange with a strong balance between innovation, asset diversity, and user-focused infrastructure. WEEX demonstrates strengths that position it as a compelling alternative for retail and mid-size traders.

WEEX doesn’t yet match the institutional-grade depth and volume of the largest exchanges, but it competes effectively in fee efficiency, asset breadth, and execution quality on major pairs. Its aggressive listing approach and focus on emerging sectors give it an edge for users seeking fast access to new market opportunities.

For retail traders, WEEX offers an appealing mix of low fees, wide asset selection, and solid execution on leading pairs. Its support for long-tail tokens and early-stage projects makes it especially attractive to users following trends and new narratives in crypto.

In summary, WEEX is a well-rounded exchange for users who prioritize early access, cost efficiency, and diverse exposure, while accepting the trade-offs of moderate depth in less mainstream markets.

Join Us on the Next WEEX Adventure

This year, WEEX measured the world with our footsteps and earned trust through action. Whether you’re a trader, developer, or industry observer, we look forward to meeting you at our next stop.

Be Part of What’s Next! Register Now

Follow WEEX on social media:

· Instagram: @WEEX_Exchange

· X: @WEEX_Official

· Tiktok: @weex_global

· Youtube: @WEEX_Global

· Telegram: WeexGlobal Group

猜你喜歡

鏈上固定利率借貸為何難成氣候?「利差」交易才是出路

ZCash 團隊分裂、美銀上調 Coinbase 評級,海外幣圈今天在聊啥?

1月9日關鍵市場資訊差,一定要看!|Alpha早報

左手BTC右手AI算力:數智時代的黃金與石油

告別「空氣」投資:用這6大指標幫助你選擇爆款專案

USD1 30億市值狂飆背後:特朗普家族押注、CEX托舉

幣權還是股權?真正的問題被問錯了

Ranger公開募資玩出新花樣,草根團隊能贏得市場信任嗎?

加密市況今日:比特幣下滑,亞洲引領的拋售潮席捲山寨幣市場

關鍵摘要 比特幣在亞洲交易時段內跌破94,500美元,拖累整個加密貨幣市場向下。 山寨幣市場比比特幣受到更大衝擊,PENGU和XRP分別下跌6.5%和3.5%。 衍生品市場持續波動,過去24小時內加密貨幣期貨清算465億美元。 去中心化金融(DeFi)雖面臨整體下行壓力,但總鎖倉價值(TVL)仍微漲0.17%。 TRX逆勢上升,自午夜以來增長1.2%。 WEEX Crypto News, 2026-01-07 14:51:40 在2026年1月7日上午的亞洲交易時段,比特幣價格未能突破94,500美元導致其跌落至91,530美元的位置,此時加密貨幣市場整體也受此影響而大幅下挫。在過去五週中,這已經是比特幣第三次試圖突破此關鍵點位失敗,這預示著市場的震盪以及投資者情緒的波動。 比特幣遭遇拋售壓力 本日早間,比特幣從午夜的高位93,750美元跌至91,530美元,再次進入2025年12月以來其主要交易區間(85,000美元至94,500美元)內。這一走勢顯示出市場對風險的避險情緒升高,與此同時,美國股市也在預交易時段下滑,NASDAQ 100期貨自午夜以來下跌0.32%。 山寨幣市場情況 與比特幣相比,山寨幣市場表現更加疲軟,尤其是PENGU和XRP,分別下降了6.5%和3.5%。而增長勢頭迅猛的迷因幣和隱私幣則是今日表現最糟糕的兩個板塊,Zcash(ZEC)領軍下跌,自午夜UTC以來已跌落4.5%。 值得一提的是,有一絲希望照亮了被陰霾籠罩的山寨幣市場,那就是去中心化金融(DeFi)領域。根據DefiLlama的數據,儘管市場向下總趨勢,DeFi生態系統中的總鎖倉價值在過去24小時內小幅上升了0.17%,這可能暗示著資金仍在流入該市場。…

