Go Left? Go Right? The Crossroads of Cryptocurrency

The recent Libra incident has completely exposed the dark side of Crypto, once again fulfilling Plato's Allegory of the Cave. Even on the most transparent blockchain, we can only catch a glimpse of the shadows cast by the torches outside the cave. However, this Libra incident unprecedentedly revealed the outside scene to those inside the cave, creating a complex situation involving central aspects of national power, market makers, the core DeFi project on Solana, and key players in the industry.

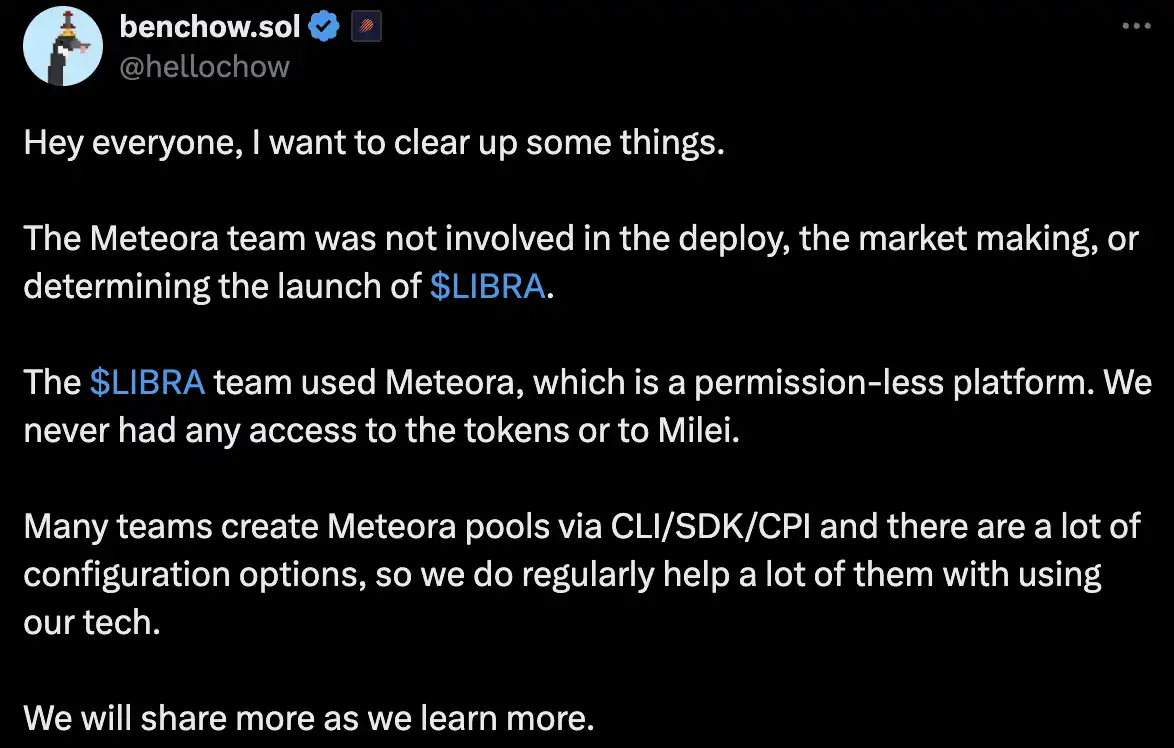

After the event, it left behind many issues that the entire industry needs to address. Among them, Solana's core DEX, Jupiter, and Meteora were embroiled in the center of the whirlpool of this event. The joint statement released by BenChow, the co-founder of both projects, prompted a rethinking of a long-standing issue in the blockchain space—the debate between "permissioned" and "permissionless" blockchain projects, representing the two factions of blockchain. In light of this, Dapenti BlockBeats invited dForce's founder, MinDao, to discuss the reflections behind this event.

The Boundaries of "Permission"

As Jupiter and Meteora were deeply embroiled in confusion, social media was filled with discussions about their involvement in this event. DForce's founder, MinDao, stated, "The focus of the event is not on sniping but on using insider information to preemptively know about the authenticity of such events and then snipe. I don't understand why Libra chose to make such a complex setup through Meteora instead of easily issuing tokens using Uniswap."

When Ben pointed out that Meteora's DLMM pool required manual customization, the market naturally compared it to Uniswap V3's concentrated liquidity feature. The timeline goes back to the iconic vote initiated by Vitalik in 2018—over 80% of users supported "Uniswap should list freely," driving the blockchain from the ICO era to the DeFi permissionless era. Leveraging this mechanism, Uniswap once held over 80% of the DeFi market share at its peak, and its "permissionless" underlying logic still profoundly influences the industry's DeFi standards today.

During the same period of Uniswap's market dominance, Meteora quickly emerged as a prominent player in the Solana ecosystem after its launch. This was the time of DeFi Summer when all the stars aligned. However, Meteora effectively solved the slippage issue with its innovative routing algorithm, gaining a share of the DeFi market. After the team split off to create the aggregator Jupiter, the Jupiter ecosystem quickly surged ahead in market share, at one point occupying over 70% of Solana's liquidity inflows, becoming the most dominant entry infrastructure during Solana's DeFi tech boom.

Both are single-sided liquidity pools, one being the undisputed giant of the DeFi golden age, Uniswap, and the other being Jupiter, a grassroots-born underdog that rose to prominence. Despite Uniswap's 5-year history, enduring multiple bull and bear cycles, and launching countless rug tokens, it has not faced the same level of public outcry as Jupiter did in this incident. The reason behind this lies in a battle between open-source and closed-source.

Open Source or Closed Source? Ethereum or Solana?

Uniswap V3 enforces liquidity rules through mathematical formulas, with all parameters like fees and price ranges being publicly transparent and immutable. Therefore, even with single-sided liquidity, on-chain arbitrageurs can actively monitor on-chain data and conduct arbitrage to rebalance the market in real-time. This presents a high opportunity cost for projects expecting to control the market through partial price range manipulation. On the contrary, for DLMM, the project team needs Meteora's assistance to create a customized liquidity pool, a process that involves subjective judgments ("only Meteora can determine the reliability of the project team") and information asymmetry. For example, the Libra team may, under the guise of "enhancing user experience," request uncommon slippage parameters within special ranges or conceal liquidity lockup periods. These details often make it difficult for on-chain arbitrageurs to execute strategies quickly, leading to market price imbalances.

Related Reading: "Quickly Understand Meteora's Liquidity Price Range Viewing Method"

Meanwhile, the closed-source protocol and special liquidity pool settings allow celebrity tokens like $Libra to exit liquidity with ease and low risk when using Meteora DLMM. This indirectly enables teams behind malicious tokens to selectively harvest profits. According to Nansen's post-incident analysis report, among the 15,000 wallets with a PNL exceeding $1,000, 86.07% suffered losses totaling $250 million, while the remaining 2,100 wallets made profits of $180 million. Hayden, the founder of the main LP in this incident, KelsierVentures, openly stated that he profited $100 million from the trades and additionally received over $10 million in transaction fees.

In fact, even in cases where the ecosystem cannot be open-sourced or for products that require customization, there are multiple ways to avoid malicious behavior from behind-the-scenes market makers. Olympus Pro's Bond mechanism "Market Maker Collateral Requirement to Prevent Malfeasance" and Trader Joe's liquidity ledger with a time-weighted exit model "Unlocking in stages based on trading volume and survival time" can both cater to the needs of large-scale token launches and customization while protecting users.

The rapid rise of DLMM TVL post-Trump event, data from DeFiLlama

「There is no middle ground in permissionless DeFi or in running a compliant CEX」 MinDao also pinpointed the core of this, adding, 「Where is the boundary, what kind of product is called DeFi, I think we need a clear framework on this. I feel that everyone in the crypto circle is also looking for various compromises, striving towards a balance of compliance and decentralization.」

Indeed, as long as humans are involved in the process, it cannot be called DeFi "decentralized" finance, and this product will inevitably face regulatory compliance issues. Faced with this issue, even Uniswap Labs, which is completely separate from the protocol and the company entity, could not escape. The U.S. SEC once attempted to charge Uniswap Labs with operating an unregistered broker, exchange, and clearinghouse, and issuing unregistered securities. From warnings, sending a Wells Notice, investigation, to formal charges, Uniswap underwent a 3-year-long self-certification process with the SEC, forcing the team to waste a significant amount of time and millions of dollars until now, on February 26, 2025, the U.S. SEC finally dropped its investigation into Uniswap Labs. We are in a phase where traditional financial rules are being abandoned to regulate DeFi by force, and in the midst of upcoming DeFi regulations.

The Double-Edged Sword of Liquidity

The above-mentioned artificial "permission" risk is just one of the reasons for community opposition, and Meteora itself does not hold a significant market share and cannot shake the entire industry. What is truly concerning is the vertical dominance of the Jupiter ecosystem.

According to Dune data, Meteora's market share is only 5%

Starting in 2024, Jupiter began acquiring various ecosystem projects, from the user entry point Ultimate Wallet, to data analysis tool Coinhall, blockchain explorer SolanaFM, from the backend liquidity pool Meteora to the frontend Moonshot. By integrating wallet, data, and trading core infrastructure, Jupiter is building a self-contained DeFi service collection. Users can complete the entire process from depositing, trading to yield optimization within this ecosystem, and the recent launch of Jupnet indicates its intention to expand beyond Solana into the entire chain's DeFi ecosystem.

Such a powerful impact and product are like a double-edged sword. When nothing goes wrong, this is undoubtedly the best path for new users to enter the blockchain Mass Adoption, as seen from the potential demonstrated by the hundreds of thousands of non-crypto users added during the Moonshot to Trump Coin era. However, when it gets involved in an "insider trading" event, the market naturally becomes anxious about how to accept regulation for such a complex DeFi functionality and process, especially since it is tied to Solana, which currently has the largest liquidity in Crypto.

Just like the saying "everyone in the crypto world is making all sorts of compromises," the open-source Uniswap, for its own business logic, has set the shackles of the BSL "Business Source License" on V3 and V4 or has delisted some tokens from the frontend for regulatory legalization. How will the closed-source Jupiter compromise its own business blueprint and the balance between user trust and compliance?