瑞波再次排除上市可能性,財務狀況支持公司保持私有

主要重點 瑞波公司在2025年再度籌集5億美元,市場估值達到400億美元,並重申無尋求首次公開募股(IPO)的計劃。 2025年,瑞波在企業數字資產基礎設施方面進行了積極的收購行動,總金額接近40億美元。 瑞波支付平台的交易量已超過950億美元,其穩定幣RLUSD在多個商業領域中發揮關鍵作用。 KuCoin在2025年的交易量超越整體加密市場,成為中心化交易所的市場佔有率領先者。 WEEX Crypto News, 2026-01-07 14:51:41(today’s date,foramt: day, month, year) 瑞波繼續保持私有,堅定否決IPO計劃 瑞波(Ripple)公司,在加密領域以其創新支付解決方案和穩定幣產品而聞名,近日再次確認其不會尋求首次公開募股(IPO)。瑞波總裁Monica Long在接受彭博新聞(Bloomberg)採訪時透露,儘管外界對公司上市持續關注,但瑞波仍會保留私有公司身份,這一決定基於公司穩健的財務狀況,她強調公司具備內部資源和能力來推動自身的成長,而不需要依賴公開市場的流動資金或資本。 在過去的幾年中,瑞波公司完成了多項重大的企業併購,這些行動進一步強化了公司在數字資產基礎設施中的地位。根據2025年的財務報告,瑞波在11月以市場估值400億美元的條件下,成功從Fortress…

開年復甦反彈失速:美洲加密貨幣日記

主要加密貨幣如比特幣、瑞波幣和Solana在過去24小時內均下跌超過1.5%。 16個CoinDesk行業指數全面下跌,以DeFi選擇指數跌幅3.6%為首。 美元上市現貨比特幣ETF前兩日流入超過10億美元,但週二流失2.43億美元。 長期日本國債收益率創歷史新高,引發市場對風險資產的擔憂,可能波及比特幣。 WEEX Crypto News, 2026-01-07 14:51:40 市場最近的調整令部分分析師質疑年初反彈是否由信心購入驅動,還是由季節性因素如新年資金配置所推動。U.S.上市的現貨比特幣ETF在2026年前兩個交易日的流入超過10億美元,但據數據來源SoSoValue,週二流失了2.43億美元。這顯示市場短期內有調整壓力,並使市場參與者心生不安。 加密市場面臨的波動主要與市場流動性和季節性因素密切相關,而非堅實的信心購入。XS.com的資深市場分析師Samer Hasn指出,儘管近來流動性稍有改善,但目前信號仍顯示力道不足導致上升動能衰減。他指出,美國投資者需求的代表”Coinbase溢價”依然為負,這說明美國投資者尚未全面投入此波反彈,即便分析師稱過去阻礙比特幣的稅相關拋售已結束。 不過,衍生品市場給牛市提供了一些積極跡象。例如,加密貨幣期貨累積未平倉合約升至近兩個月最高,顯示投資者的風險承受能力開始恢復。此外,永續合約的資金費率持續改善,這也是一個樂觀的信號。Glassnode指出,歷史上,市場穩定上行通常伴隨著資金費率持續高於~0.01%,暗示當前條件仍然有利。 然而,傳統市場方面,日本政府債券(JGB)收益率創歷史新高,引發社交媒體對風險資產影響的關注,包括對比特幣的可能影響。更高的JGB收益率可能波及其他先進國家,CoinDesk此前已經討論過這個問題。此外,比特幣與日元的相關性增強,這意味著日本市場的變動可能會影響加密貨幣的走勢。 市場投資者需要留意即將發布的ADP就業報告和ISM非製造業數據,這可能進一步增加市場波動性。 未來值得關注的事件 本周將有一系列重要的加密貨幣和宏觀經濟事件值得關注。以加密貨幣領域為例,1月7日,Ethereum將激活其第二次“Blob Parameter…