Cultural DNA

When we extend the discussion to Uniswap and Jupiter, discussing whether ETH and Solana products have been influenced by the underlying culture of these two chains, MinDao believes that "Solana's closed-source pragmatism, pursuit of efficiency and value chain integration, is conducive to rapid expansion; while Ethereum's open-source freedom and diverse ecosystem require more considerations for development direction, and the underlying culture of the chain will profoundly influence the product's path."

In his article "Layer 2s as cultural extensions of Ethereum," Vitalik mentioned that Ethereum's underlying subculture is broadly divided into three camps: Crypto Punks, Regens, and Degens. Looking at it now, Ethereum's "crypto punk culture" is more vibrant, while the Degen culture has flourished in Solana. Ethereum leans more towards the white left, with its cultural DNA rooted in the spirit of open source and decentralized idealism, which is essentially a continuation of the BTC spirit, and its ecosystem evolution follows the logic of "common cooperation."

Ethereum core protocols like Uniswap and Aave are completely open source, allowing any developer to fork and iterate, as seen with Sushiswap forking Uniswap, forming a free-market competition. This has also led to the emergence of more niche products on Ethereum, each product excelling in its own field, with the product's moat being the "brand" itself. The speed of iteration and the solidity of the community significantly influence the project's dominance, while its development path is more horizontal.

Protocols on the EVM are mostly multichain

While Solana embraces efficiency, its culture is based on a competitive sports spirit and relentless execution, closer to Web2's "winner-takes-all" mentality. This has allowed the "Degen culture" to take root extensively in this environment. The Solana Foundation excels in proactively integrating resources such as capital and government relations, enabling them to develop at an extraordinary pace. This mindset has permeated various products on the platform, where most mainstream projects on Solana are either difficult to integrate with other chains due to the underlying technology, or choose to keep their source code closed to prevent on-chain competitors from copying them. Solana is adept at leveraging various resources to develop and prioritize creating a value chain with the highest efficiency, monopolizing the entire value chain, and controlling the interest chain, similar to Tencent's "super-app" strategy. For example, Jupiter has acquired Meteora (DEX) and Moonshot (fiat gateway) to achieve "trade-mint-liquidity," or more recently, Pumpfun announced the abandonment of Raydium to directly launch a product business adding AMM pools on Pumpfun.

Protocols on Solana are mostly single-chain

The Future of Blockchain, Ethereum to the Left, Solana to the Right

The "Liberal" Ethereum

The underlying cultures of both sides have also shaped the paths they are currently on. Firstly, environmentalist Vitalik proposed transitioning Ethereum from PoW (Proof of Work) to PoS (Proof of Stake) due to the excessive energy consumption of PoW. In September 2022, Ethereum completed The Merge, officially transitioning from PoW to PoS. Energy consumption decreased from approximately 78 TWh per year, equivalent to Chile's national electricity consumption, to about 0.01 TWh. The PoS-introduced staking mechanism with a "32 ETH threshold" and the deflationary model of EIP-1559's burning mechanism have transformed Ethereum's tokenomics. Post-merge, the circulating ETH supply decreased by 3 million, the annual inflation rate dropped from 3.5% to -0.2%, and the number of validator nodes expanded from a few thousand miners in the PoW era to over 1 million stakers.

However, this initial choice has led to a phenomenon where the PoS staking threshold of "32 ETH" restricts the participation of most ordinary users. The top three staking service providers—Lido, Coinbase, and Kraken—control over 35% of the staked amount, sparking criticisms of the market becoming "the richer getting richer." Even Ethereum core developer Dankrad Feist acknowledged that "if Lido's share exceeds 33%, it may trigger social consensus intervention." Coupled with the exorbitant GasFee, this has led to "whales" becoming the primary users of Ethereum, leading to Ethereum being known as a "noble chain."

The Ethereum Improvement Proposal (EIP) voting process is lengthy, and community consensus is difficult to quickly achieve unless driven by core members. Reports have indicated that 68% of Ethereum Improvement Proposals are implemented by 10 individuals associated with the Ethereum Foundation. However, ecosystem decision-making often gets caught up in multi-party games, leading to low efficiency in key upgrades. For example, innovations like "account abstraction" have not been fully deployed yet, and the transition to Proof of Stake (PoS) mentioned above has been ongoing for 6 years. The complementary "EIP-1559" fee burning mechanism took two years of discussion to be implemented. YBB Capital researcher Zeke believes that the EIP process has lost its original democratic intent: "Governance tokens are meaningless until the Sybil problem is solved. Democratic voting can never be reflected in proposal governance. In the current Ethereum ecosystem, similar to big institutions like a16z, a few wallets can veto a large community's approval votes, rendering the vote meaningless."

On the same day Trump announced strong support for the "American" blockchain, Vitalik tweeted that the Ethereum Foundation will avoid including: promoting any ideology, actively lobbying regulatory bodies and powerful political figures, especially in the United States or any major country, risking damaging Ethereum's status as a globally neutral platform, becoming an arena for vested interests, and becoming a highly centralized organization. Vitalik still hopes to maintain Ethereum as a digital Tower of Babel against authoritarianism, guarded by a globally open network of validators using mathematics.

The "Pragmatic" Solana

Image Source: Blockworks

In contrast, Solana, heading to the right, has gradually turned its vision of Mass Adoption through ultra-fast transaction efficiency and throughput into a reality. It has established overwhelming superiority in a blockchain, from transaction volume and activity to liquidity, making Solana a well-deserved leader. The launch of the Trump Coin can be seen as the best stress test of Solana's performance. $5.6 billion in real value was generated in a day, and half of the value was generated by outsiders who had never participated in blockchain. Polygon co-founder Brendan Farmer, however, expressed concerns about Solana's structural issues. Most of Solana's economic value is derived from pump and trading bots, forming a derivative industry of Meme coins that does not create any economic value. The consequence is that they will extract liquidity from the ecosystem. Each dollar of REV paid means a reduction in funds for future Meme coin transactions, creating a vicious cycle.

Over the past five years, Solana has experienced a total of seven independent outage events, five of which were caused by client errors and two due to the network's inability to handle a large volume of spam transactions. However, some community leaders, including Helius founder Mert Mumtaz, predict that outages will continue to occur. The exposed issue of Solana's excessive centralization was widely discussed around 2022, but as the market sentiment shifted from geek culture to an application-centric mindset, with Solana demonstrating transaction throughput comparable to Web2 networks, this issue has been of little concern to most.

Source: Helius Report on Solana Outage History

Unlike Vitalik, Lily Liu, the head of the Solana Foundation, mentioned in an interview, "We believe the new administration will recognize the role of blockchain in supporting the U.S. strategy, so we are very hopeful and have plans to collaborate with the U.S. government in the future." The Solana Foundation's excellent resource integration capabilities have shown that in this round of the market, opportunities have leaned towards Solana, from government support to even the U.S. president endorsing a memecoin. However, MinDao believes, "If Solana is too politically inclined, its politically interventionist nature will make it potentially vulnerable to political influences in the future globalized ecosystem. For example, if a Chinese company wants to issue a Layer2, they probably won't want to issue it on a chain that represents the U.S."

The Crossroads of Progress, Forward We Go

We are wandering between crossroads of left and right, seemingly facing a deadlock in Ethereum's governance gridlock and Solana's capital frenzy. However, this evolution movement that seems to "betray" its original intention may be forging the Holy Grail of a financial system that can accommodate both Hayek and Keynes.

Going left, Ethereum, after transitioning to PoS to reduce resource consumption and decrease the possibility of centralized regulation, has turned ETH into a chain for the elites. The initial intention to accept democratic voting through the EIP process has made Ethereum struggle. The ethos of being firm not to be involved in politics has also led it to lose to Solana in this round of large-scale application cycles. Even in 2024, Solana has surpassed Ethereum in ecosystem developer growth, despite Ethereum's status as a concentrated hub for ecosystem development.

The right-leaning Solana, with its high performance and cost efficiency, has rightfully become the "Liquidity King" amidst the Meme craze. However, by emitting hundreds of thousands of Meme tokens monthly, it has transformed Solana, originally envisioned as the decentralized "Nasdaq," into a perfect decentralized "casino." This situation simultaneously devours the potential value Solana could create in the future. Excessive involvement in geopolitics also limits its application on a global scale.

It seems that whichever path is taken, challenges are encountered.

Yet, MinDao remains optimistic about the left and right leanings towards "Ethereum" and "Solana." He believes that the competition between them is not a zero-sum game. The ultimate potential of blockchain is neither Ethereum's ideal state nor Solana's efficiency empire but a new species born through the confrontation and integration of both. This will undoubtedly include utilitarianism and perfect "decentralization" through a mechanism driven by economies of scale. This revolution is not a betrayal but a redefinition of the "revolution" itself.

Regarding the future path, Vitalik recently provided an answer in a Tako AMA, stating that it is no longer the era of infrastructure but the era of applications. Therefore, these stories cannot be abstract concepts like "freedom, openness, censorship resistance," etc. They require some clear application layer solutions. He proposed the concept of Ethereum as the world's finance and that it will further support application layer products such as info finance, AI + crypto, high-quality public goods financing methods, RWA, etc. Interestingly, the two factions represented by ETH and Solana are becoming more alike in their development process, akin to the obverse and reverse of a coin, the double helix of DNA. Only by transforming human game theory into a verifiable public knowledge core can blockchain evolve into a trustworthy value network.

a16z partner Chris Dixon believes that AI, the Internet, and Crypto all have their ups and downs. When we wait for things to improve before taking action, we find ourselves doing the same things as a large group. Thus, when people believe that a technology has reached its limit, it often conceals the best opportunities.

We are currently at a crossroads both horizontally and vertically. Whether we lean "left" or "right," the ultimate result will be moving forward. Perhaps the ultimate form of blockchain is neither the utopia of the "savior faction" nor the hegemony empire of the "apocalypse faction" but a hybrid that finds a dynamic balance between openness and efficiency, idealism and realism. The future belongs to those who can embed "imperfect human nature" in code yet maintain the system's robustness.