對沖基金 Karatage 任命 IMC 退伍軍人 Shane O’Callaghan 為高級合夥人

重要要點 Shane O’Callaghan 被任命為 Karatage 的高級合夥人和機構策略負責人,加入了這家專注於數位資產的對沖基金。 O’Callaghan 曾在 IMC Trading 擔任全球機構合作與數字資產銷售部門的負責人。 Karatage 成立於 2017 年,是一家總部位於倫敦的對沖基金,專注於數字資產、加密貨幣基金以及區塊鏈相關公司。 新任命的高級合夥人 O’Callaghan 表示,他期待與…

XRP可能超越比特幣,因為XRP/BTC圖表顯示自2018年以來的稀有Ichimoku突破

主要要點 XRP價格從2.39美元跌至2.27美元,突破了2.32美元的支撐水平。 買家吸收了跌至2.21美元的大量拋售,穩定了價格。 市場關注XRP能否重新收復2.31-2.32美元的區間,還是維持在下降通道內。 XRP/BTC圖表顯示出一旦確認突破,高相對強度可能預示著XRP將優於比特幣。 WEEX Crypto News, 2026-01-07 14:55:44 在加密貨幣市場中,Ripple旗下的XRP一直以來都是一個受到廣泛關注的標的。近期,其與比特幣(BTC)的匯率圖表顯示出一個自2018年以來未見的罕見信號:Ichimoku雲層突破。在這個背景下,市場專家和投資者正在密切觀察這一現象對市場的潛在影響。 市場背景與XRP價格動態 今年年初,XRP價格從2.39美元一路下跌至2.27美元,突破了重要的2.32美元支撐水平。這一跌勢引發了市場的廣泛關注,因為它指向一個潛在的下跌通道。不過,在一波高達256.3萬的成交量下,價格曾探至2.21美元,這標誌著一個潛在的這通道格局中可能的低點。這種賣壓並未將價格進一步推低,而是顯示出需求已經吸收了此波拋售。 對於技術分析師來說,XRP試圖在這一區間內穩住陣腳,並在短期內展示出一種試圖形成底部的勢頭。具體來說,在60分鐘的技術結構中,多次守住了2.258美元至2.260美元的區間,並在1.33美元的低點後顯示出更高的低點,這讓市場期待XRP能重新測試2.31-2.32美元這一的重要性阻力區間。 XRP/BTC Ichimoku突破的意義 技術分析師「The Great…

JPMorgan 針對下一階段的 JPM Coin 進軍 Canton Network

JPMorgan 拓展 JPM Coin 的區塊鏈應用至 Canton Network,強化多鏈策略。 與 Digital Asset 合作,計劃將 JPM Coin 擴大至公共區塊鏈。 Canton Network 提供多資產同步結算,具隱私與合規等特性。 JPM…

2025年加密貨幣熊市是機構資本的“重新定價”年:分析師

關鍵點: – 由於機構資本的進入,加密市場正在經歷一場重新定價的過程。 – 2025年,去中心化金融(DeFi)代幣和智能合約相關的加密貨幣大幅下降。 – 儘管過去一年的表現不佳,大型金融機構仍在推出受監管的加密投資產品。 – 市場分析中,Solana和Tron在區塊鏈費用上領先,但以太坊(ETH)表現異常穩定。 WEEX Crypto News, 2026-01-07 14:55:46 加密貨幣市場在2025年經歷了一個顯著的調整期,尤其是對於去中心化金融和與智能合約相關的加密貨幣來說。這些加密貨幣的表現不佳,被視為市場對哪些區塊鏈網絡能吸引長期資本進行更廣泛評估的一個側面。隨著機構投資者逐漸、持續地進入市場,這被稱為“重新定價”的過程開始受到分析師的廣泛關注。 在不計算比特幣(BTC)的情況下,2025年對於廣泛的加密貨幣市場來說是熊市的一年。根據Real Vision首席加密分析師Jamie Coutts的區塊鏈數據,去中心化金融代幣下降了67%,而與智能合約區塊鏈相關的加密貨幣則平均下跌了66%。Coutts在星期三的一篇文章中表示,這一年的糟糕表現是一種“重新定價”的現象,因為機構資本正在尋求更多的市場曝光機會。…

趋势研究:2026超越范式,WLFI开启金融生态新纪元

2026加密開門紅,謹慎看漲的市場新起點