猜你喜歡

穩定幣驅動全球B2B支付革新,如何打破工作流程瓶頸釋放兆市場潛力?

這些新創公司正在無需資料中心的情況下建立先進AI模型

CEX與Wallet之後,OKX入局支付

RWA永續產品危機:為什麼GLP模式註定撐不住RWA永續?

科學平權運動:DeSci的萬億美元知識經濟重建革命

Sentient深度研報:獲8,500萬美元融資,建置去中心化AGI新範式

專訪Virtuals聯創empty:AI 創業不需要大量資金,Crypto是答案之一

今年 2 月,Base 生態中的 AI 協議 Virtuals 宣布跨鏈至 Solana,然而加密市場隨後進入流動性緊縮期,AI Agent 板塊從人聲鼎沸轉為低迷,Virtuals 生態也陷入一段蟄伏期。

三月初,BlockBeats 對 Virtuals 共同創辦人 empty 進行了一次專訪。彼時,團隊尚未推出如今被廣泛討論的 Genesis Launch 機制,但已在內部持續探索如何透過機制設計激活舊資產、提高用戶參與度,並重構代幣發行與融資路徑。那是一個市場尚未復甦、生態尚處冷啟動階段的時間點,Virtuals 團隊卻沒有停下腳步,而是在努力尋找新的產品方向和敘事突破口。

兩個月過去,AI Agent 板塊重新升溫,Virtuals 代幣反彈超 150%,Genesis 機製成為帶動生態回暖的重要觸發器。從積分獲取規則的動態調整,到專案參與熱度的持續上升,再到「新代幣帶老代幣」的機制閉環,Virtuals 逐漸走出寒冬,並再次站上討論焦點。

值得注意的是,Virtuals 的 Genesis 機制與近期 Binance 推出的 Alpha 積分系統有一些相似之處,評估用戶在 Alpha 和幣安錢包生態系統內的參與度,決定用戶 Alpha 代幣空投的資格。用戶可透過持倉、交易等方式獲得積分,積分越高,參與新項目的機會越大。透過積分系統篩選使用者、分配資源,專案方能夠更有效地激勵社群參與,提升專案的公平性和透明度。 Virtuals 和 Binance 的探索,或許預示著加密融資的新趨勢正在形成。

回看這次對話,empty 在專訪中所展現出的思路與判斷,正在一步步顯現其前瞻性,這不僅是一場圍繞打新機制的訪談,更是一次關於“資產驅動型 AI 協議”的路徑構建與底層邏輯的深度討論。

BlockBeats:可以簡單分享一下最近團隊主要在忙些什麼?

empty:目前我們的工作重點主要有兩個部分。第一部分,我們希望將 Virtuals 打造成一個類似「華爾街」的代理人(Agent)服務平台。設想一下,如果你是專注於 Agent 或 Agent 團隊建立的創業者,從融資、發幣到流動性退出,整個流程都需要係統性的支援。我們希望為真正專注於 Agent 和 AI 研發的團隊,提供這一整套服務體系,讓他們可以把精力集中在底層能力的開發上,而不用為其他環節分心。這一塊的工作其實也包括了與散戶買賣相關的內容,後面可以再詳細展開。

第二部分,我們正在深入推進 AI 相關的佈局。我們的願景是建立一個 AI 社會,希望每個 Agent 都能聚焦自身優勢,同時透過彼此之間的協作,實現更大的價值。因此,最近我們發布了一個新的標準——ACP(Agent Communication Protocol),目的是讓不同的 Agent 能夠相互互動、協作,共同推動各自的業務目標。這是目前我們主要在推進的兩大方向。

BlockBeats:可以再展開說說嗎?

empty:在我看來,其實我們面對的客戶群可以分為三類:第一類是專注於開發 Agent 的團隊;第二類是投資者,包括散戶、基金等各種投資機構;第三類則是 C 端用戶,也就是最終使用 Agent 產品的個人用戶。

不過,我們主要的精力其實是放在前兩大類──也就是團隊和投資人。對於 C 端用戶這一塊,我們並不打算直接介入,而是希望各個 Agent 團隊能夠自己解決 C 端市場的拓展問題。

此外,我們也認為,Agent 與 Agent 之間的交互作用應該成為一個核心模式。簡單來說,就是未來的服務更多應該是由一個 Agent 銷售或提供給另一個 Agent,而不是單純賣給人類使用者。因此,在團隊的 BD 工作中,我們也積極幫助現有的 AI 團隊尋找這樣的客戶和合作機會。

BlockBeats:大概有一些什麼具體案例呢?

empty:「華爾街」說白了就是圍繞資本運作體系的建設,假設你是一個技術團隊,想要融資,傳統路徑是去找 VC 募資,拿到資金後開始發展。如果專案做得不錯,接下來可能會考慮進入二級市場,例如在紐約證券交易所上市,或是在 Binance 這樣的交易所上幣,實現流動性退出。

我們希望把這一整套流程打通-從早期融資,到專案開發過程中對資金的靈活使用需求,再到最終二級市場的流動性退出,全部覆蓋和完善,這是我們希望補齊的一條完整鏈條。

而這一部分的工作和 ACP(Agent Communication Protocol)是不同的,ACP 更多是關於 Agent 與 Agent 之間交互標準的製定,不直接涉及資本運作系統。

BlockBeats:它和現在 Virtuals 的這個 Launchpad 有什麼差別呢?資金也是從 C 端來是嗎?

empty:其實現在你在 Virtuals 上發幣,如果沒有真正融到資金,那就只是發了一個幣而已,實際是融不到錢的。我們目前能提供的服務,是透過設定買賣時的交易稅機制,從中提取一部分稅收回饋給創業者,希望這部分能成為他們的現金流來源。

不過,問題其實還分成兩塊。第一是如何真正幫助團隊完成融資,這個問題目前我們還沒有徹底解決。第二是關於目前專案發行模式本身存在的結構性問題。簡單來說,現在的版本有點像過去 Pumpfun 那種模式——也就是當專案剛上線時,部分籌碼就被外賣給了外部投資人。但現實是,目前整個市場上存在著太多機構集團和「狙擊手」。

當一個真正優秀的專案一發幣,還沒真正觸達普通散戶,就已經被機構在極高估值時搶購了。等到散戶能夠接觸到時,往往價格已經偏高,專案品質也可能變差,整個價值發行體係被扭曲。

針對這個問題,我們希望探索一種新的發幣和融資模式,目的是讓專案方的籌碼既不是死死握在自己手裡,也不是優先流向英文圈的大機構,而是能夠真正留給那些相信專案、願意長期支持專案的普通投資者手中。我們正在思考該如何設計這樣一個新的發行機制,來解決這個根本問題。

BlockBeats:新模式的具體想法會是什麼樣子呢?

empty:關於資金這一塊,其實我們目前還沒有完全想透。現階段來看,最直接的方式還是去找 VC 融資,或是採取公開預售等形式進行資金募集。不過說實話,我個人對傳統的公開預售模式並不是特別認同。

在「公平發售」這件事上,我們正在嘗試換一個角度來思考-希望能從「reputation」出發,重新設計機制。

具體來說,就是如果你對整個 Virtuals 生態有貢獻,例如早期參與、提供支持或建設,那麼你就可以在後續購買優質代幣時享有更高的優先權。透過這種方式,我們希望把資源更多留給真正支持生態發展的用戶,而不是由短期套利的人主導。

BlockBeats:您會不會考慮採用類似之前 Fjord Foundry 推出的 LBP 模式,或者像 Daos.fun 那種採用白名單機制的模式。這些模式在某種程度上,和您剛才提到的「對生態有貢獻的人享有優先權」的想法是有些相似的。不過,這類做法後來也引發了一些爭議,例如白名單內部操作、分配不公等問題。 Virtuals 在設計時會考慮借鏡這些模式的優點,或有針對性地規避類似的問題嗎?

empty:我認為白名單機制最大的問題在於,白名單的選擇權掌握在專案方手中。這和「老鼠倉」行為非常相似。專案方可以選擇將白名單名額分配給自己人或身邊的朋友,導致最終的籌碼仍然掌握在少數人手中。

我們希望做的,依然是類似白名單的機制,但不同的是,白名單的獲取權應基於一個公開透明的規則體系,而不是由項目方單方面決定。只有這樣,才能真正做到公平分配,避免內幕操作的問題。

我認為在今天這個 AI 時代,很多時候創業並不需要大量資金。我常跟團隊強調,你們應該優先考慮自力更生,例如透過組成社區,而不是一開始就想著去融資。因為一旦融資,實際上就等於背負了負債。

我們更希望從 Training Fee的角度去看待早期發展路徑。也就是說,專案可以選擇直接發幣,透過交易稅所帶來的現金流,支持日常營運。這樣一來,專案可以在公開建設的過程中獲得初步資金,而不是依賴外部投資。如果專案做大了,自然也會有機會透過二級市場流動性退出。

當然最理想的情況是,專案本身能夠有穩定的現金流來源,這樣甚至連自己的幣都無需拋售,這才是真正健康可持續的狀態。

我自己也常在和團隊交流時分享這種思路,很有意思的是,那些真正抱著「搞快錢」心態的項目,一聽到這種機制就失去了興趣。他們會覺得,在這種模式下,既無法操作老鼠倉,也很難短期套利,於是很快就選擇離開。

但從我們的角度來看,這其實反而是個很好的篩選機制。透過這種方式,理念不同的專案自然會被過濾出去,最後留下的,都是那些願意真正建立、和我們價值觀契合的團隊,一起把事情做起來。

BlockBeats:這個理念可以發展出一些能夠創造收益的 AI agent。

empty:我覺得這是很有必要的。坦白說,放眼今天的市場,真正擁有穩定現金流的產品幾乎鳳毛麟角,但我認為這並不意味著我們應該停止嘗試。事實上,我們每天在對接的團隊中,有至少一半以上的人依然懷抱著長遠的願景。很多時候,他們甚至已經提前向我們提供了 VC 階段的資金支持,或表達了強烈的合作意願。

其實對他們來說想要去收穫一個很好的社區,因為社區可以給他們的產品做更好的回饋,這才是他們真正的目的。這樣聽起來有一點匪夷所思,但其實真的有很多這樣的團隊,而那種團隊的是我們真的想扶持的團隊。

BlockBeats:您剛才提到的這套「AI 華爾街」的產品體系-從融資、發行到退出,建構的是一整套完整的流程。這套機制是否更多是為了激勵那些有意願發幣的團隊?還是說,它在設計上也考慮瞭如何更好地支持那些希望透過產品本身的現金流來發展的團隊?這兩類團隊在您這套體系中會不會被區別對待,或者說有什麼機制設計能讓不同路徑的創業者都能被合理支持?

empty:是的,我們 BD 的核心職責其實就是去鼓勵團隊發幣。說得直接一點,就是引導他們思考發幣的可能性和意義。所以團隊最常問的問題就是:「為什麼要發幣?」這時我們需要採取不同的方式和角度,去幫助他們理解背後的價值邏輯。當然如果最終判斷不適合,我們也不會強迫他們推進。

不過我們觀察到一個非常明顯的趨勢,傳統的融資路徑已經越來越難走通了。過去那種融資做大,發幣上所的模式已經逐漸失效。面對這樣的現實,很多團隊都陷入了尷尬的境地。而我們希望能從鏈上和加密的視角,提供一套不同的解決方案,讓他們找到新的發展路徑。

BlockBeats:明白,我剛才其實想表達的是,您剛剛也提到,傳統的 AI 模式在很大程度上仍然依賴「燒錢」競爭。但在 DeepSeek 出現之後,市場上一些資金體積較小的團隊或投資人開始重新燃起了信心,躍躍欲試地進入這個領域。您怎麼看待這種現象?這會不會對目前正在做 AI 基礎研發,或是 AI 應用層開發的團隊產生一定的影響?

empty:對,我覺得先不談 DeepSeek,從傳統角度來看,其實到目前為止,AI 領域真正賺錢的只有英偉達,其他幾乎所有玩家都還沒有實現盈利。所以其實沒有人真正享受了這個商業模式的成果,大家也仍在探索如何面對 C 端打造真正有產出的應用。

沒有哪個領域像幣圈一樣能如此快速獲得社群回饋。你一發幣,用戶就會主動去讀白皮書的每一個字,試試你產品的每個功能。

當然,這套機制並不適合所有人。例如有些 Agent 產品偏 Web2,對於幣圈用戶而言,可能感知不到其價值。因此,我也會鼓勵做 Agent 的團隊在 Virtuals 生態中認真思考,如何真正將 Crypto 作為自身產品的差異化要素加以運用與設計。

BlockBeats:這點我特別認同,在 Crypto 這個領域 AI 的迭代速度確實非常快,但這群用戶給予的回饋,真的是代表真實的市場需求嗎?或者說這些回饋是否真的符合更大眾化、更具規模性的需求?

empty:我覺得很多時候產品本身不應該是強行推廣給不適合的使用者群體。例如 AIXBT 最成功的一點就在於,它的用戶本身就是那群炒作他人內容的人,所以他們的使用行為是非常自然的,並不覺得是在被迫使用一個無聊的產品。 mass adoption 這個概念已經講了很多年,大家可能早就該放棄這個執念了。我們不如就認了,把東西賣給幣圈的人就好了。

BlockBeats:AI Agent 與 AI Agent 所對應的代幣之間,究竟應該是什麼樣的動態關係?

empty:對,我覺得這裡可以分成兩個核心點。首先其實不是在投資某個具體的 AI Agent,而是在投資背後經營這個 Agent 的團隊。你應該把它理解為一種更接近創投的思路:你投的是這個人,而不是他目前正在做的產品。因為產品本身是可以快速變化的,可能一個月後團隊會發現方向不對,立即調整。所以,這裡的「幣」本質上代表的是對團隊的信任,而不是某個特定 Agent 本身。

第二則是期望一旦某個 Agent 產品做出來後,未來它能真正產生現金流,或者有實際的使用場景(utility),從而讓對應的代幣具備賦能效應。

BlockBeats:您覺得有哪些賦能方式是目前還沒看到的,但未來可能出現、值得期待的?

empty:其實主要有兩塊,第一是比較常見的那種你要使用我的產品,就必須付費,或者使用代幣支付,從而間接實現對代幣的「軟銷毀」或消耗。

但我覺得更有趣的賦能方式,其實是在獲客成本的角度思考。也就是說,你希望你的用戶同時也是你的投資者,這樣他們就有動機去主動幫你推廣、吸引更多用戶。

BlockBeats:那基於這些觀點,您怎麼看 ai16z,在專案設計和代幣機制方面,似乎整體表現並不太樂觀?

empty:從一個很純粹的投資角度來看,撇開我們與他們之間的關係,其實很簡單。他們現在做的事情,對代幣本身沒有任何賦能。從開源的角度來看,一個開源模型本身是無法直接賦能代幣的。

但它仍然有價值的原因在於,它像一個期權(call option),也就是說,如果有一天他們突然決定要做一些事情,比如推出一個 launchpad,那麼那些提前知道、提前參與的人,可能會因此受益。

開發者未來確實有可能會使用他們的 Launchpad,只有在那一刻,代幣才會真正產生賦能。這是目前最大的一個問號——如果這個模式真的跑得通,我認為確實會非常強大,因為他們的確觸達了大量開發者。

但我個人還是有很多疑問。例如即使我是使用 Eliza 的開發者,也不代表我一定會選擇在他們的 Launchpad 上發幣。我會貨比三家,會比較。而且,做一個 Launchpad 和做一個開源框架,所需的產品能力和社群運作能力是完全不同的,這是另一個重要的不確定性。

BlockBeats:這種不同是體現在什麼地方呢?

empty:在 Virtuals 上我們幾乎每天都在處理客服相關的問題,只要有任何一個團隊在我們平台上發生 rug,即使與我們沒有直接關係,用戶也會第一時間來找我們投訴。

這時我們就必須出面安撫用戶,並思考如何降低 rug 的整體風險。一旦有團隊因為自己的代幣設計錯誤或技術失誤而被駭客攻擊、資產被盜,我們往往需要自掏腰包,確保他們的社群至少能拿回一點資金,以便專案能夠重新開始。這些項目方可能在技術上很強,但未必擅長代幣發行,結果因操作失誤被攻擊導致資產損失。只要涉及「被欺騙」相關的問題,對我們來說就已經是非常麻煩的事了,做這些工作跟做交易所的客服沒有太大差別。

另一方面,做 BD 也非常困難。優秀的團隊手上有很多選擇,他們可以選擇在 Pumpfun 或交易所上發幣,為什麼他們要來找我們,那這背後必須要有一整套支援體系,包括融資支援、技術協助、市場推廣等,每個環節都不能出問題。

BlockBeats:那我們就繼續沿著這個話題聊聊 Virtuals 目前的 Launchpad 業務。有一些社群成員在 Twitter 上統計了 Virtuals Launchpad 的整體獲利狀況,確實目前看起來獲利的項目比較少。接下來 Launchpad 還會是 Virtuals 的主要業務區嗎?還是說,未來的重心會逐漸轉向您剛才提到的「AI 華爾街」這條路徑?

empty:其實這兩塊本質上是一件事,是一整套體系的一部分,所以我們必須繼續推進。市場的波動是很正常的,我們始終要堅持的一點是:非常清楚地認識到我們的核心客戶是誰。我一直強調我們的客戶只有兩類——團隊。所以市場行情的好壞對我們來說並不是最重要的,關鍵是在每一個關鍵節點上,對於一個團隊來說,發幣的最佳選擇是否依然是我們 Virtuals。

BlockBeats:您會不會擔心「Crypto + AI」或「Crypto AI Agent」這一類敘事已經過去了?如果未來還有一輪多頭市場,您是否認為市場炒作的焦點可能已經不再是這些方向了?

empty:有可能啊,我覺得 it is what it is,這確實是有可能發生的,但這也屬於我們無法控制的範圍。不過如果你問我,在所有可能的趨勢中,哪個賽道更有機會長期保持領先,我仍然認為是 AI。從一個打德撲的角度來看,它仍然是最優選擇。

而且我們團隊的技術架構和底層能力其實早已搭建完成了,現在只是順勢而為而已。更重要的是,我們本身真的熱愛這件事,帶著好奇心去做這件事。每天早上醒來就有驅動力去研究最新的技術,這種狀態本身就挺讓人滿足的,對吧?

很多時候,大家不應該只看產品本身。實際上很多優秀的團隊,他們的基因決定了他們有在規則中勝出的能力——他們可能過去在做派盤交易時,每筆規模就是上百萬的操作,而這些團隊的 CEO,一年的薪資可能就有 100 萬美金。如果他們願意出來單幹項目,從天使投資或 VC 的視角來看,這本質上是用一個很划算的價格買到一個高品質的團隊。

更何況這些資產是 liquid 的,不是鎖倉狀態。如果你當下不急著用錢,完全可以在早期階段買進一些優秀團隊的代幣,靜靜等待他們去創造一些奇蹟,基本上就是這樣一個邏輯。

第16週鏈上數據:結構性供需失衡加劇,數據揭⽰下⼀輪上漲的堅實藍圖?

a16z領投2500萬美元,0xMiden要在你手機裡跑一條隱私鏈

Sui Q1進階報告:BTCfi基建崛起、借貸協議爆發與執行分片未來

川普次子的加密生意經

SignalPlus宏觀分析:關稅撕裂的M2敘事與TradFi式FOMO的回歸

盤點10大新興Launchpad平台,誰能完成Pump.fun的顛覆?

懂王簽字後,美國哪些州在「乖乖」推進比特幣戰略儲備法案?

GoRich正式上線:鏈上交易零門檻,新手也能抓住100x Meme幣

4月29日市場關鍵情報,你錯過了多少?

PENGU觸底反彈發拉漲360%,胖企鵝如何靠IP行銷迎第二春?